This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form W-8BEN

for the current year.

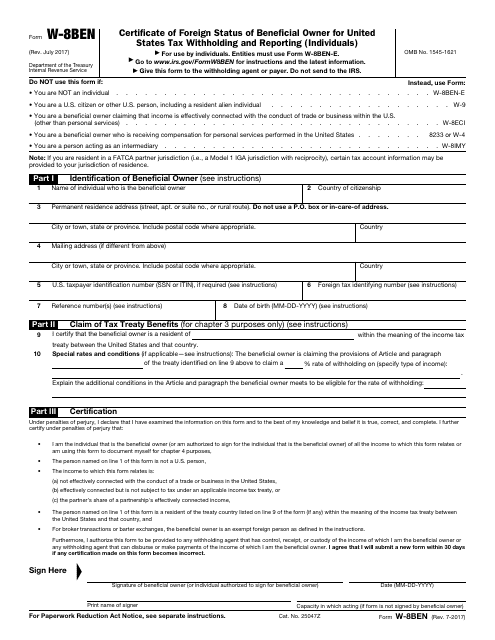

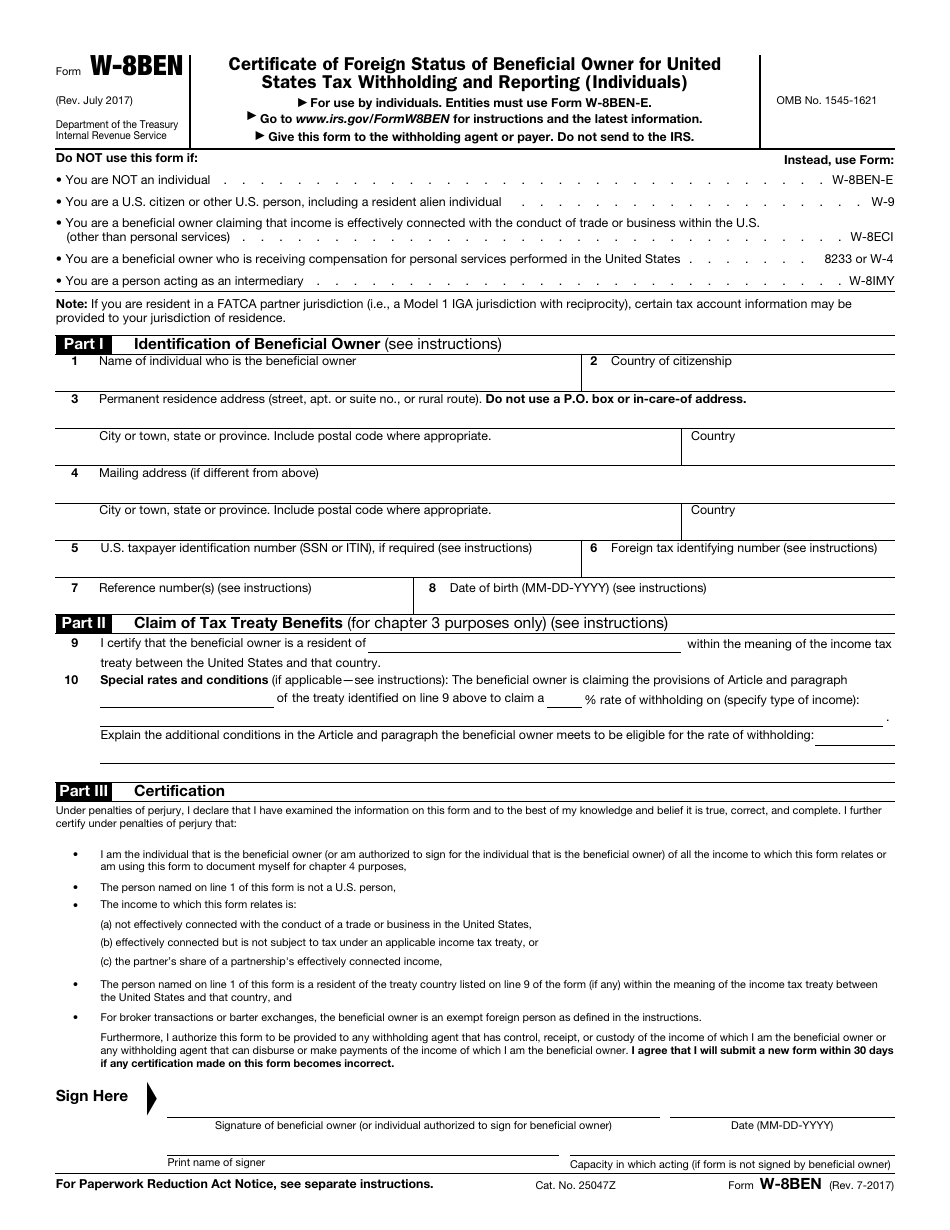

IRS Form W-8BEN Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals)

What Is IRS Form W-8BEN?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on July 1, 2017. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form W-8BEN?

A: IRS Form W-8BEN is a certificate used to determine the foreign status of the beneficial owner for tax withholding and reporting purposes.

Q: Who needs to fill out IRS Form W-8BEN?

A: Individuals who are foreign beneficiaries that receive income from U.S. sources and want to claim tax treaty benefits must fill out IRS Form W-8BEN.

Q: What is the purpose of IRS Form W-8BEN?

A: The purpose of IRS Form W-8BEN is to establish that the individual is a foreign person and is eligible for certain tax benefits under a tax treaty.

Q: What information is required on IRS Form W-8BEN?

A: IRS Form W-8BEN requires the individual's name, address, country of citizenship, taxpayer identification number (if applicable), and information about their foreign status and tax treaty eligibility.

Q: Do I need to provide a U.S. taxpayer identification number on IRS Form W-8BEN?

A: No, a U.S. taxpayer identification number is not required if the individual is not a U.S. taxpayer.

Q: How often do I need to fill out IRS Form W-8BEN?

A: IRS Form W-8BEN is generally valid for a period of three years. However, if there are any changes in the individual's circumstances, a new form may need to be completed.

Q: What happens if I don't fill out IRS Form W-8BEN?

A: If you don't fill out IRS Form W-8BEN when required, you may be subject to U.S. tax withholding at a higher rate.

Q: Can I claim tax treaty benefits without filling out IRS Form W-8BEN?

A: No, in order to claim tax treaty benefits, you must fill out IRS Form W-8BEN.

Q: Can a nonresident alien Individual who is not eligible for a Social Security Number (SSN) apply for an Individual Taxpayer Identification Number (ITIN) using IRS Form W-8BEN?

A: Yes, a nonresident alien individual who is not eligible for a Social Security Number (SSN) can apply for an Individual Taxpayer Identification Number (ITIN) using IRS Form W-8BEN.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form W-8BEN through the link below or browse more documents in our library of IRS Forms.