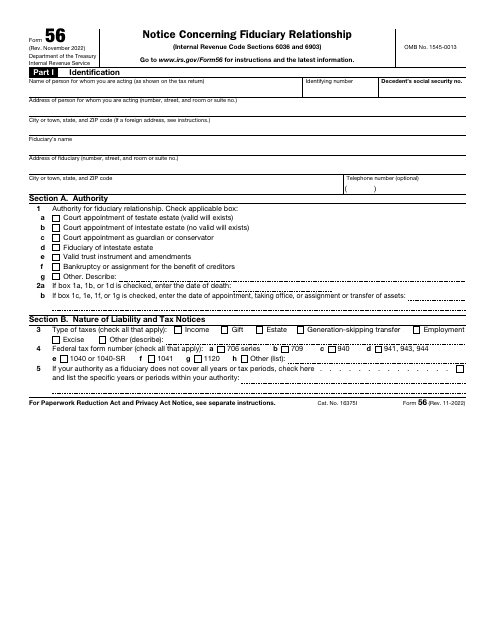

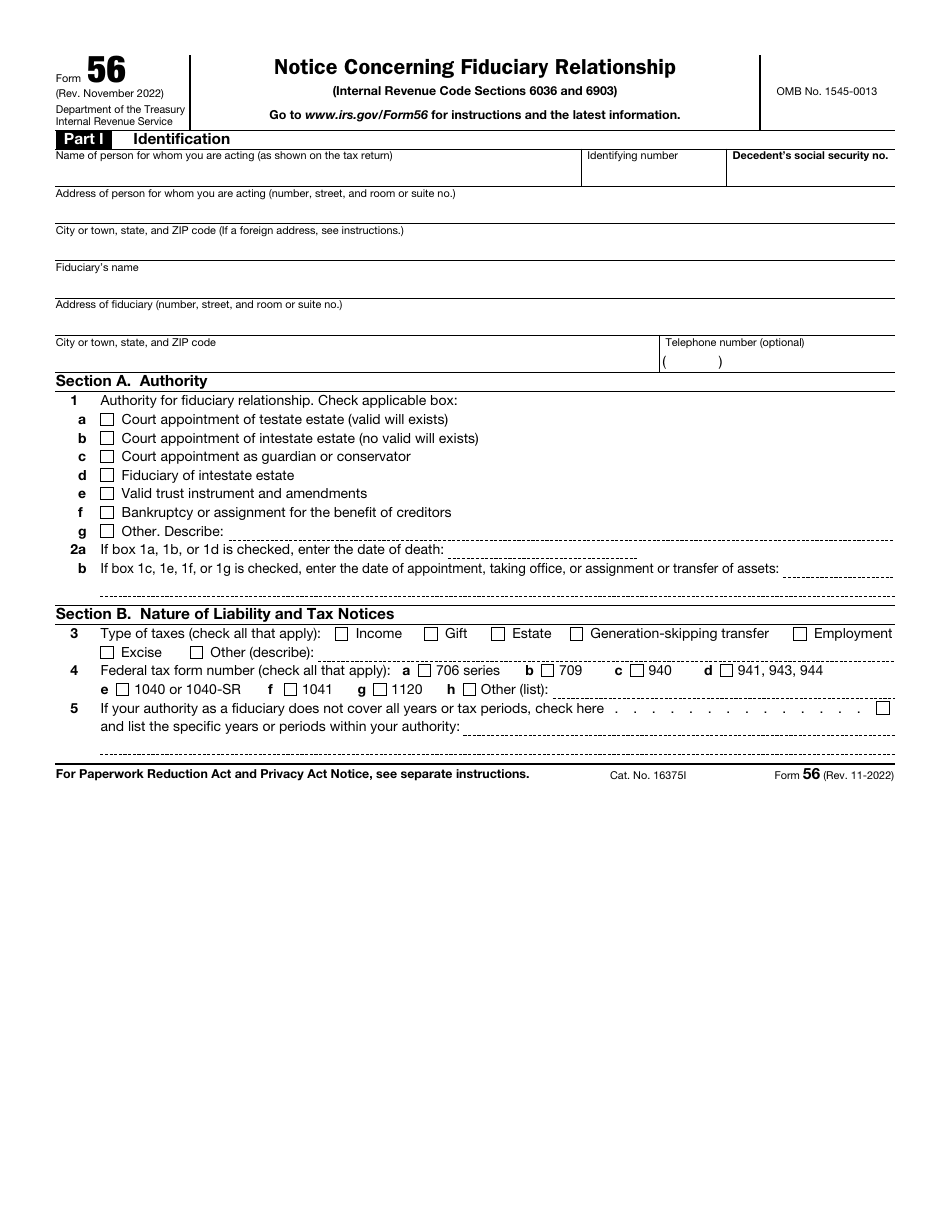

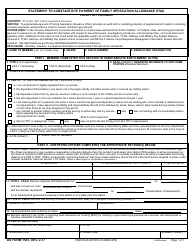

IRS Form 56 Notice Concerning Fiduciary Relationship

What Is IRS Form 56?

IRS Form 56, Notice Concerning Fiduciary Relationship , is a fiscal statement prepared by a person or organization to tell the government about the fiduciary arrangement that was formed with them serving as a fiduciary.

Alternate Name:

- Tax Form 56.

Authorities have to know how the property of a deceased individual will be administered or how the business will go through insolvency - if you are responsible for someone else's assets and you do not have a formal authorization to speak and act in their name, you will need to file this notice with the tax organs.

This notice was released by the Internal Revenue Service (IRS) on November 1, 2022 - older editions of the instrument are now outdated. An IRS Form 56 fillable version is available for download below.

When Is Form 56 Required?

IRS Form 56 must be completed and submitted to the IRS once a certain individual or company becomes a fiduciary - their duty is to act on behalf of someone else, a person or a business, whether they are managing the possessions of a decedent or overseeing an insolvency procedure. No matter what your status is - you may be an administrator of assets, guardian, or trustee - you have to notify tax authorities about the responsibility you have accepted since many of the decisions you will be in charge of are closely connected to the payment of taxes.

How to Fill Out Form 56?

Follow these Form 56 Instructions to properly inform tax authorities about the fiduciary arrangement you have set up or chose to terminate:

-

