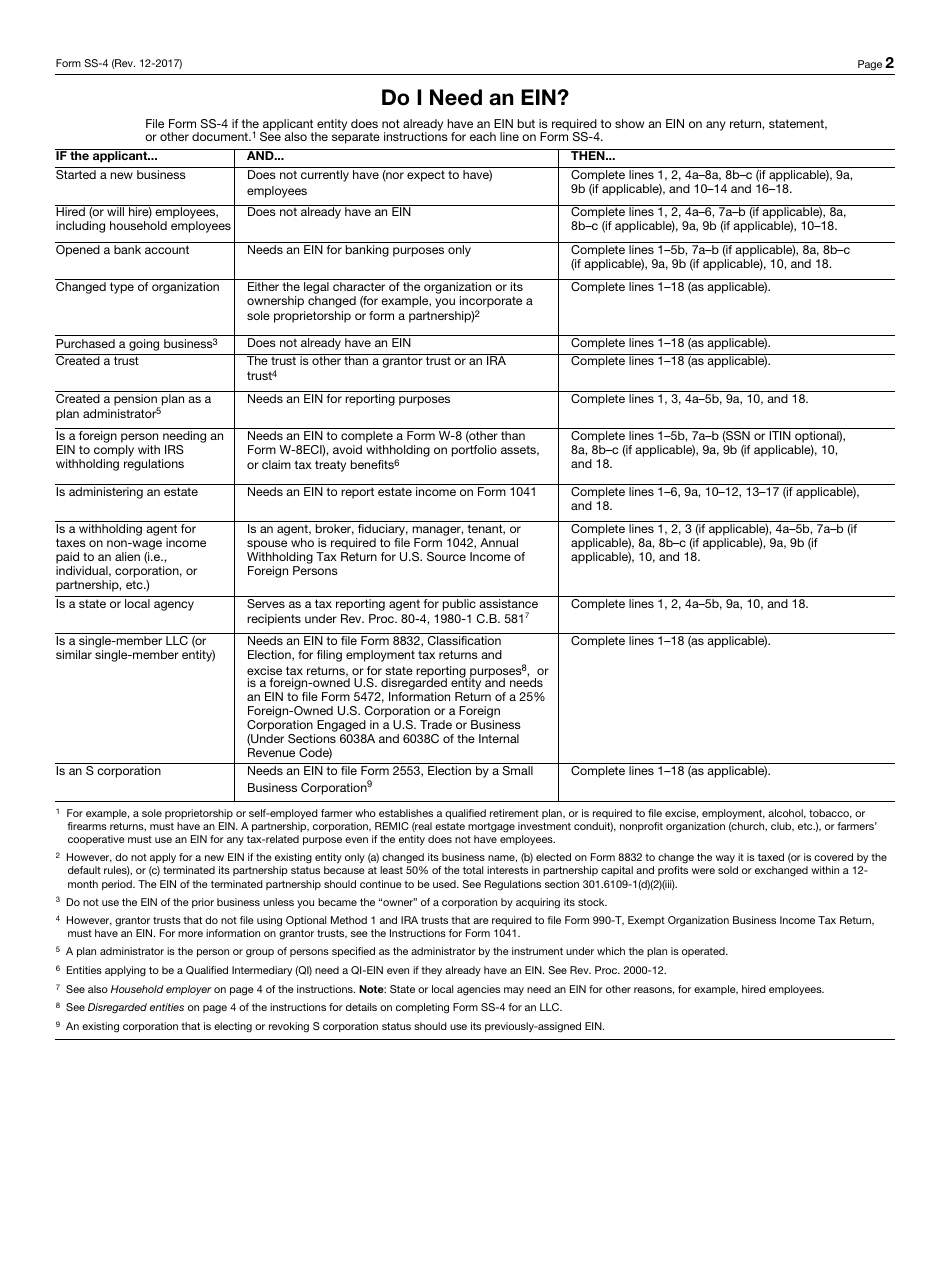

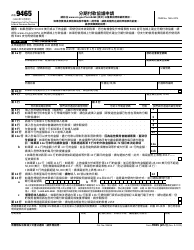

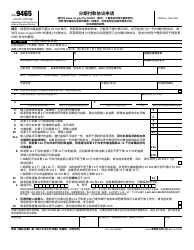

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form SS-4

for the current year.

