Instructions for IRS Form 1128 Application to Adopt, Change, or Retain a Tax Year

This document contains instructions forIRS Form 1128, Application to Adopt, Change, or Retain a Tax Year. The purpose of the form is to let the filers request a change in tax year. The instructions were issued by the Internal Revenue Service (IRS) on November 1, 2017 . A PDF version of the file can be downloaded below.

The instructions for IRS Form 1128 contain the following sections:

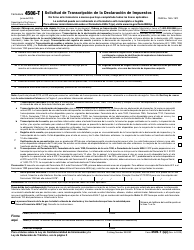

- Part I, General Information. This part must be completed and signed by all types of filers.

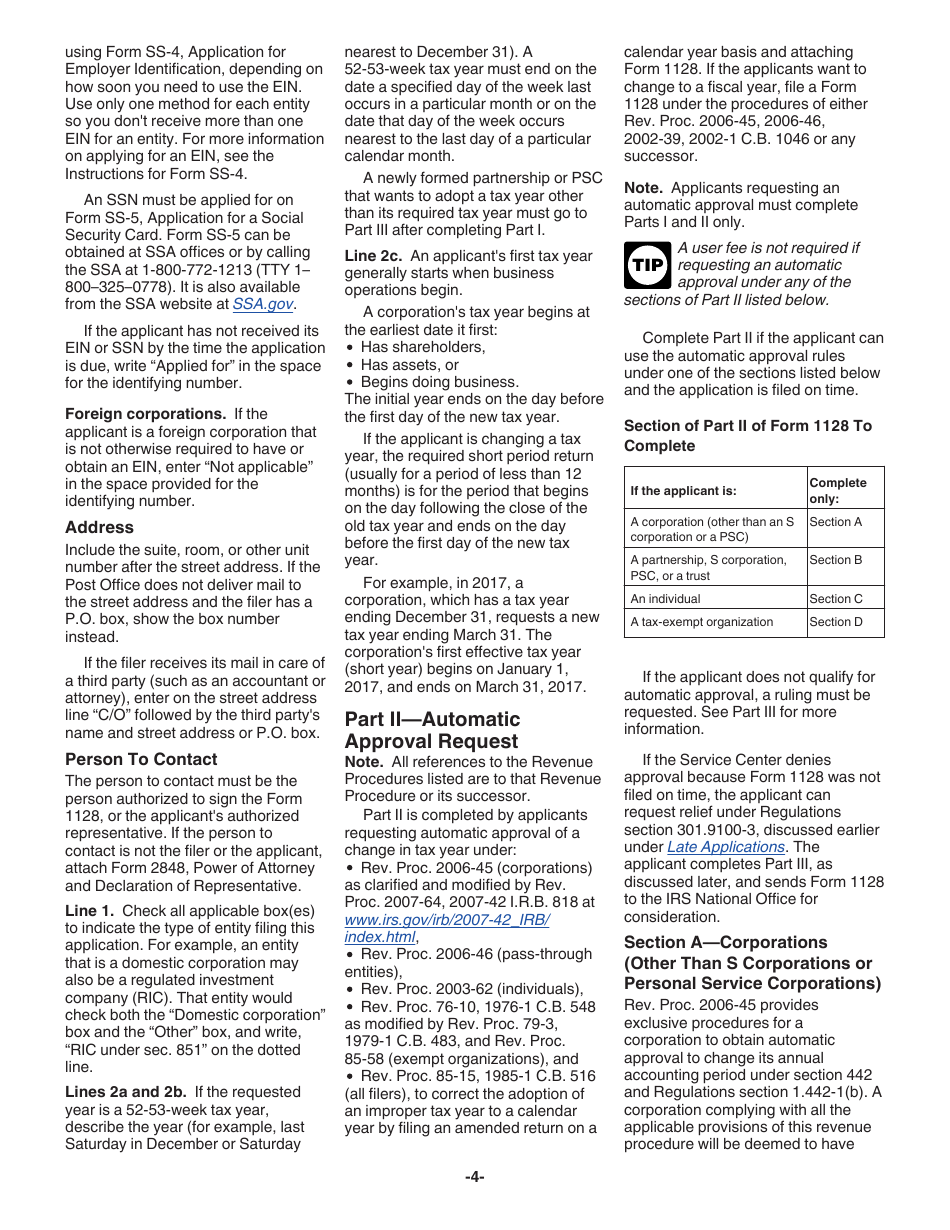

- Part II, Automatic Approval Request. If a filer is requesting automatic approval of a change in tax year, then they must fill out this part.

