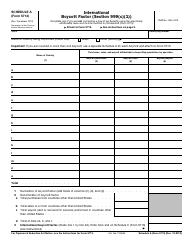

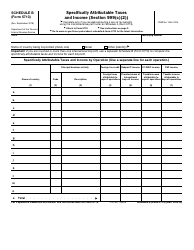

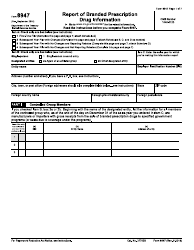

Instructions for IRS Form 5713 International Boycott Report

This document contains official instructions for IRS Form 5713 , International Boycott Report - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 5713 is available for download through this link.

FAQ

Q: What is IRS Form 5713?

A: IRS Form 5713 is the International Boycott Report.

Q: Who needs to file IRS Form 5713?

A: US taxpayers engaged in activities that may be subject to an international boycott need to file IRS Form 5713.

Q: What is the purpose of filing IRS Form 5713?

A: The purpose of filing IRS Form 5713 is to report activities that may be subject to an international boycott.

Q: When is the deadline for filing IRS Form 5713?

A: The deadline for filing IRS Form 5713 is the same as the taxpayer's income tax return due date, including extensions.

Q: How do I fill out IRS Form 5713?

A: You need to provide information about your activities and transactions related to international boycotts on the form.

Q: Are there any penalties for not filing IRS Form 5713?

A: Yes, there can be penalties for failure to file or filing an inaccurate form, so it's important to comply with the filing requirements.

Instruction Details:

- This 8-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.