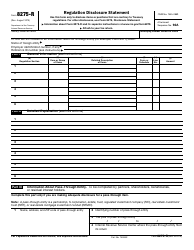

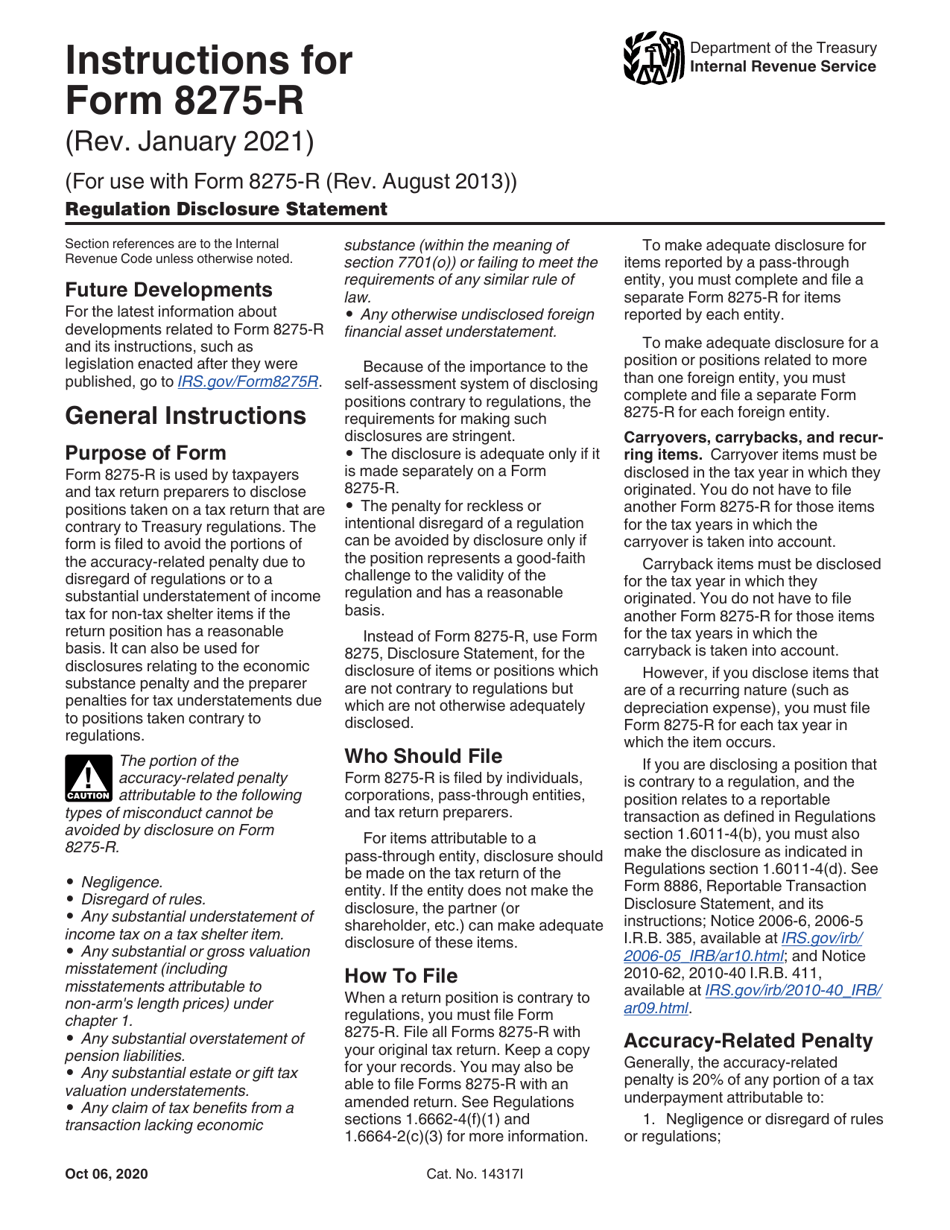

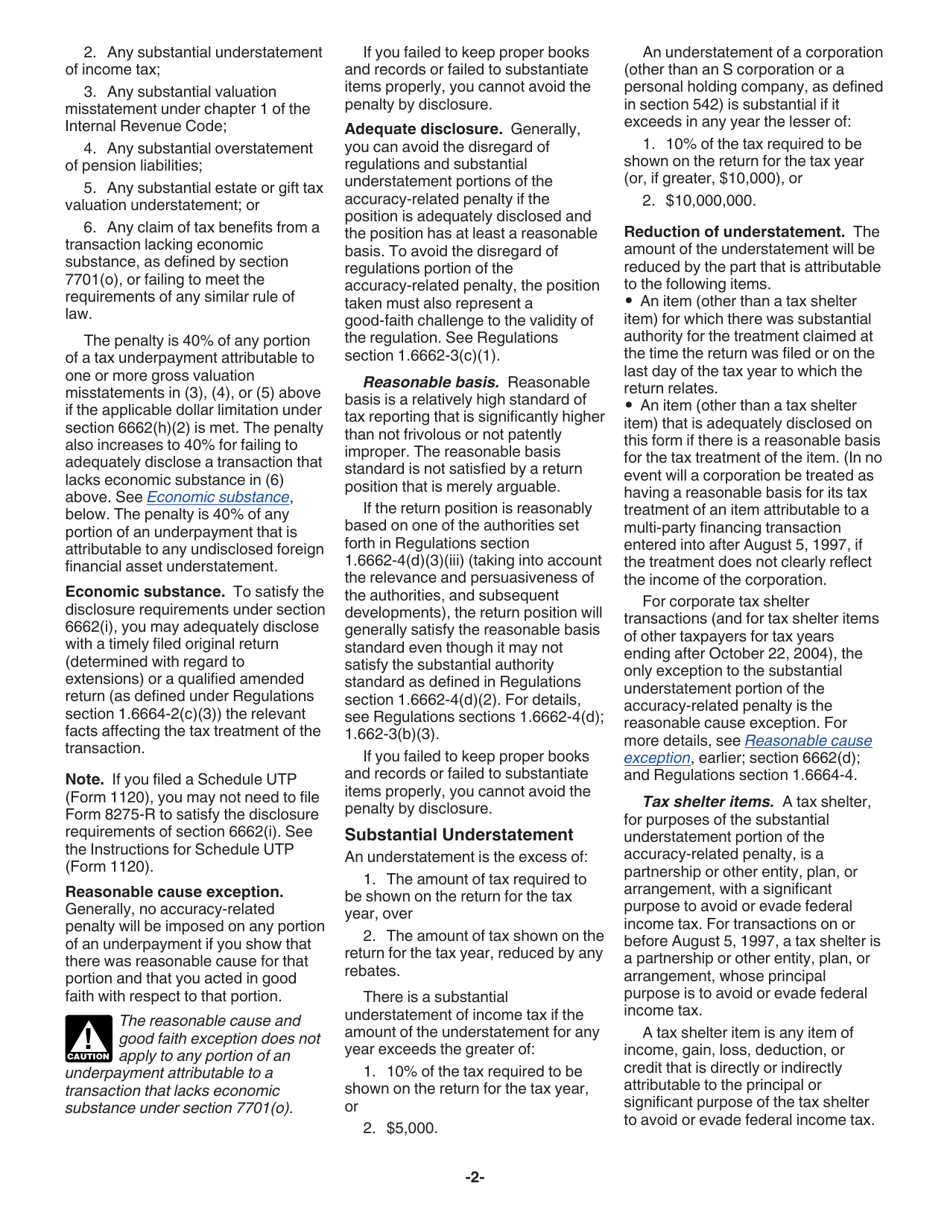

Instructions for IRS Form 8275-R Regulation Disclosure Statement

This document contains official instructions for IRS Form 8275-R , Regulation Disclosure Statement - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8275-R is available for download through this link.

FAQ

Q: What is IRS Form 8275-R?

A: IRS Form 8275-R is a regulation disclosure statement.

Q: When is IRS Form 8275-R used?

A: IRS Form 8275-R is used when a taxpayer wants to disclose a position that does not meet the regulatory authority of the IRS.

Q: Why would someone use IRS Form 8275-R?

A: Someone might use IRS Form 8275-R to disclose a position that is not fully supported by the tax laws or regulations.

Q: What information is required on IRS Form 8275-R?

A: IRS Form 8275-R requires the taxpayer to provide information about the position being disclosed and explain why it does not meet the regulatory authority.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.