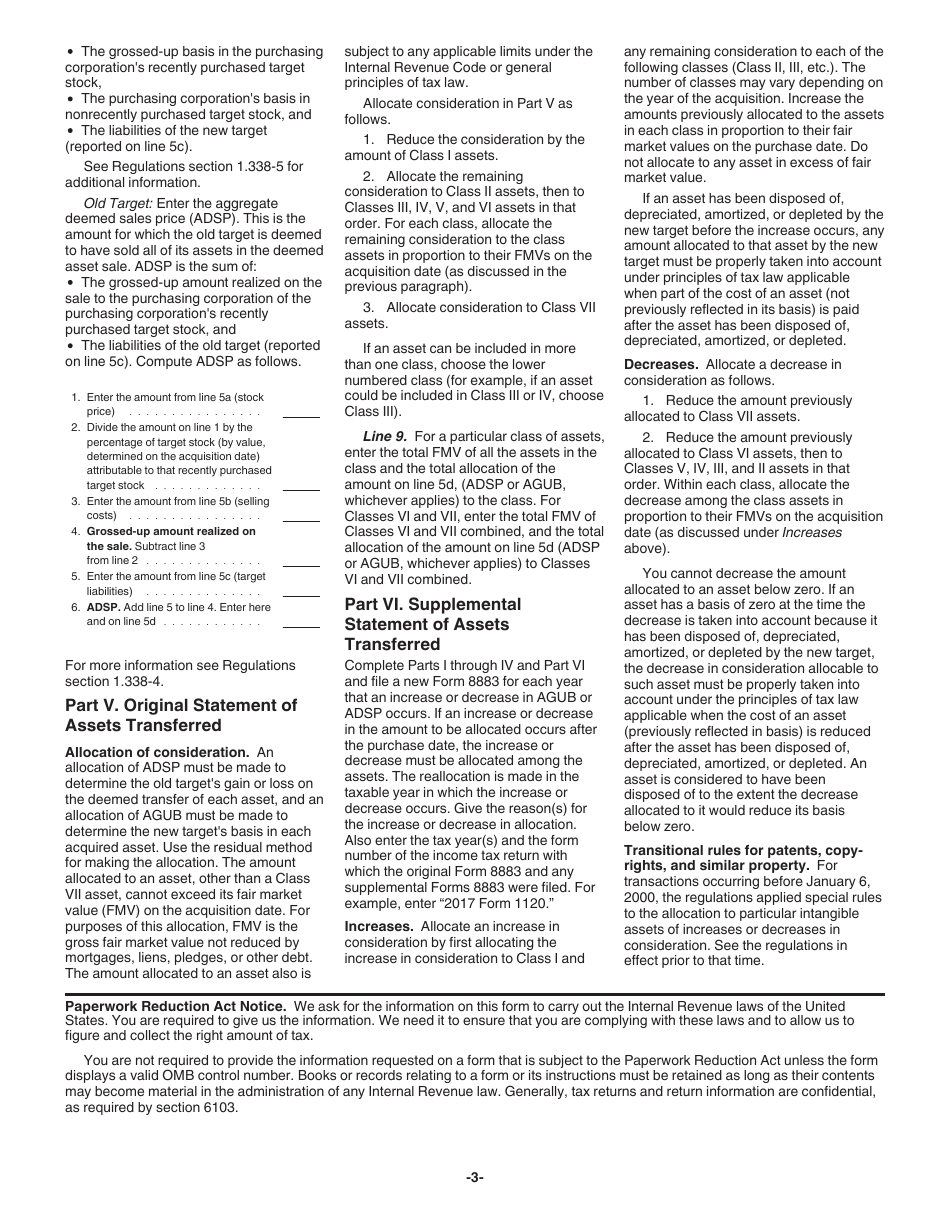

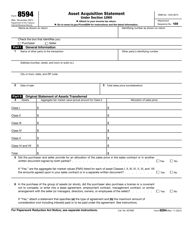

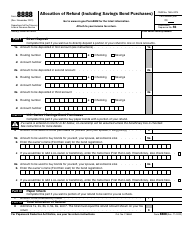

Instructions for IRS Form 8883 Asset Allocation Statement Under Section 338

This document contains official instructions for IRS Form 8883 , Asset Allocation Statement Under Section 338 - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8883 is available for download through this link.

FAQ

Q: What is IRS Form 8883?

A: IRS Form 8883 is the Asset Allocation Statement Under Section 338.

Q: Who needs to file Form 8883?

A: Those taxpayers who are involved in the acquisition of a corporation and make an election under Section 338(h)(10) of the Internal Revenue Code.

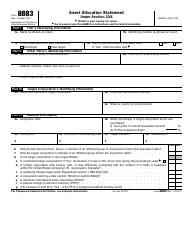

Q: What is the purpose of Form 8883?

A: The purpose of Form 8883 is to provide information about the allocation of assets and liabilities for tax purposes following the acquisition of a corporation.

Q: What information is required on Form 8883?

A: Form 8883 requires information about the acquired corporation, details of the acquisition, and the allocation of assets and liabilities.

Q: When is Form 8883 due?

A: Form 8883 is generally due on the same date as the federal income tax return for the year in which the acquisition occurred.

Q: Are there any penalties for failing to file Form 8883?

A: Yes, failure to file or incomplete filing of Form 8883 may result in penalties imposed by the IRS.

Q: Can I e-file Form 8883?

A: No, currently Form 8883 cannot be filed electronically and must be submitted by mail to the IRS.

Q: Can I amend Form 8883 if I made a mistake?

A: Yes, if you made a mistake on your previously filed Form 8883, you can file an amended form to correct the error.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.