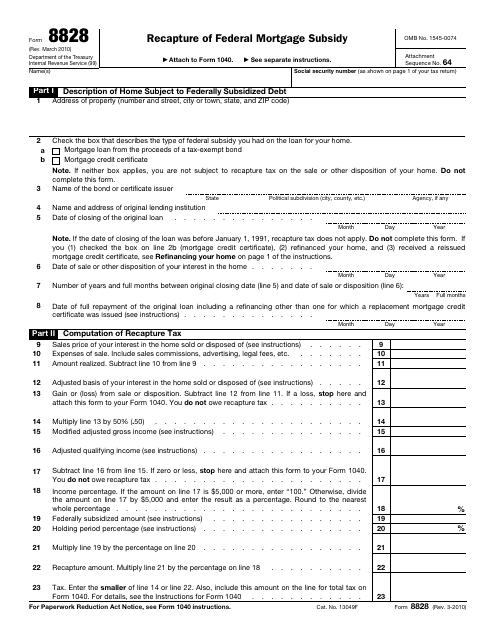

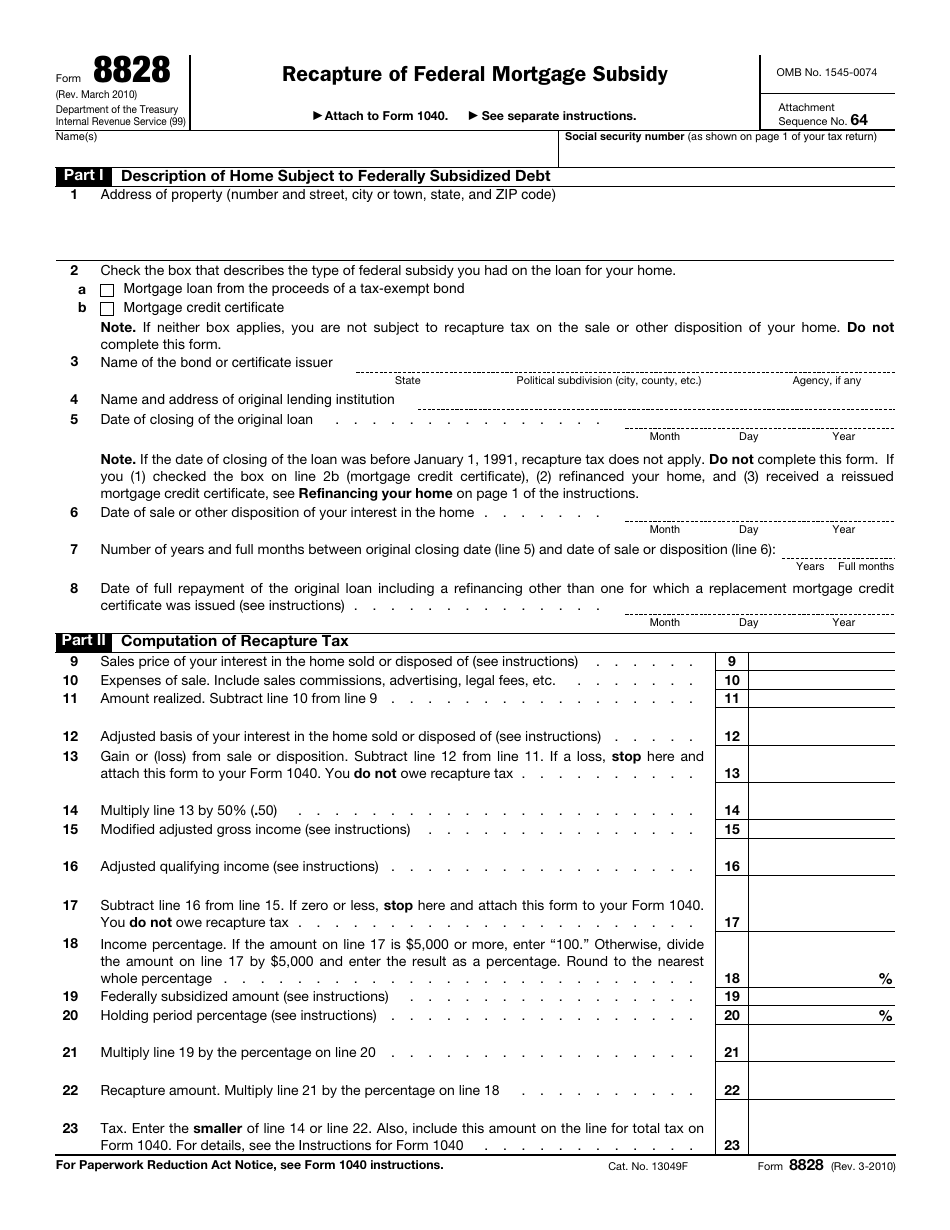

IRS Form 8828 Recapture of Federal Mortgage Subsidy

What Is IRS Form 8828?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on March 1, 2010. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8828?

A: IRS Form 8828 is used to report the recapture of a federal mortgage subsidy.

Q: What is a federal mortgage subsidy?

A: A federal mortgage subsidy is a financial assistance provided to homeowners by the government to help with the cost of their mortgage.

Q: Who needs to file Form 8828?

A: You need to file Form 8828 if you received a federal mortgage subsidy and you meet certain criteria that require the subsidy to be recaptured.

Q: What is recapture?

A: Recapture is the process of repaying a portion of the federal mortgage subsidy that you received.

Q: What information is required when filing Form 8828?

A: When filing Form 8828, you will need to provide details about the property, the subsidy, and calculate the recapture amount.

Q: When is Form 8828 due?

A: Form 8828 is typically due on the same day as your federal income tax return, which is usually April 15th.

Q: Is there any penalty for not filing Form 8828?

A: If you are required to file Form 8828 and you fail to do so, you may be subject to penalties and interest on the unpaid subsidy amount.

Q: Can I e-file Form 8828?

A: No, Form 8828 cannot be e-filed and must be filed by mail.

Q: Can I amend Form 8828?

A: Yes, if you need to make changes to your original Form 8828, you can file an amended Form 8828.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8828 through the link below or browse more documents in our library of IRS Forms.