US Tax Templates

US Tax Documentation and Forms

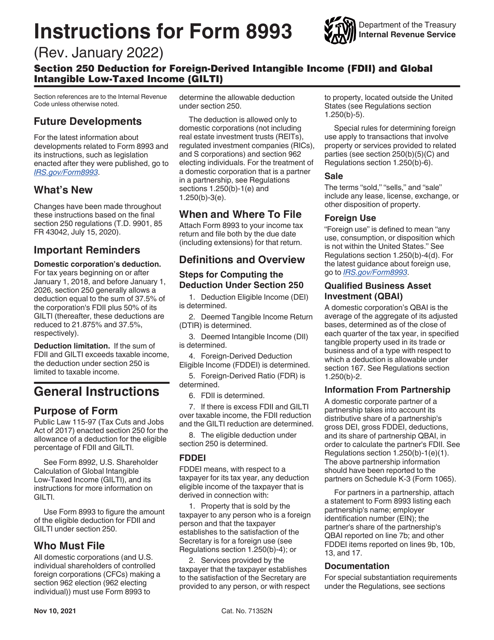

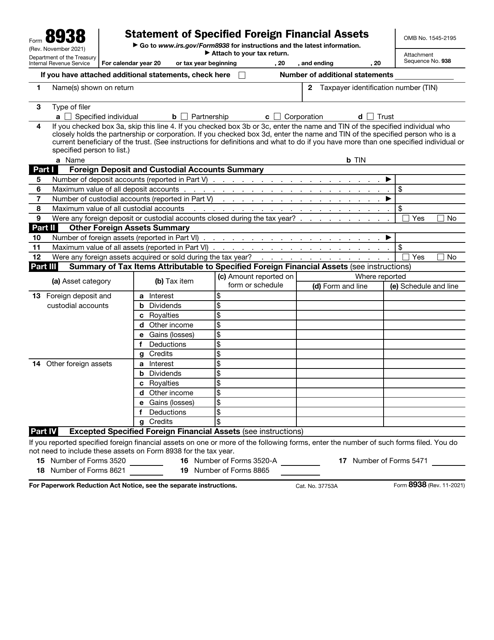

Are you looking for information on US taxes or need to file your tax forms? Our comprehensive collection of US tax documentation and forms provides a wealth of resources to help you navigate the complex world of tax regulations. Whether you're a US citizen, a business owner, or an individual with specific tax circumstances, we have the information you need to ensure compliance and maximize your deductions.

