This version of the form is not currently in use and is provided for reference only. Download this version of

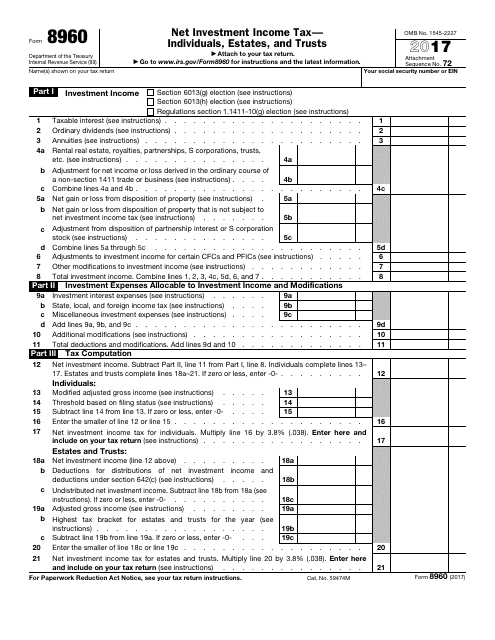

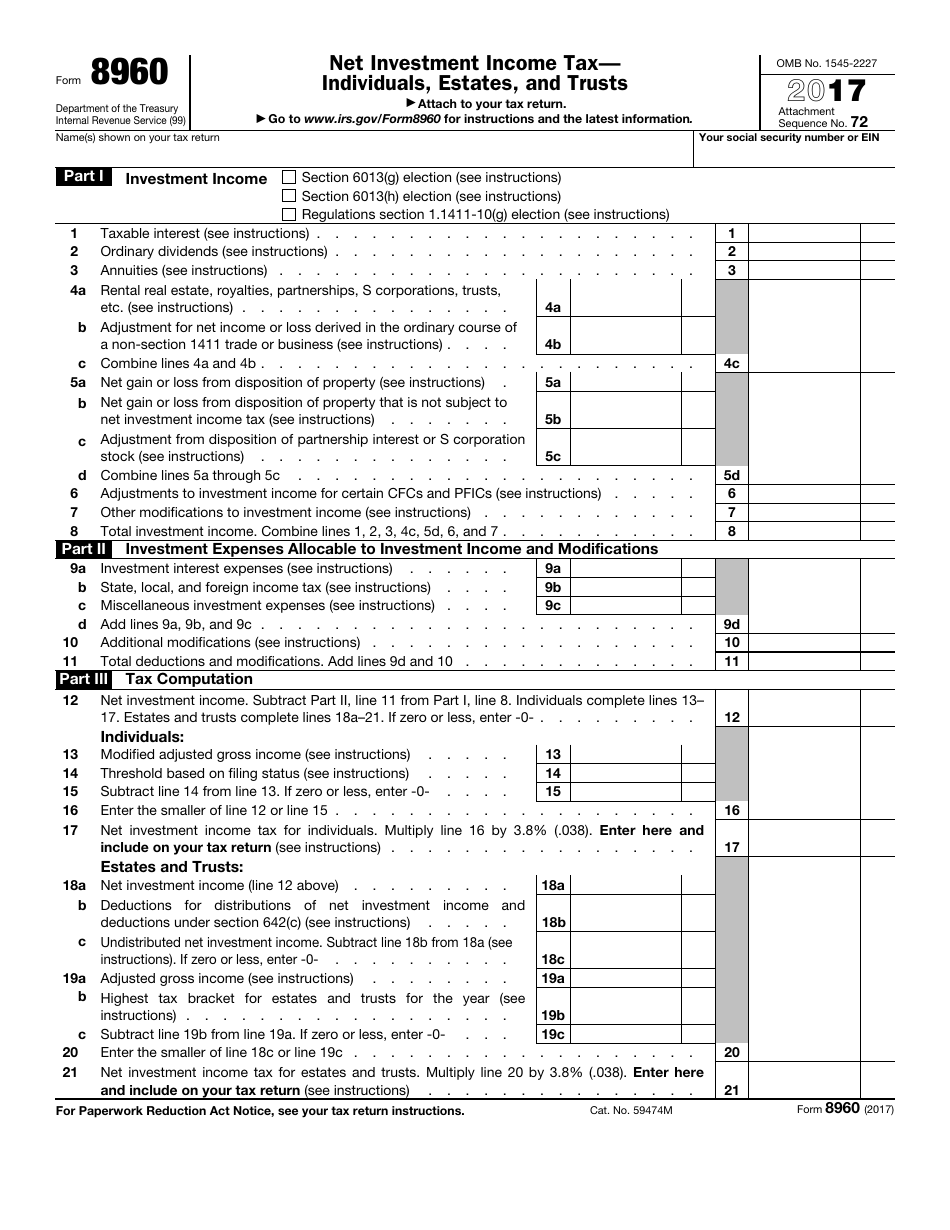

IRS Form 8960

for the current year.

IRS Form 8960 Net Investment Income Tax Individuals, Estates, and Trusts

What Is IRS Form 8960?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8960?

A: IRS Form 8960 is a tax form used to calculate the Net Investment Income Tax.

Q: Who needs to file IRS Form 8960?

A: Individuals, estates, and trusts may need to file IRS Form 8960 if they have net investment income that exceeds certain thresholds.

Q: What is the Net Investment Income Tax?

A: The Net Investment Income Tax is an additional tax on certain investment income. It is used to help fund the Affordable Care Act.

Q: How do I calculate the Net Investment Income Tax?

A: To calculate the Net Investment Income Tax, you need to determine your net investment income and compare it to the applicable threshold amount.

Q: What is considered net investment income?

A: Net investment income includes income from interest, dividends, capital gains, rental income, and other passive activities.

Q: What are the threshold amounts for the Net Investment Income Tax?

A: For most individuals, the threshold amount is $200,000 for single filers and $250,000 for married filers. Different thresholds apply to estates and trusts.

Q: When is IRS Form 8960 due?

A: IRS Form 8960 is generally due at the same time as your individual income tax return, usually April 15th.

Q: Are there any exceptions or exemptions for the Net Investment Income Tax?

A: Yes, there are certain exceptions and exemptions that may apply. It's best to consult the instructions for IRS Form 8960 or speak with a tax professional for more information.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8960 through the link below or browse more documents in our library of IRS Forms.