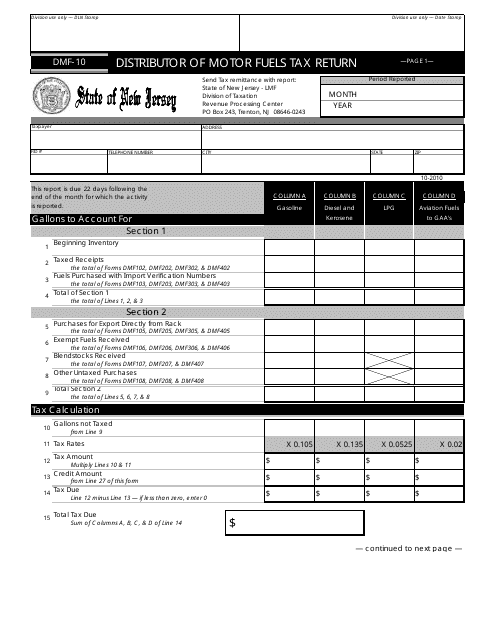

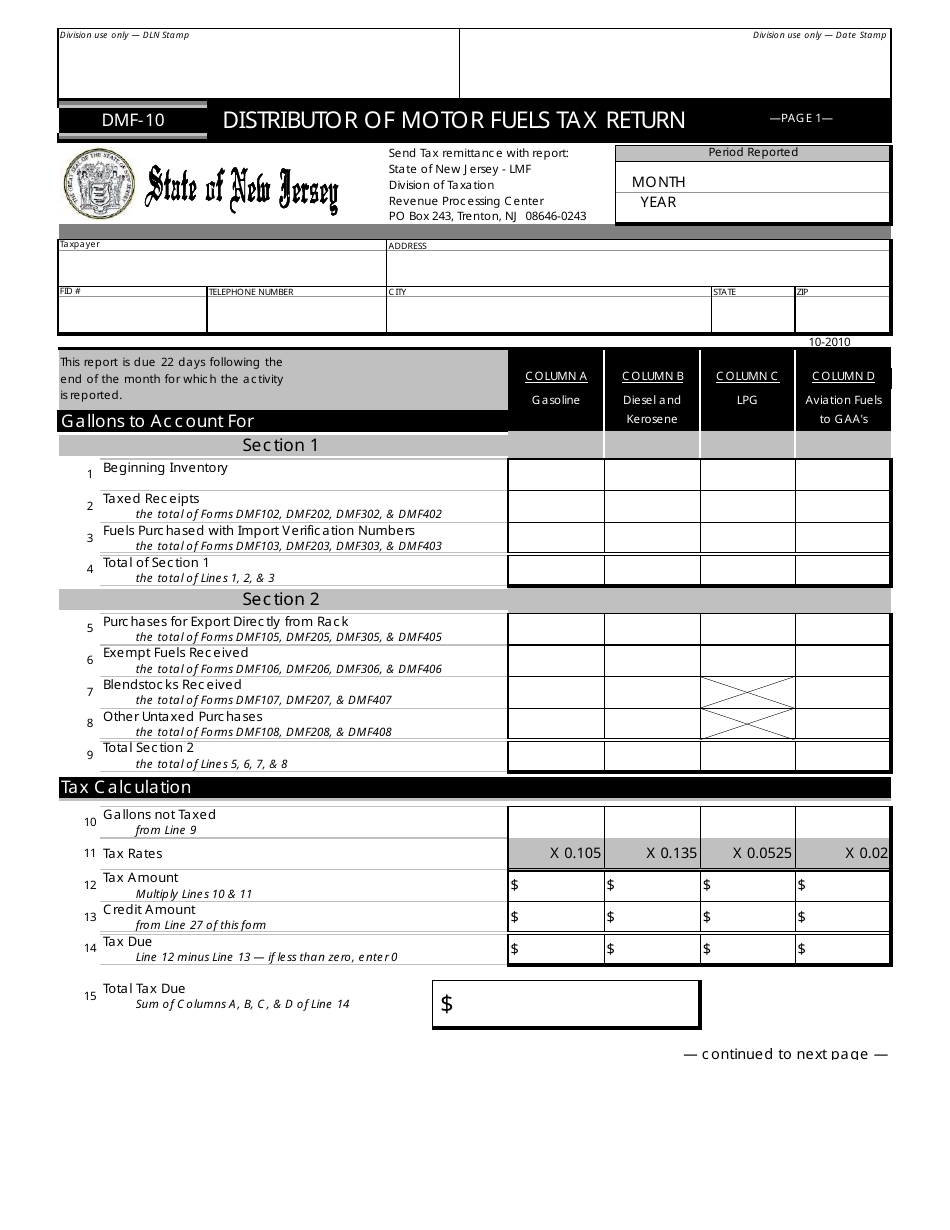

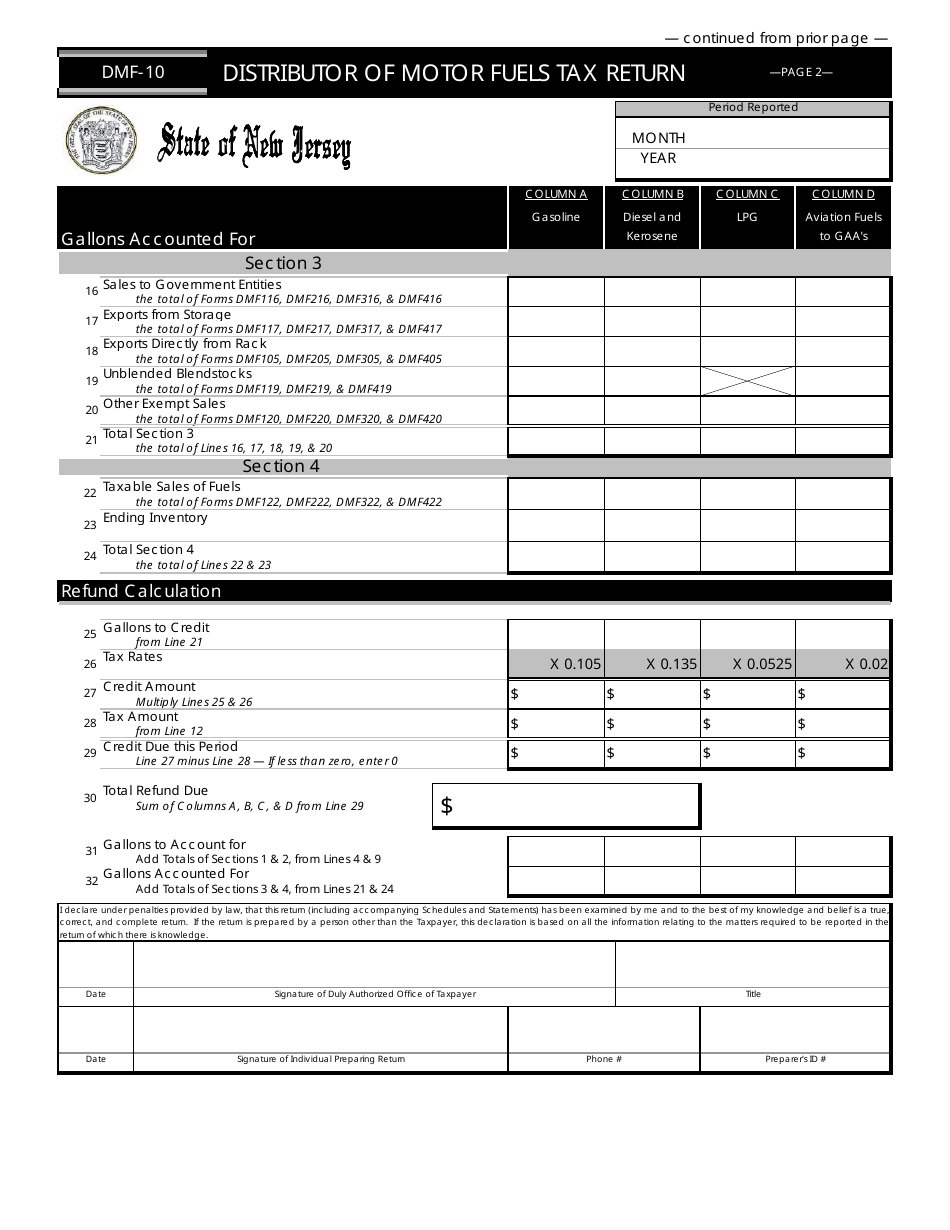

