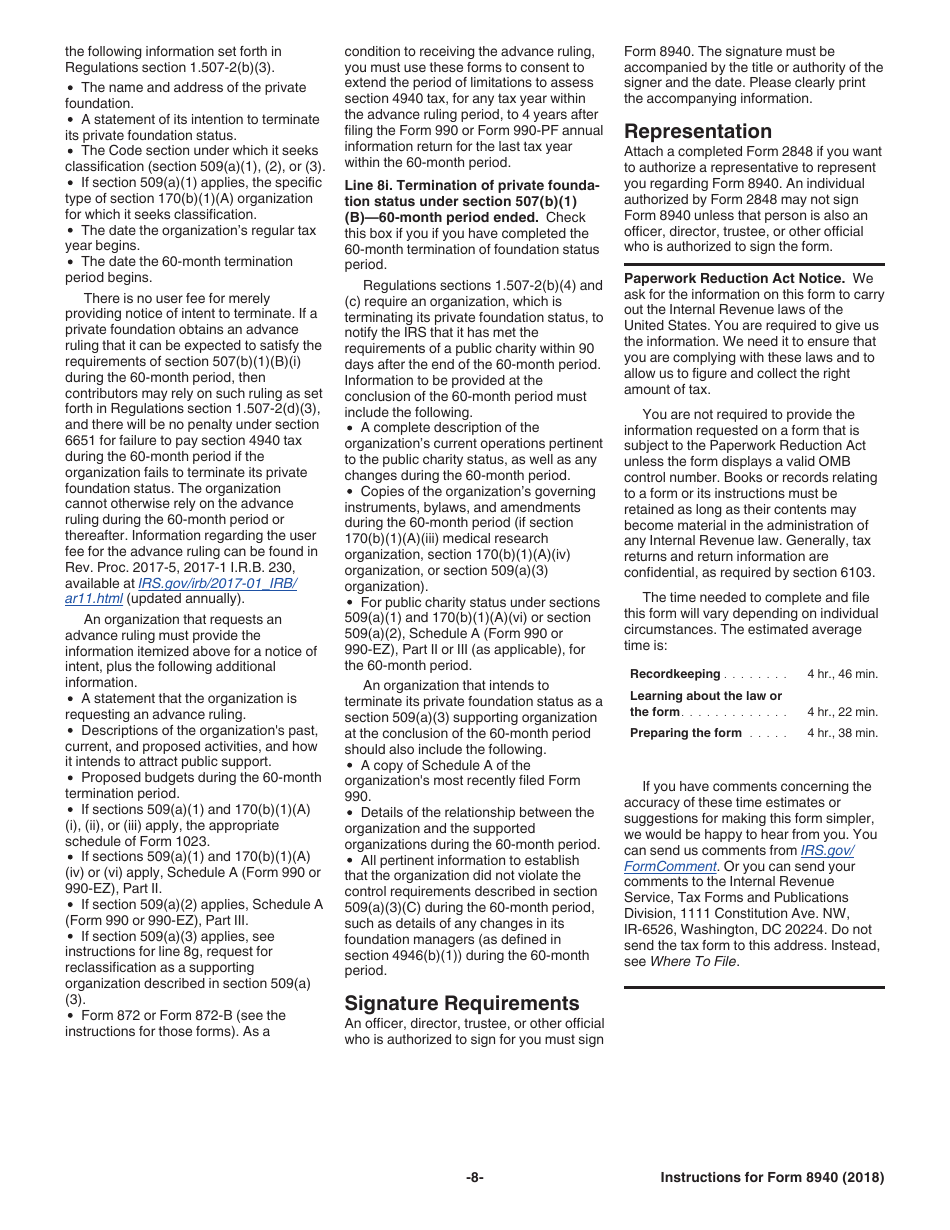

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8940

for the current year.

