This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form W-8IMY

for the current year.

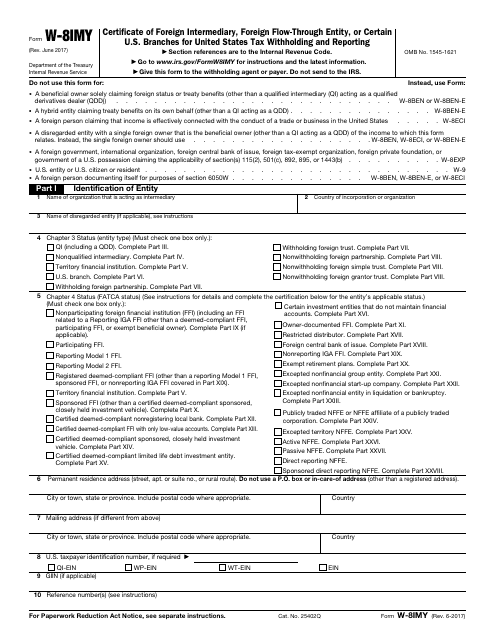

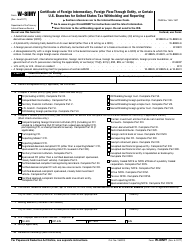

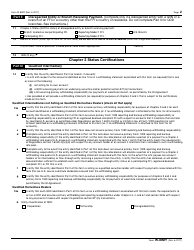

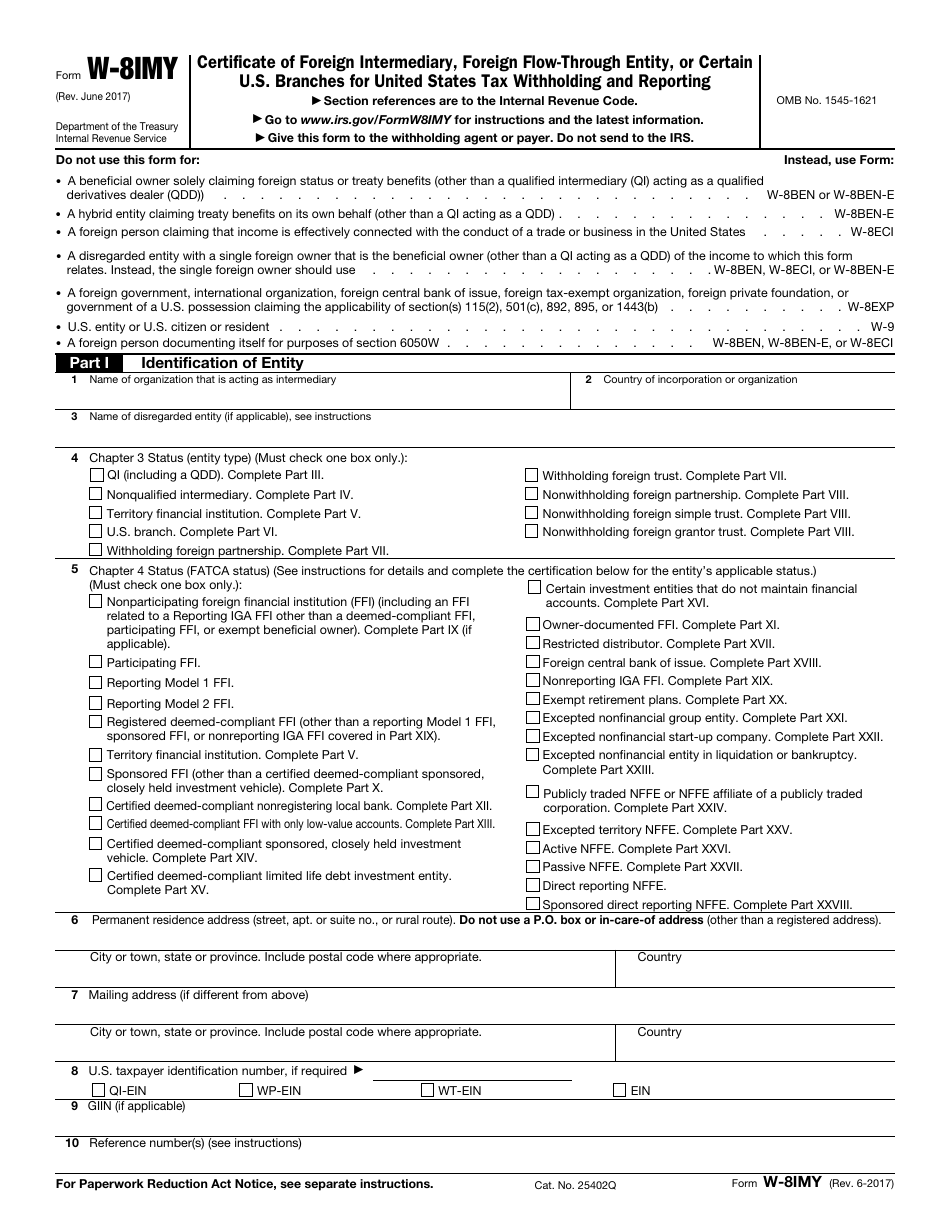

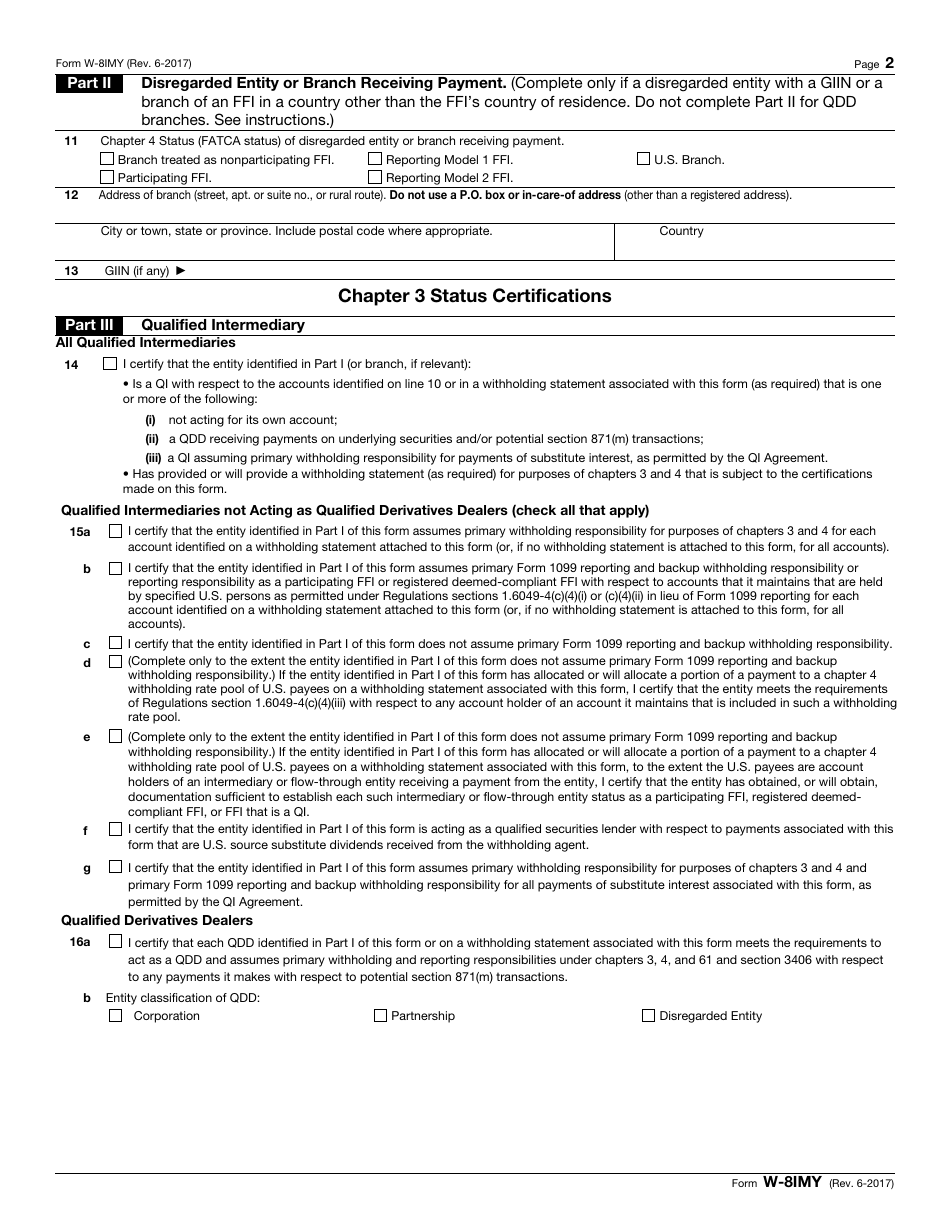

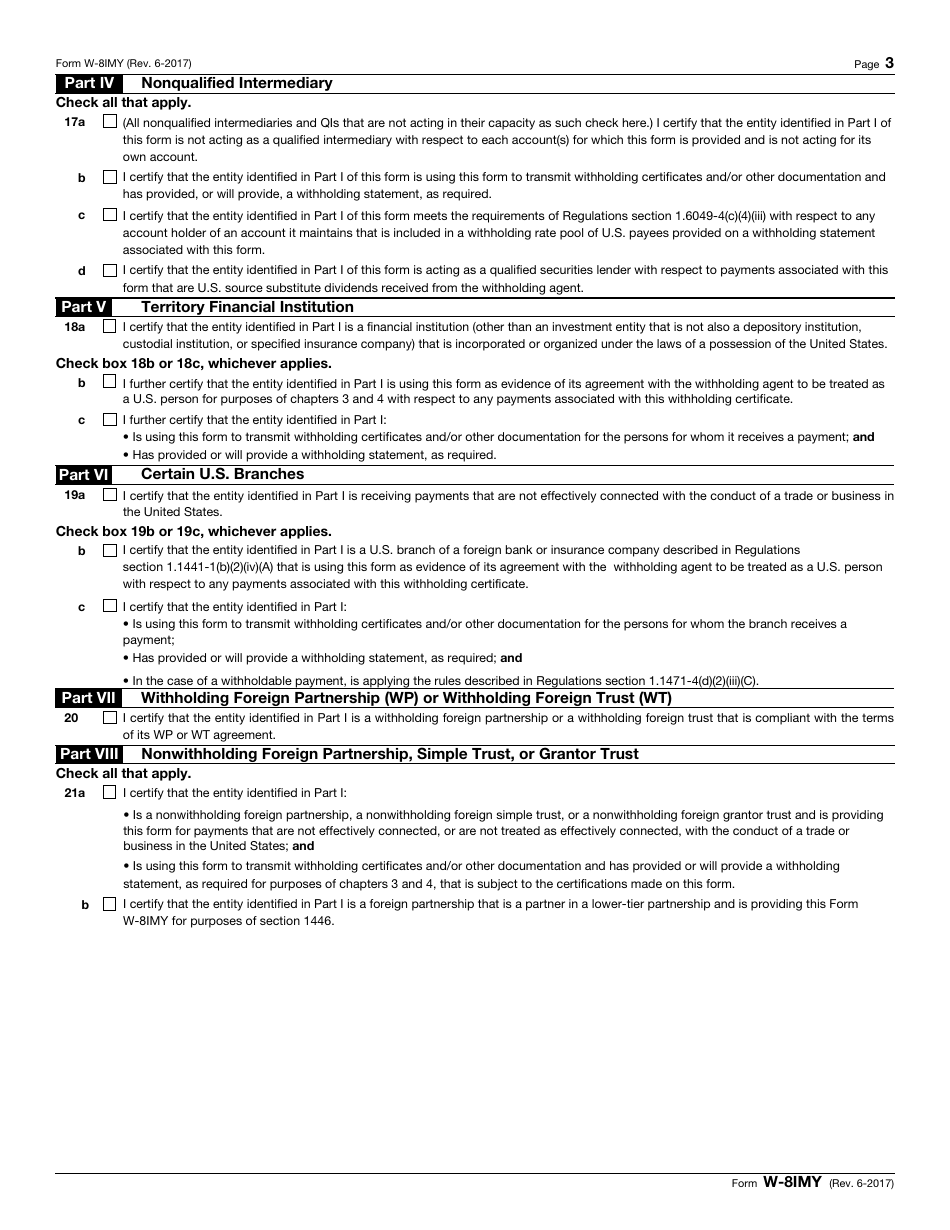