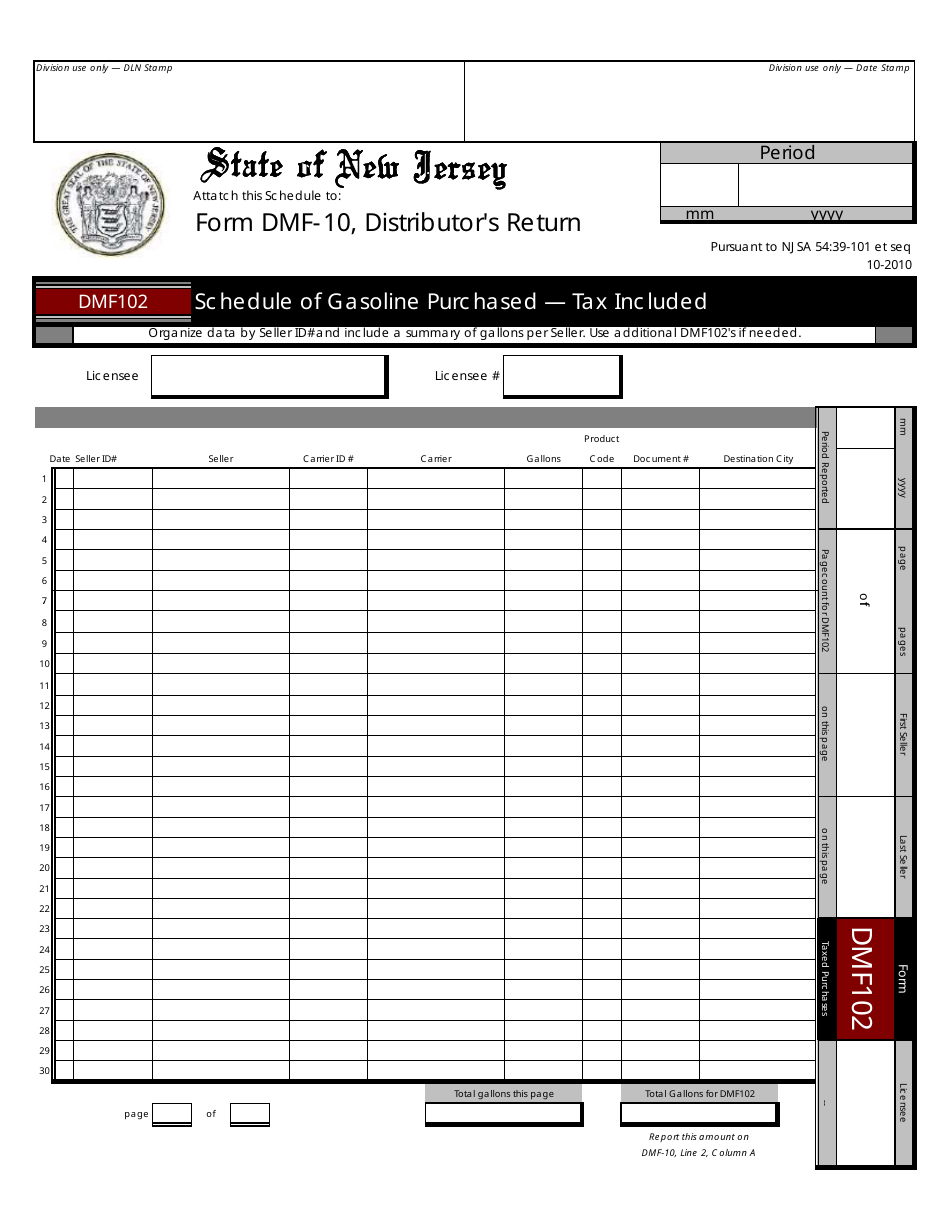

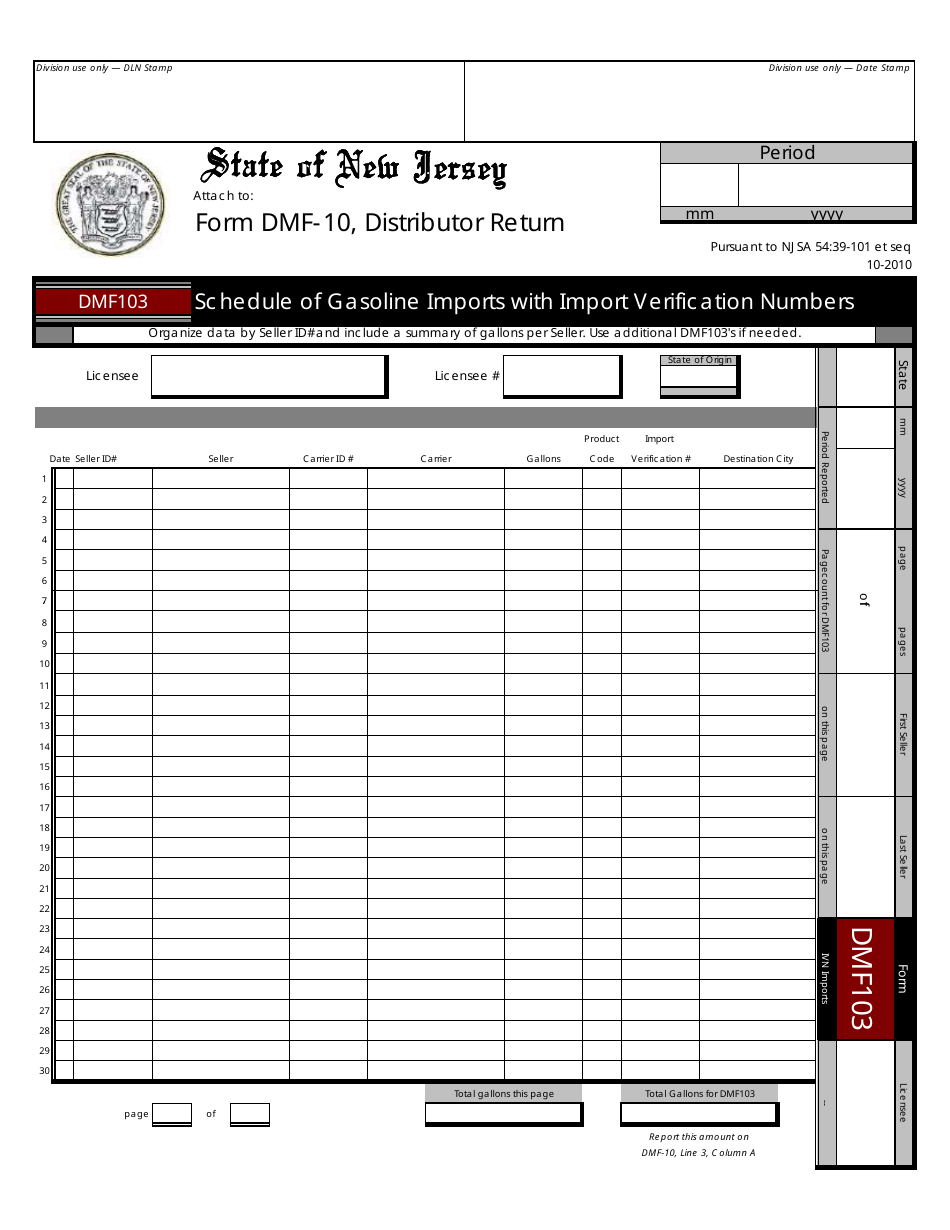

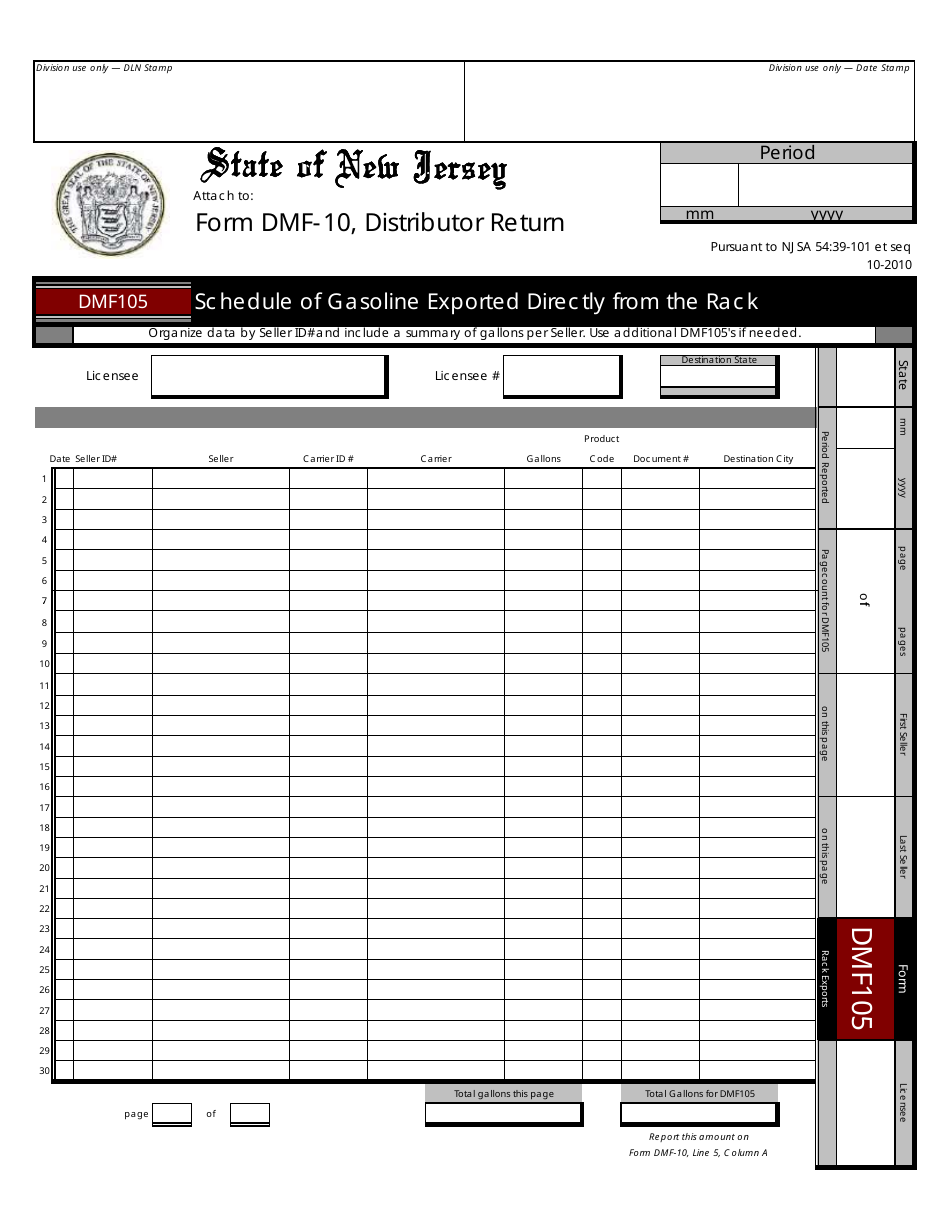

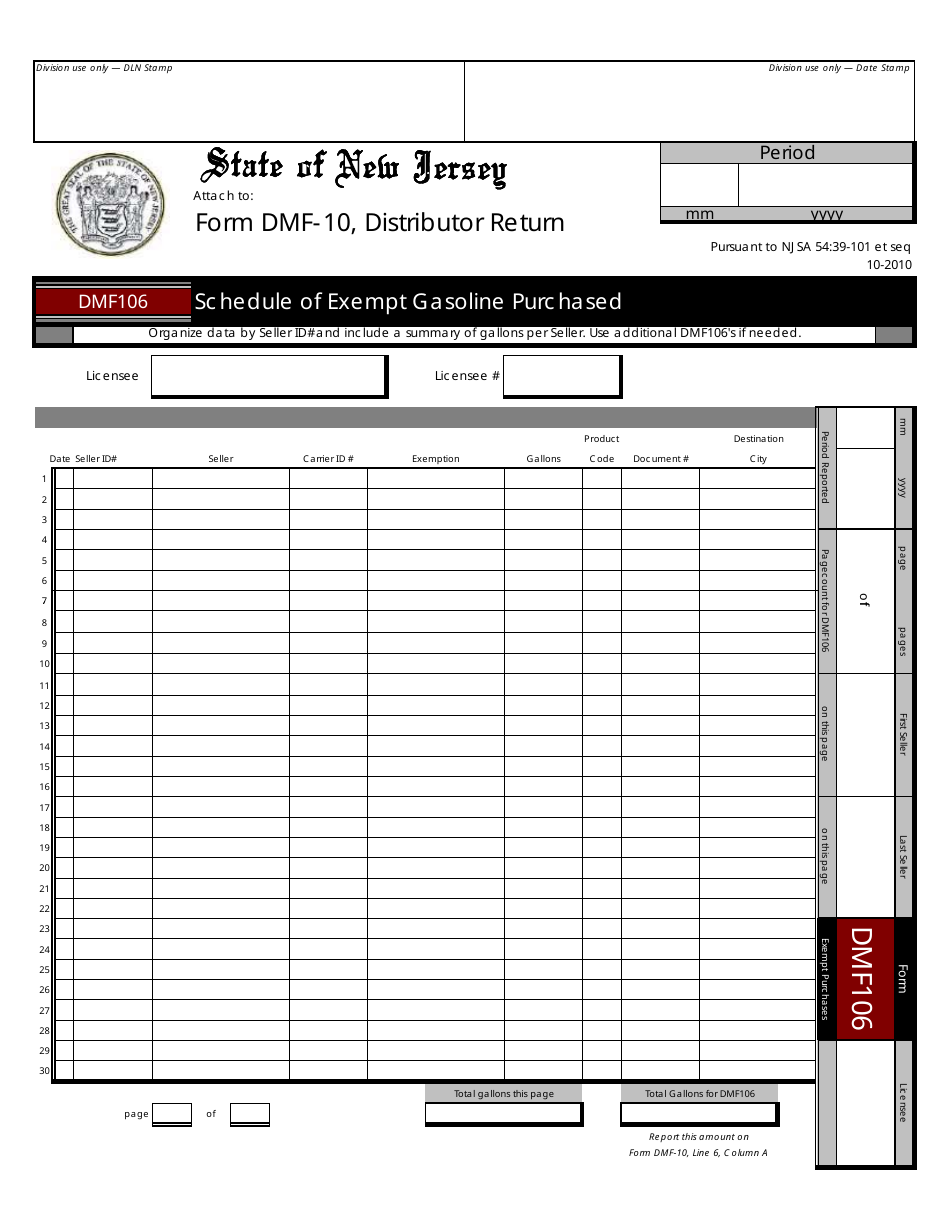