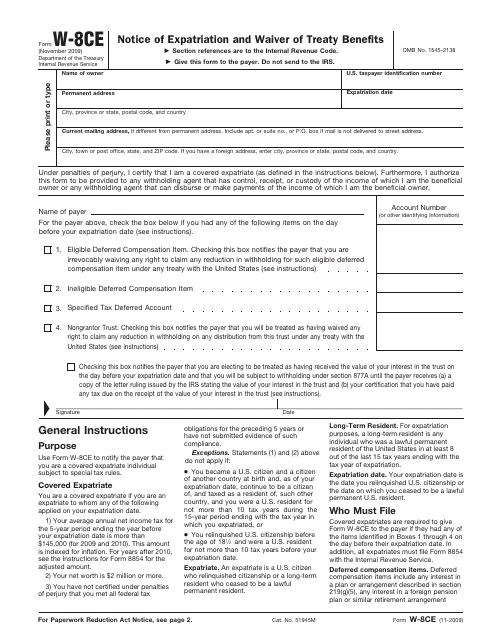

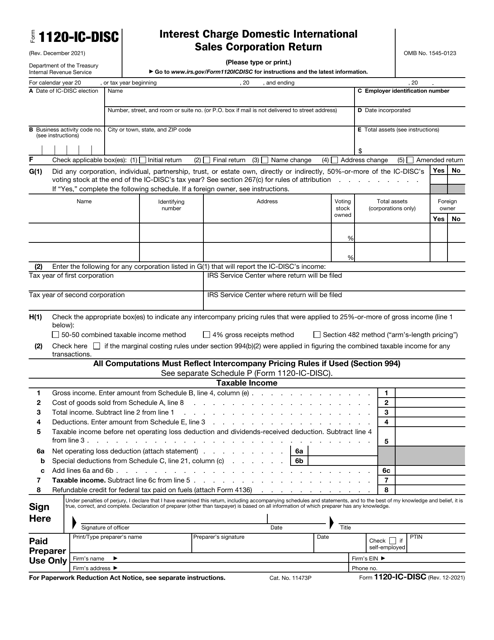

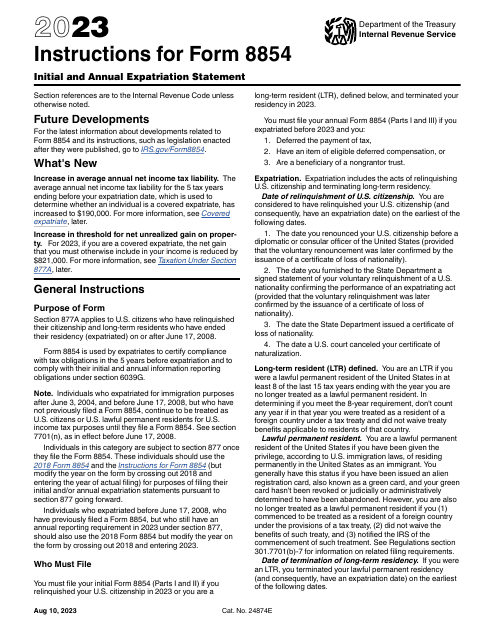

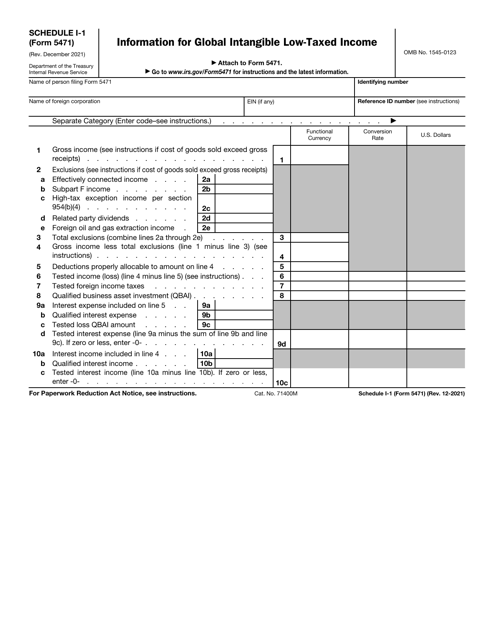

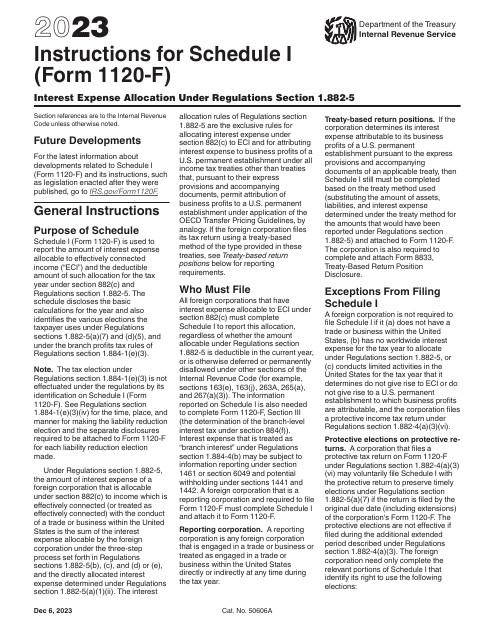

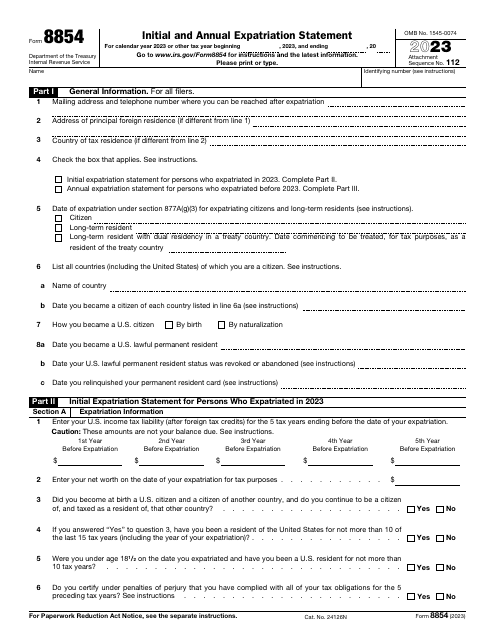

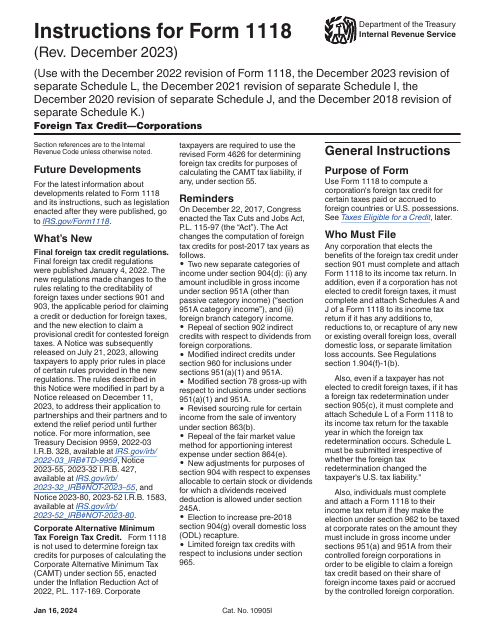

Our extensive library includes various US tax forms, such as the IRS Form W-8CE Notice of Expatriation and Waiver of Treaty Benefits, the IRS Form 1120-IC-DISC Interest Charge Domestic International Sales Corporation Return, and the IRS Form 8843 Statement for Exempt Individuals and Individuals With a Medical Condition. We also provide access to essential documents like the IRS Form 1099-NEC mployee Compensation and the IRS Form 8854 Initial and Annual Expatriation Statement.

