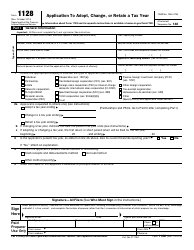

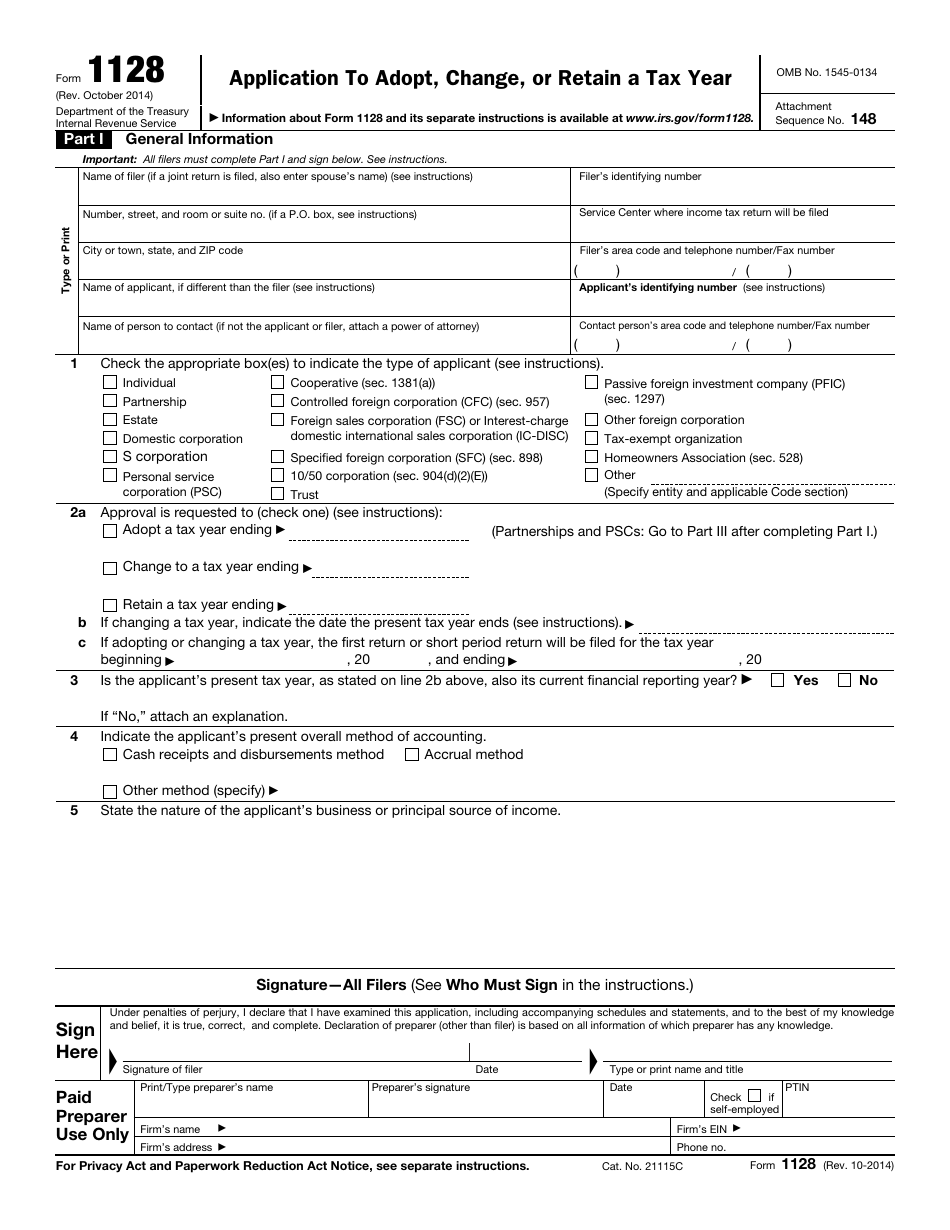

IRS Form 1128 Application to Adopt, Change or Retain a Tax Year

What Is IRS Form 1128?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2014. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1128?

A: IRS Form 1128 is an application used to adopt, change, or retain a tax year.

