This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 2553

for the current year.

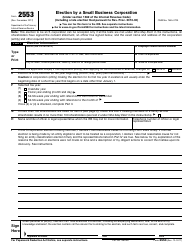

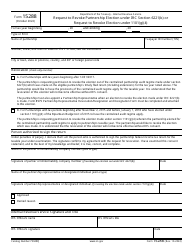

Instructions for IRS Form 2553 Election by a Small Business Corporation

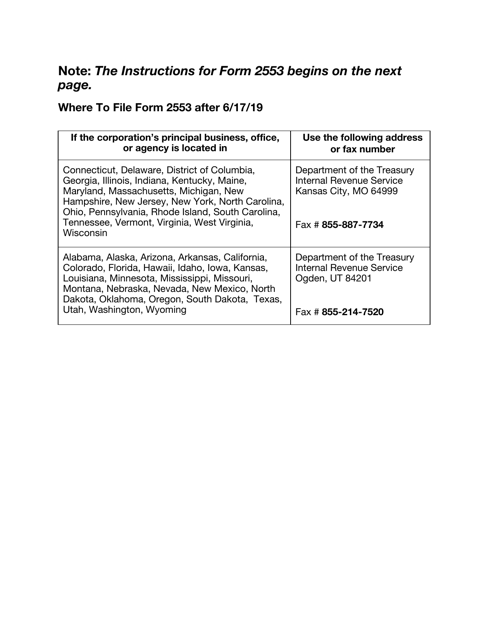

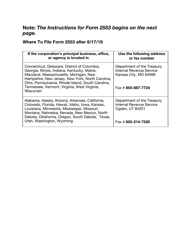

This document contains official instructions for IRS Form 2553 , Election by a Small Business Corporation - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 2553 is available for download through this link.

FAQ

Q: What is IRS Form 2553?

A: IRS Form 2553 is a form used by small business corporations to elect to be treated as an S Corporation for tax purposes.

Q: Who can use Form 2553?

A: Small business corporations can use Form 2553 to elect to be treated as an S Corporation.

Q: What does it mean to be treated as an S Corporation?

A: Being treated as an S Corporation means that the company's profits, losses, deductions, and credits are passed through to the shareholders and reflected on their individual tax returns.

Q: Are there any eligibility requirements to use Form 2553?

A: Yes, there are eligibility requirements. The corporation must be a domestic corporation, have only allowable shareholders, have no more than 100 shareholders, and meet certain other criteria.

Q: When should Form 2553 be filed?

A: Form 2553 should be filed no more than two months and 15 days after the beginning of the tax year the election is to take effect, or at any time during the tax year preceding the tax year it is to take effect.

Instruction Details:

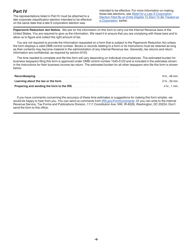

- This 7-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.