Navigating the US tax system can be overwhelming, but our user-friendly resources make it easier to understand and fulfill your tax obligations. From detailed instructions on how tofill out each form to useful tips and guidelines, our documentation serves as a valuable guide throughout the tax filing process.

Don't let US taxes cause you stress. Explore our comprehensive collection of US tax documentation and forms today, and ensure that you're on top of your tax obligations.

Documents:

26

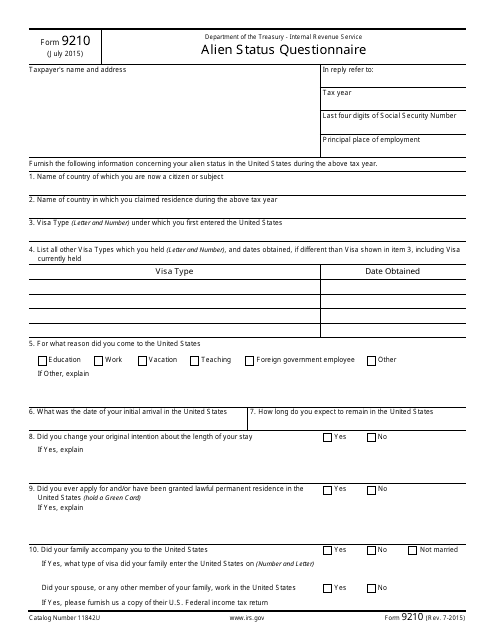

This document is used for determining the alien status of an individual for tax purposes.

