This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form W-8IMY

for the current year.

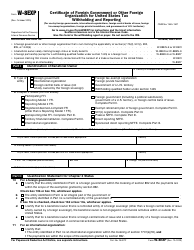

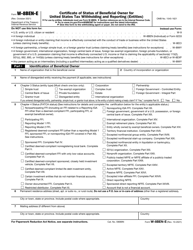

Instructions for IRS Form W-8IMY Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Branches for United States Tax Withholding and Reporting

This document contains official instructions for IRS Form W-8IMY , Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Branches for United States Tax Withholding and Reporting - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form W-8IMY is available for download through this link.

FAQ

Q: What is the purpose of IRS Form W-8IMY?

A: IRS Form W-8IMY is used to certify the status of a foreign intermediary, foreign flow-through entity, or certain U.S. branches for tax withholding and reporting purposes.

Q: Who needs to fill out and submit IRS Form W-8IMY?

A: Foreign intermediaries, foreign flow-through entities, and certain U.S. branches are required to fill out and submit IRS Form W-8IMY.

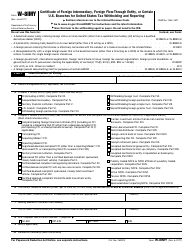

Q: What information is required on IRS Form W-8IMY?

A: IRS Form W-8IMY requires information about the entity's status, name, address, taxpayer identification number (if applicable), and the treaty claims (if any) they are asserting.

Q: When should IRS Form W-8IMY be submitted?

A: IRS Form W-8IMY should be submitted to the withholding agent or payer before income subject to withholding is paid or credited.

Q: What happens if IRS Form W-8IMY is not submitted?

A: If IRS Form W-8IMY is not submitted, the withholding agent or payer may be required to withhold a higher rate of tax on the income.

Q: Are there any penalties for providing false information on IRS Form W-8IMY?

A: Yes, there are penalties for providing false information on IRS Form W-8IMY, including civil and criminal penalties.

Q: Can IRS Form W-8IMY be used for purposes other than tax withholding and reporting?

A: No, IRS Form W-8IMY is specifically used for tax withholding and reporting purposes.

Q: Is there a separate IRS form for individual taxpayers?

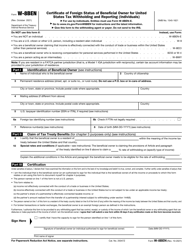

A: Yes, individual taxpayers should use IRS Form W-8BEN to certify their status.

Instruction Details:

- This 18-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.