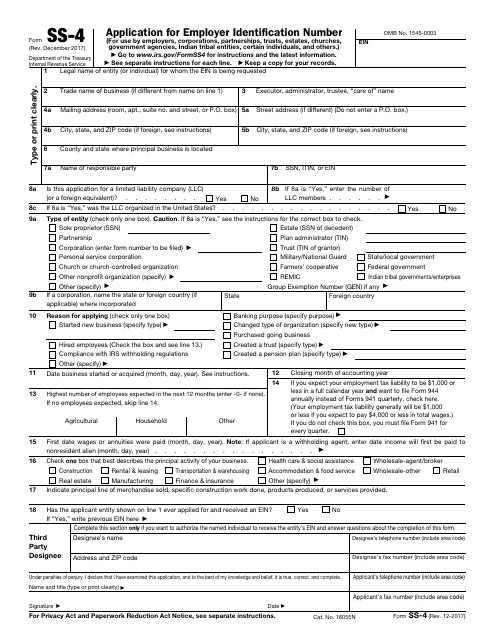

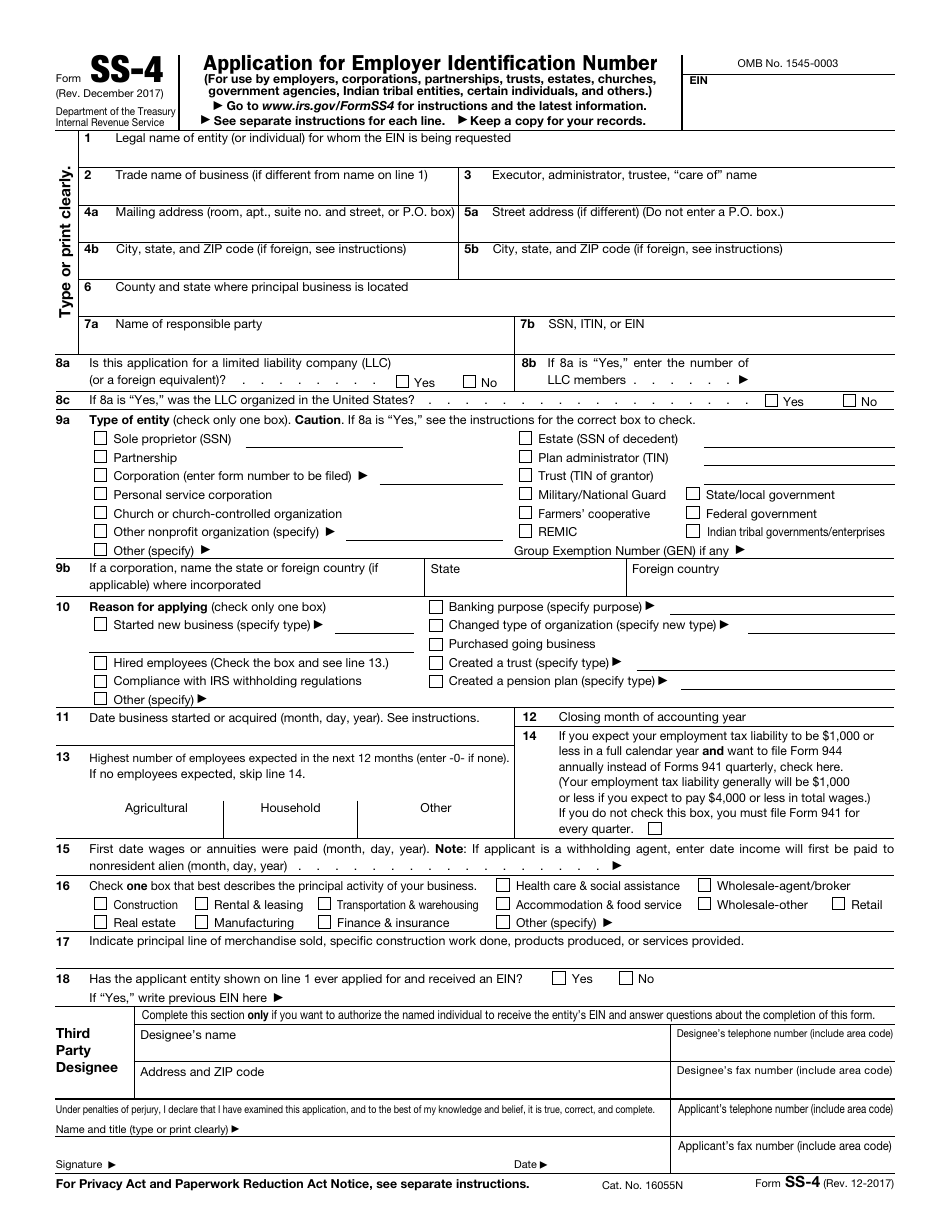

IRS Form SS-4 Application for Employer Identification Number

What Is IRS Form SS-4?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2017. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form SS-4?

A: IRS Form SS-4 is the Application for Employer Identification Number.

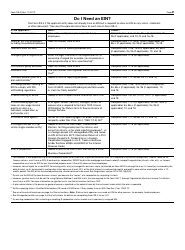

Q: Why do I need an Employer Identification Number (EIN)?

A: You need an EIN if you have employees, operate a business as a partnership or corporation, or file certain tax returns.

Q: What information is required on Form SS-4?

A: Form SS-4 requires information about the entity applying for an EIN, such as the legal name, business address, and type of entity.

Q: How do I submit Form SS-4?

A: You can submit Form SS-4 electronically, by mail, or by fax.

Q: Is there a fee to apply for an EIN using Form SS-4?

A: No, there is no fee to apply for an EIN using Form SS-4.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form SS-4 through the link below or browse more documents in our library of IRS Forms.