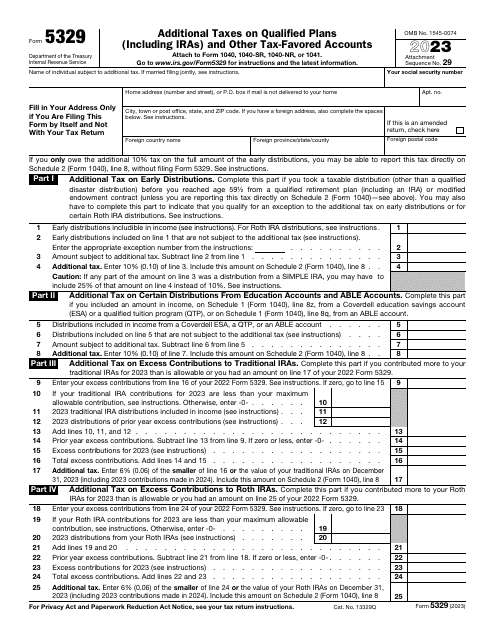

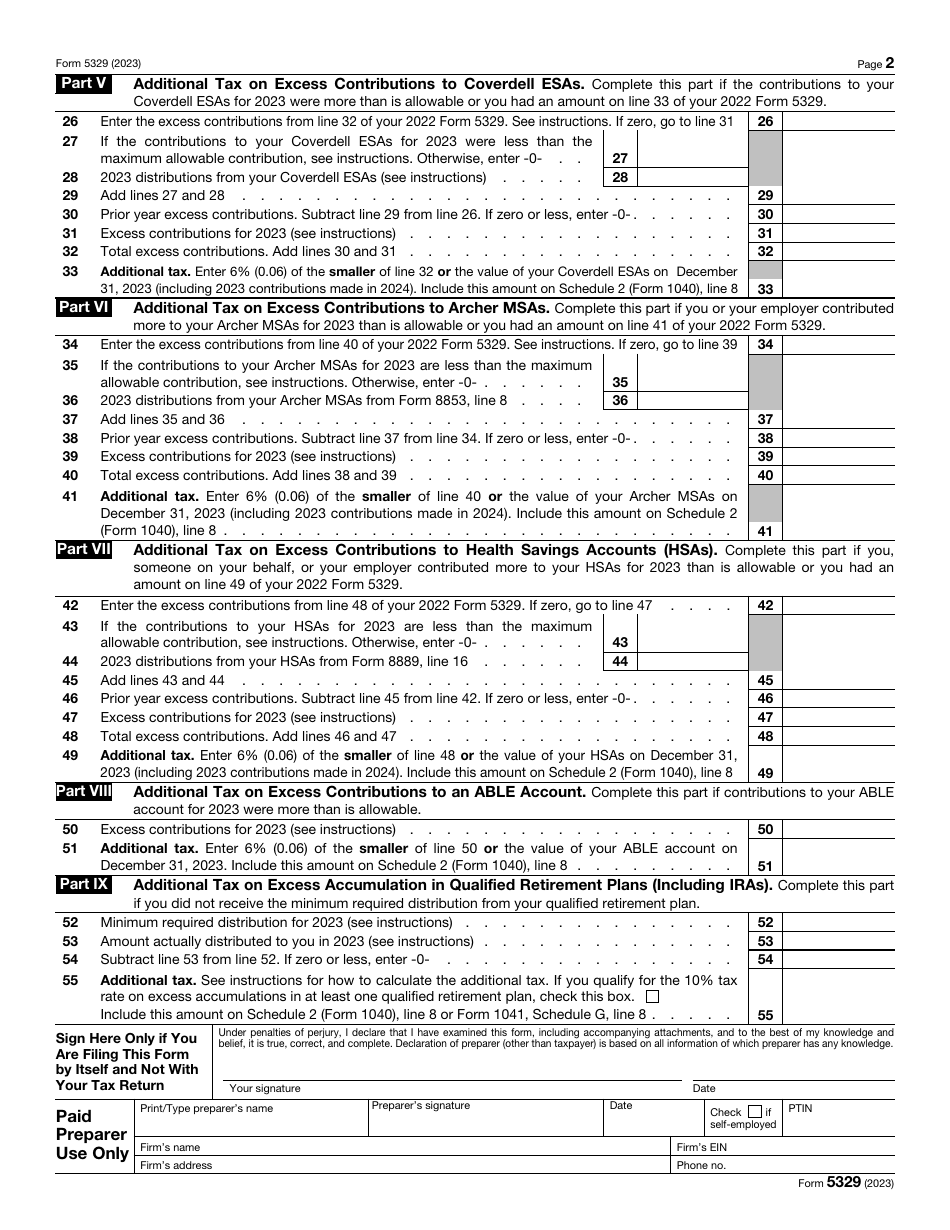

IRS Form 5329 Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts

What Is IRS Form 5329?

IRS Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts , is a fiscal document individual taxpayers need to prepare and file to demonstrate whether they need to pay the government penalties on education savings plans or retirement plans as well as a percentage of distributions they got throughout the tax year.

Alternate Name:

- Tax Form 5329.

You are obliged to attach a copy of this instrument to your tax return if you obtained distributions from qualifying tax-favored accounts or if you or your employer made surplus contributions to those accounts during the year.

Additionally, you will have to submit this tool to calculate the tax penalty if you failed to accept the mandatory minimum distributions - this provision also applies to estates and trusts that did not get the prescribed amount.

This document was issued by the Internal Revenue Service (IRS) in 2023 - previous editions of the form are now outdated. An IRS Form 5329 fillable version can be found via the link below.

Form 5329 Instructions

The IRS Form 5329 Instructions are as follows:

-

Start with identifying yourself - write down your full name, social security number, and correspondence address . You may indicate your foreign address if you are residing abroad. Note that taxpayers that submit the form with their tax return do not have to record their address in the document.

