IRS Form 8960 Net Investment Income Tax - Individuals, Estates, and Trusts

What Is IRS Form 8960?

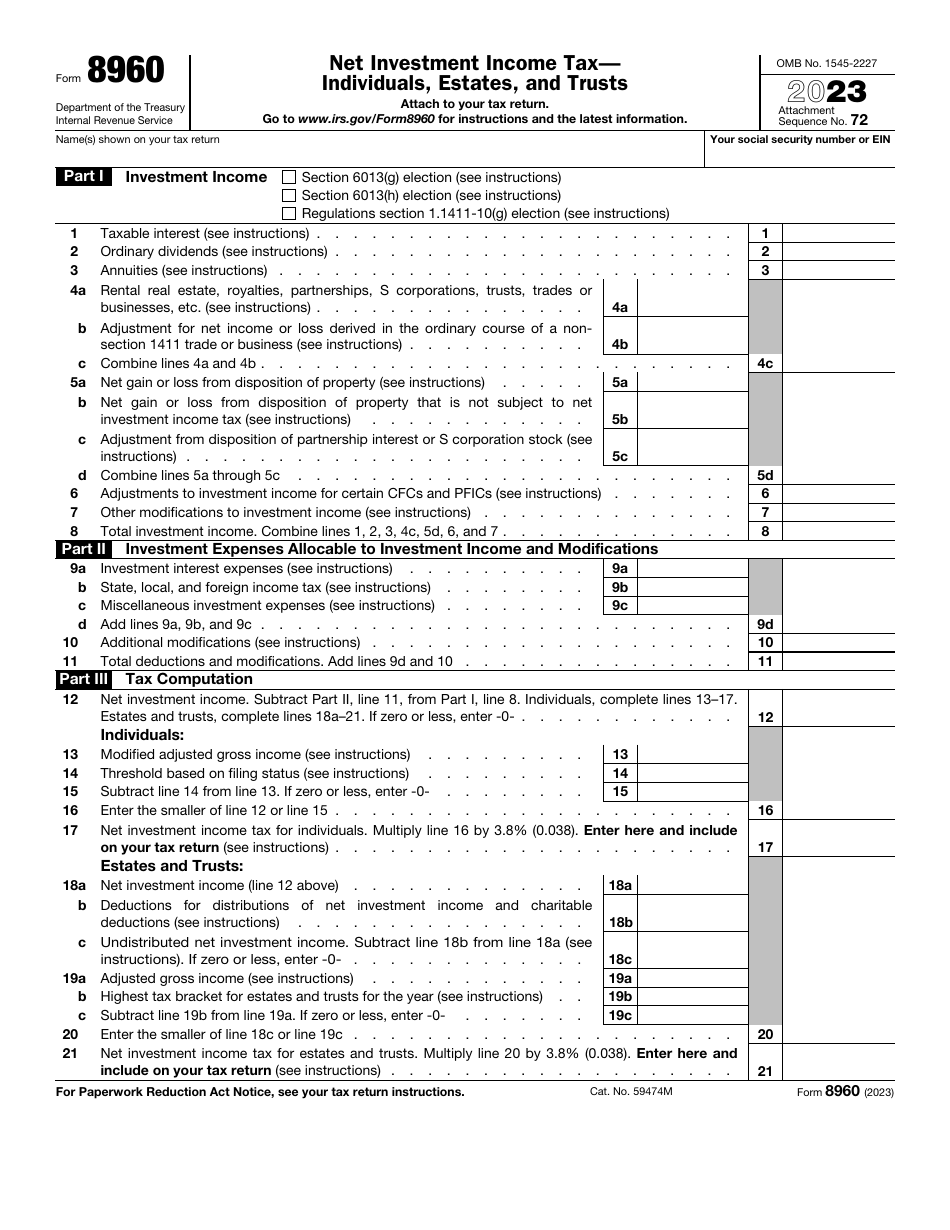

IRS Form 8960, Net Investment Income Tax Individuals, Estates, and Trusts , is a formal instrument used by taxpayers to clarify how much investment income they have received and to figure out the amount of supplementary tax they have to pay.

Alternate Name:

- Tax Form 8960.

Enclose a copy of Form 8960 with your annual income statement to let fiscal authorities know about the extra tax you owe - if it turns out the net income from investments is zero or even less due to all the expenses you have had to deal with, you will not have to submit this document.

This form was released by the Internal Revenue Service (IRS) in 2023 , making previous editions of the document outdated. You can find an IRS Form 8960 fillable version via the link below.

What Is Form 8960 Used For?

File and submit the 8960 Tax Form to compute your total investment income and figure out how much tax you have to pay as long as you were able to generate income from any investments throughout the year. It is obligatory to pay investment income tax - 3.8% of either the net income or the excess over the specific amount prescribed by the IRS.

However, most people with the small amount of income they have earned do not have to file the paperwork in question - the extra tax is your responsibility only if you earned hundreds of thousands of dollars during the tax year.

Who Needs to File Form 8960?

It is mandatory to attach Form 8960 to the IRS Form 1040, U.S. Individual Tax Return, if the gross income you have earned and applied all deductions to is bigger than the amount established by tax authorities. Nowadays, the income limit for single taxpayers is $200.000 and the income limit for people who send an income statement jointly with their spouse is $250.000. In case you decided to file separately from your partner, the level of income for you will amount to $125.000.

The tax regulations apply equally to citizens, residents, and individuals with dual residency. If you are a nonresident, you will not have to pay tax on investment income. As for the types of taxpayers obliged to submit a document that breaks down their investment income and the tax they owe, the same rules are in full effect for individual taxpayers and entities as long as the set thresholds are exceeded.

Form 8960 Instructions

Follow these IRS Form 8960 Instructions to outline the tax you owe after receiving investment income:

-

Write down your name and taxpayer identification number the way these details appear on your regular income statement . Check the box that applies to you - you may decide to file the paperwork jointly with your spouse who is not a resident or make a tax election in regard to your position of a stock owner if this stock was issued by the controlled foreign corporation or qualified electing fund.

-

Indicate different categories of investment income you have generated over the past tax year . The form lists interest that will be taxed, annuities, dividends, income you obtained from renting out real estate, and royalties. You must state how big was the gain or loss after you disposed of the property and describe applicable adjustments and modifications to investment income. After all the numbers are written down, combine them to record the total amount of investment income.

-

Elaborate on investment expenses . You have to disclose various itemized deductions - indicate how much interest expense you accrued or paid, add income taxes that can be attributed to net investment income (on the state level and locally as well as foreign taxes imposed on you), write down miscellaneous costs that are directly related to the investment income, and identify further deductions to the income. Note that official instructions for Form 8960 provide taxpayers with a worksheet they can use to see how deduction limitations affect the amount of expenses they must inform the IRS about.

-

Calculate the tax. Individual taxpayers are required to fill out fields 12-17 while entities need to complete fields 18-21 . A person has to compute the next investment income using formulas from the document and write down the modified income and the level of income that applies in their instance (based on their filing status). The eventual number you get must be multiplied by 3.8% - this will be the amount of tax you owe; it needs to be replicated on your income statement. Individuals that act on behalf of entities are obliged to list the net investment income alongside the adjusted gross income. The tax amount they come up with also needs to be multiplied by 3.8% to point out how much tax the entity owes.