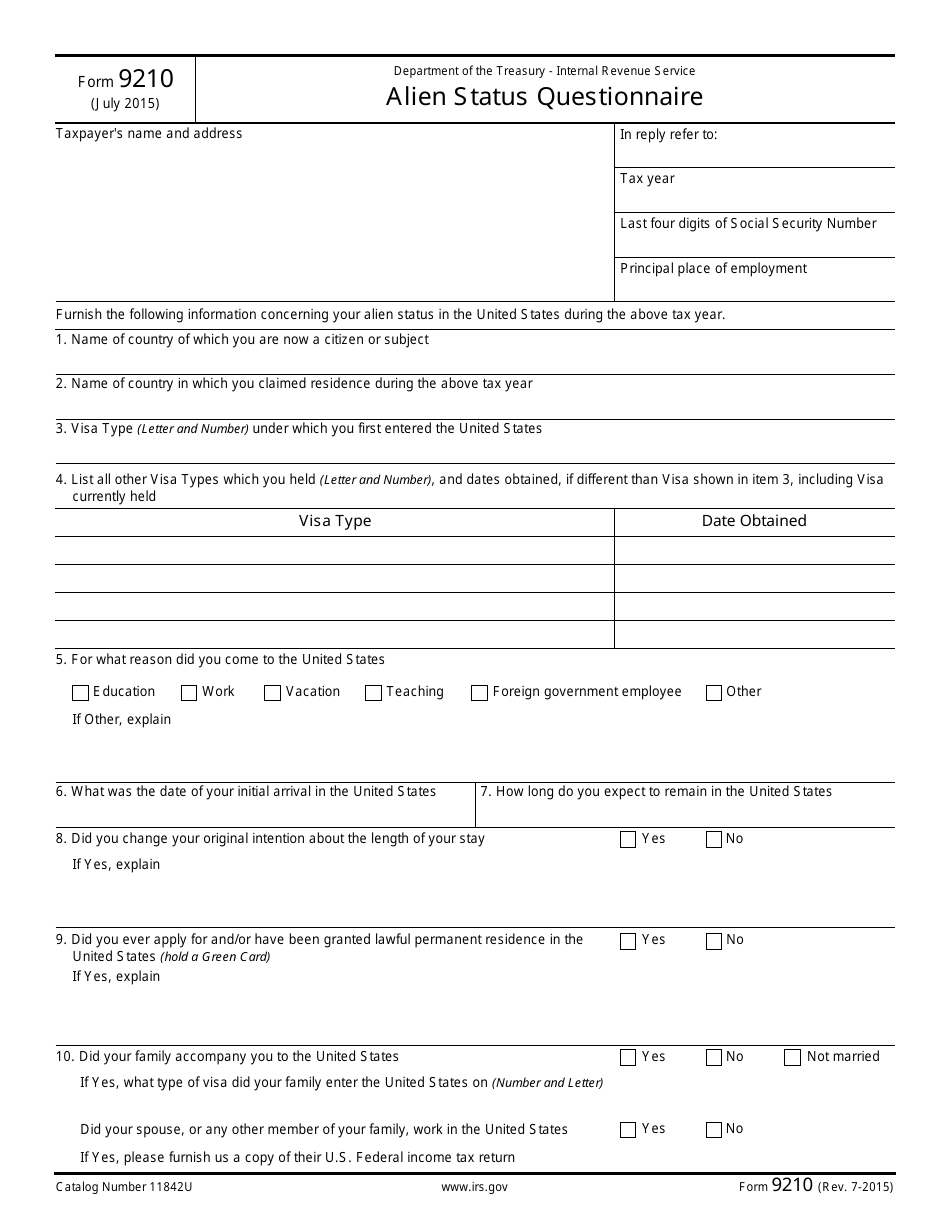

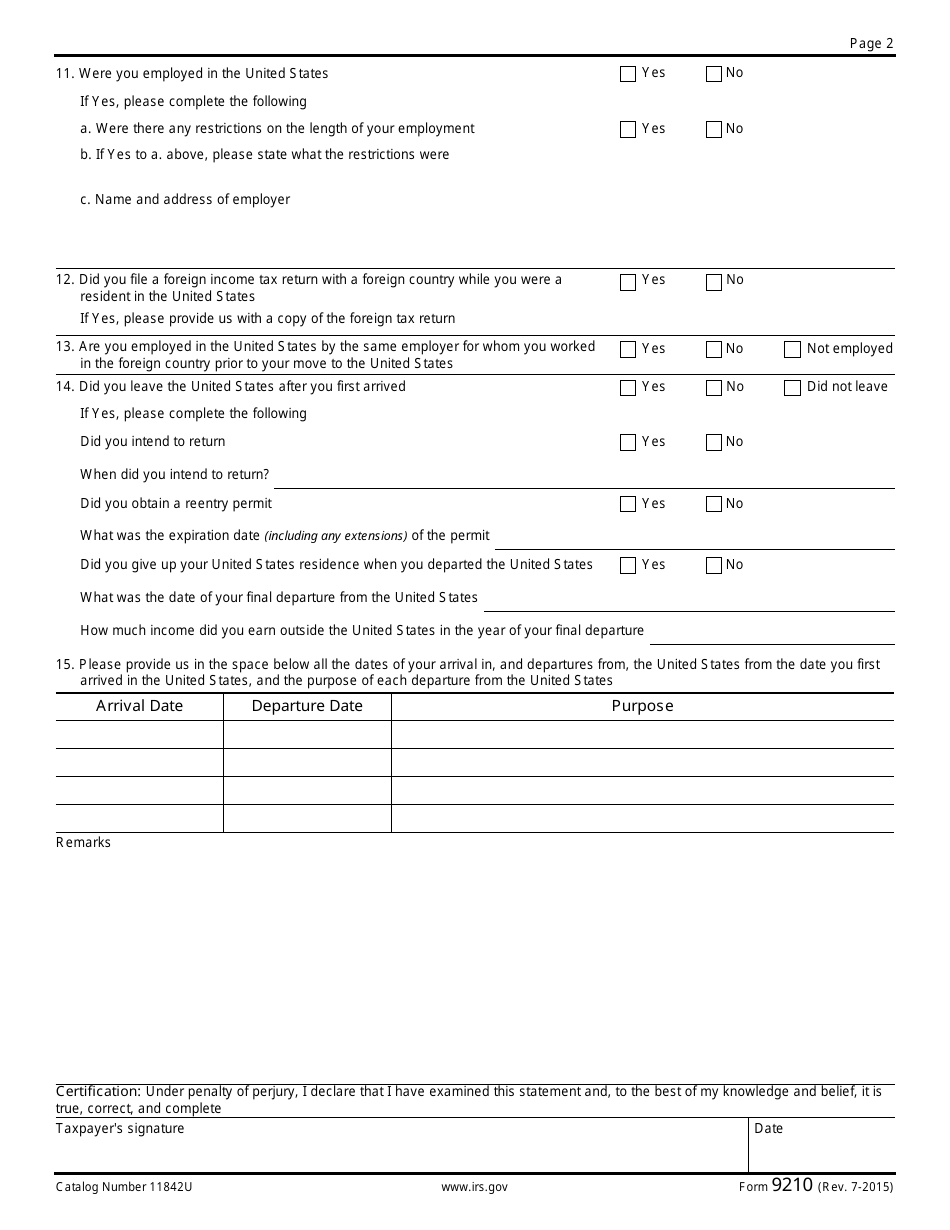

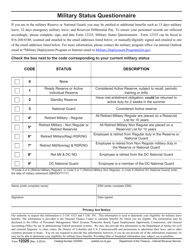

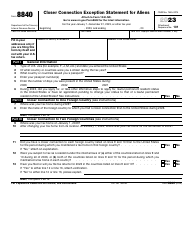

IRS Form 9210 Alien Status Questionnaire

What Is IRS Form 9210?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on July 1, 2015. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 9210?

A: IRS Form 9210 is the Alien Status Questionnaire.

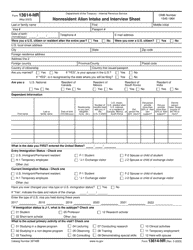

Q: Who needs to fill out IRS Form 9210?

A: Non-U.S. citizens who are applying for a taxpayer identification number (TIN) or certain tax benefits may need to fill out IRS Form 9210.

Q: What is the purpose of IRS Form 9210?

A: The purpose of IRS Form 9210 is to gather information about an individual's immigration status and determine their eligibility for certain tax benefits.

Q: Are there any filing fees associated with IRS Form 9210?

A: No, there are no filing fees for IRS Form 9210.

Q: Is IRS Form 9210 required for U.S. citizens?

A: No, IRS Form 9210 is only required for non-U.S. citizens.

Q: How long does it take to fill out IRS Form 9210?

A: The time required to fill out IRS Form 9210 may vary depending on individual circumstances and the availability of required documentation.

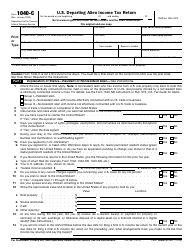

Q: What happens after I file IRS Form 9210?

A: After filing IRS Form 9210, the IRS will review the information provided and process the application for a taxpayer identification number or tax benefit.

Q: Are assistance or guidance available for filling out IRS Form 9210?

A: Yes, individuals may seek assistance or guidance from tax professionals or contact the IRS directly for any questions or concerns regarding IRS Form 9210.

Form Details:

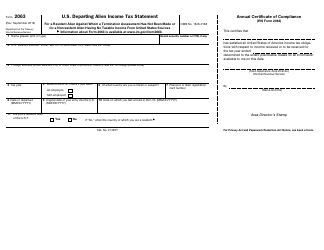

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 9210 through the link below or browse more documents in our library of IRS Forms.