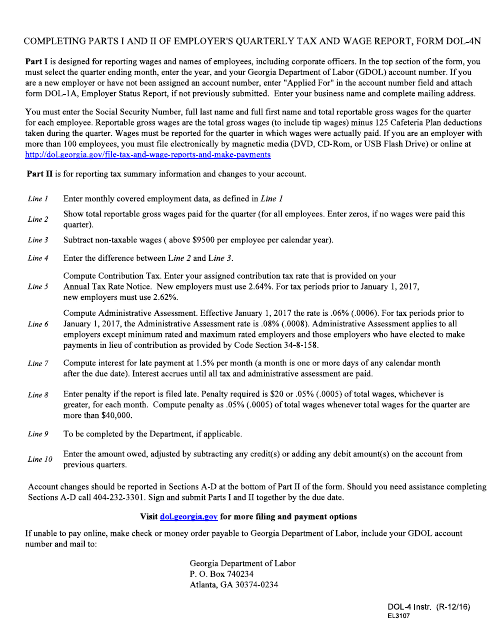

This is a formal document for the state of Georgia that all employers must file each quarter if their business is active to inform the authorities about the wages they have paid to their employees.

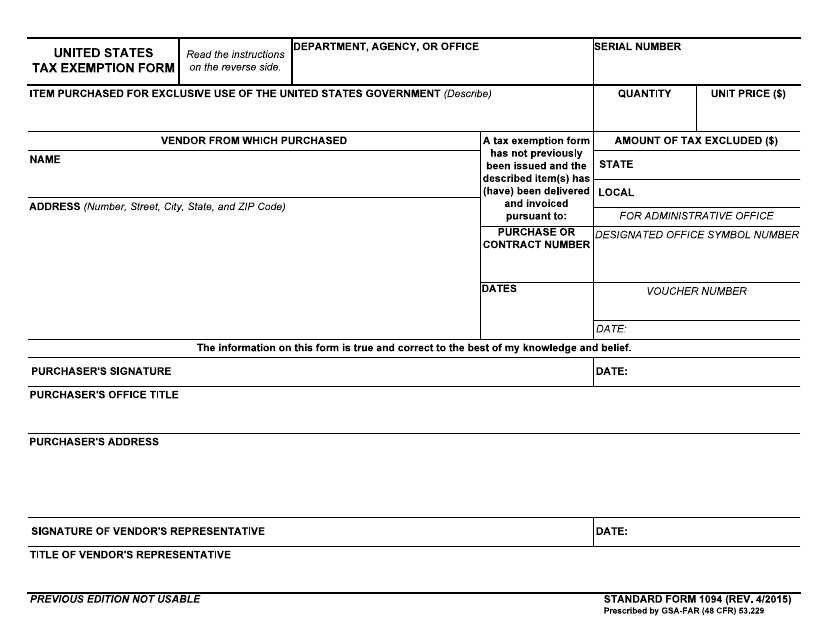

This form is used for applying for tax exemption in the United States.

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.

This form is also called the IC-DISC tax return. It is a form used by corporations as an information return reported to the Internal Revenue Service (IRS). A list of available Schedules is presented in the form description.

