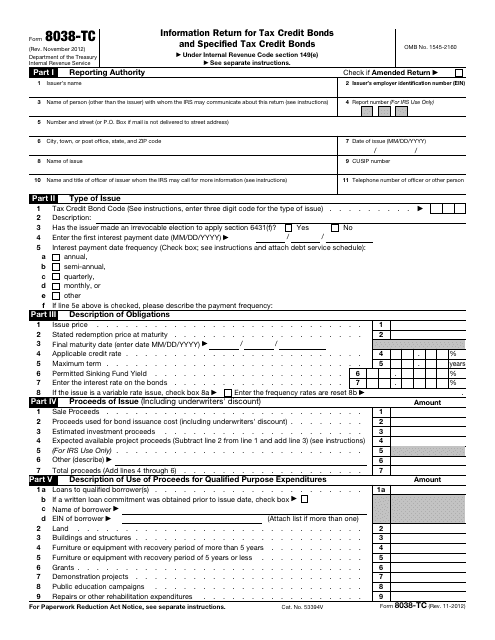

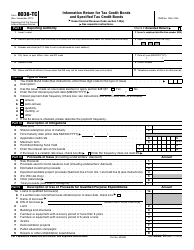

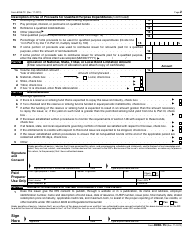

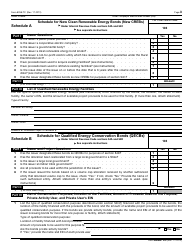

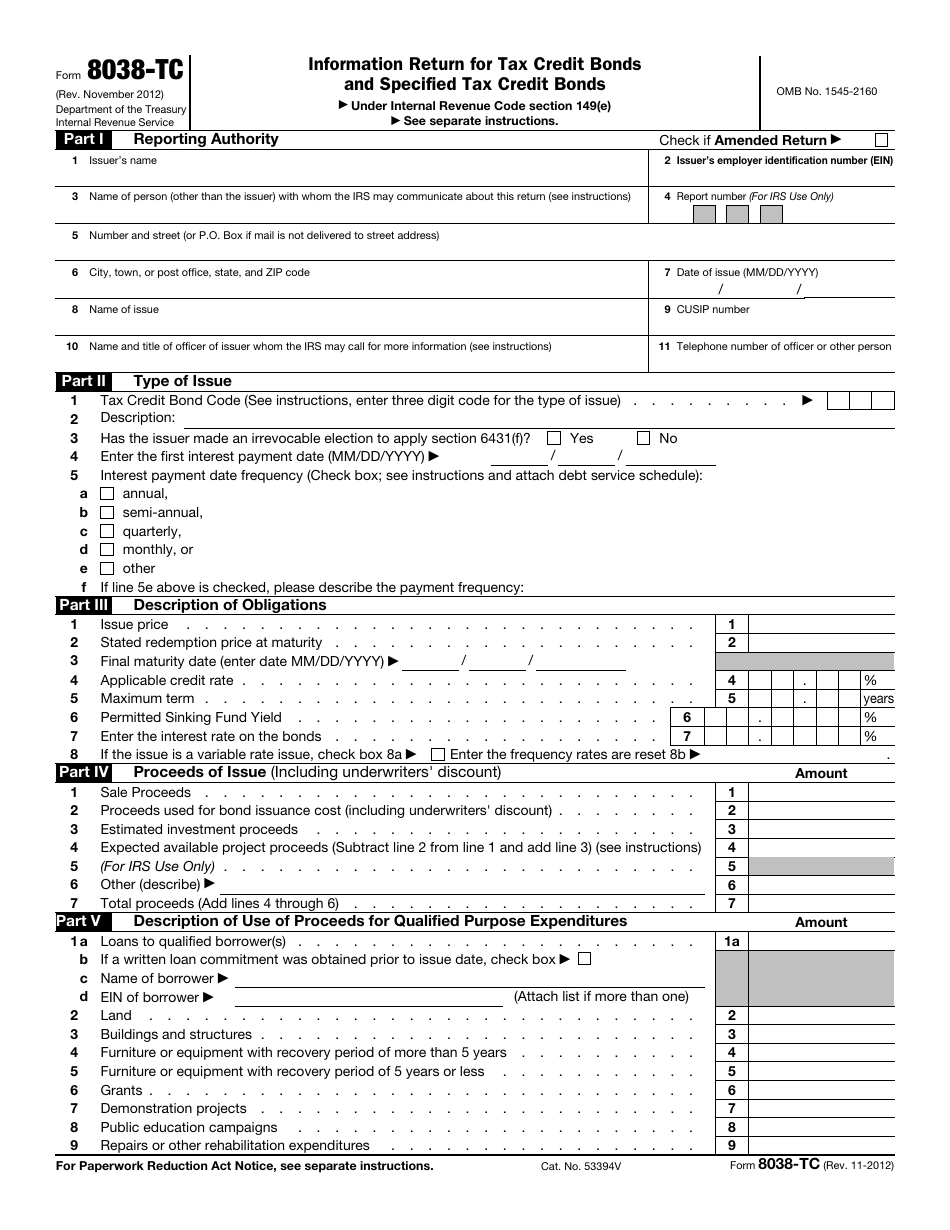

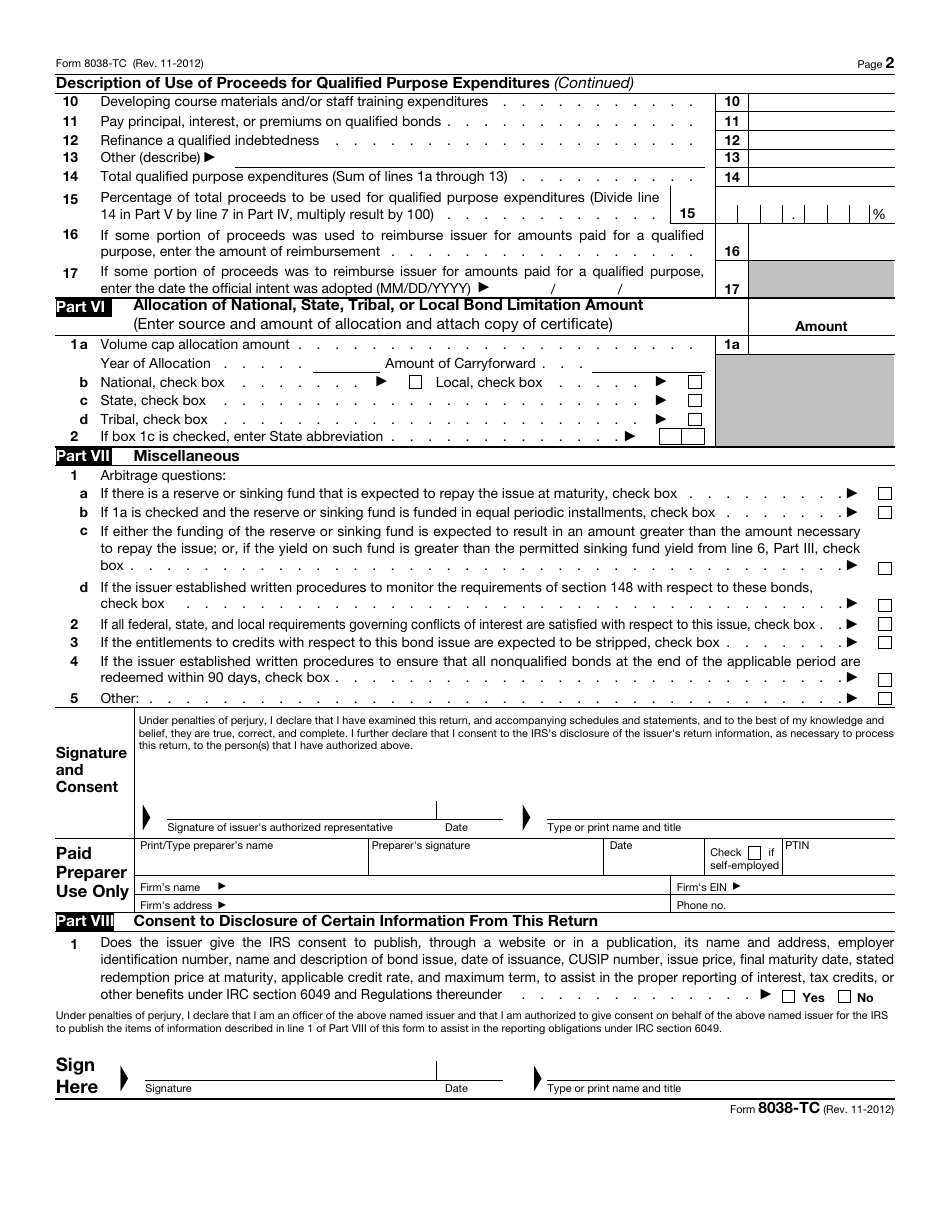

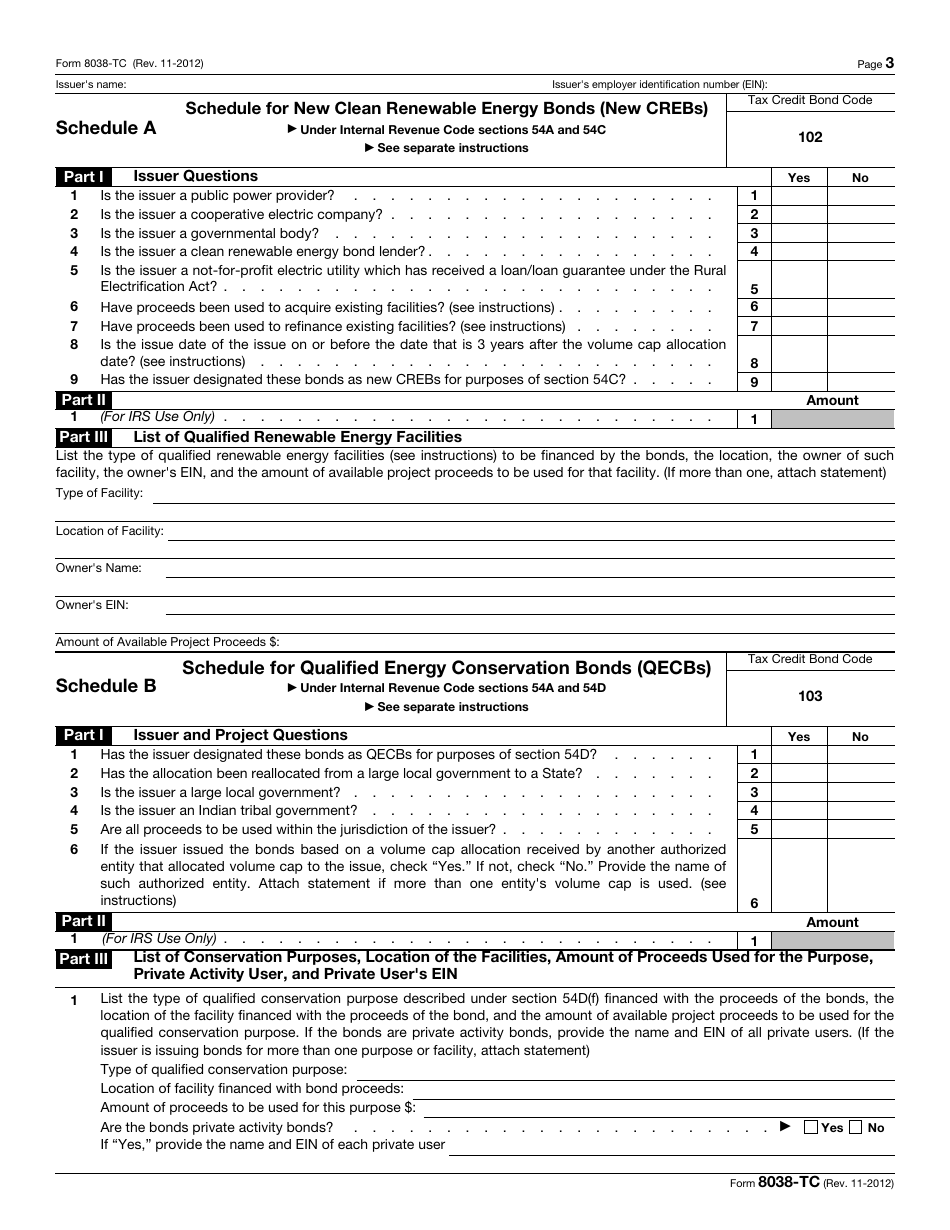