Start with the personal and contact details of the person or company for whom you will perform the fiduciary duty - you have to state their full name (the one that matches the name on their tax return), taxpayer identification number, and correspondence address. Make sure you comply with the guidelines established for foreign addresses - if this is your case, list the city, region, and the country where the individual resides or business currently operates. Fiduciaries that submit the form in the name of a deceased individual must record the social security number of the person that passed away.

-

Identify yourself - add your full name, mailing address, and telephone number . It is recommended not to skip the latter field since the IRS may want to contact you in the near future to ask questions about the nature of the arrangement.

-

Specify where your fiduciary authority comes from . It is necessary to check the box to explain whether you were ordered by a court to act on behalf of a deceased person who left a will or passed away without one, named as a conservator or guardian to manage the interests of another individual or organization, or nominated to be a trustee in line with the provisions of a valid instrument. If none of the circumstances listed in the form apply to you, elaborate on your authority in the field designed for this purpose. In case you are dealing with the estate of a decedent, enter their date of death. You may also need to indicate when you were given the fiduciary authority or when the assets were transferred.

-

Clarify what tax documentation you will file as a fiduciary and what types of taxes are relevant in regard to the matter at hand . It is likely your authority does not cover all tax periods - check the box and specify what tax years you will cover in the tax forms you are going to submit.

