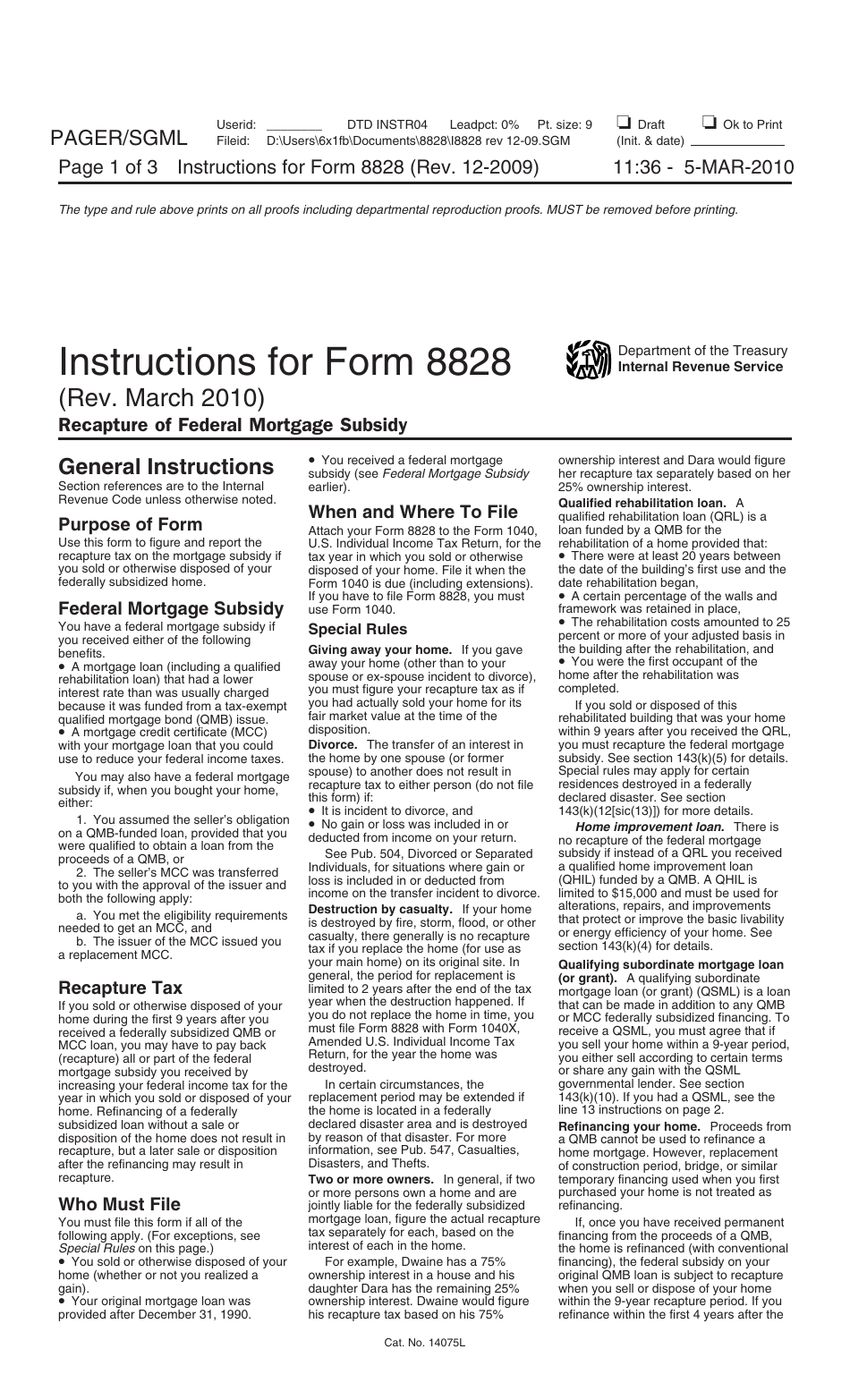

Instructions for IRS Form 8828 Recapture of Federal Mortgage Subsidy

This document contains official instructions for IRS Form 8828 , Recapture of Federal Mortgage Subsidy - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8828 is available for download through this link.

FAQ

Q: What is IRS Form 8828?

A: IRS Form 8828 is used to recapture a federal mortgage subsidy.

Q: When is IRS Form 8828 needed?

A: IRS Form 8828 is needed if you received a federal mortgage subsidy and need to recapture part of it.

