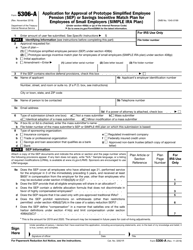

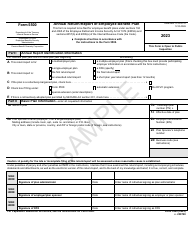

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 5300

for the current year.

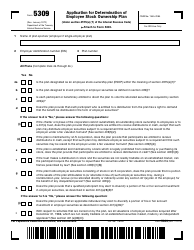

Instructions for IRS Form 5300 Application for Determination for Employee Benefit Plan

This document contains official instructions for IRS Form 5300 , Application for Determination for Employee Benefit Plan - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 5300 is available for download through this link.

FAQ

Q: What is IRS Form 5300?

A: IRS Form 5300 is an application for determination for employee benefit plans.

Q: Who needs to file IRS Form 5300?

A: Employers or plan administrators who sponsor employee benefit plans need to file IRS Form 5300.

Q: What is the purpose of filing IRS Form 5300?

A: The purpose of filing IRS Form 5300 is to request a determination letter from the IRS regarding the tax-qualified status of an employee benefit plan.

Q: What is a determination letter?

A: A determination letter is a written document from the IRS that confirms the tax-qualified status of an employee benefit plan.

Q: What information is required to complete IRS Form 5300?

A: IRS Form 5300 requires information about the plan sponsor, plan terms, plan provisions, plan operations, and plan compliance.

Q: Are there any filing fees for IRS Form 5300?

A: Yes, there are specific filing fees for submitting IRS Form 5300. The fee amount depends on the type and size of the plan.

Instruction Details:

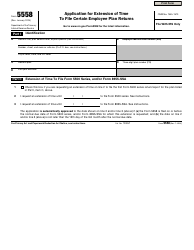

- This 5-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.