This version of the form is not currently in use and is provided for reference only. Download this version of

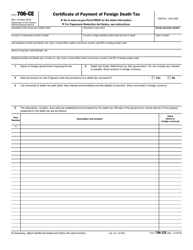

Instructions for IRS Form W-8BEN

for the current year.

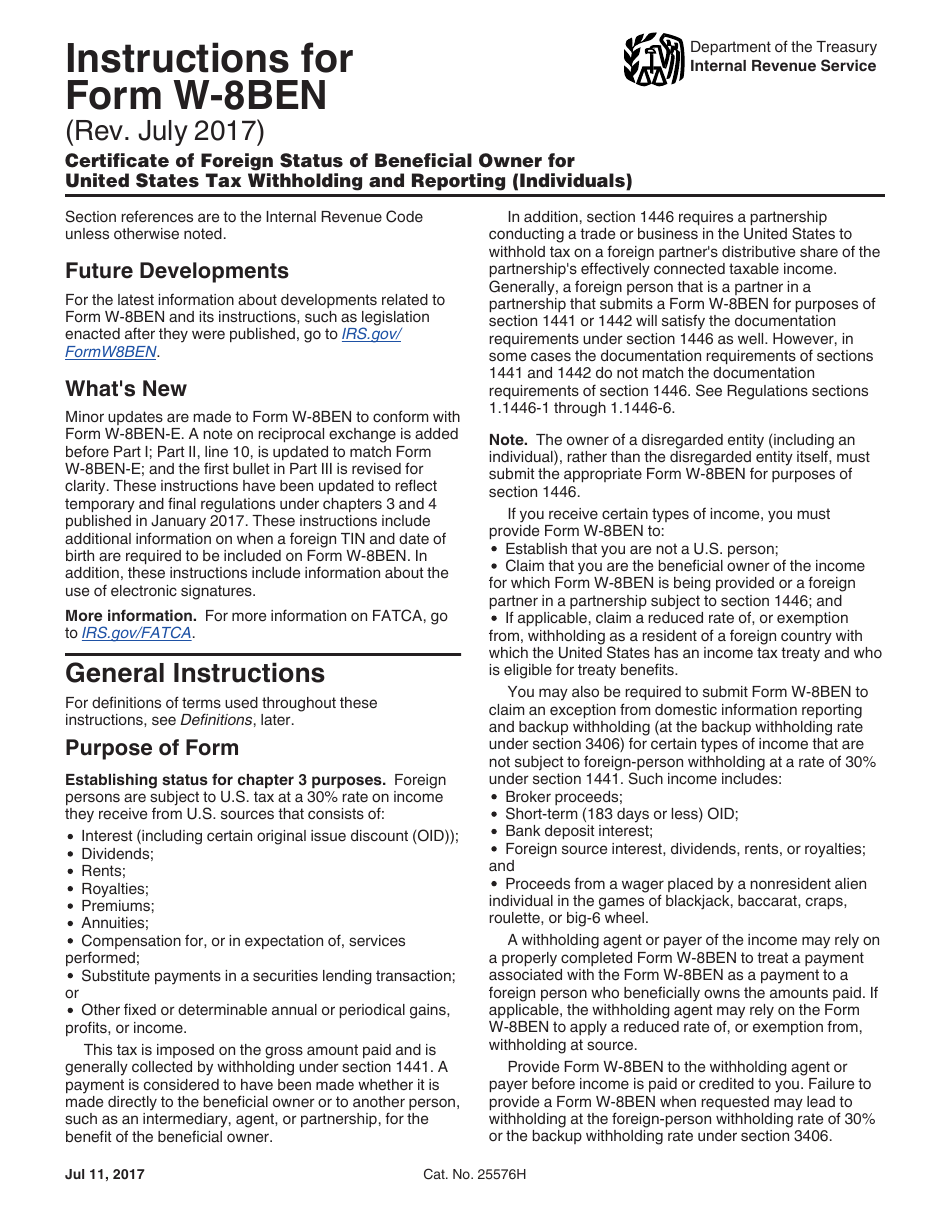

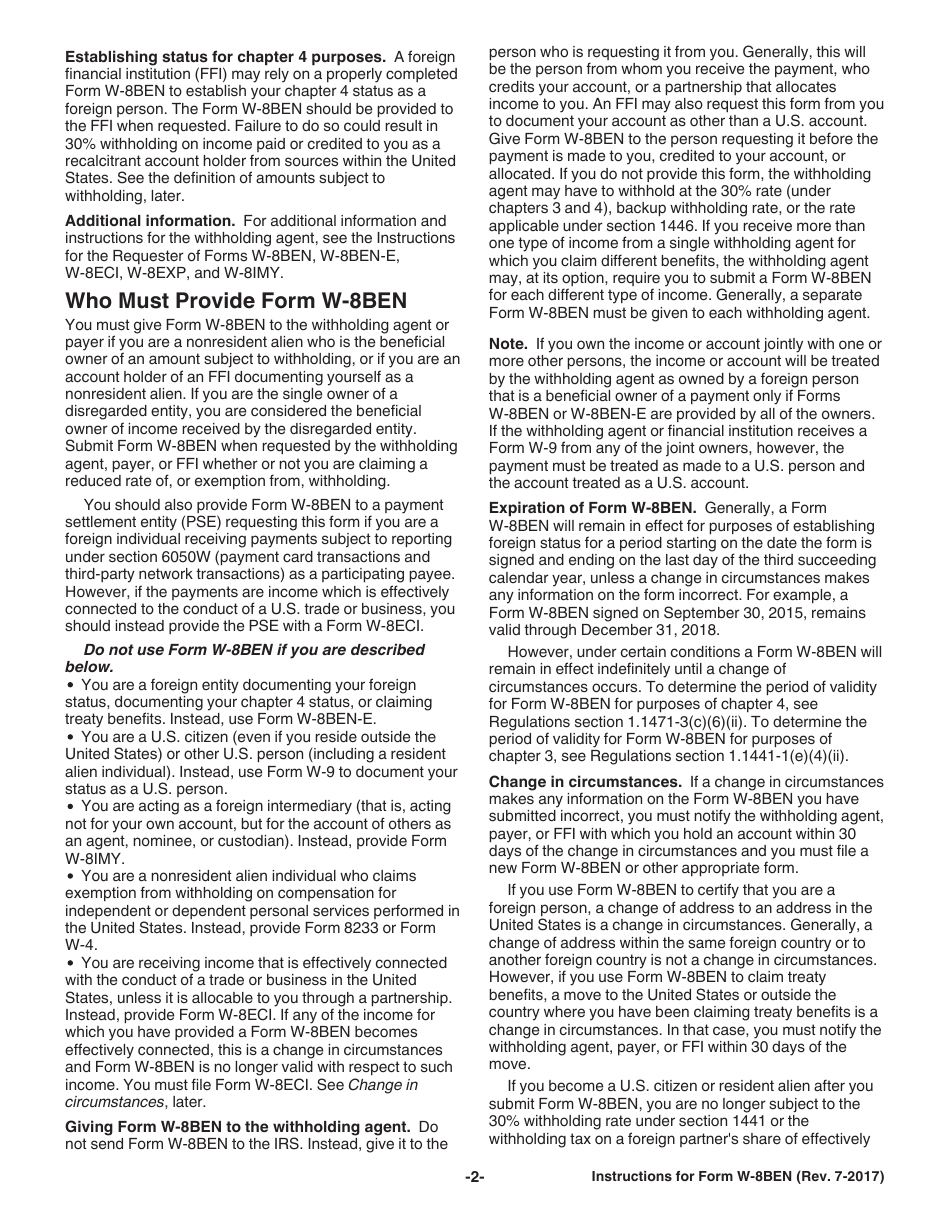

Instructions for IRS Form W-8BEN Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals)

This document contains official instructions for IRS Form W-8BEN , Certificate of Foreign Status of Tax Withholding and Reporting (Individuals) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form W-8BEN is available for download through this link.

FAQ

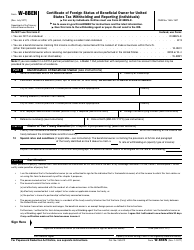

Q: What is IRS Form W-8BEN?

A: IRS Form W-8BEN is a certificate of foreign status of beneficial owner for United States tax withholding and reporting.

Q: Who should use IRS Form W-8BEN?

A: Individuals who are foreign beneficial owners of income subject to U.S. tax withholding should use IRS Form W-8BEN.

Q: What is the purpose of IRS Form W-8BEN?

A: The purpose of IRS Form W-8BEN is to establish the foreign status of the beneficial owner for tax withholding purposes.

Q: How do I fill out IRS Form W-8BEN?

A: You must provide your personal information, including name, address, and taxpayer identification number, as well as certify your foreign status and eligibility for treaty benefits, if applicable.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.