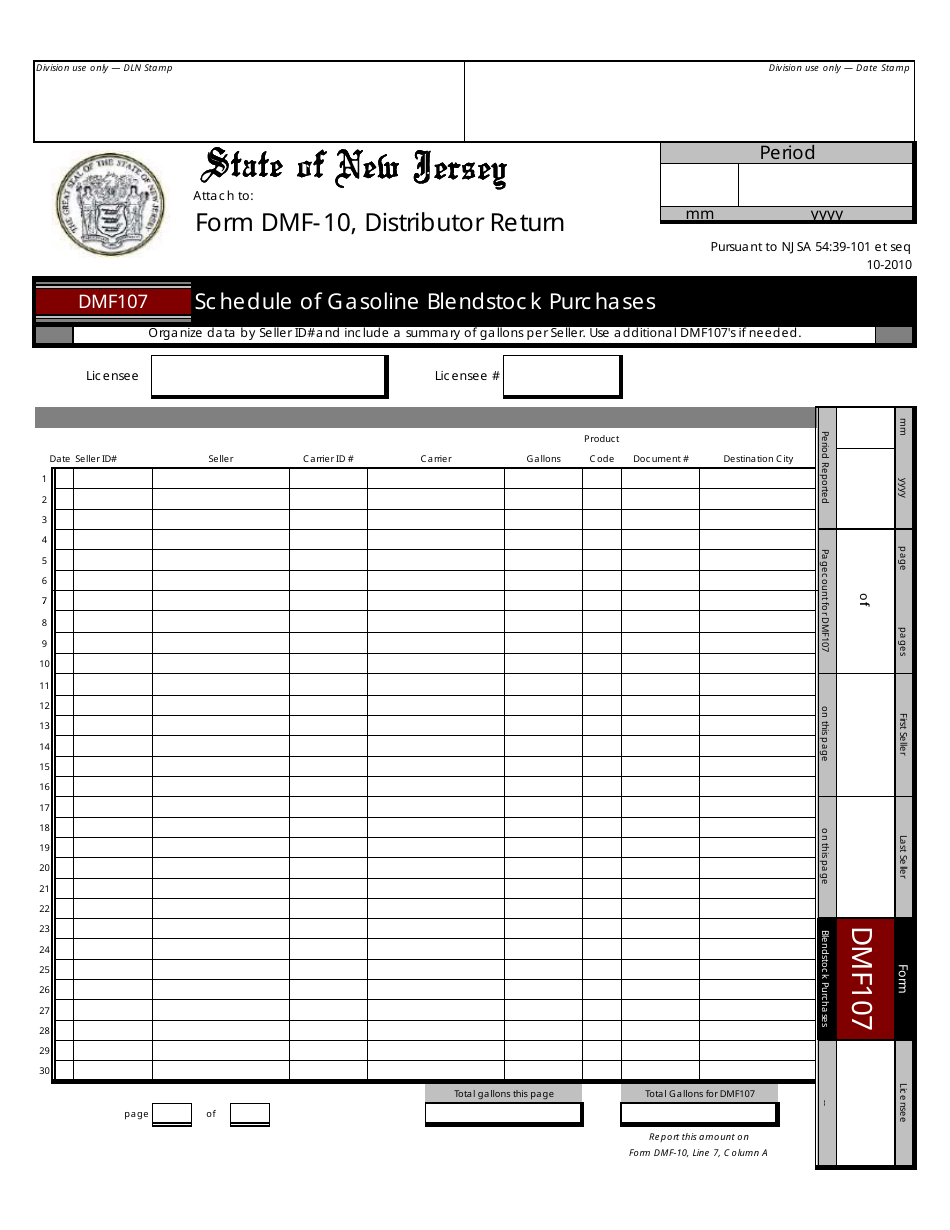

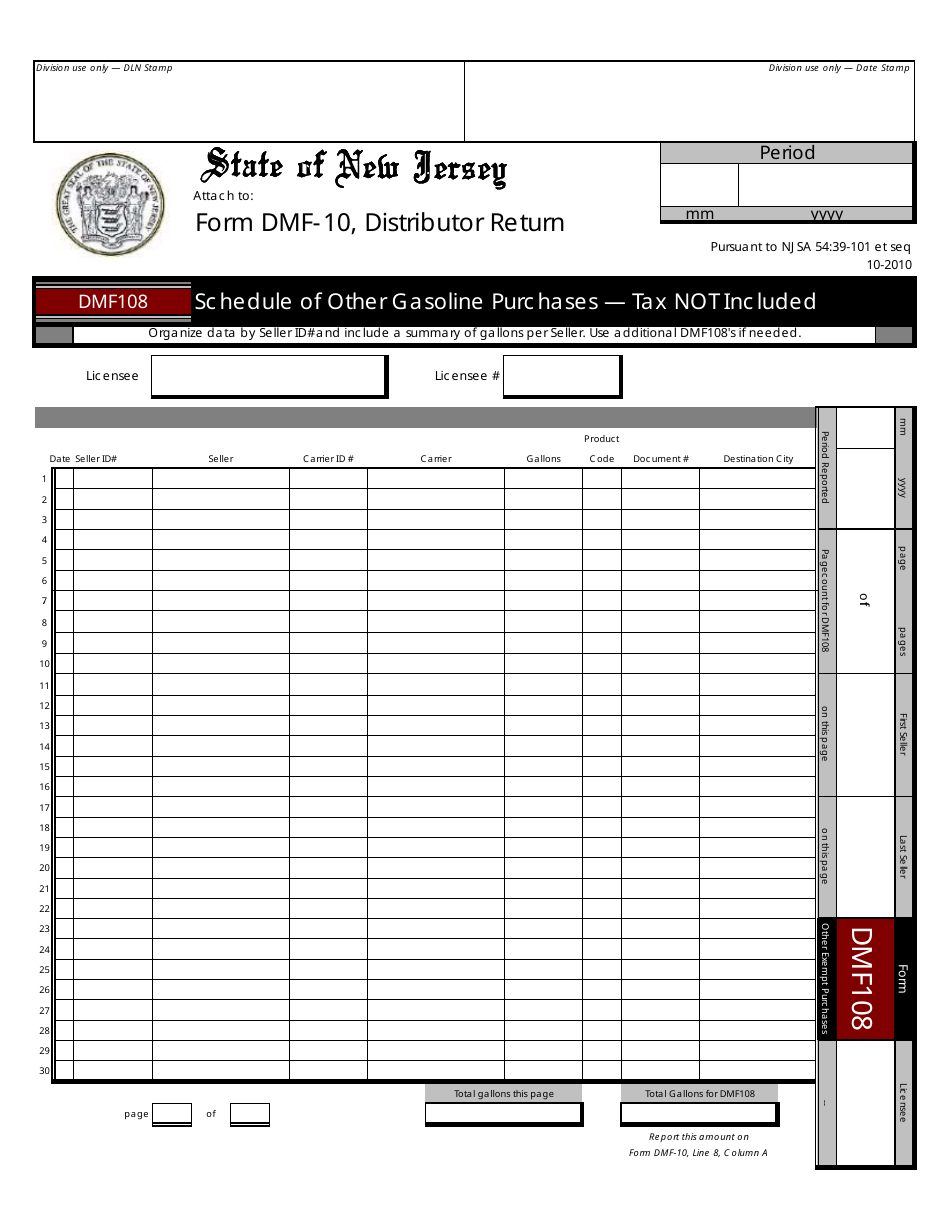

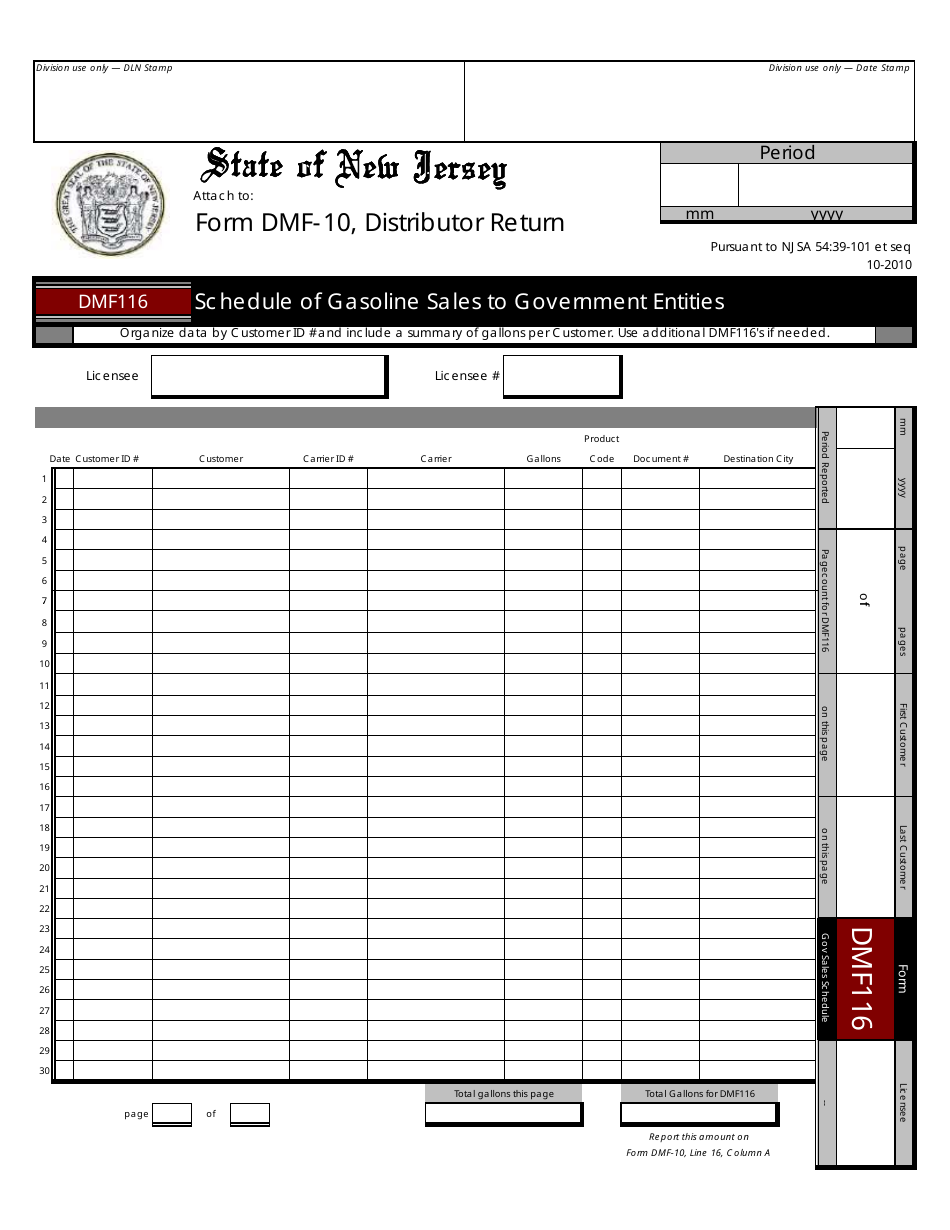