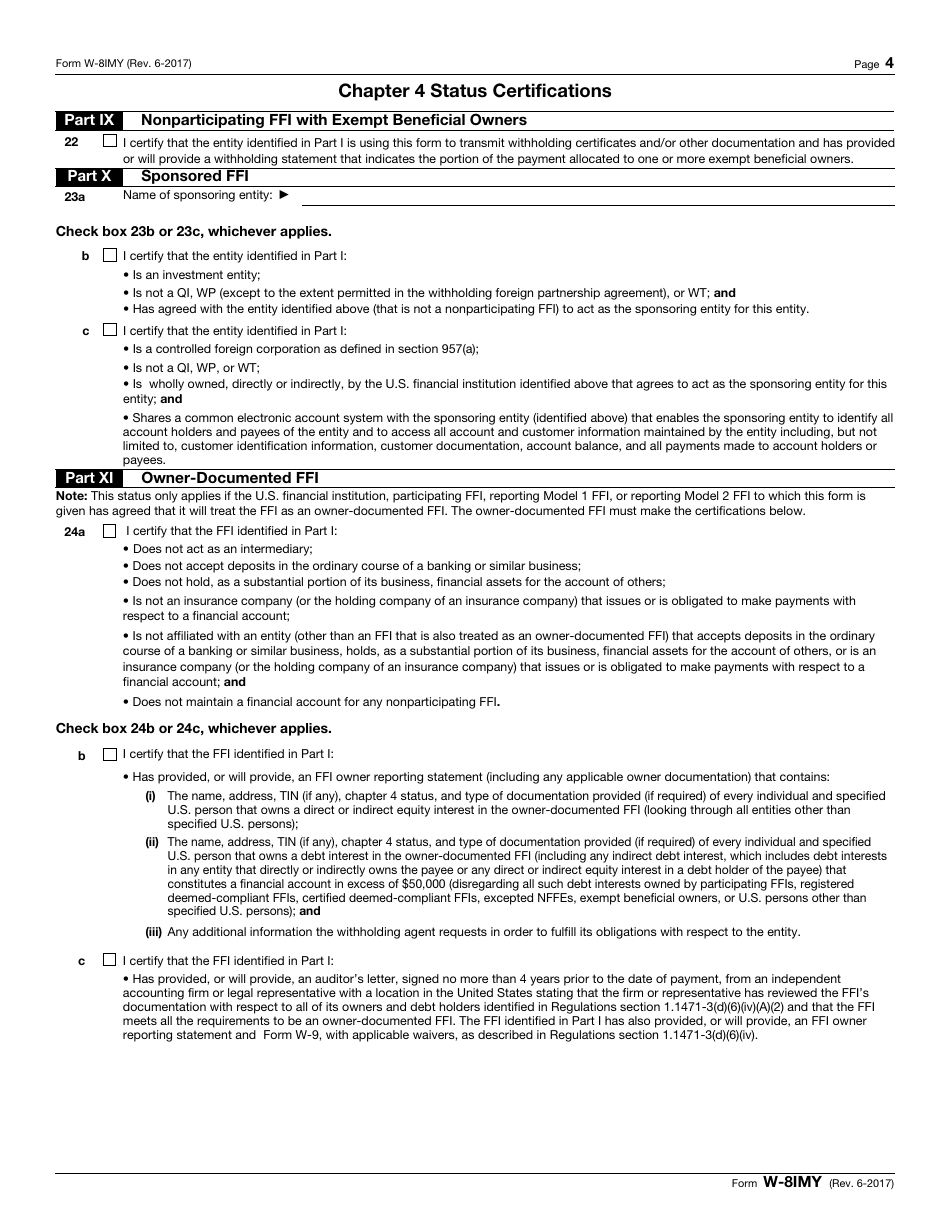

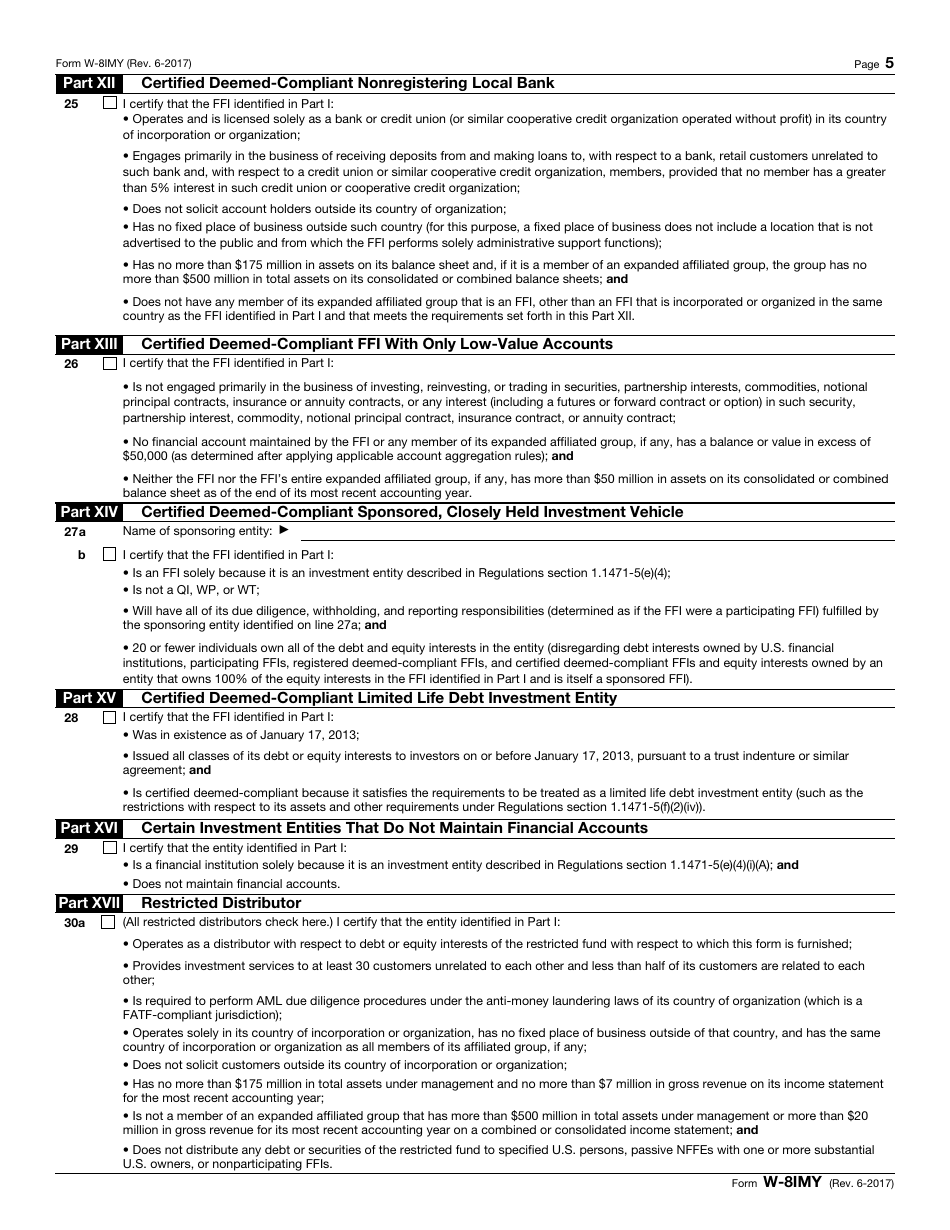

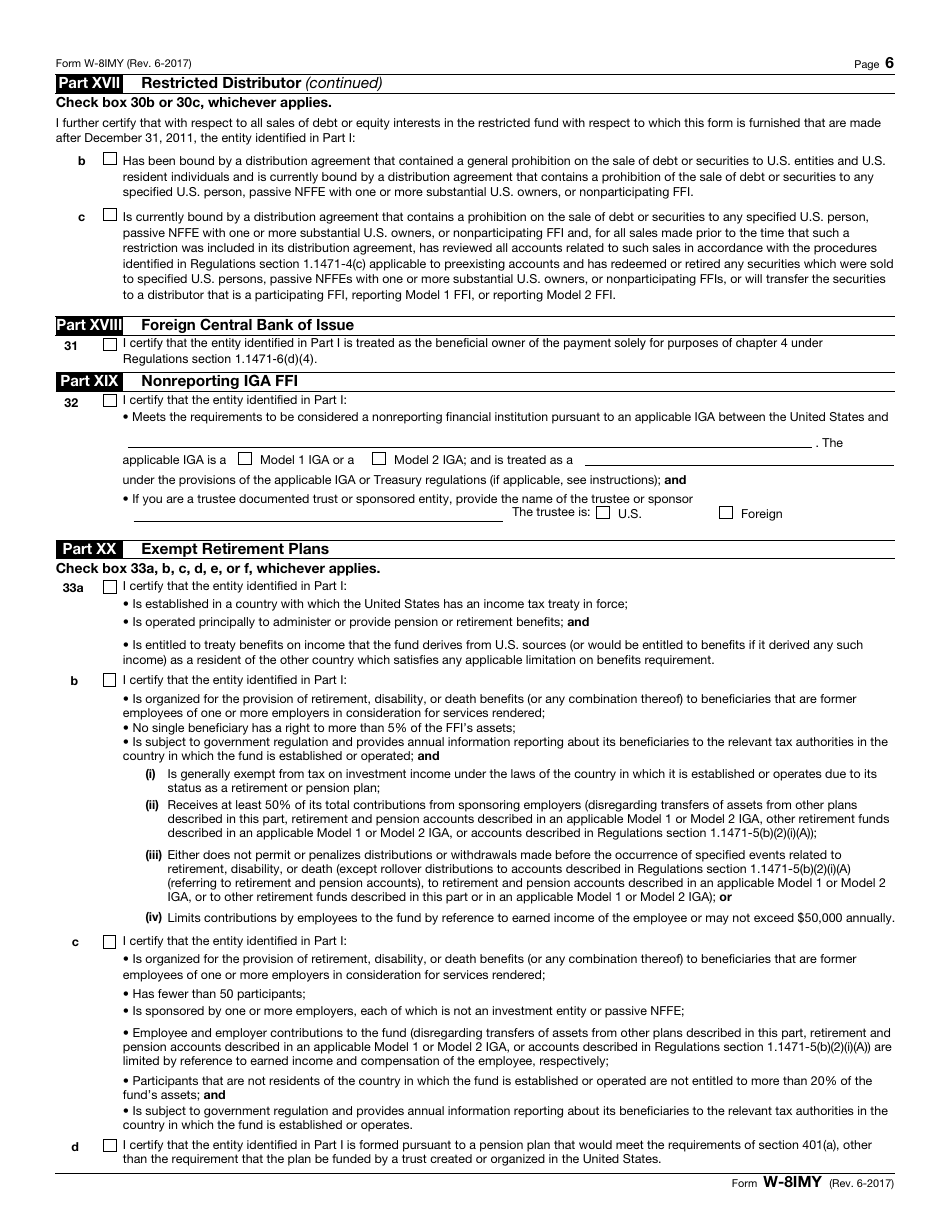

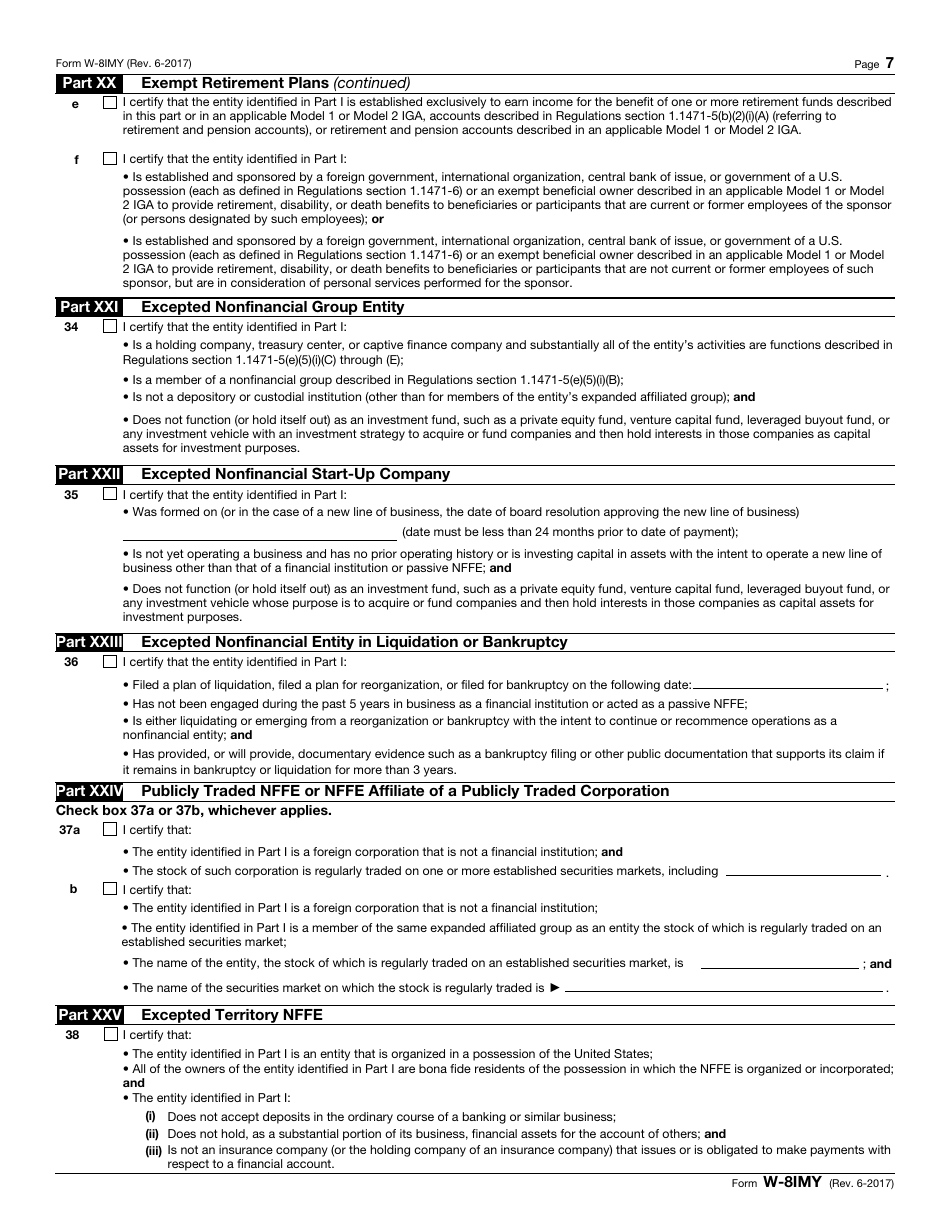

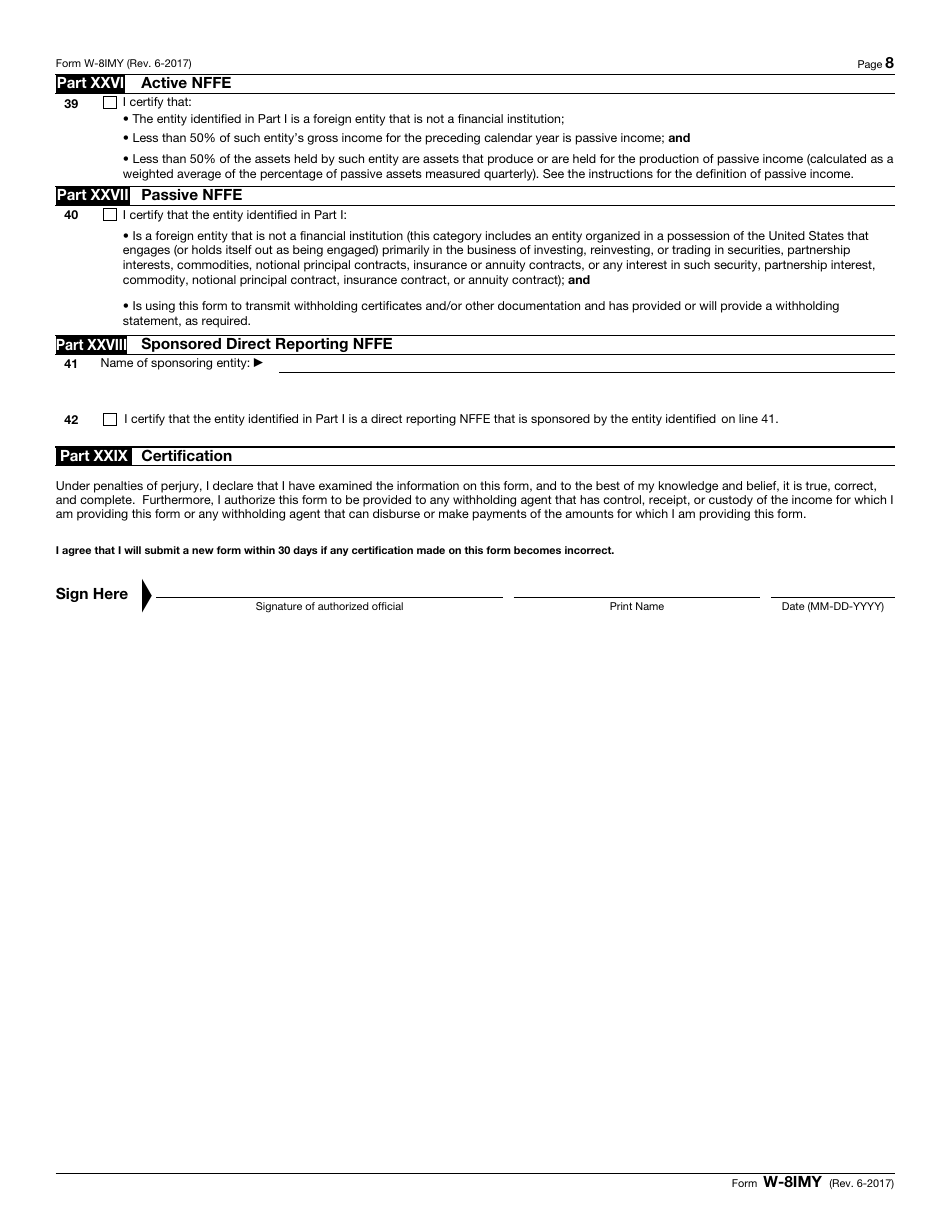

IRS Form W-8IMY Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Branches for United States Tax Withholding and Reporting