-

Provide information about distributions that are categorized as your income if you obtained them from life insurance contracts or qualified retirement plans . Specify the amount of income that will be subjected to extra taxation and replicate that number on the Schedule 2 you enclose with your tax return.

-

Use the official instructions released by the IRS to learn more about Form 5329 exceptions applied to extra tax - you need to add the number that describes the distributions . Outline the distributions you got from Achieving a Better Life Experience (ABLE) accounts and education accounts.

-

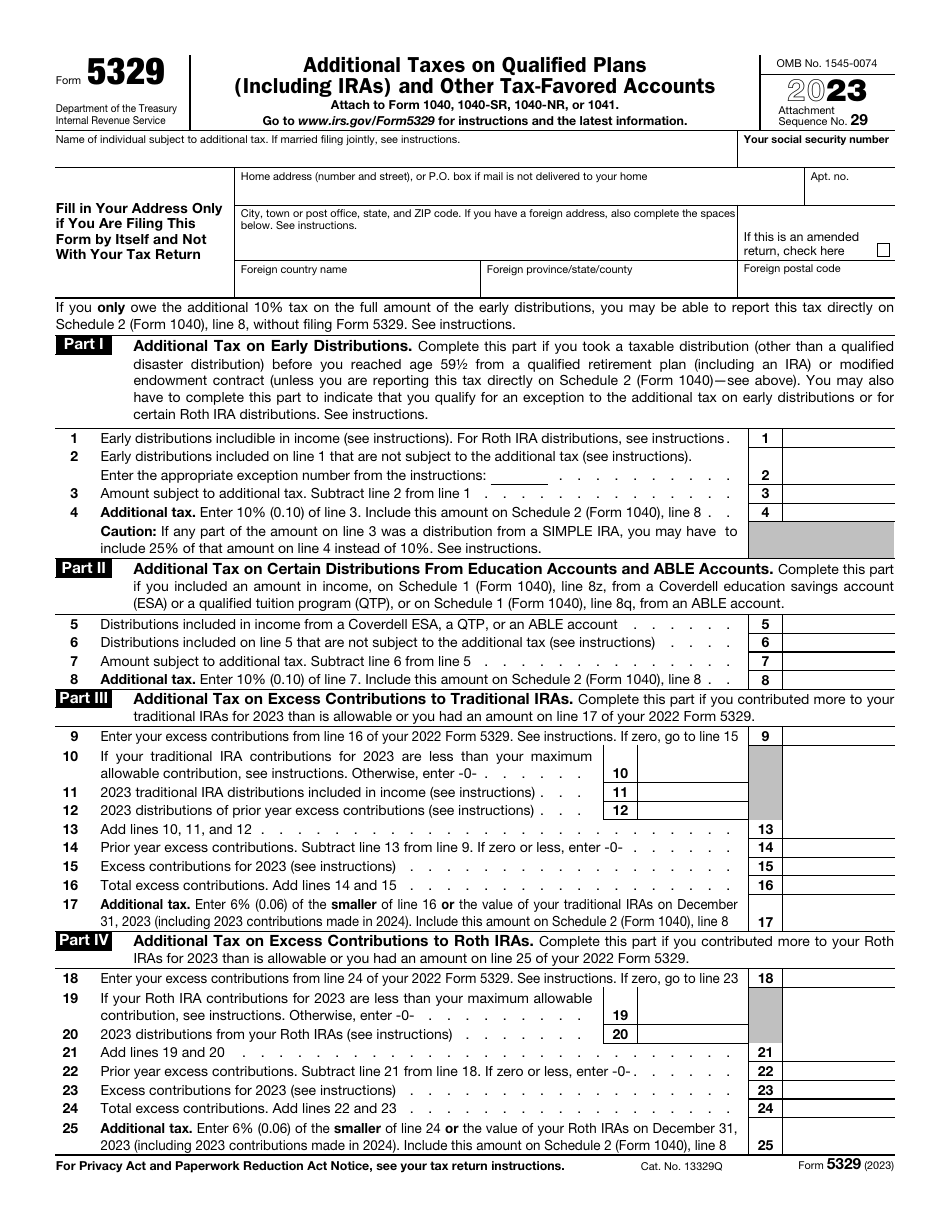

List the distributions that correspond to surplus contributions to various individual retirement accounts (IRAs) - both traditional accounts and Roth IRAs . In case the amount is zero, proceed to the next section of the form. You must also take into account surplus contributions from the previous tax year.

-

Elaborate on surplus contributions to education savings accounts, medical savings accounts, and health savings accounts . If the amount of contributions was above the allowable threshold and you or your employer contributed more than it was permitted in the first place, you need to describe those contributions and calculate the tax you are obliged to pay.

-

If surplus contributions were made to an ABLE account, specify their amount . Write down the tax you are expected to pay in case you did not get the minimum amount of distribution from qualified retirement plans.

-

Certify the documentation - once again, your signature is only necessary if you need to file this document on its own, without attaching it to your income statement . The instrument can be certified by a tax professional you hired to help you out with your tax documentation - they must provide the details of their firm if applicable and add their contact information.

Where to Mail Form 5329?

Send IRS Form 5329 to the IRS center where you are regularly submitting your tax returns - remember to file the papers before the deadline in April. As for the filing method, you get to decide how to submit the paperwork - the form can be prepared manually after you print out the template or filed electronically alongside the income statement you complete.

E-filing remains the safest way to inform tax authorities about the tax you owe which is why taxpayers are advised to prepare the form online. If you fail to send this document to tax organs, it is likely you will end up owing more taxes and penalties so take this responsibility seriously and submit the form on time unless you file an extension request in advance.