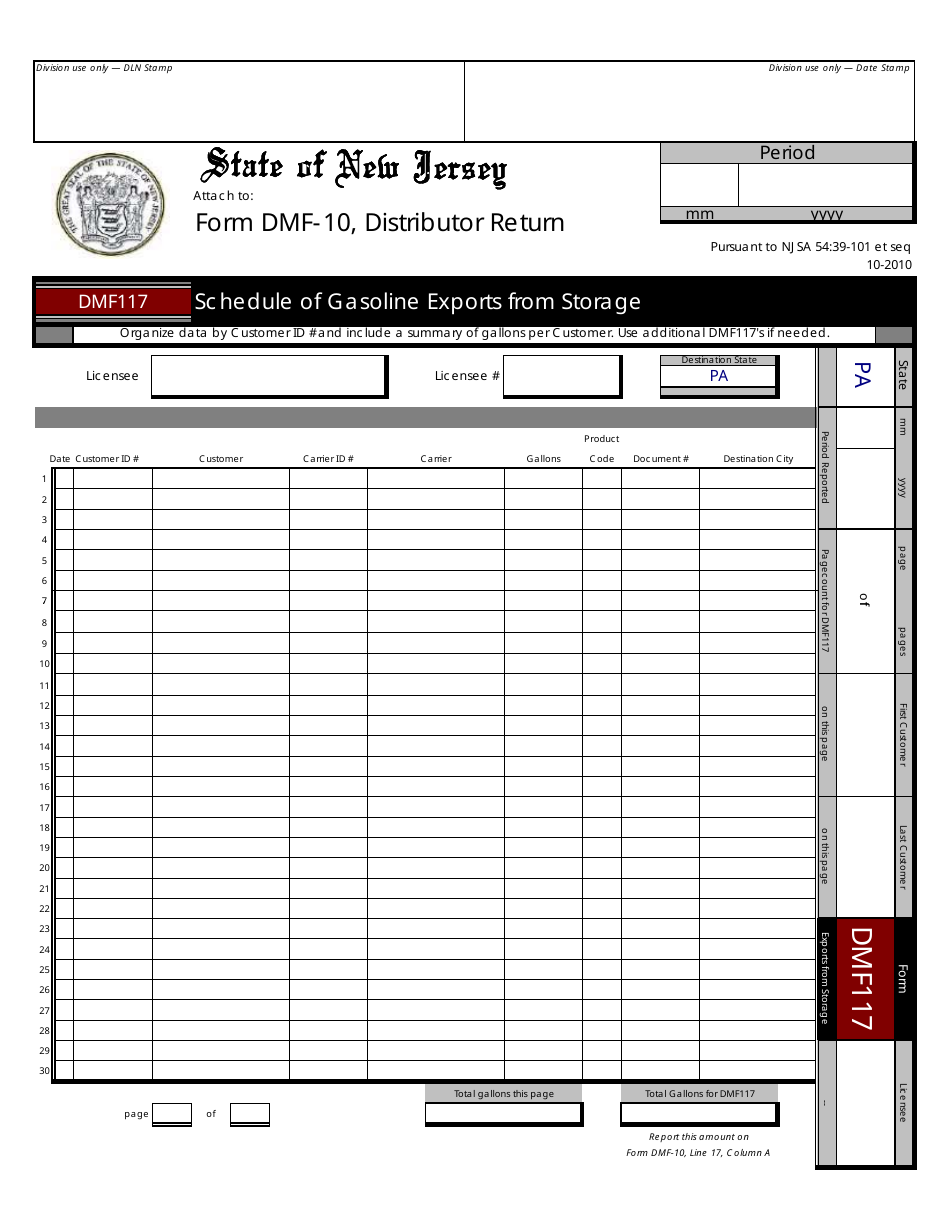

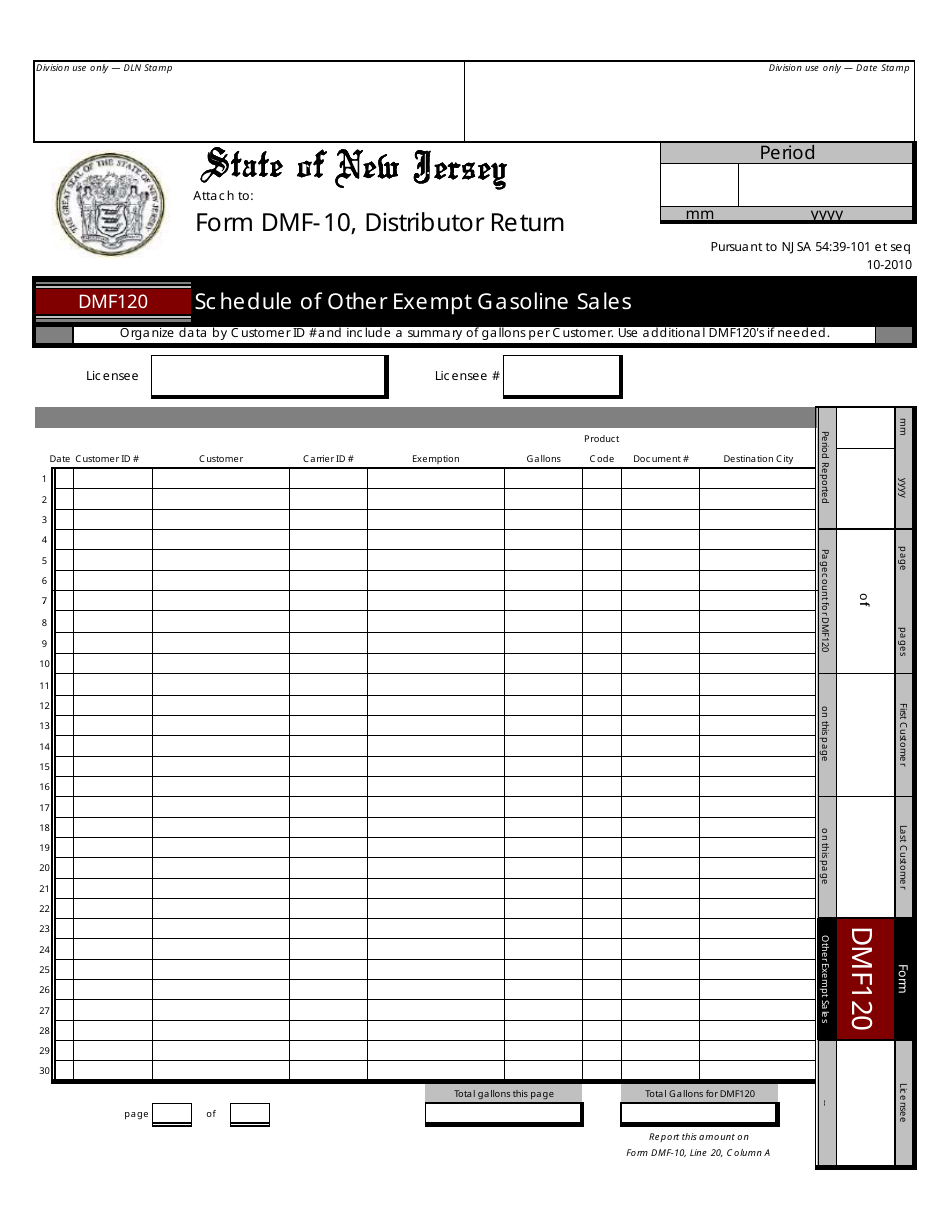

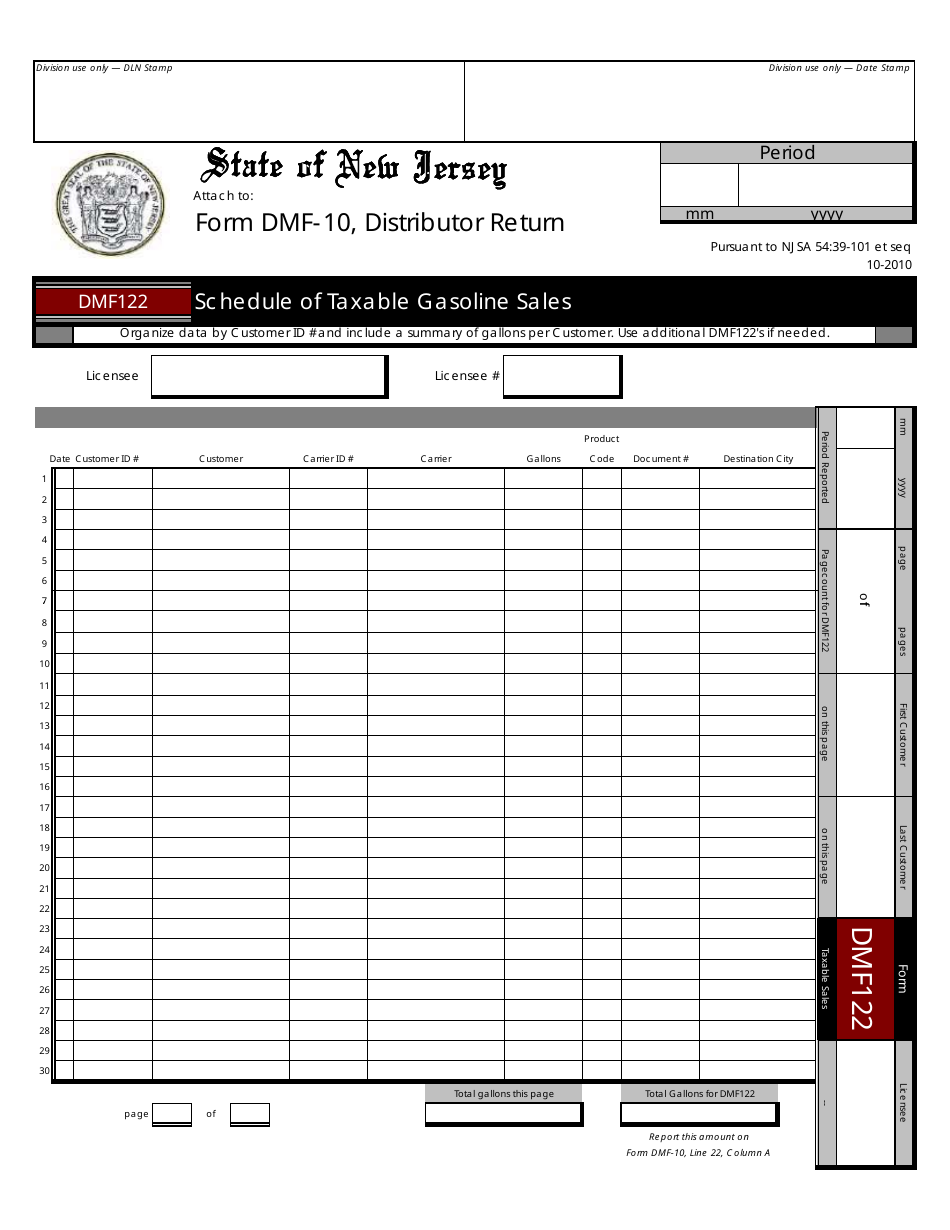