-

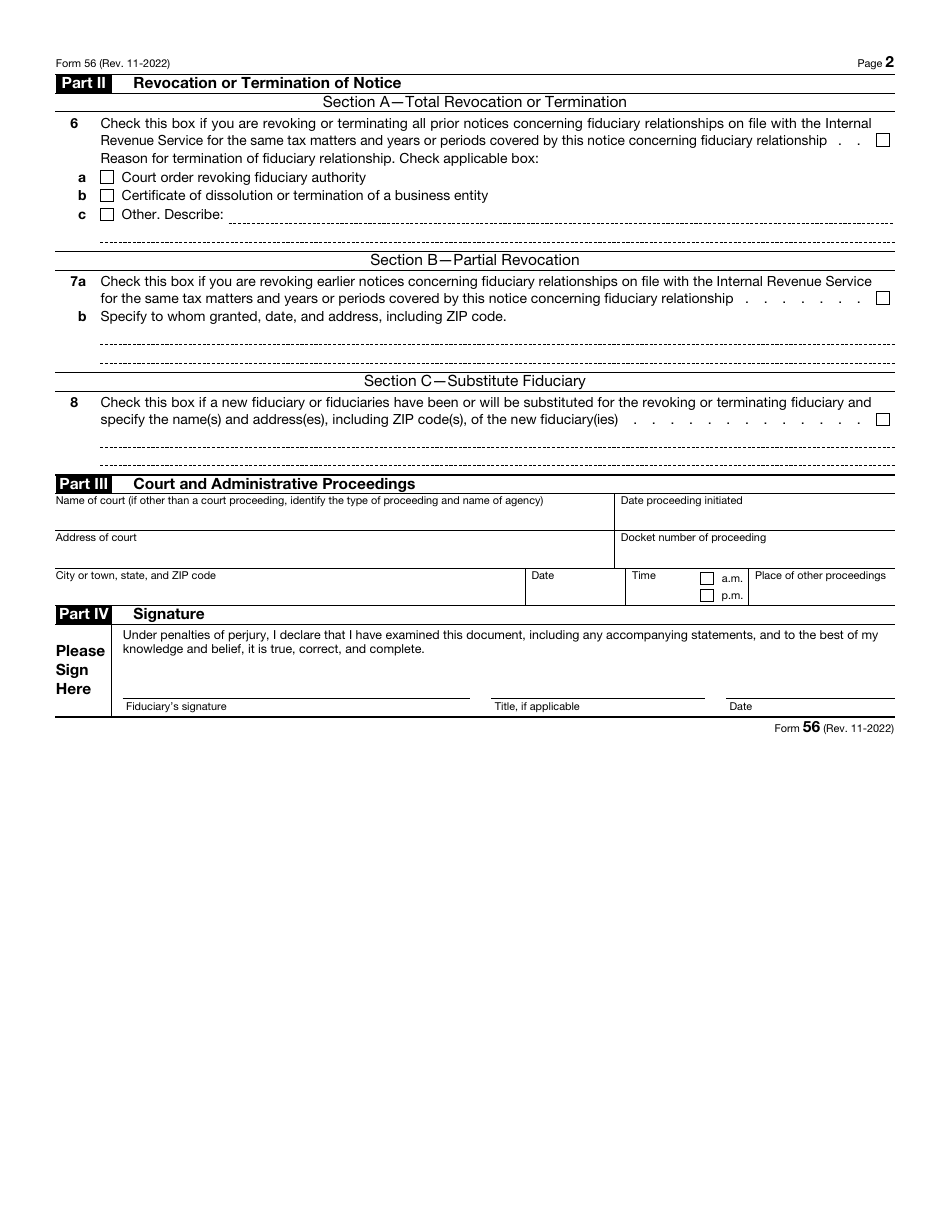

Complete the second part of the instrument if you are ending the arrangement . You will need to explain whether the revocation is total or partial and whether a new fiduciary will handle the obligations you previously had to deal with. Check the box to point out the reason behind possible termination and add the details of the new fiduciary if necessary.

-

Fill out the third part of the form to provide information about a court order or the assignment given to you by a government agency to act as a fiduciary or trustee - you have to identify the court and list the details of the proceeding. Formalize the document by stating your position and actual date and signing the papers.

Where to Mail Form 56?

The IRS Form 56 mailing address varies depending on the individual or organization on whose behalf you are acting as a fiduciary - file the paperwork with the IRS center where they submit their annual income statement. Note that you are supposed to notify tax organs about your decision to assume the fiduciary duty as soon as you assume the authority of a fiduciary - likewise, fiduciaries that want to put an end to the arrangement in question are expected to submit a notice right away.