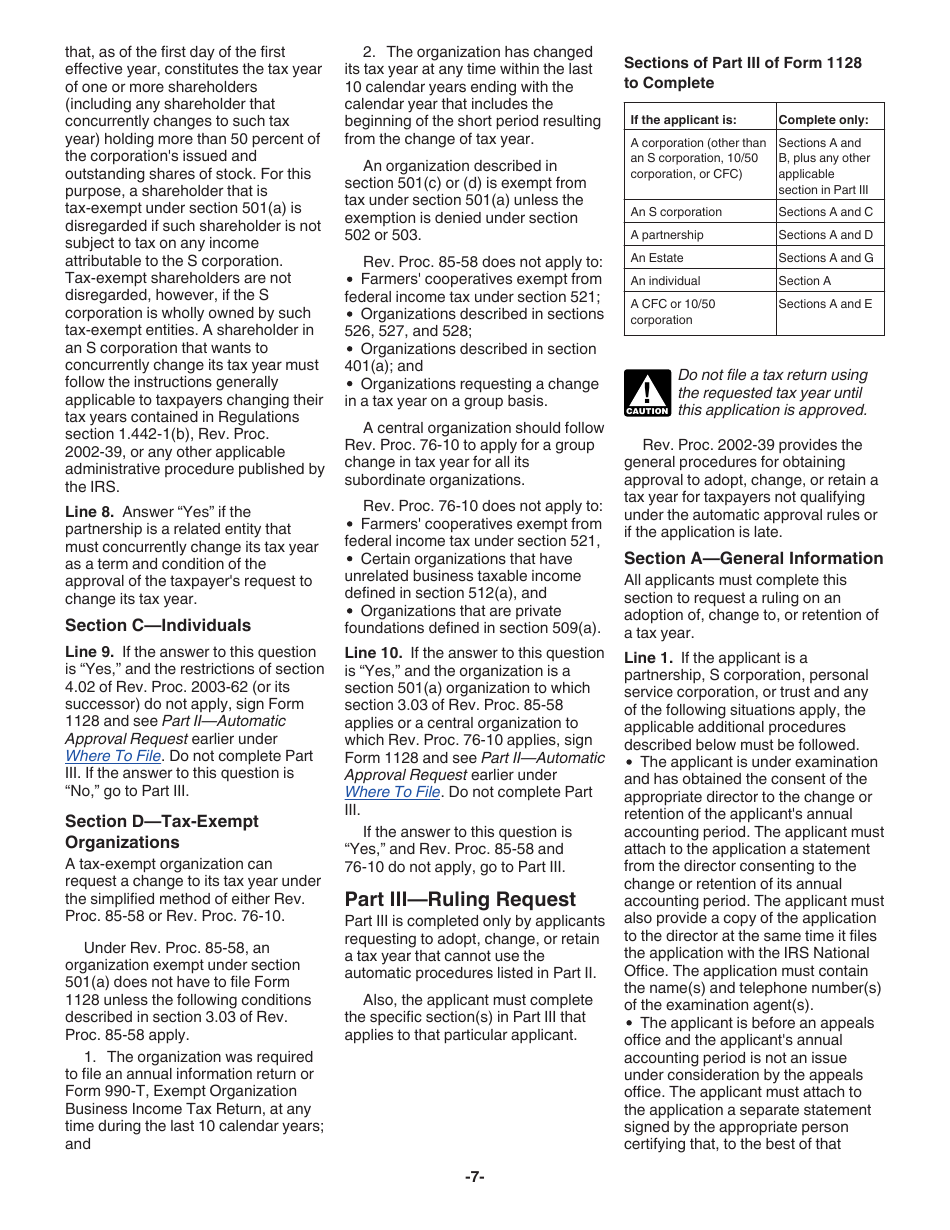

- Part III, Ruling Request. Only applicants who are requesting to change, adopt or retain a tax year that cannot use the automatic procedures listed in Part II, are supposed to fill out Part III.

Where to Mail Form 1128?

The address of where to mail the form depends on the application itself. If the applicant filled out Part II of the document, then the document must be filed with the IRS Center, Attention: Entity Control. The applicant must use the address where their income tax return is filed.

If the applicant filled out Part III of the document, then the document (along with the appropriate user fee) must be filed with the IRS National Office, Associate Chief Counsel (Income Tax and Accounting), Attention: CC:PA:LPD:DRU, PO Box 7604, Ben Franklin Station Washington, DC 20044-7604.

If the applicant is an exempt organization requesting a ruling, they should mail the application to the IRS 1973 N Rulon White Blvd, M/S 6273 Ogden, Utah 84201.

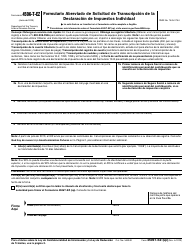

When to File Form 1128?

Depending on the reasons for submitting the form, its due date can vary:

- To request a ruling to adopt, change, or retain a tax year, a filer must submit the document by the due date of the federal income tax return for the first effective year;

- To request automatic approval to change a tax year, the document must be submitted by the due date of the return (including extensions) for the short period required to effect the change;

- For an individual filing to change to a calendar year, the document must be filed on or before the due date for filing the federal income tax return for the short period required to effect the change;

- To change a tax year, a filer must submit the document by the 15th day of the 5th calendar month after the end of the short period.

Except for those listed above, the Instructions for IRS Form 1128 gives information on the exceptions for the general rules of timing, particular parts of the form that must be filled in, and the specific instructions on how to fill out each line.