Q: What is a federal mortgage subsidy?

A: A federal mortgage subsidy is a benefit or tax break given to homeowners with certain types of mortgages.

Q: Why do I need to recapture a federal mortgage subsidy?

A: You may need to recapture a federal mortgage subsidy if you no longer meet the qualifications or sell your home within a certain timeframe.

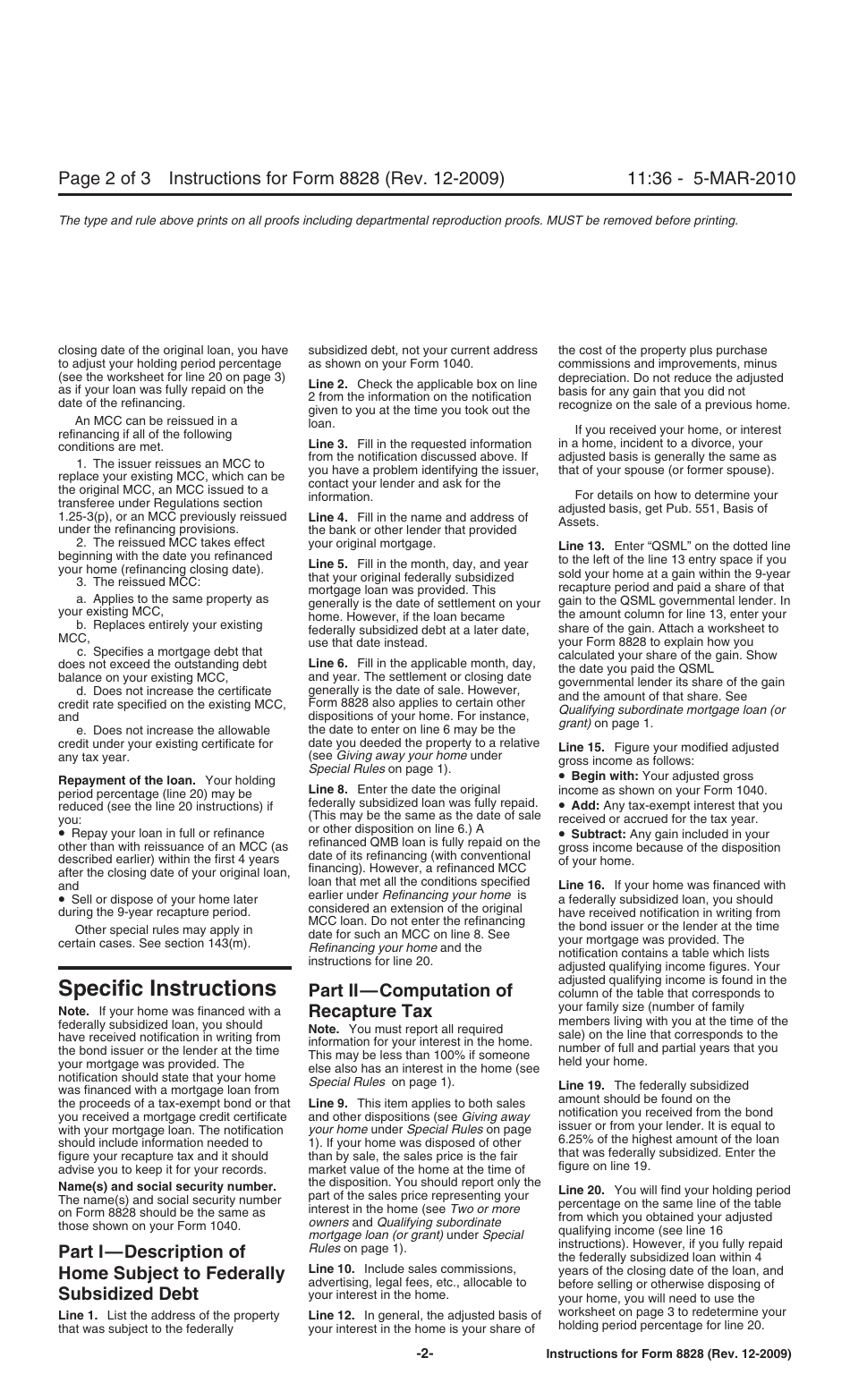

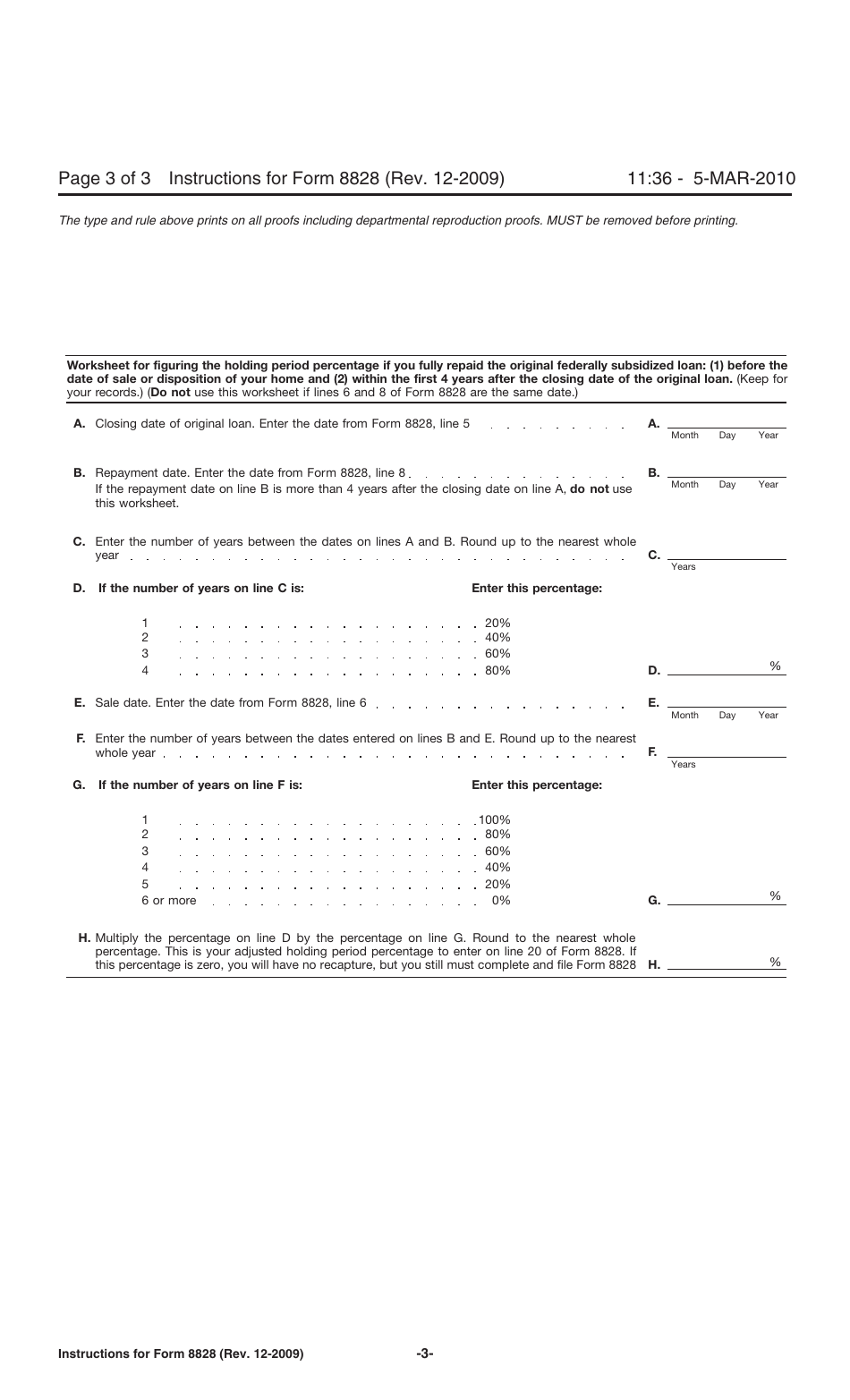

Q: How do I fill out IRS Form 8828?

A: You will need to provide information about your mortgage, subsidy amount, and calculate the recapture amount using the instructions provided with the form.

Q: What happens if I don't recapture a federal mortgage subsidy?

A: If you do not recapture a federal mortgage subsidy when required, you may face penalties or additional taxes owed.

Q: Are there any exceptions to recapturing a federal mortgage subsidy?

A: Yes, there are certain exceptions and special rules for recapturing a federal mortgage subsidy, so it's important to review the instructions or consult a tax professional.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.