Q: When should I use Form 1128?

A: You should use Form 1128 if you need to adopt, change, or retain a tax year for your business.

Q: What is the purpose of adopting, changing, or retaining a tax year?

A: Adopting, changing, or retaining a tax year helps determine the timing of when income is reported and when deductions can be taken.

Q: Are there any fees associated with filing Form 1128?

A: Yes, there is a fee for filing Form 1128. The current fee amount can be found in the instructions for the form.

Q: What information do I need to provide when filling out Form 1128?

A: You will need to provide information about your business, the tax year you currently have, and the tax year you want to adopt, change, or retain.

Q: How long does it take for the IRS to process Form 1128?

A: The processing time for Form 1128 can vary, but it is generally recommended to submit your application at least 12 months before the desired change or adoption date.

Q: Can I e-file Form 1128?

A: No, Form 1128 cannot be e-filed and must be filed by mail.

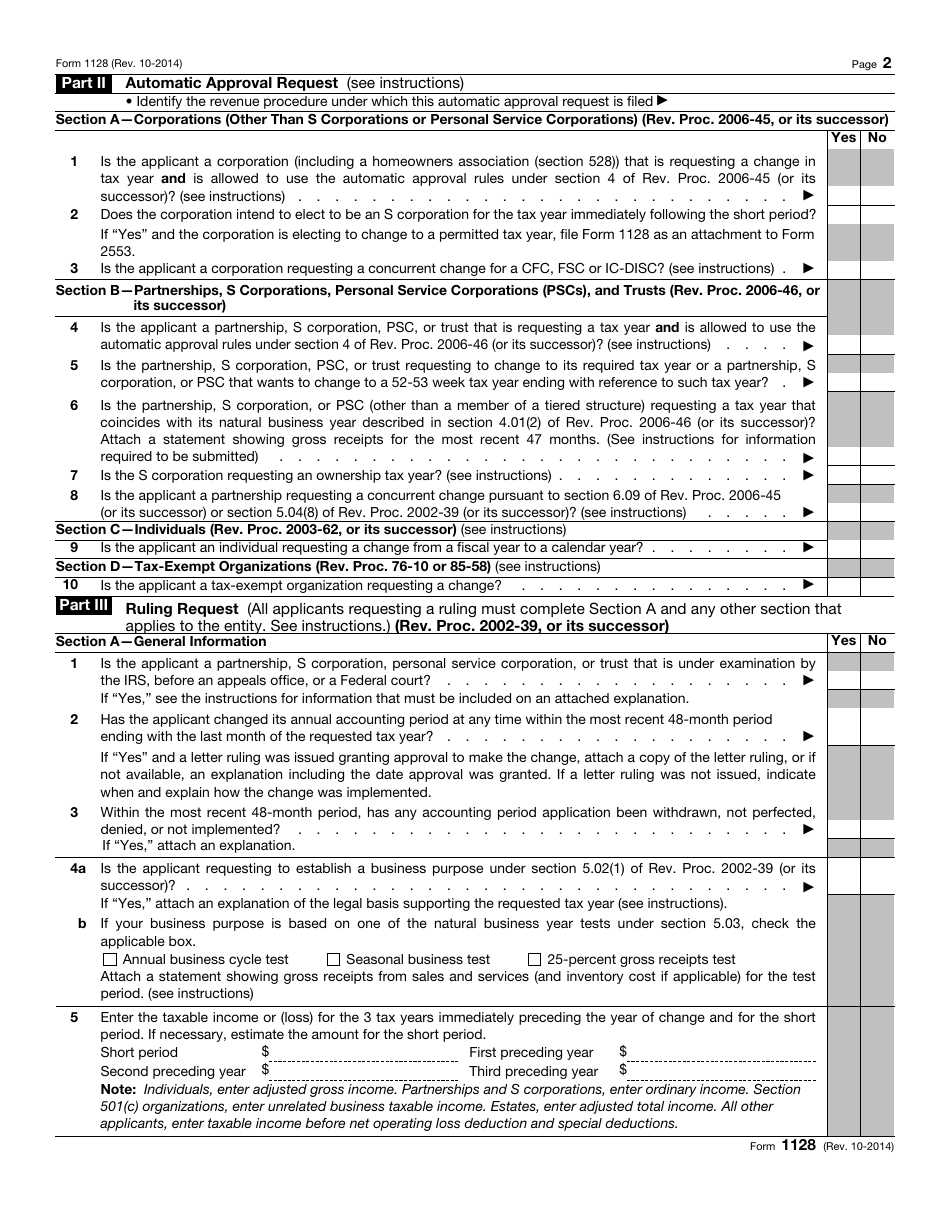

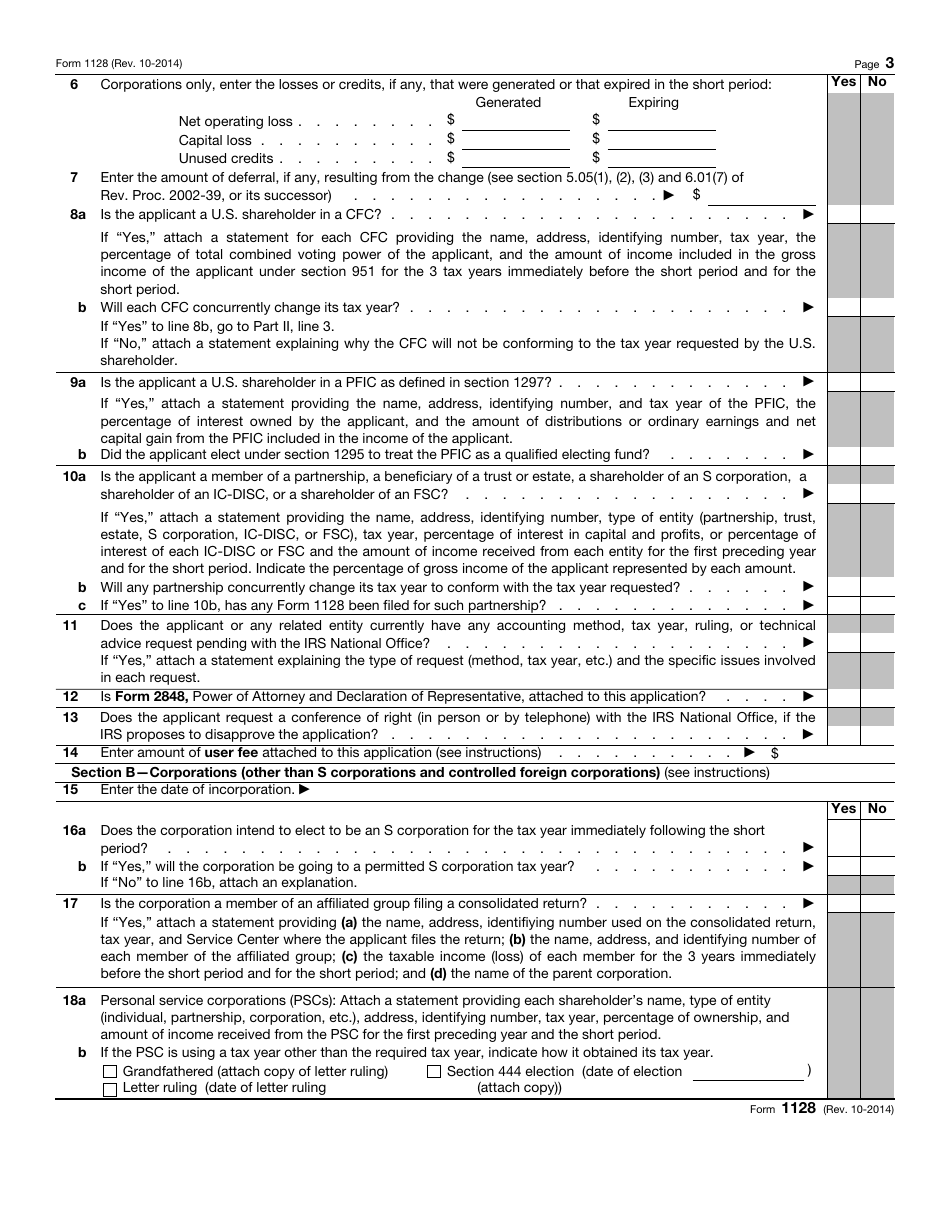

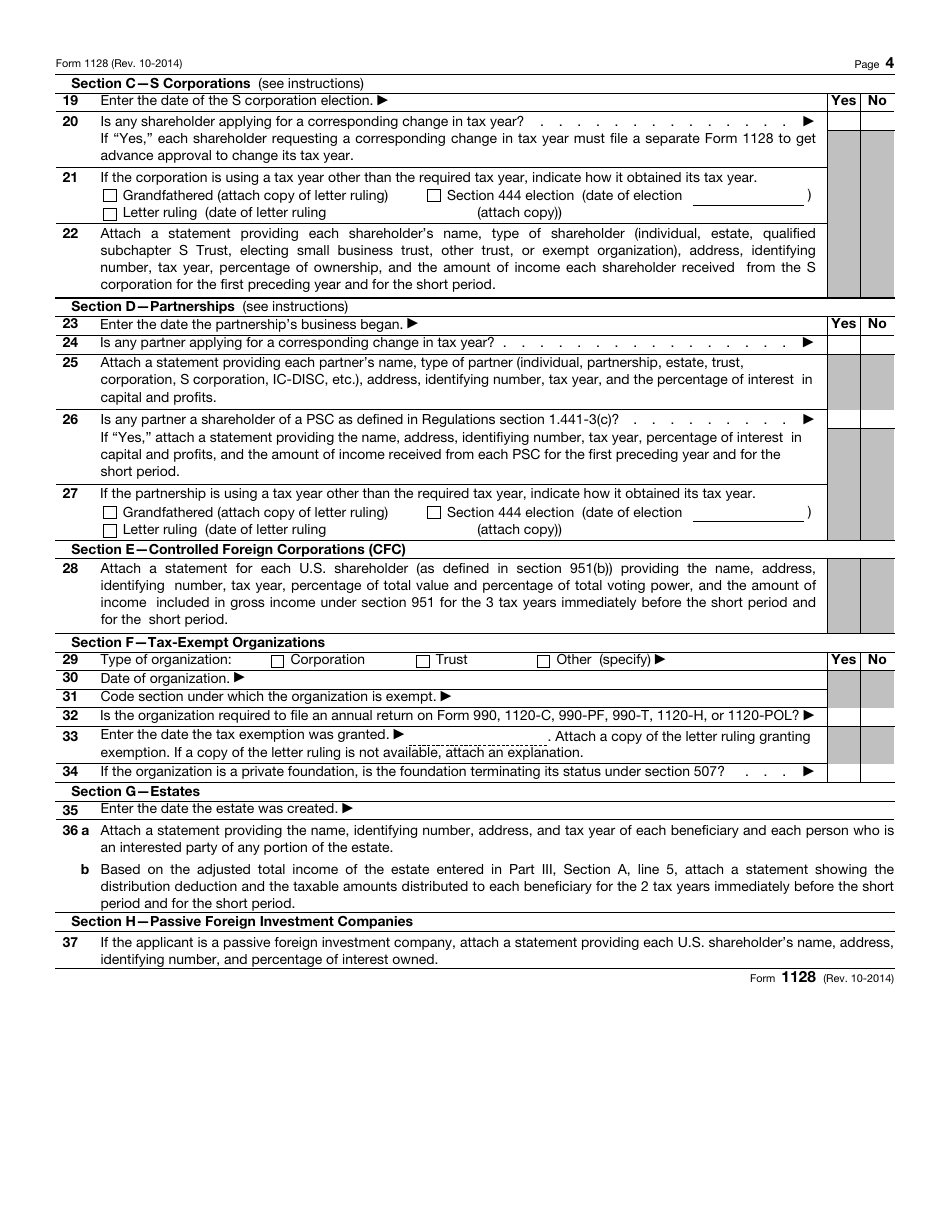

Form Details:

- A 5-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1128 through the link below or browse more documents in our library of IRS Forms.