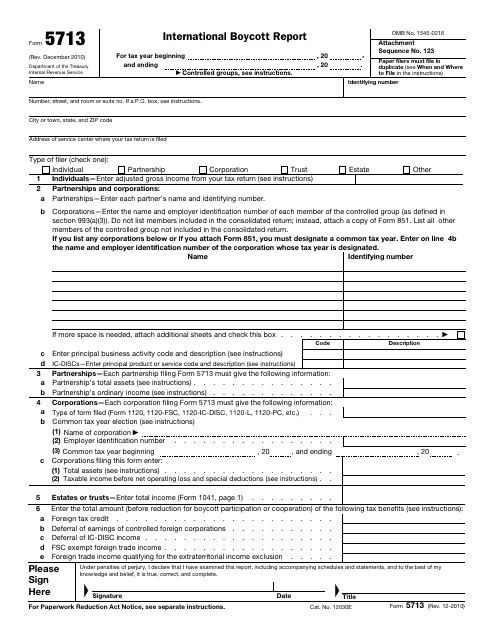

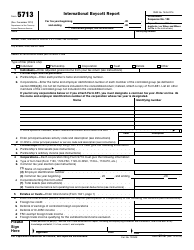

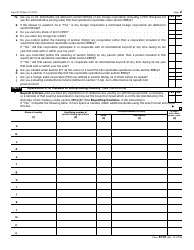

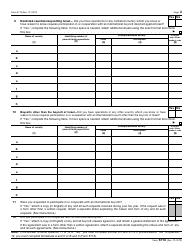

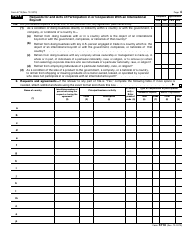

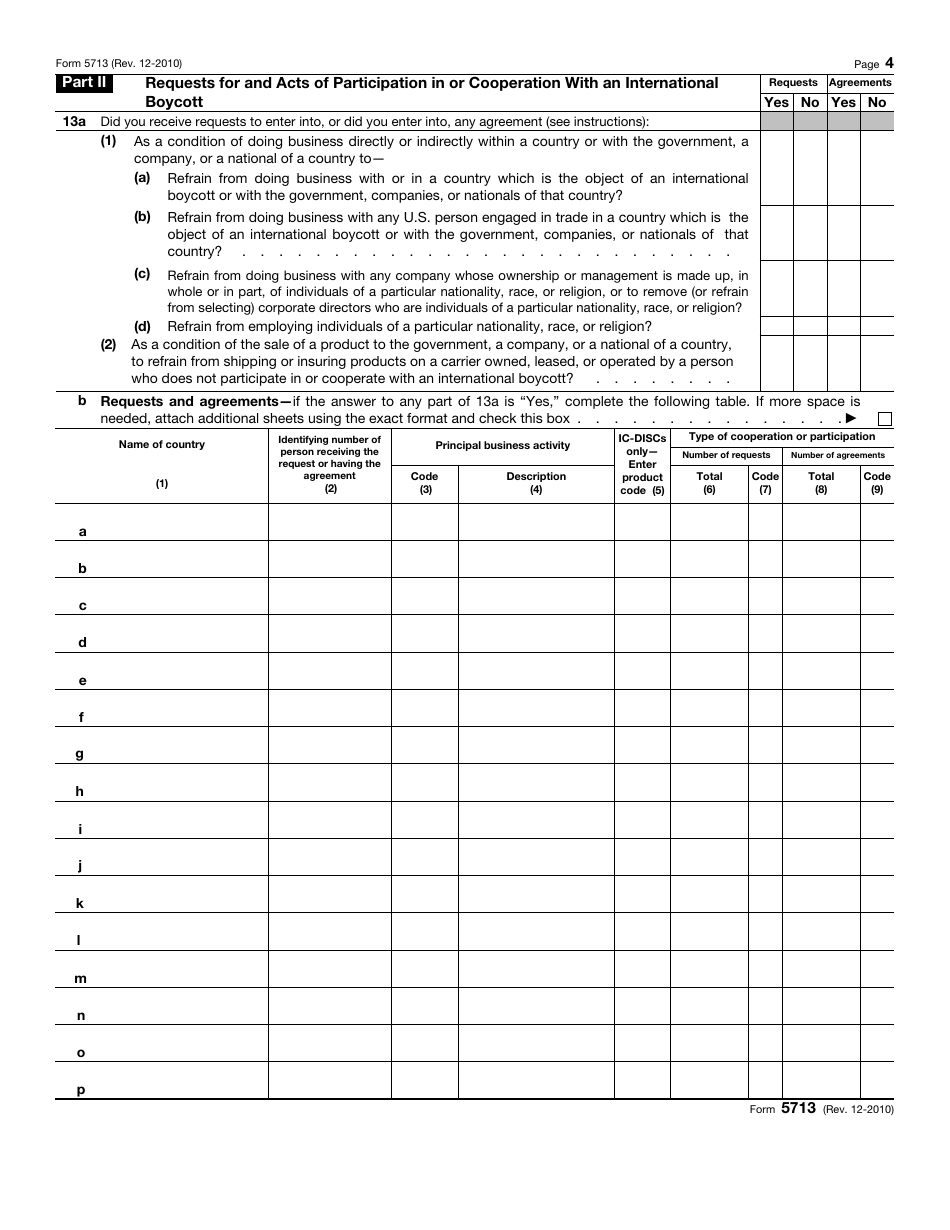

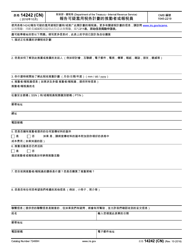

IRS Form 5713 International Boycott Report

What Is IRS Form 5713?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2010. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

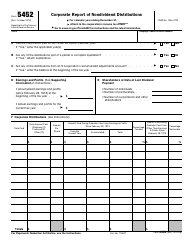

Q: What is IRS Form 5713?

