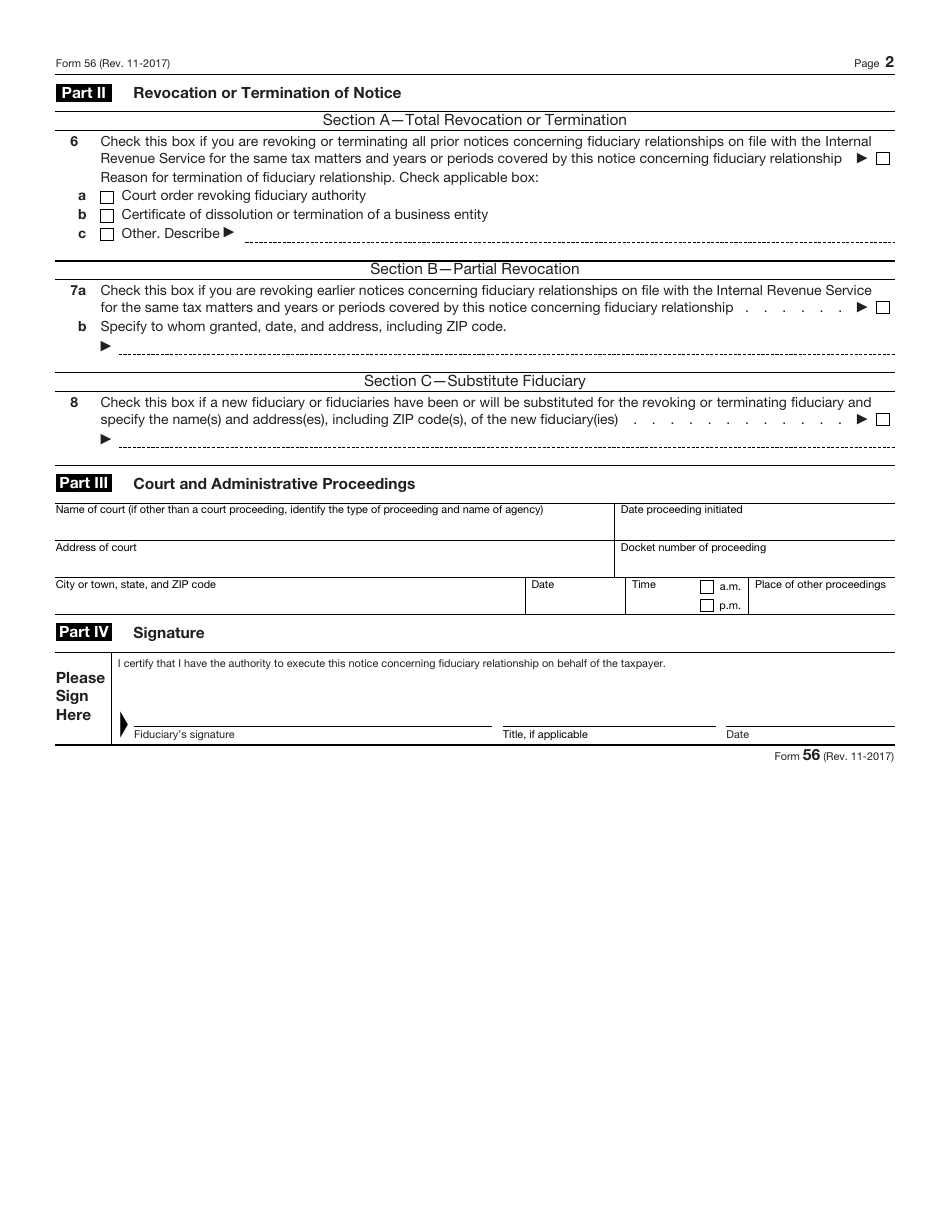

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 56

for the current year.

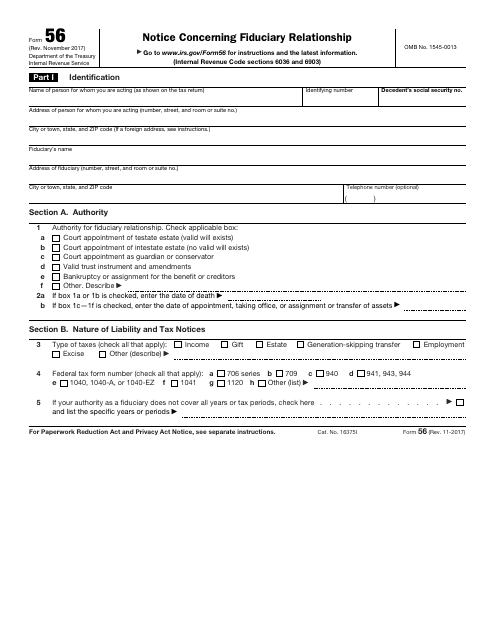

IRS Form 56 Notice Concerning Fiduciary Relationship

What Is IRS Form 56?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2017. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 56?

A: IRS Form 56 is a notice used to notify the IRS about the appointment of a fiduciary or a representative for an estate, trust, or other entities.

Q: When is IRS Form 56 used?

A: IRS Form 56 is used when there is a change in fiduciary or representative for an estate, trust, or other entities.

Q: What information is required on IRS Form 56?

A: IRS Form 56 requires information about the estate, trust, or entity, as well as the appointed fiduciary or representative.

Q: How do I submit IRS Form 56?

A: IRS Form 56 can be submitted by mail to the appropriate IRS office or filed electronically.

Q: Is there a deadline for filing IRS Form 56?

A: Yes, IRS Form 56 must be filed within 90 days of the appointment of the fiduciary or representative.

Q: What happens after I submit IRS Form 56?

A: After submitting IRS Form 56, the IRS will update their records and communicate with the appointed fiduciary or representative regarding tax matters.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 56 through the link below or browse more documents in our library of IRS Forms.