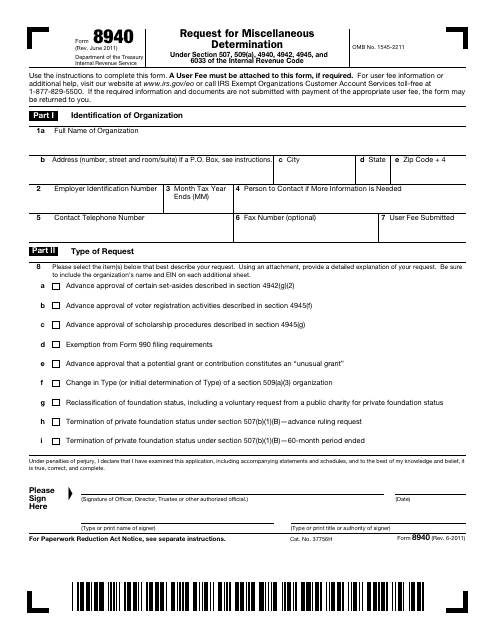

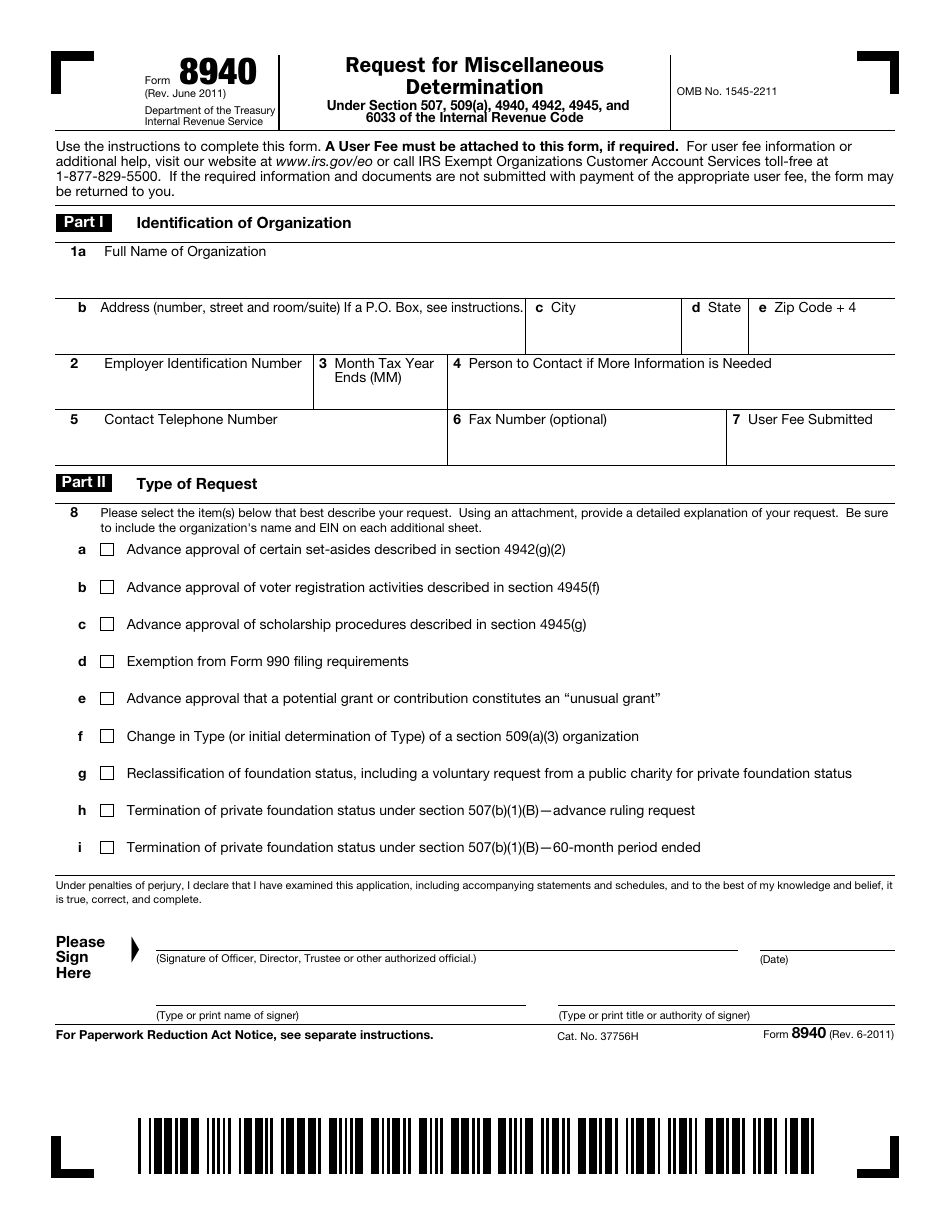

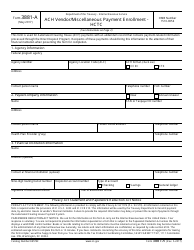

IRS Form 8940 Request for Miscellaneous Determination

What Is IRS Form 8940?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2011. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8940?

A: IRS Form 8940 is used to request a miscellaneous determination from the Internal Revenue Service.

Q: What is a miscellaneous determination?

A: A miscellaneous determination refers to a special ruling or decision made by the IRS for specific tax issues not covered by other forms.

Q: Who should file IRS Form 8940?

A: Individuals, organizations, or trusts that need a miscellaneous determination from the IRS should file Form 8940.

Q: What type of issues can be requested on Form 8940?

A: Form 8940 can be used to request determinations on issues like operating as a tax-exempt organization, foundation classification, foreign tax status, etc.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8940 through the link below or browse more documents in our library of IRS Forms.