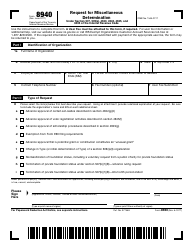

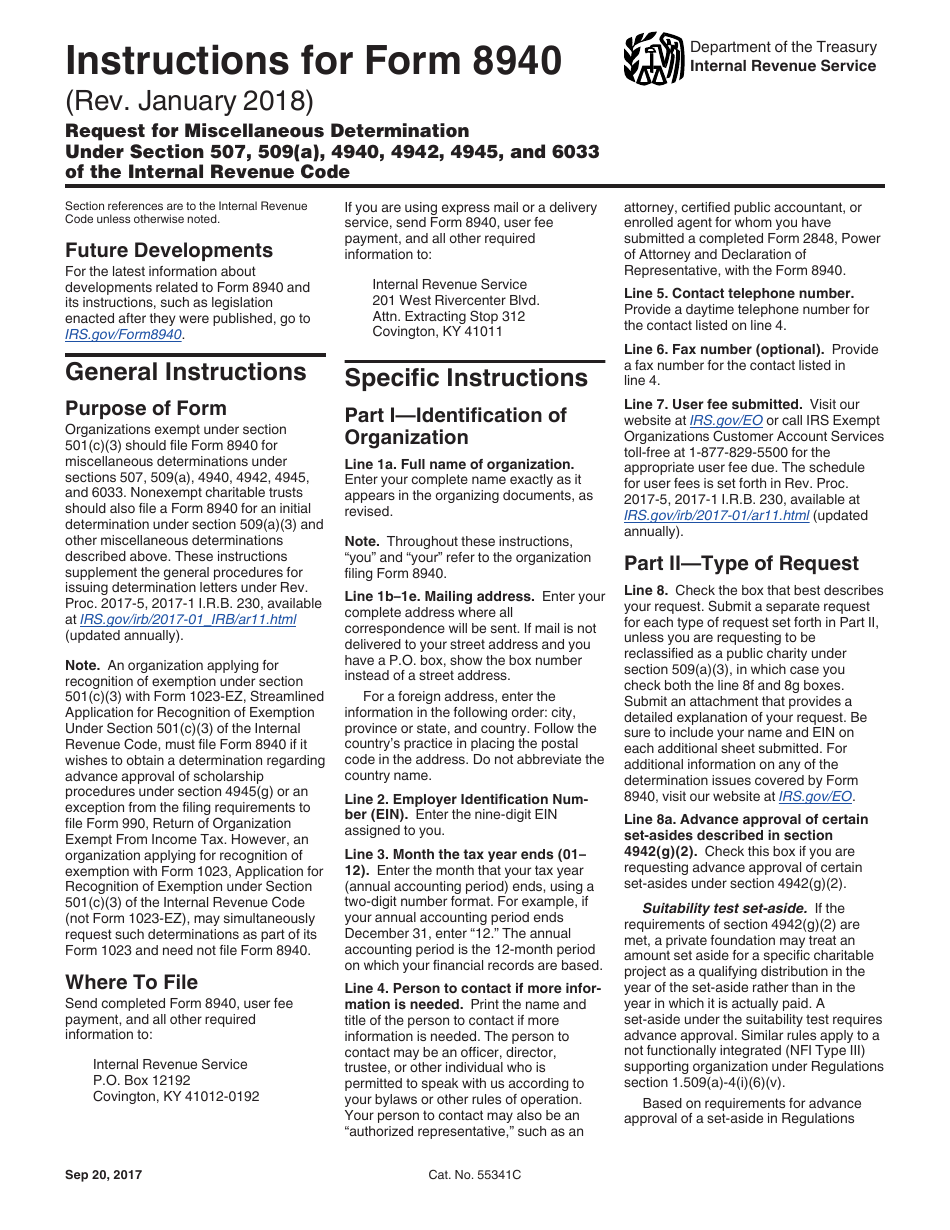

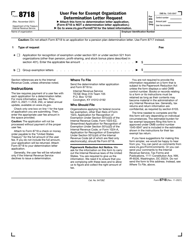

Instructions for IRS Form 8940 Request for Miscellaneous Determination Under Section 507, 509(A), 4940, 4942, 4945, and 6033 of the Internal Revenue Code

This document contains official instructions for IRS Form 8940 , Request for Miscellaneous Determination Under Section 507, 509(A), 4940, 4942, 4945, and 6033 of the Internal Revenue Code - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8940 is available for download through this link.

FAQ

Q: What is IRS Form 8940?

A: IRS Form 8940 is used to request a miscellaneous determination from the Internal Revenue Service (IRS) regarding tax-exempt organizations.

Q: What is a miscellaneous determination?

A: A miscellaneous determination is a specific determination made by the IRS for tax-exempt organizations related to sections 507, 509(a), 4940, 4942, 4945, and 6033 of the Internal Revenue Code.

Q: Who needs to file IRS Form 8940?

A: Tax-exempt organizations that need a determination related to sections 507, 509(a), 4940, 4942, 4945, and 6033 of the Internal Revenue Code must file Form 8940.

Q: What does IRS Form 8940 cover?

A: IRS Form 8940 covers various determinations related to tax-exempt organizations, such as classification of private foundation status, reclassification of public charity status, and approval for certain acts.

Q: How do I fill out IRS Form 8940?

A: You need to provide complete and accurate information about your organization, the requested determination, and any supporting documentation as required by the form's instructions.

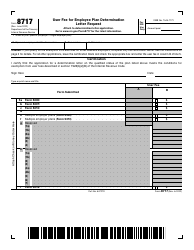

Q: Is there a fee for filing IRS Form 8940?

A: Yes, there is a user fee required when filing IRS Form 8940. The specific fee amount can be found in the form's instructions.

Q: What if I need help with IRS Form 8940?

A: If you need assistance in completing IRS Form 8940, you can refer to the form's instructions, consult with a tax professional, or contact the IRS directly for guidance.

Instruction Details:

- This 8-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.