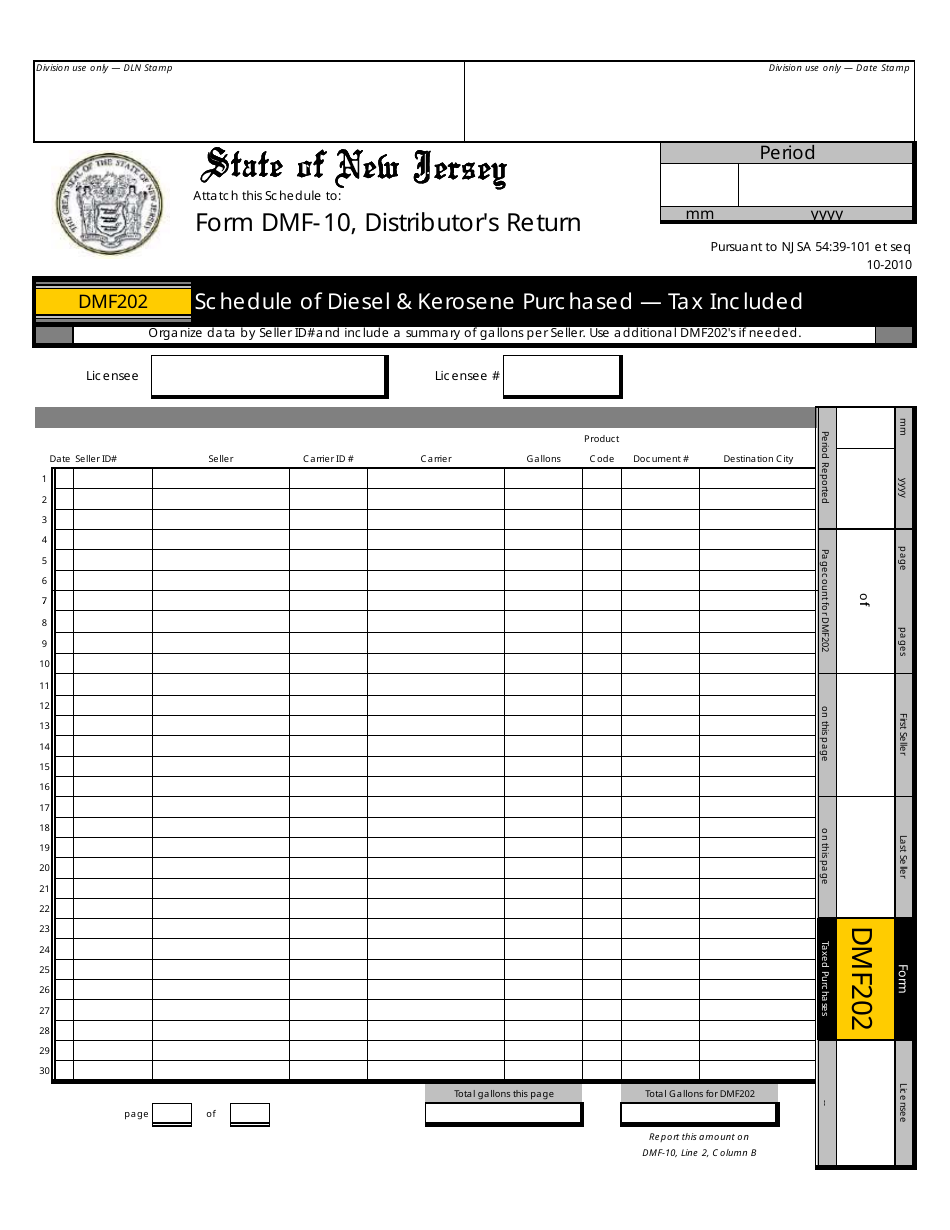

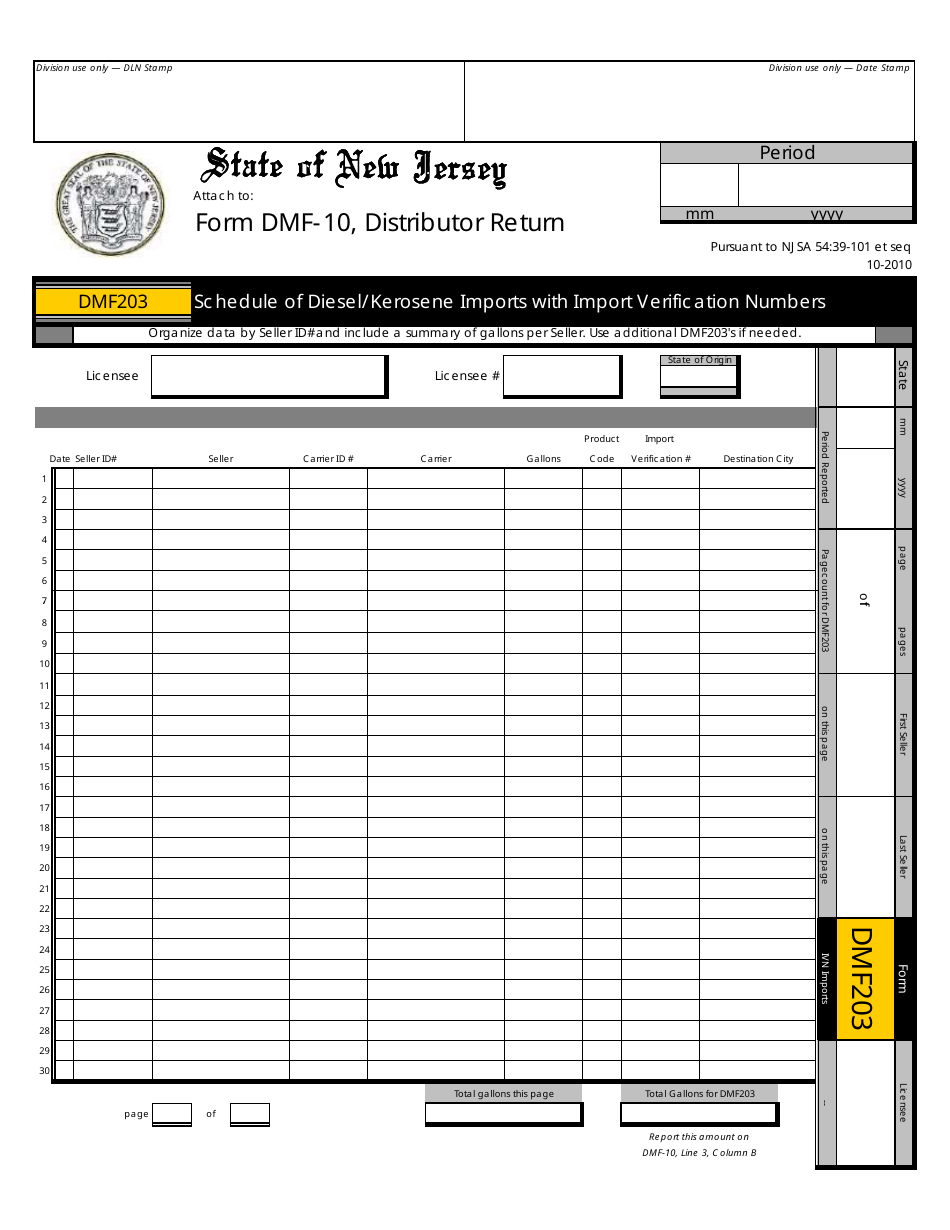

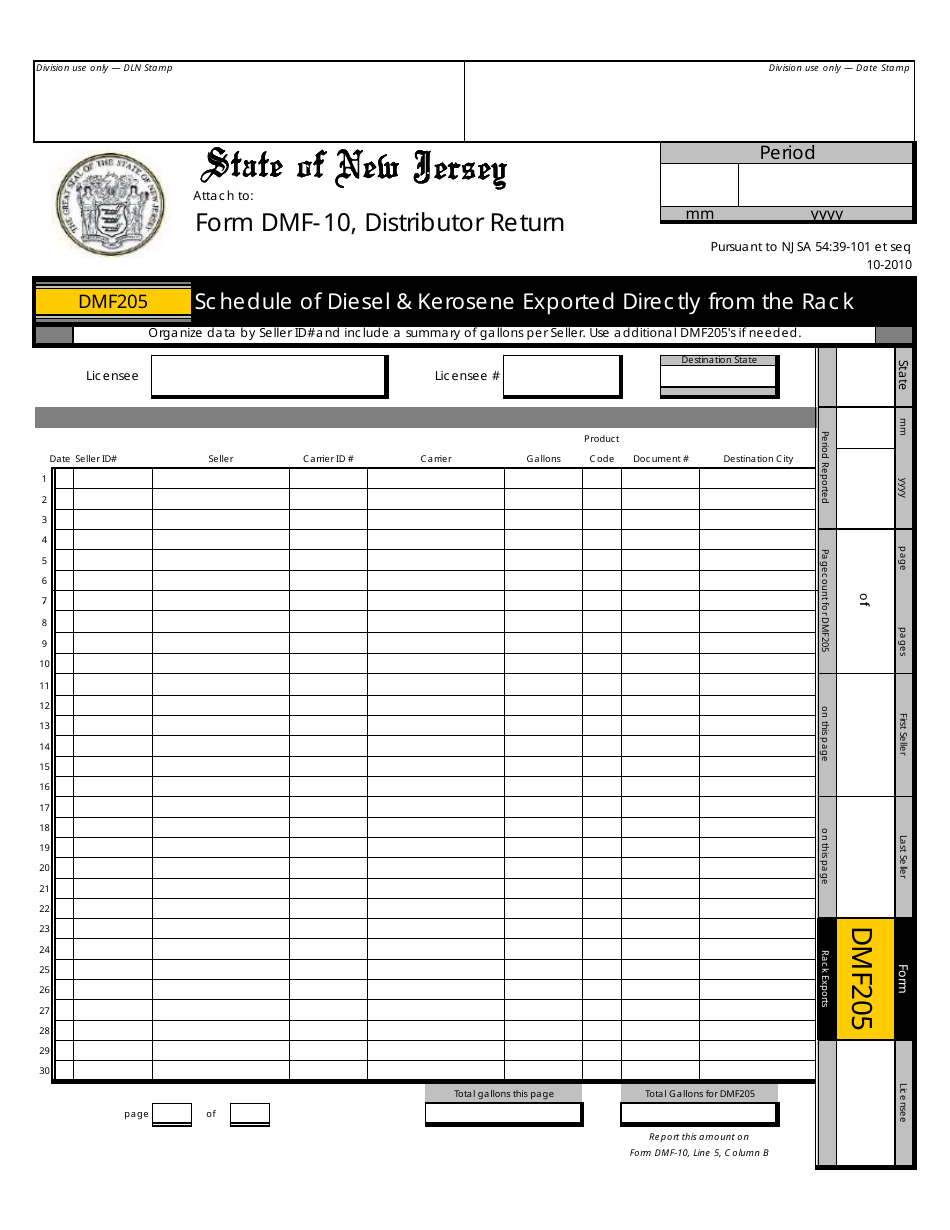

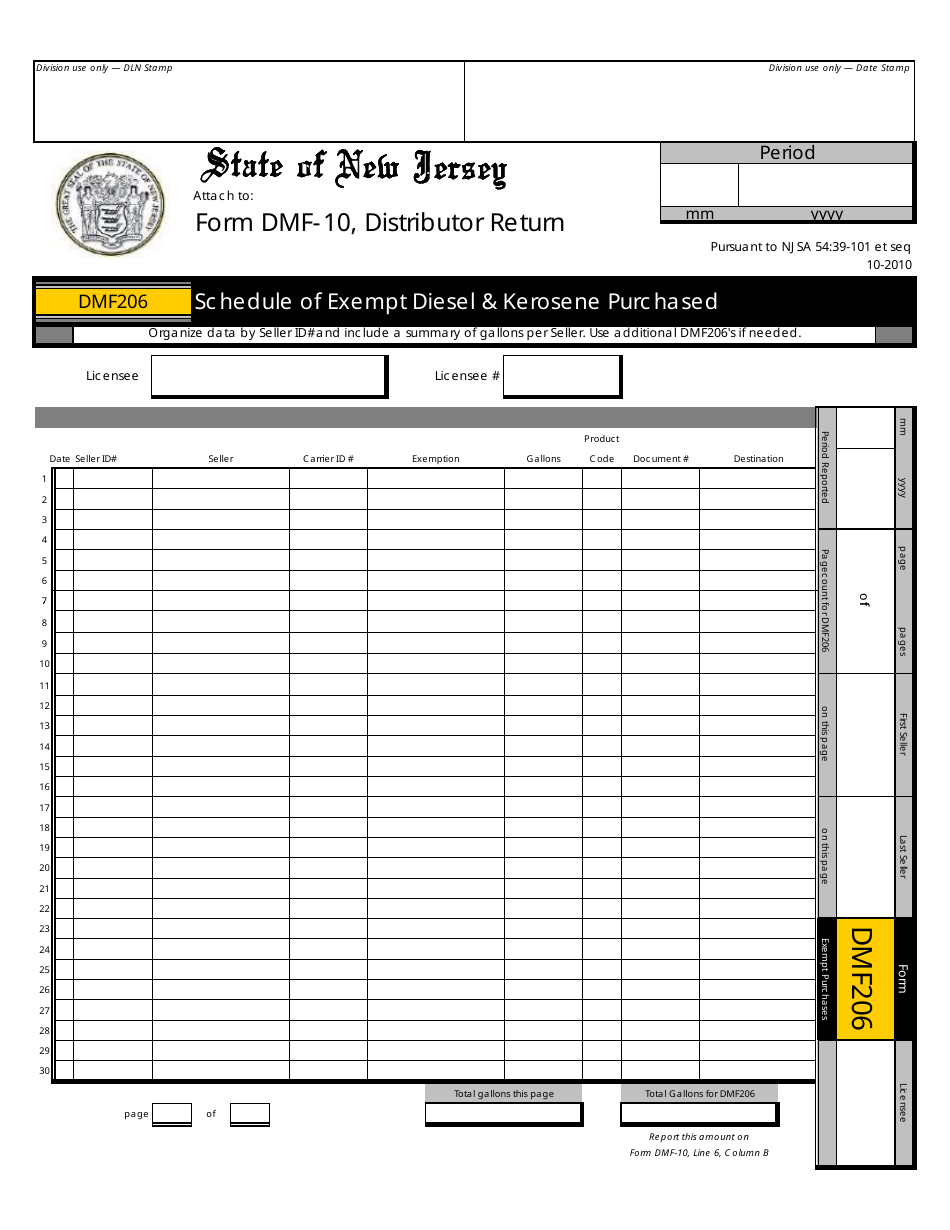