What Is IRS Form W-8IMY?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2017. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is Form W-8IMY?

A: Form W-8IMY is a tax form used by foreign intermediaries, foreign flow-through entities, or certain U.S. branches to certify their status and claim a reduced rate of withholding on income from U.S. sources.

Q: Who needs to file Form W-8IMY?

A: Foreign intermediaries, foreign flow-through entities, or certain U.S. branches who receive income from U.S. sources and want to claim a reduced rate of withholding need to file Form W-8IMY.

Q: What is the purpose of Form W-8IMY?

A: The purpose of Form W-8IMY is to establish the foreign status of the filer and to claim a reduced rate of withholding on income from U.S. sources.

Q: When should Form W-8IMY be filed?

A: Form W-8IMY should be filed before the first payment of income from U.S. sources is received.

Q: What happens if I don't file Form W-8IMY?

A: If you don't file Form W-8IMY, the payer may be required to withhold taxes at the maximum rate on the income you receive from U.S. sources.

Q: Can I claim a refund of withheld taxes if I file Form W-8IMY?

A: Yes, if you are eligible for a reduced rate of withholding and have filed Form W-8IMY, you may be able to claim a refund of any excess taxes withheld.

Q: Are there any penalties for failing to file Form W-8IMY?

A: Yes, failing to file Form W-8IMY or providing incorrect information on the form may result in penalties imposed by the IRS.

Q: Do I need to file Form W-8IMY every year?

A: No, you generally only need to file Form W-8IMY once, unless there are changes in your circumstances that affect your foreign status or eligibility for reduced withholding.

Q: What other forms may be required in addition to Form W-8IMY?

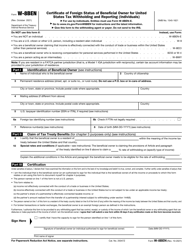

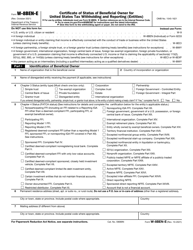

A: Depending on your specific situation, you may also need to file other tax forms such as Form W-8BEN or Form W-8ECI. It is best to consult with a tax professional or the IRS for guidance.

Form Details:

- A 8-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form W-8IMY through the link below or browse more documents in our library of IRS Forms.