IRS Form 1125-E Compensation of Officers

What Is Form 1125-E?

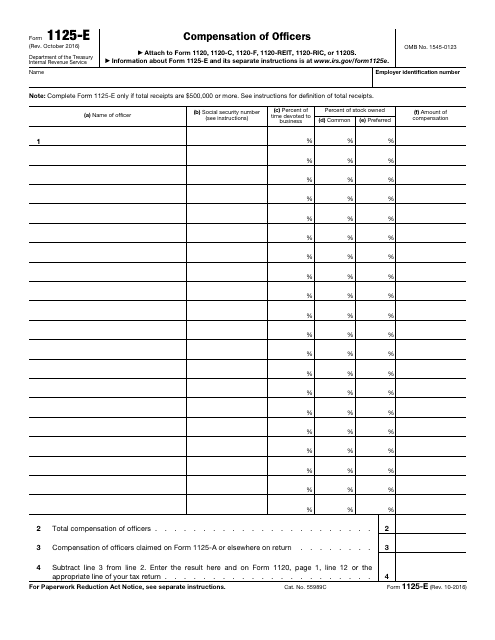

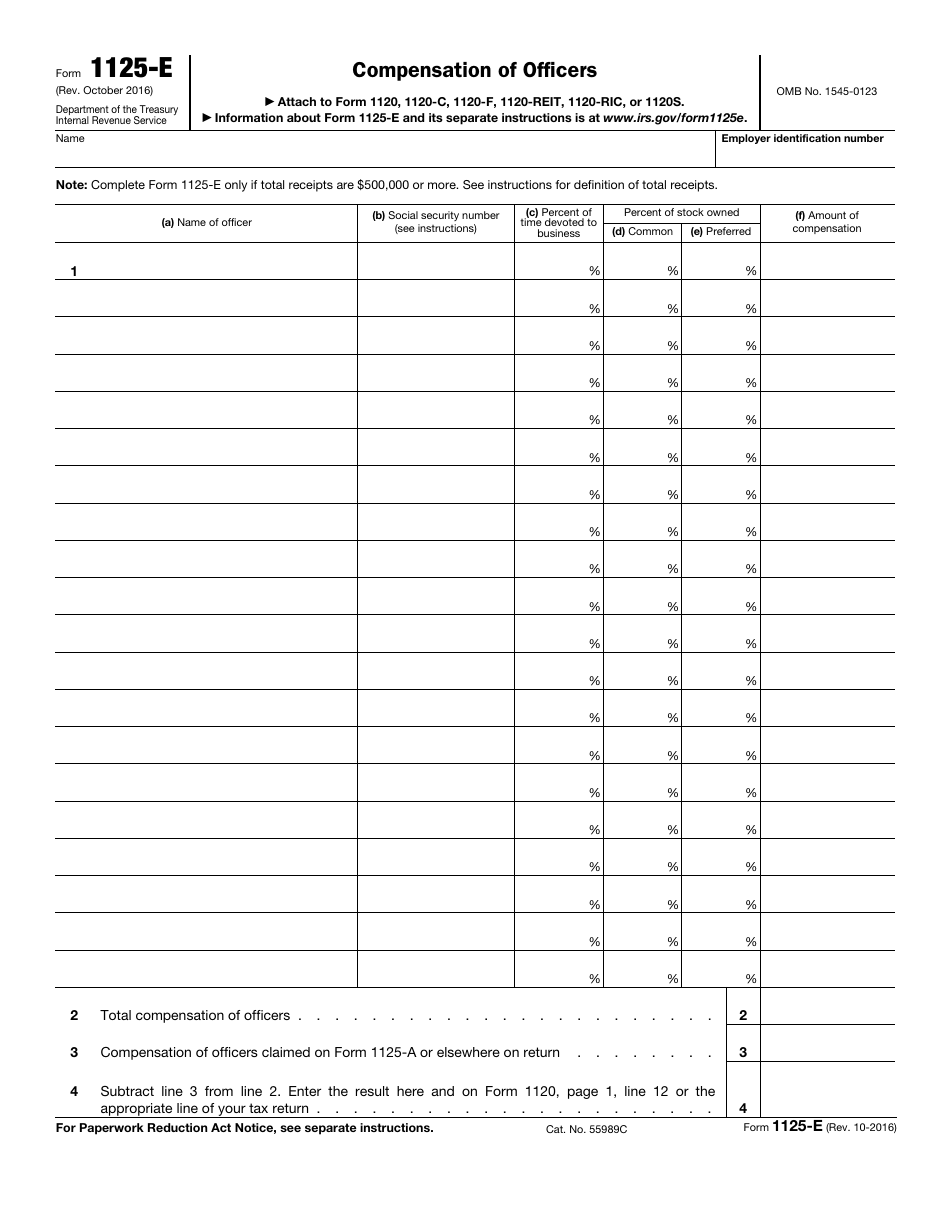

IRS Form 1125-E, Compensation of Officers , is used to provide a detailed report in regards to the deduction for compensation of officers when an entity has $500,000 or more in total receipts. This form is issued by the Internal Revenue Service (IRS) and was last updated on October 1, 2016 . The 1125-E Form does not allow for deductions based on payments to key personnel that go above and beyond their normal compensation, such as instances with golden parachutes. Furthermore, publicly held companies may not deduct compensation for a "covered employee" if the compensation is over $1 million.

A fillable IRS Form 1125-E version is available for download below.

When Does Form 1125-E Need to Be Used?

Form 1125-E needs to be used as a detailed report of deduction for compensation of officers when the entity has $500,000 or more in total receipts during the given tax year.

How to Fill Out Form 1125-E?

The IRS defines a "covered employee" as the principal executive officer or principal financial officer of a corporation, an employee who is listed as among the three highest compensated officer during that tax year (pursuant to regulations from the Securities and Exchange Act of 1934), a "covered employee" for any preceding tax year starting after December 31st, 2016. Compensation is also not deductible from income from specific employee trusts, annuity plans, or pensions, nor any benefit paid to an employee that is outside the employee's income.