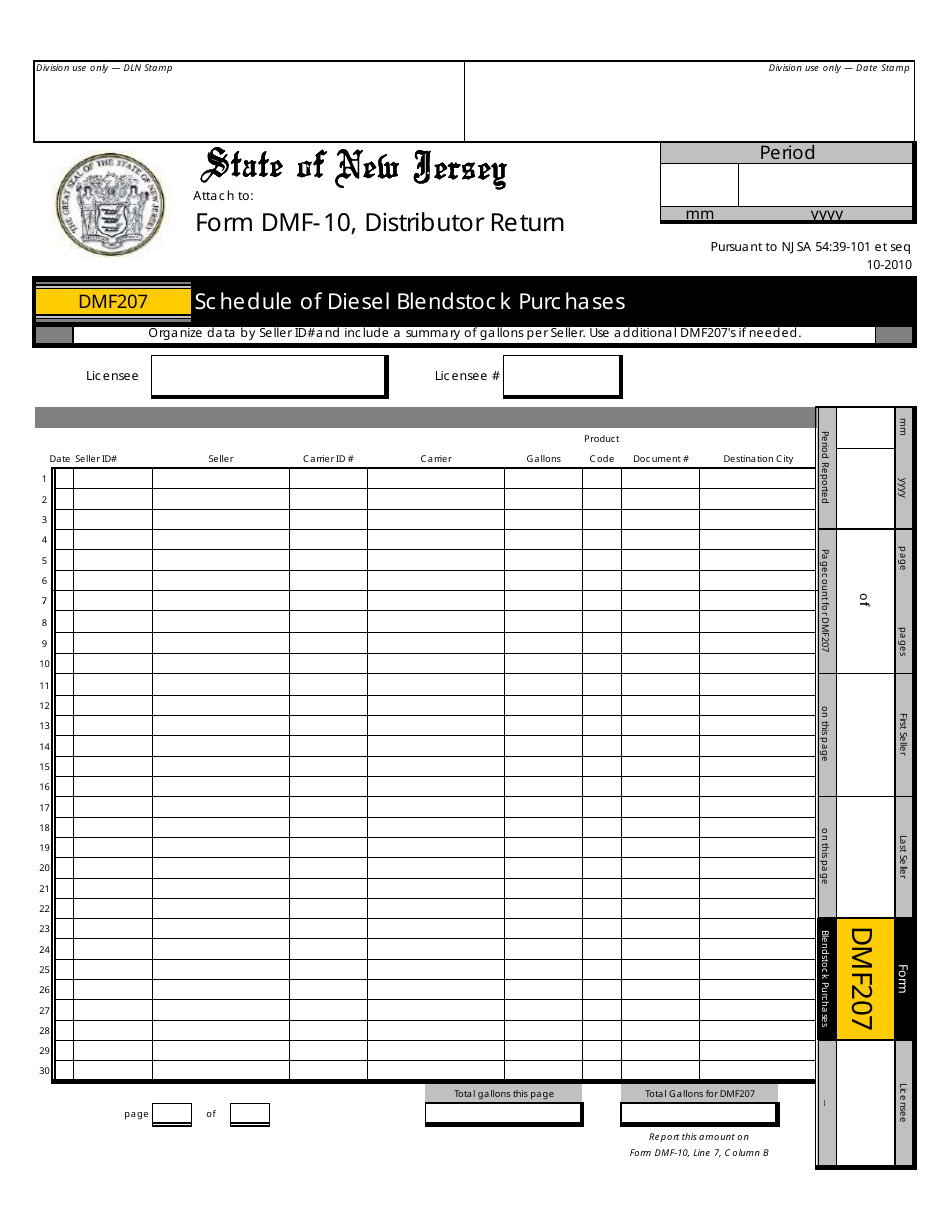

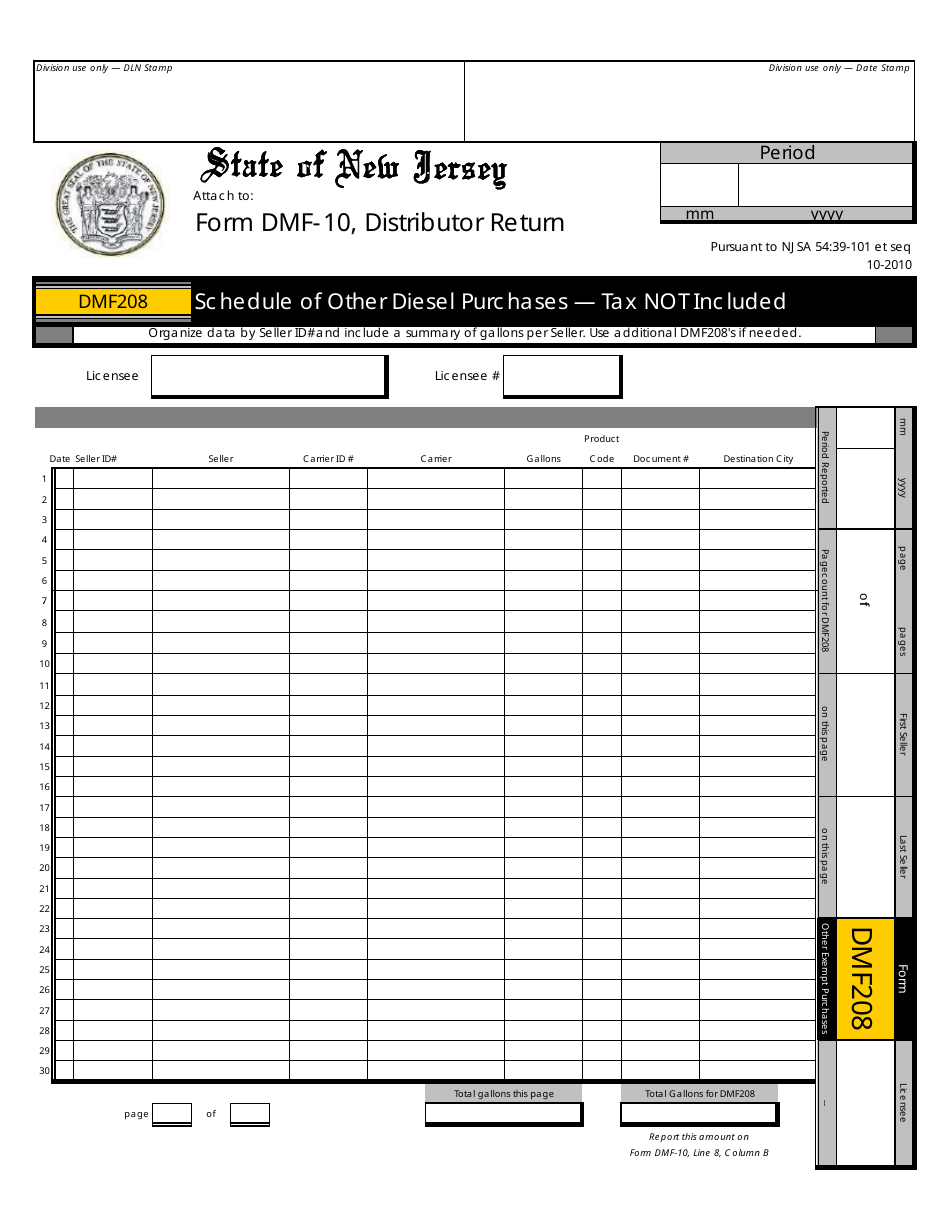

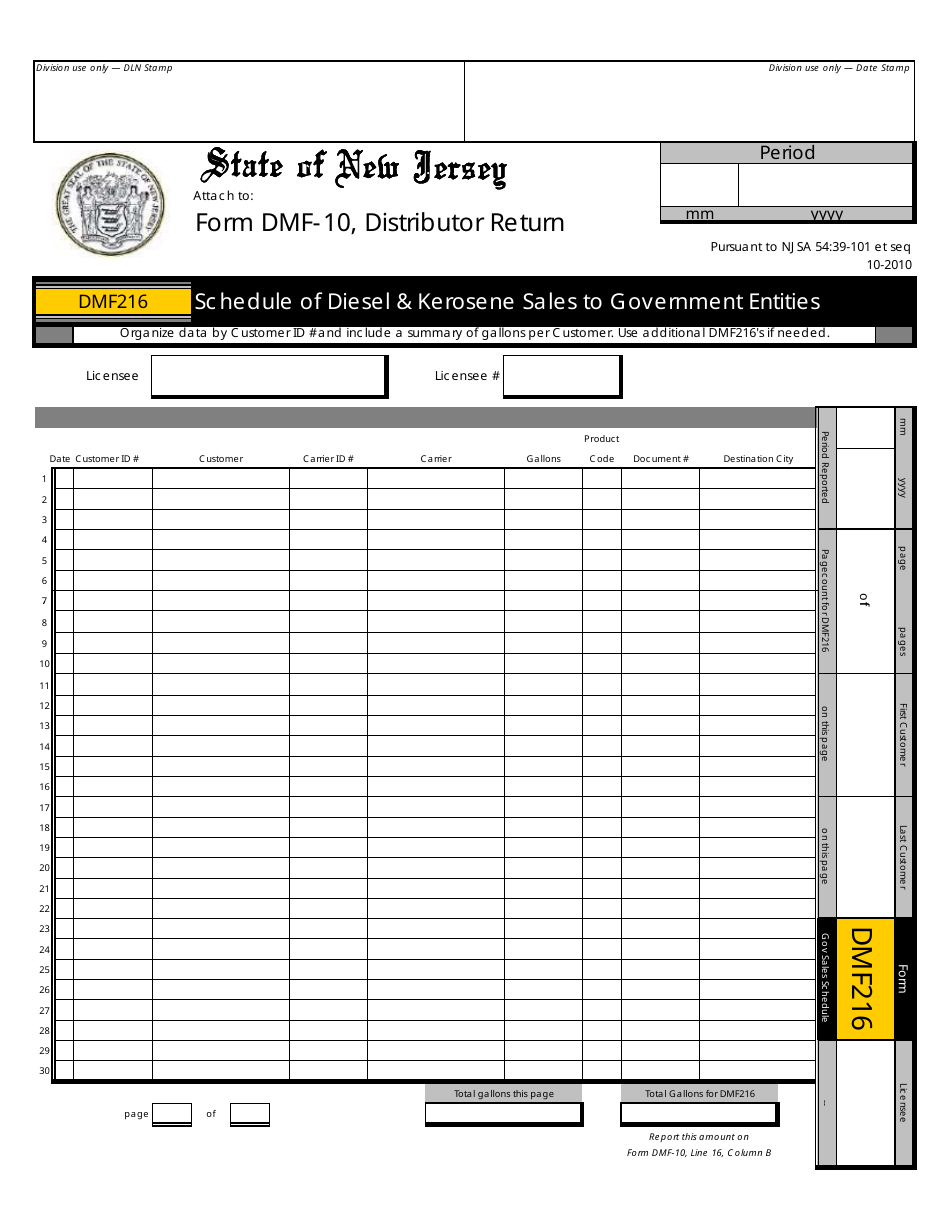