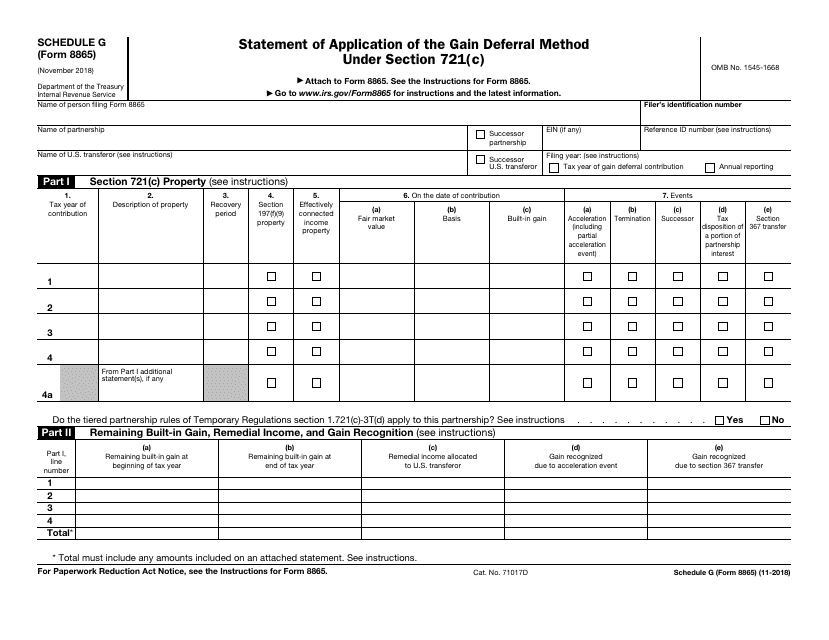

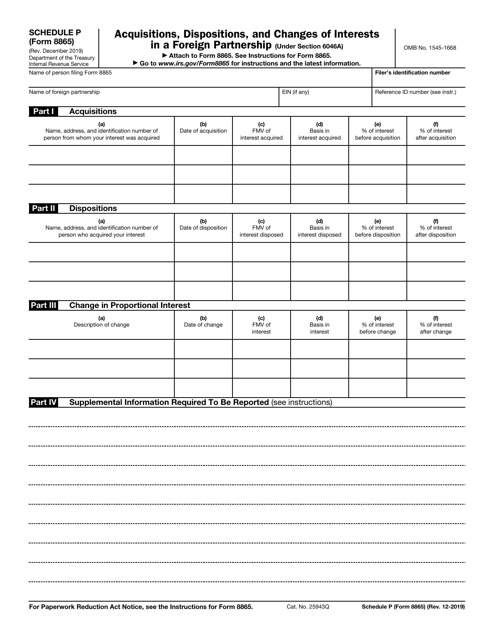

This Form is used for reporting the application of the gain deferral method under Section 721(c) on IRS Form 8865 Schedule G.

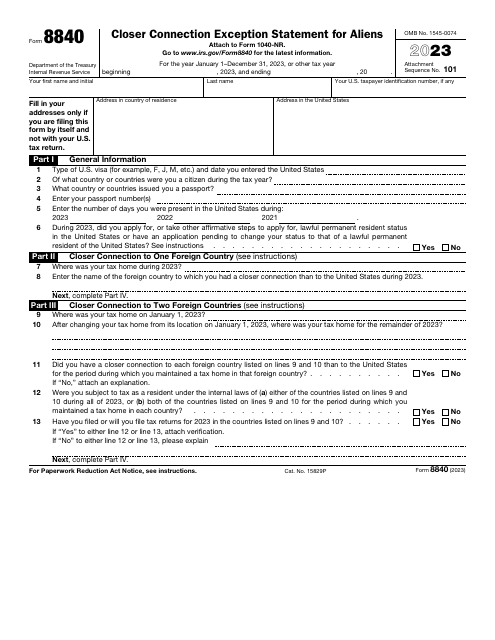

This is an application issued by the Internal Revenue Service (IRS) especially for alien individuals who use it to claim the closer connection to a foreign country exception to the substantial presence test.

This is a fiscal IRS document business entities have to use to report compensation they have paid to individuals and companies they do not consider their employees.

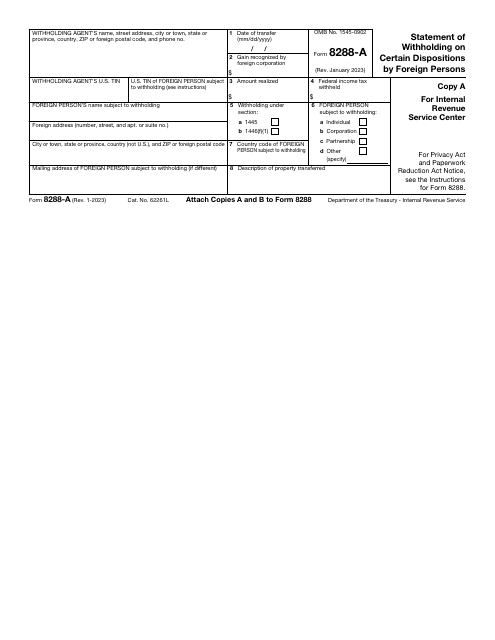

This is a supplementary document used by a withholding agent to describe the disposition of real property and report how much tax was withheld as a result of the transaction.