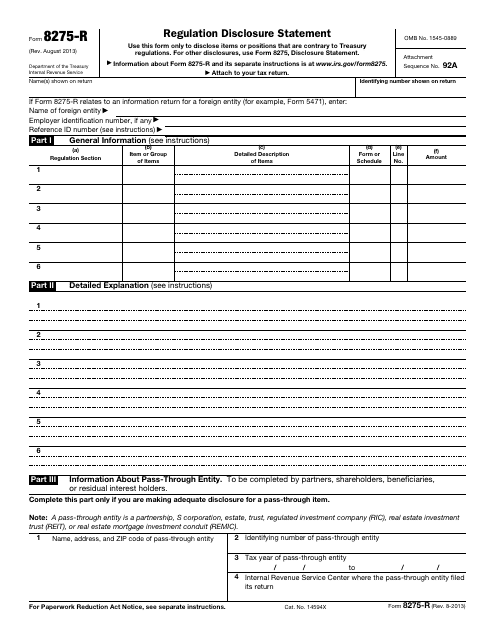

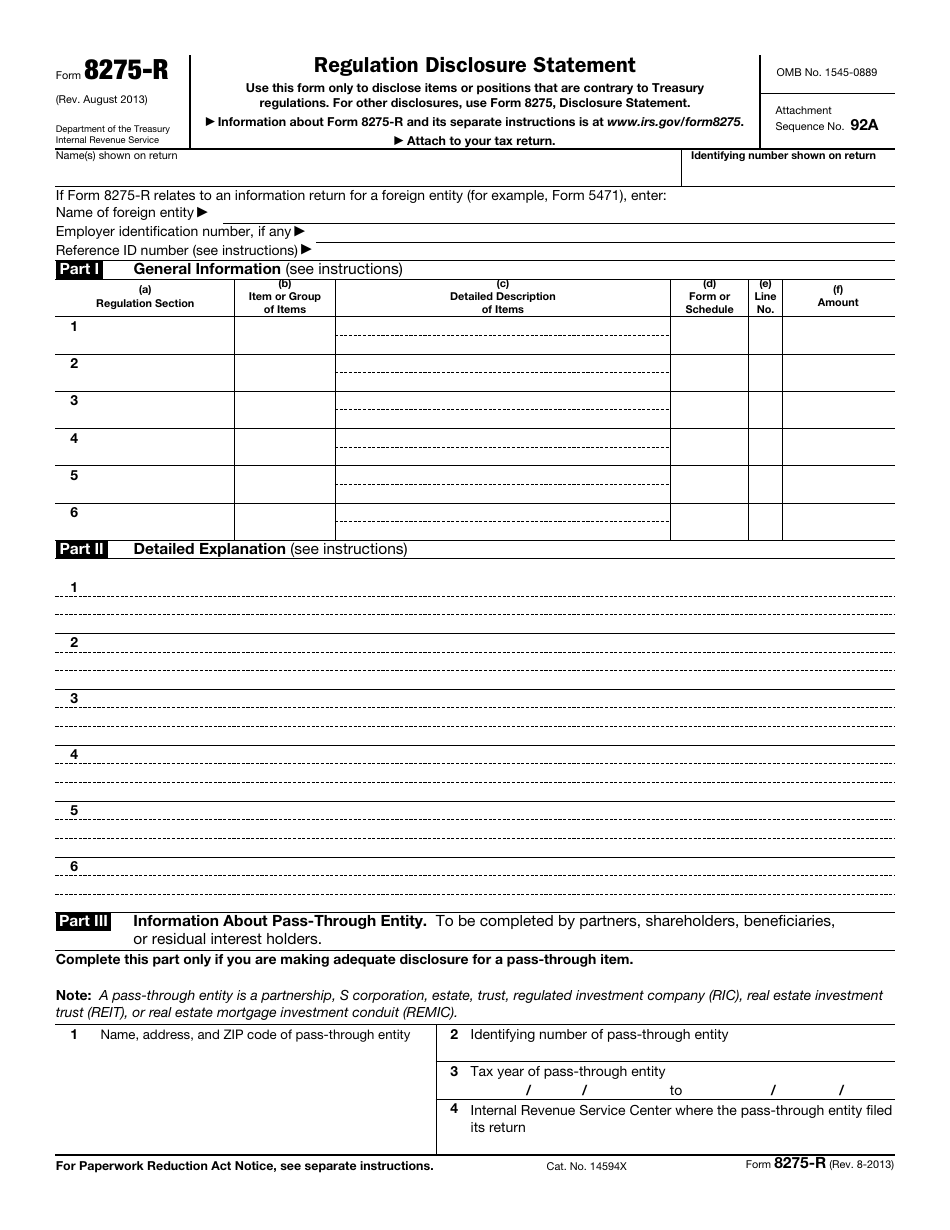

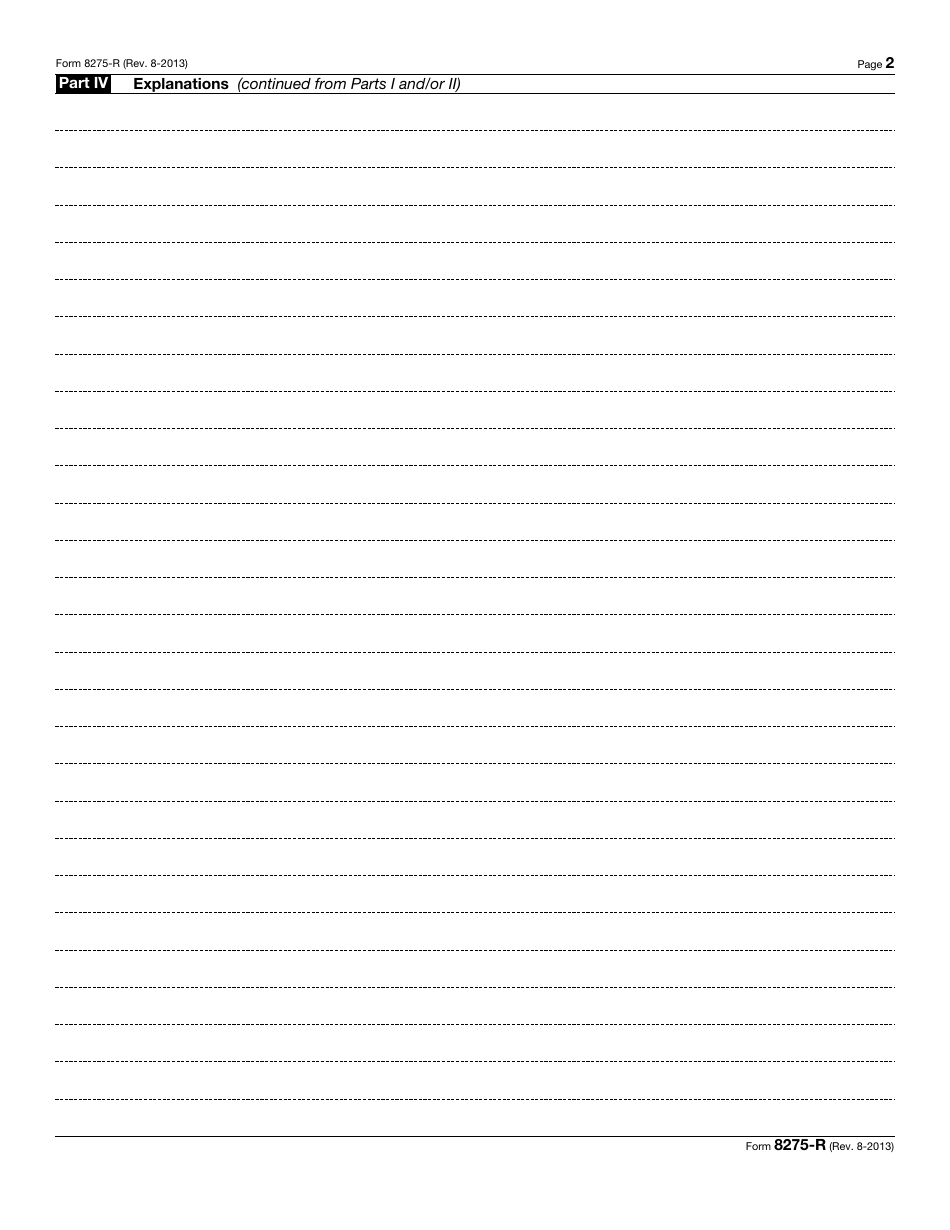

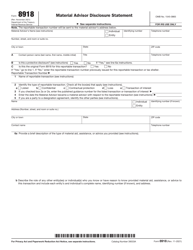

IRS Form 8275-R Regulation Disclosure Statement

What Is IRS Form 8275-R?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on August 1, 2013. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

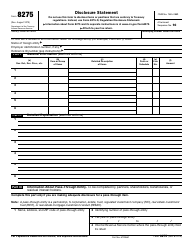

Q: What is IRS Form 8275-R?

A: IRS Form 8275-R is the Regulation Disclosure Statement form.

Q: What is the purpose of IRS Form 8275-R?

A: The purpose of IRS Form 8275-R is to disclose positions taken on a tax return that are contrary to IRS regulations.

Q: When should I use IRS Form 8275-R?

A: You should use IRS Form 8275-R when you want to disclose positions taken on your tax return that are contrary to IRS regulations.

Q: Are there any penalties for not filing IRS Form 8275-R?

A: Yes, there may be penalties for not filing IRS Form 8275-R, including accuracy-related penalties and potential audit exposure.

Q: Can IRS Form 8275-R be filed electronically?

A: No, IRS Form 8275-R cannot be filed electronically. It must be filed by mail with your tax return.

Q: Do I need to attach IRS Form 8275-R to my tax return?

A: Yes, you need to attach IRS Form 8275-R to your tax return if you are disclosing positions taken that are contrary to IRS regulations.

Q: Is IRS Form 8275-R required for every tax return?

A: No, IRS Form 8275-R is not required for every tax return. It is only required if you are disclosing positions taken that are contrary to IRS regulations.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8275-R through the link below or browse more documents in our library of IRS Forms.