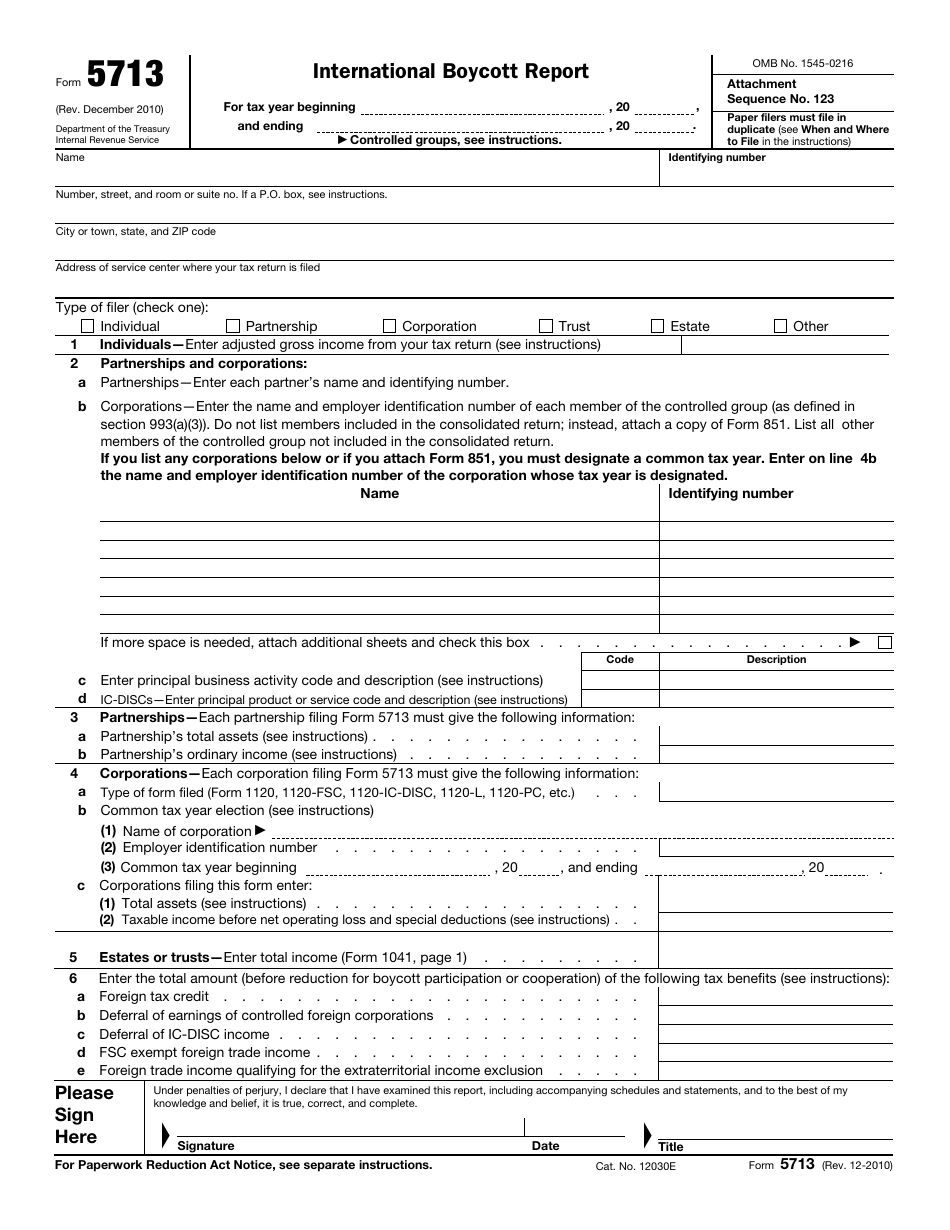

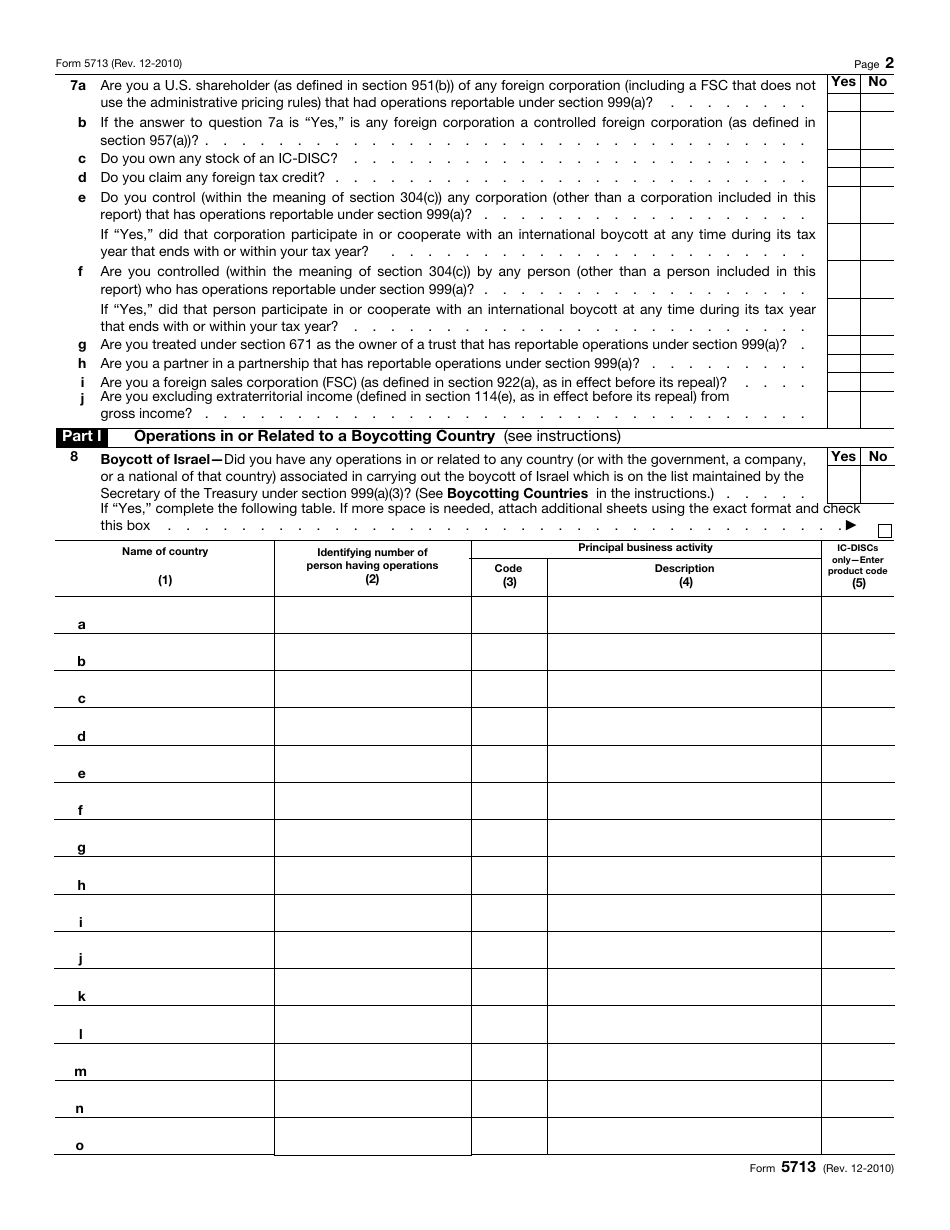

A: IRS Form 5713 is the form used to report information about international boycott activities.

Q: Who needs to file IRS Form 5713?

A: Certain taxpayers engaged in international transactions or business activities need to file IRS Form 5713.

Q: What information is required on IRS Form 5713?