There are three other rules that must be followed when completing Compensation of Officers Form 1125-E. The first is that the limit for deductions does not apply to payable income listed under a binding, written contract that came into effect on February 17, 1993. The second is that the $1 million ceiling is further lowered by amounts not allowed as excess parachute payments listed in section 280G. The $1 million compensation limit is lowered to $500,000 for executive remuneration and deferred deduction of executive remuneration which is paid to "covered executives" by any business or entity that receives or has received aid financially under the Treasury Troubled Asset Relief Program (TARP). The third is that special rules also apply to binding, written contracts in effect on November 2, 2017 and must not have been materially modified on or after that date.

Form 1125-E is comprised of four sections. The first section asks for the name of the officer, their social security number (SSN), the percent of time the officer is devoted to business, the percent of stock owned by the officer (both common and preferred), and the amount of compensation given to the officer. The second is the total compensation of all officers listed in the previous section. The third section is the compensation of officers claimed on IRS Form 1125-A, Cost of Goods Sold, or anywhere else on the return. The fourth and final section asks to subtract line 3 from line 2 and to enter the result in the space provided on the right and on Form 1120, page 1, line 12 of the tax return.

IRS 1125-E Related Forms

- Form 1120, U.S. Corporation Income Tax Return;

- Form 1120-C, U.S. Income Tax Return for Cooperative Associations;

- Form 1120-F, U.S. Income Tax Return of a Foreign Corporation;

- Form 1120-REIT, U.S. Income Tax Return for Real Estate Investment Trusts;

- Form 1120-RIC, U.S. Income Tax Return for Regulated Investment Companies;

- Form 1120-S, U.S. Income Tax Return for an S Corporation.