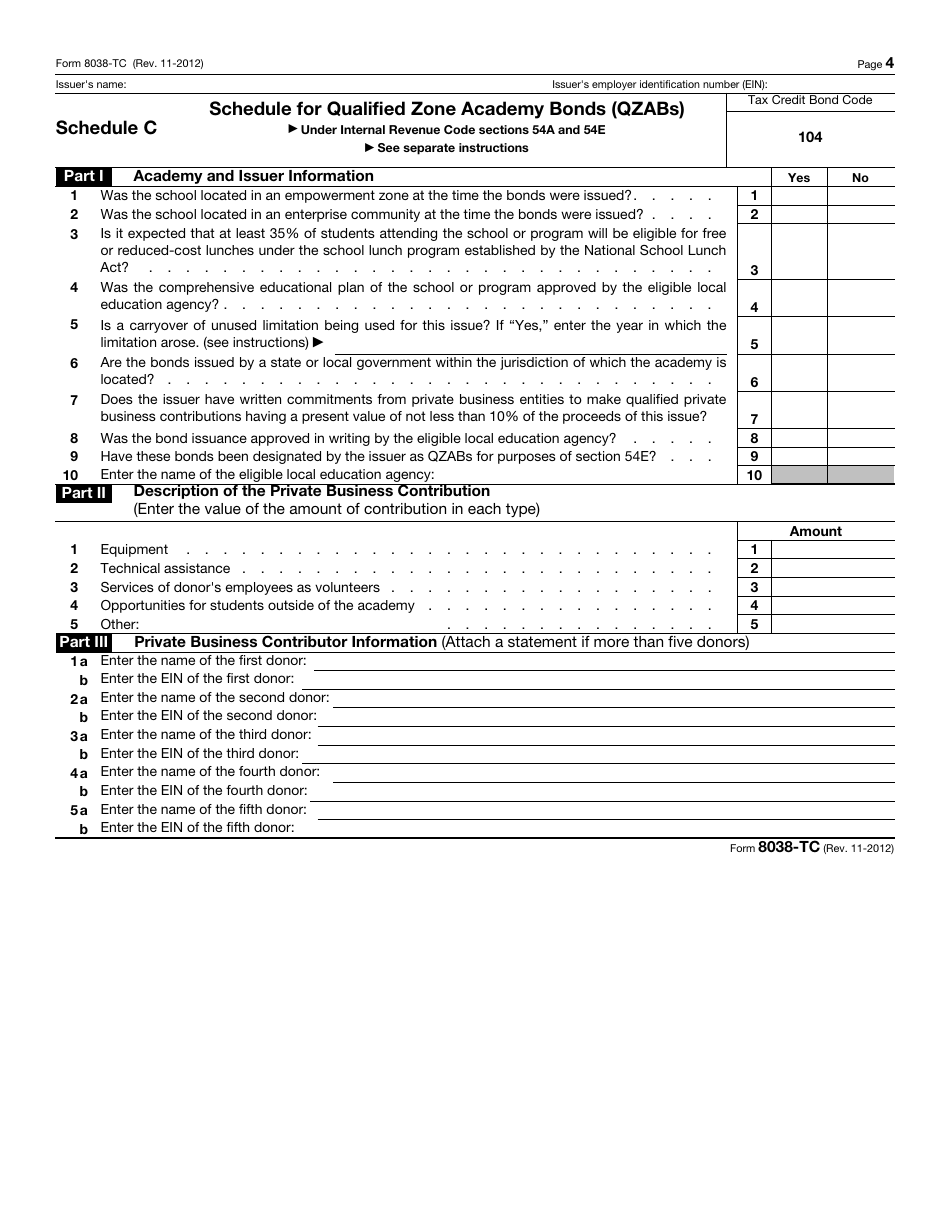

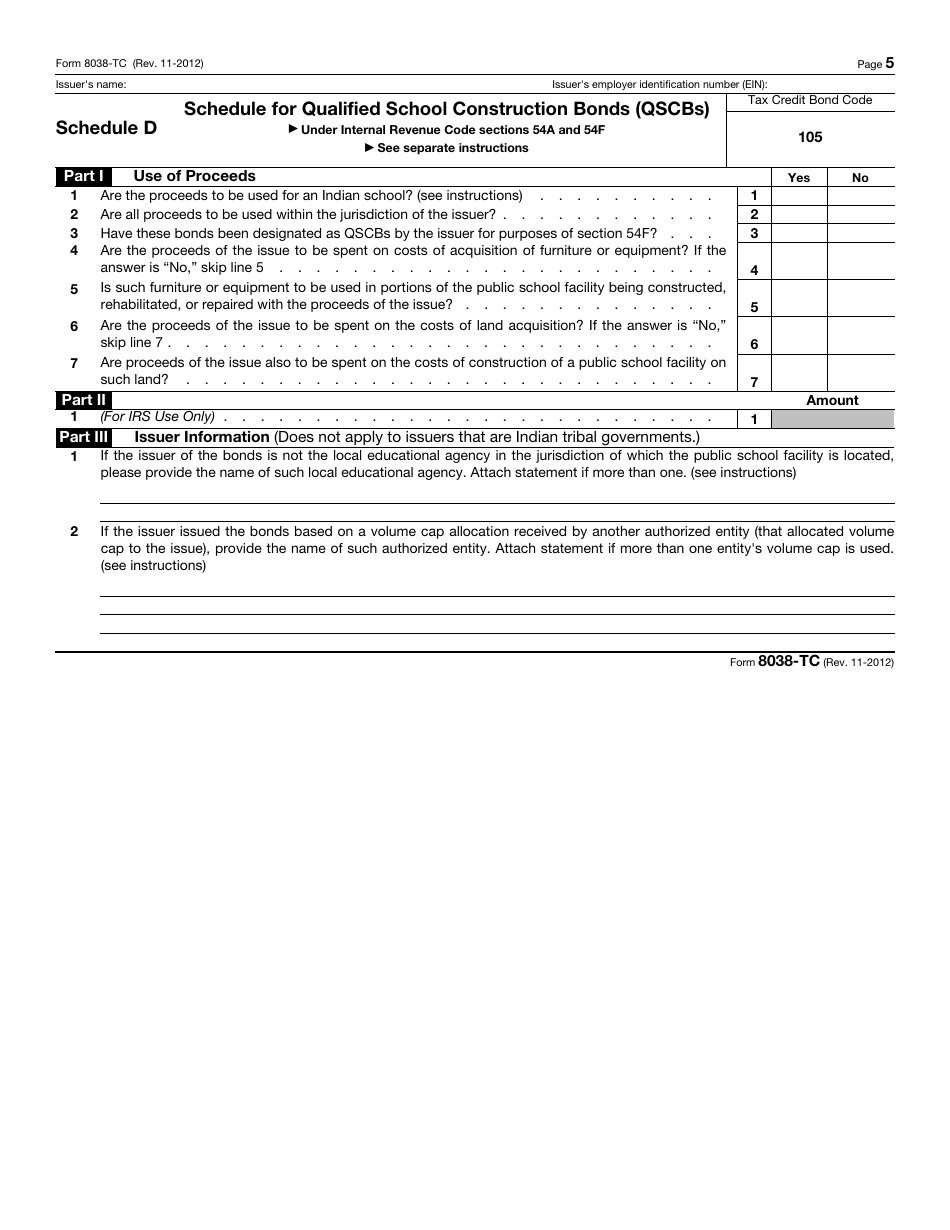

IRS Form 8038-TC Information Return for Tax Credit Bonds

What Is IRS Form 8038-TC?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2012. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8038-TC?

A: IRS Form 8038-TC is an Information Return for Tax Credit Bonds.

Q: Who needs to file IRS Form 8038-TC?

A: Those who issued tax credit bonds need to file IRS Form 8038-TC.

Q: What is the purpose of IRS Form 8038-TC?

A: The purpose of IRS Form 8038-TC is to report information about tax credit bonds.

Q: When is the deadline to file IRS Form 8038-TC?

A: The deadline to file IRS Form 8038-TC is generally the 15th day of the 6th month after the close of the issuer's bond issuance period.

Q: Are there any penalties for not filing IRS Form 8038-TC?

A: Yes, there are penalties for not filing IRS Form 8038-TC, such as late filing penalties and accuracy-related penalties.

Form Details:

- A 5-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8038-TC through the link below or browse more documents in our library of IRS Forms.