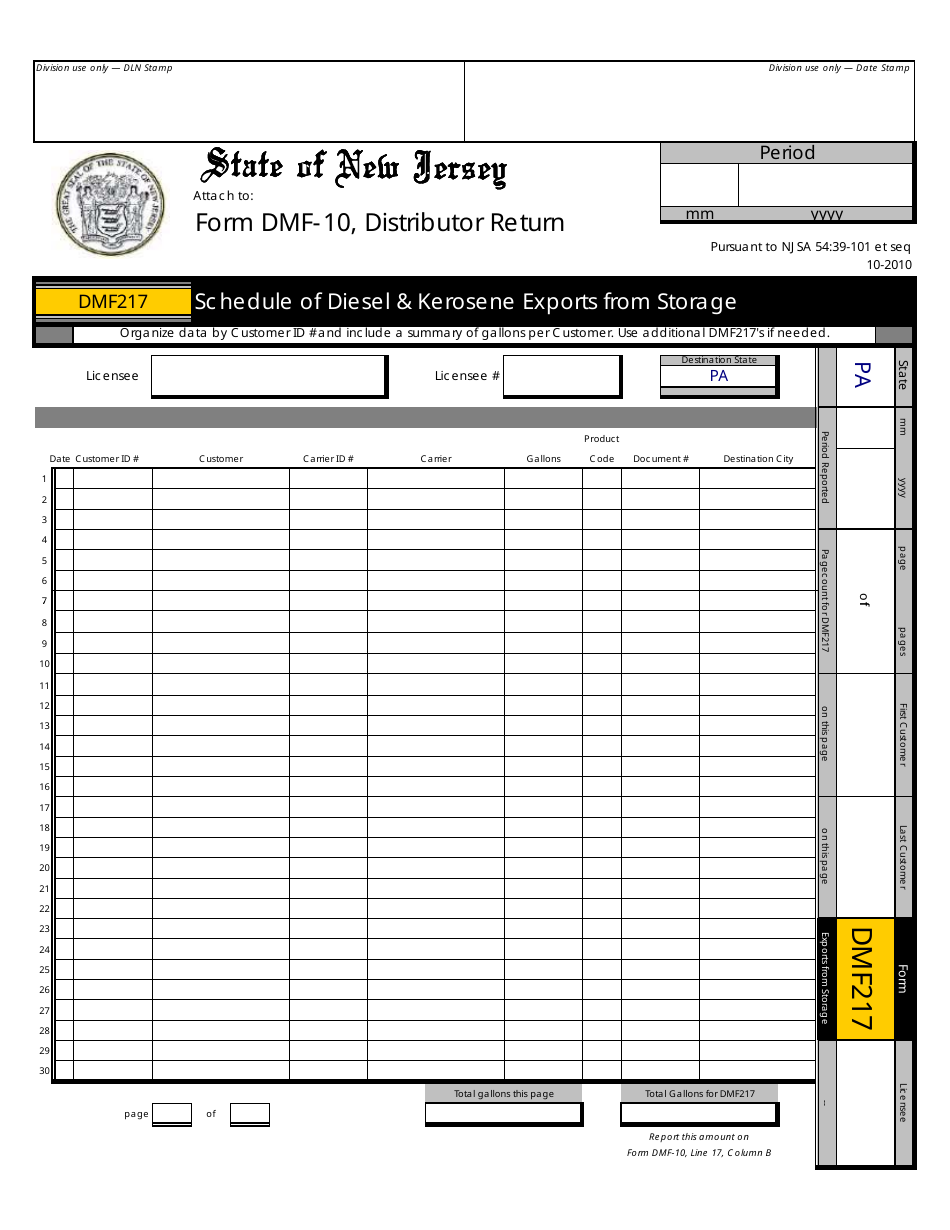

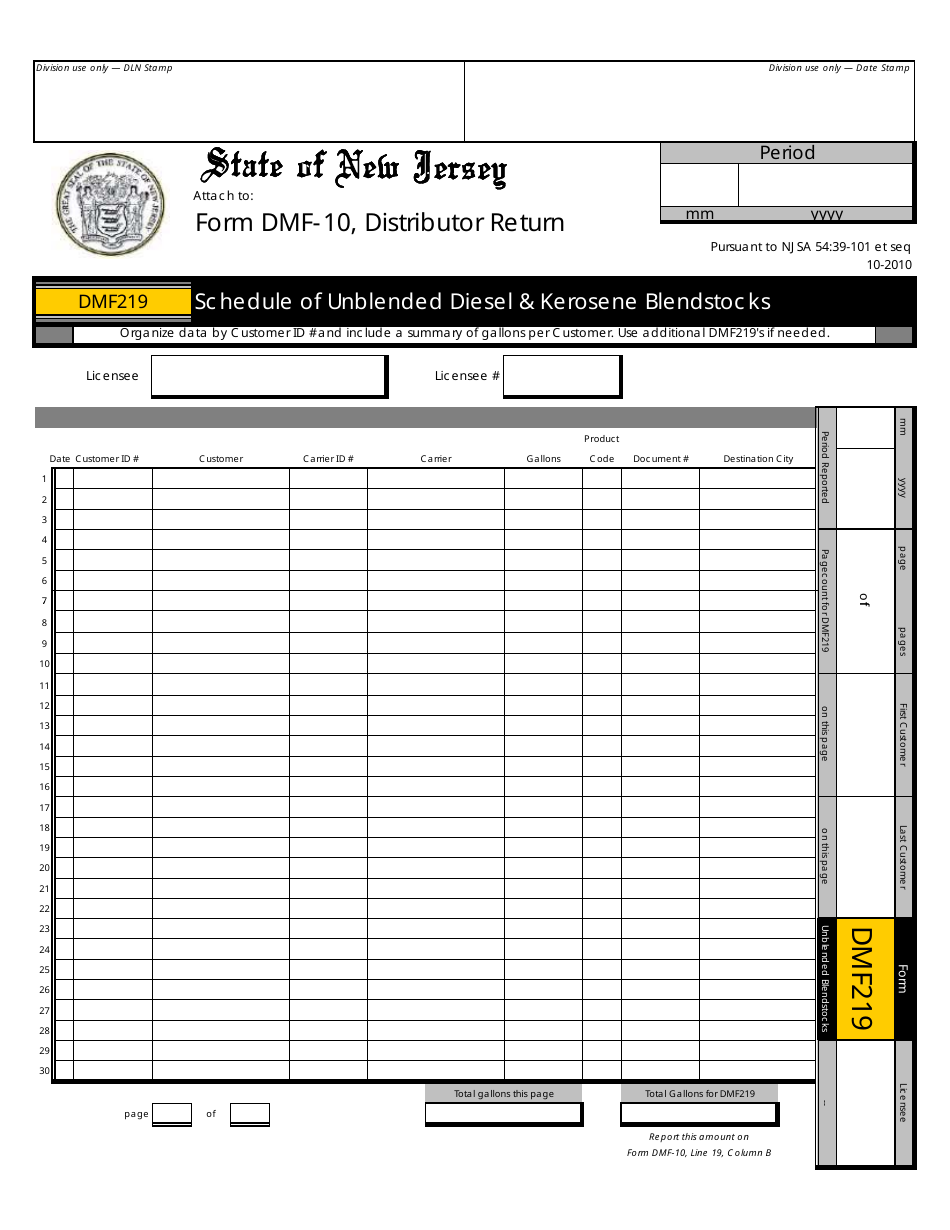

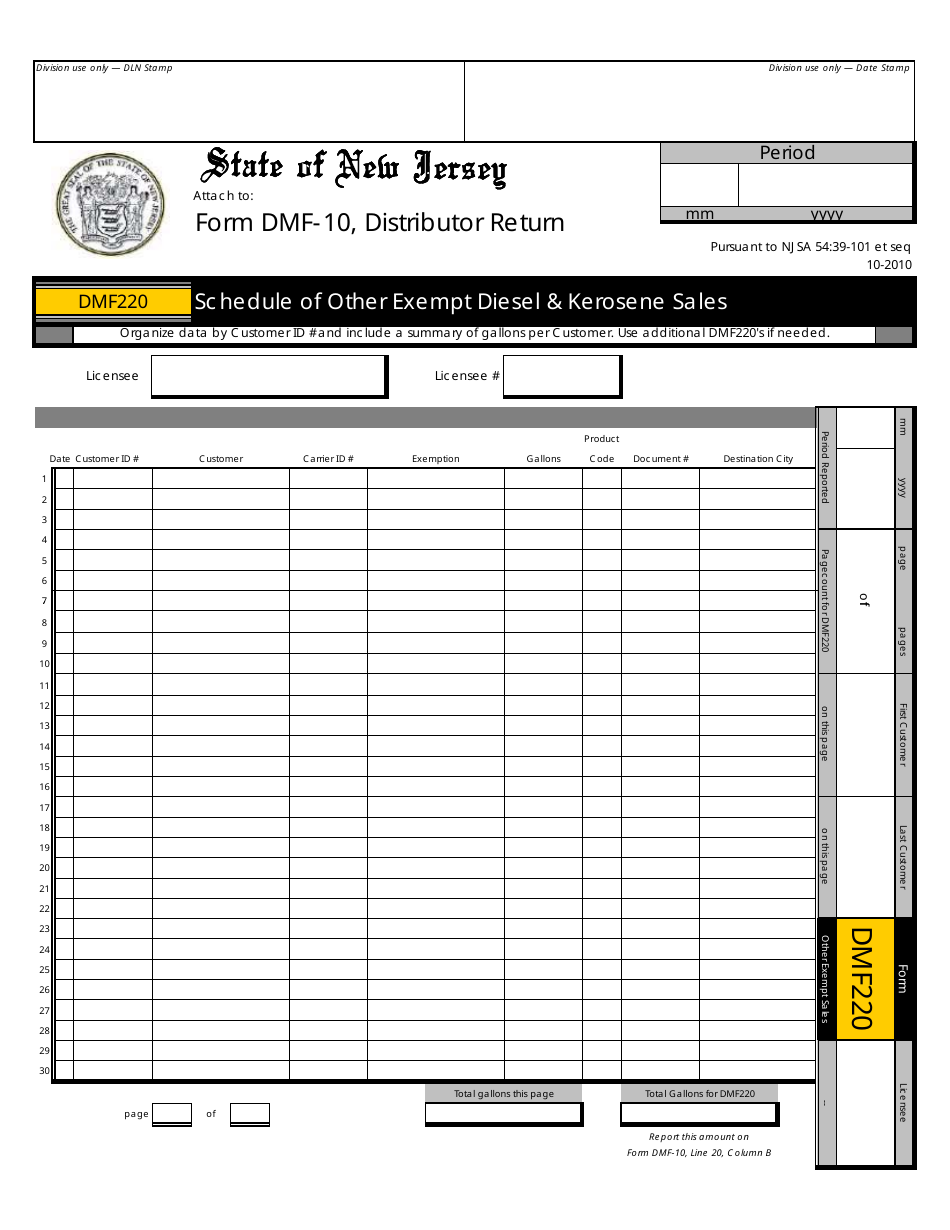

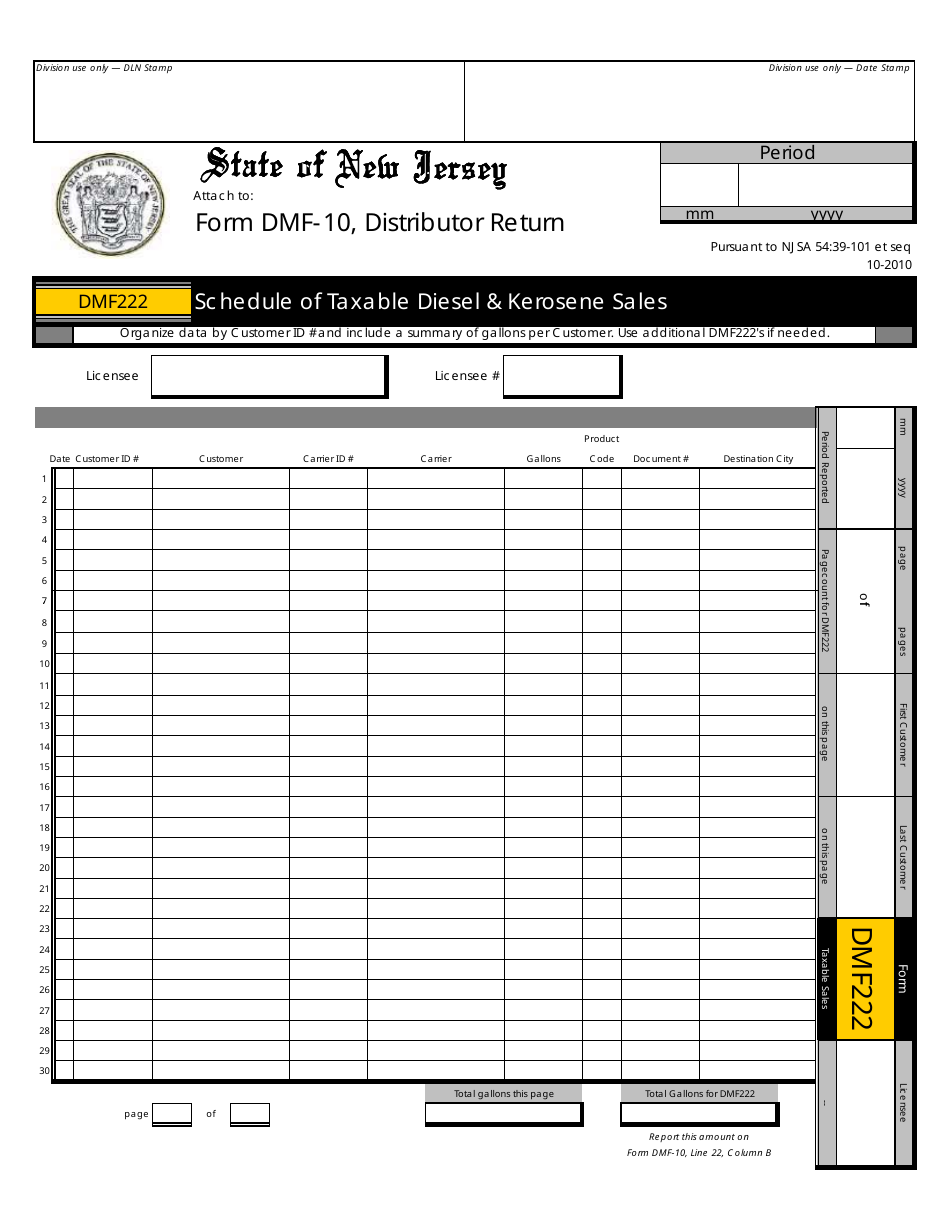

