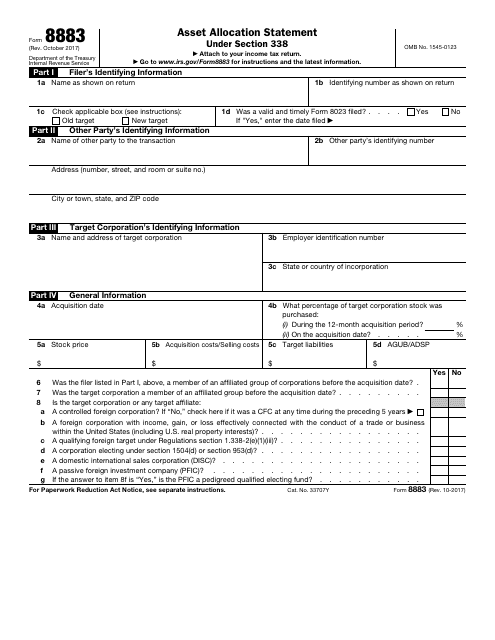

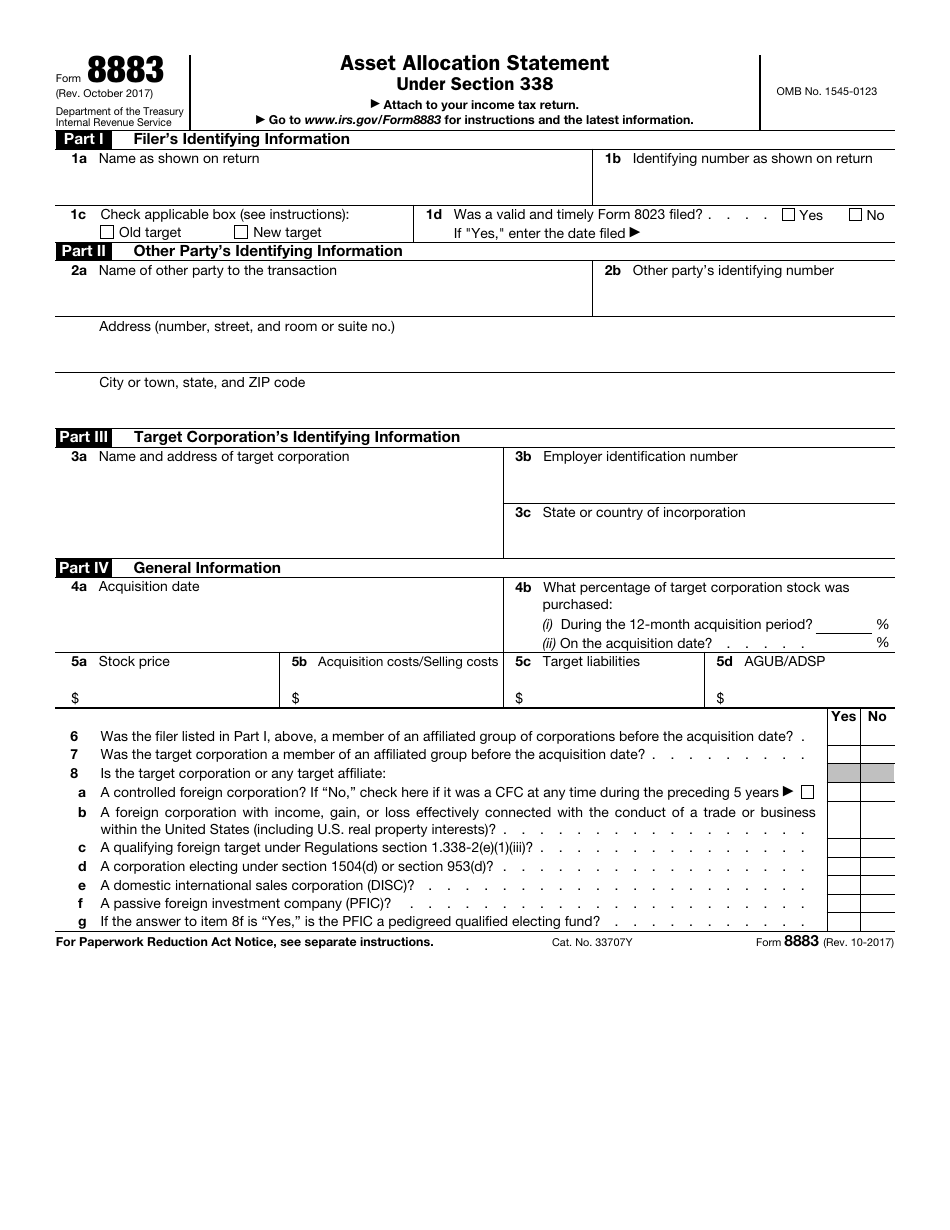

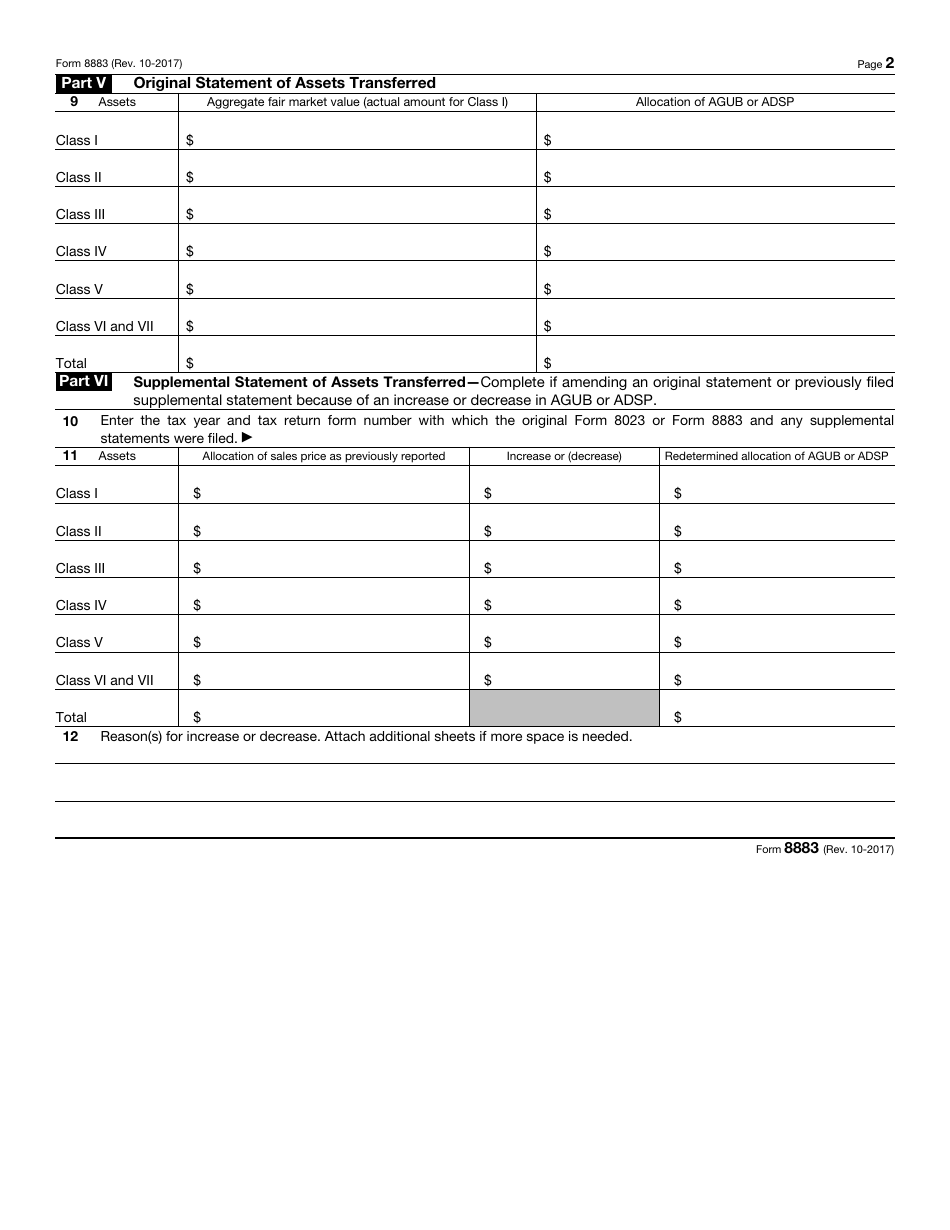

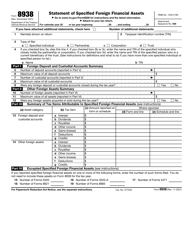

IRS Form 8883 Asset Allocation Statement Under Section 338

What Is IRS Form 8883?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2017. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is Form 8883?

A: Form 8883 is used to report asset allocations under Section 338.

Q: What is Section 338?

A: Section 338 refers to a provision in the IRS code that allows a corporation to be treated as sold for tax purposes.

Q: Who needs to file Form 8883?

A: Form 8883 is typically filed by corporations that have undergone a deemed sale or purchase of assets under Section 338.

Q: What information is required on Form 8883?

A: Form 8883 requires information about the corporation, the deemed sale or purchase, and the asset allocations.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8883 through the link below or browse more documents in our library of IRS Forms.