Instructions for IRS Form 1125-E Compensation of Officers

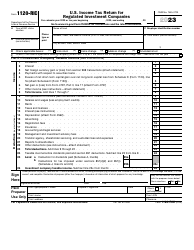

This document contains official instructions for IRS Form 1125-E , Compensation of Officers - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1125-E is available for download through this link.

FAQ

Q: What is IRS Form 1125-E?

A: IRS Form 1125-E is a form used to report the compensation of officers for corporations.

Q: Who needs to file Form 1125-E?

A: Corporations that have employees who are also corporate officers need to file Form 1125-E.

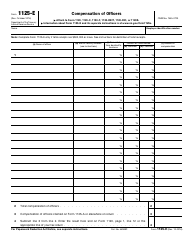

Q: What information is required on Form 1125-E?

A: Form 1125-E requires information about the compensation paid to corporate officers, including their names, titles, and amounts of compensation.

Q: When is Form 1125-E due?

A: Form 1125-E is typically due with the corporation's tax return, which is generally due on the 15th day of the third month after the end of the corporation's tax year.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.