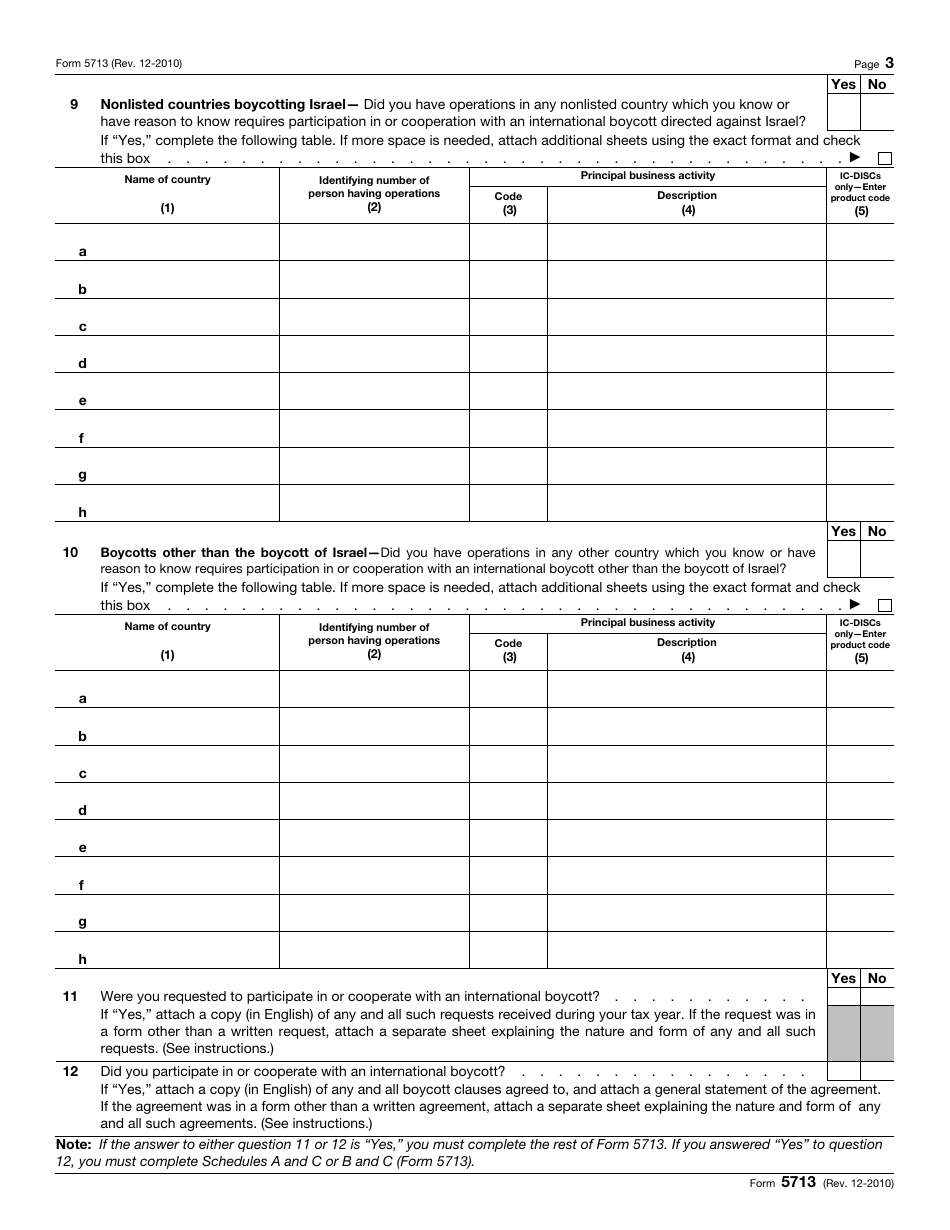

A: IRS Form 5713 requires the taxpayer to provide details about their involvement in international boycott activities.

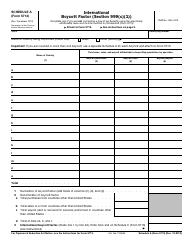

Q: When is the deadline for filing IRS Form 5713?

A: The deadline for filing IRS Form 5713 is typically the same as the taxpayer's income tax return due date.

Q: What happens if I don't file IRS Form 5713?

A: Failure to file IRS Form 5713 when required can result in penalties and potential legal consequences.

Q: Are there any exceptions to filing IRS Form 5713?

A: Certain exceptions may apply, so it is important to consult with a tax professional or refer to the instructions for the form.

Q: Can I e-file IRS Form 5713?

A: No, IRS Form 5713 cannot be e-filed. It must be filed by mail or, in some cases, a designated private delivery service.

Form Details:

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 5713 through the link below or browse more documents in our library of IRS Forms.