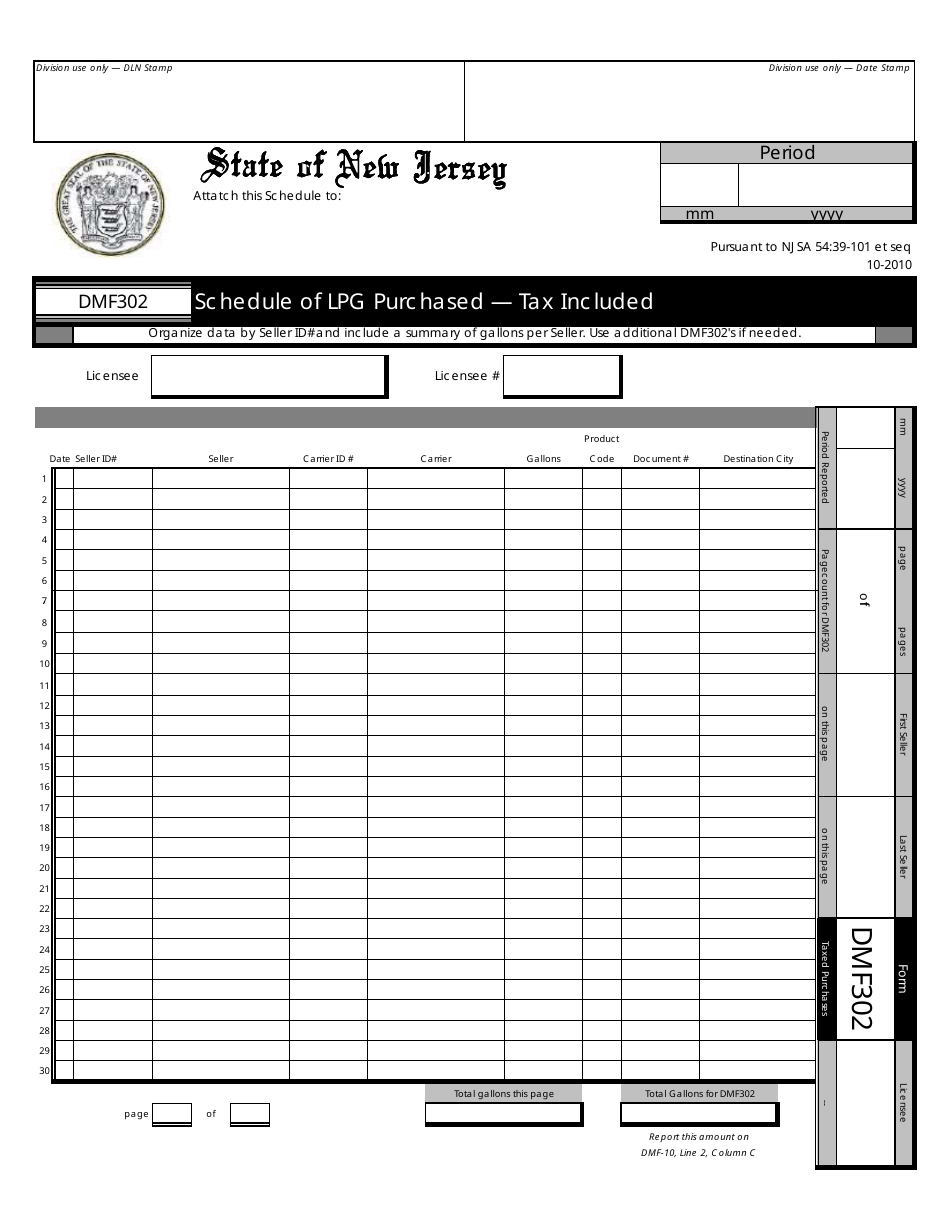

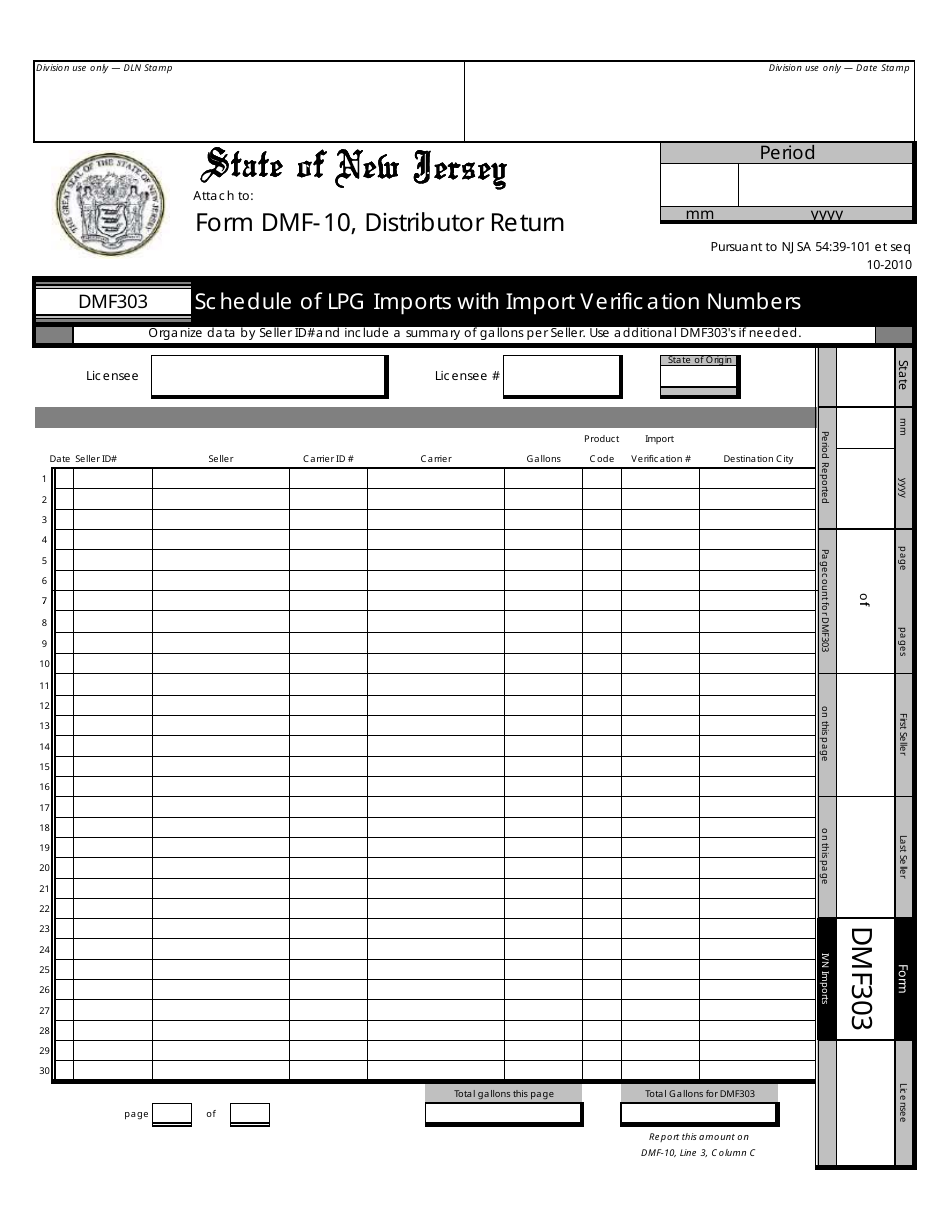

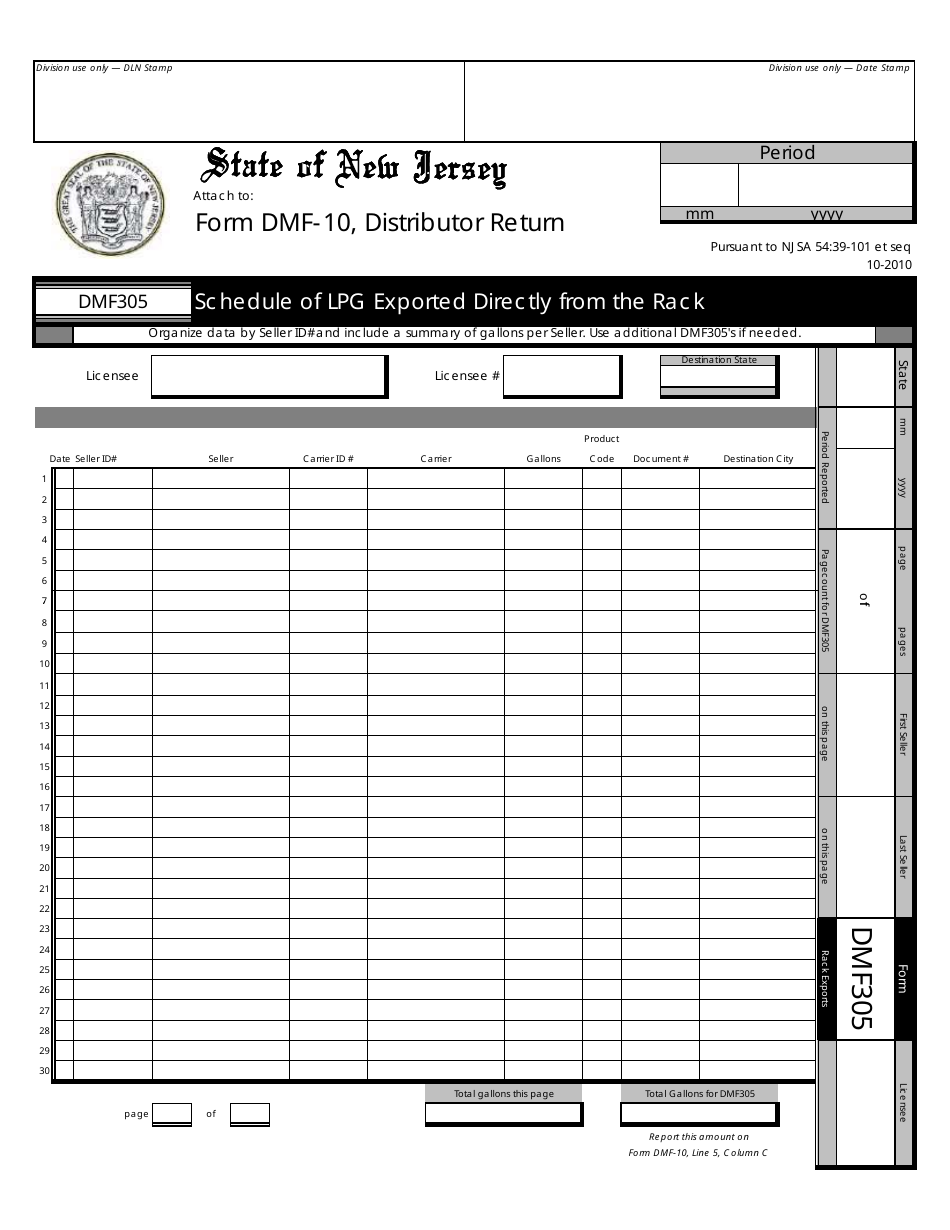

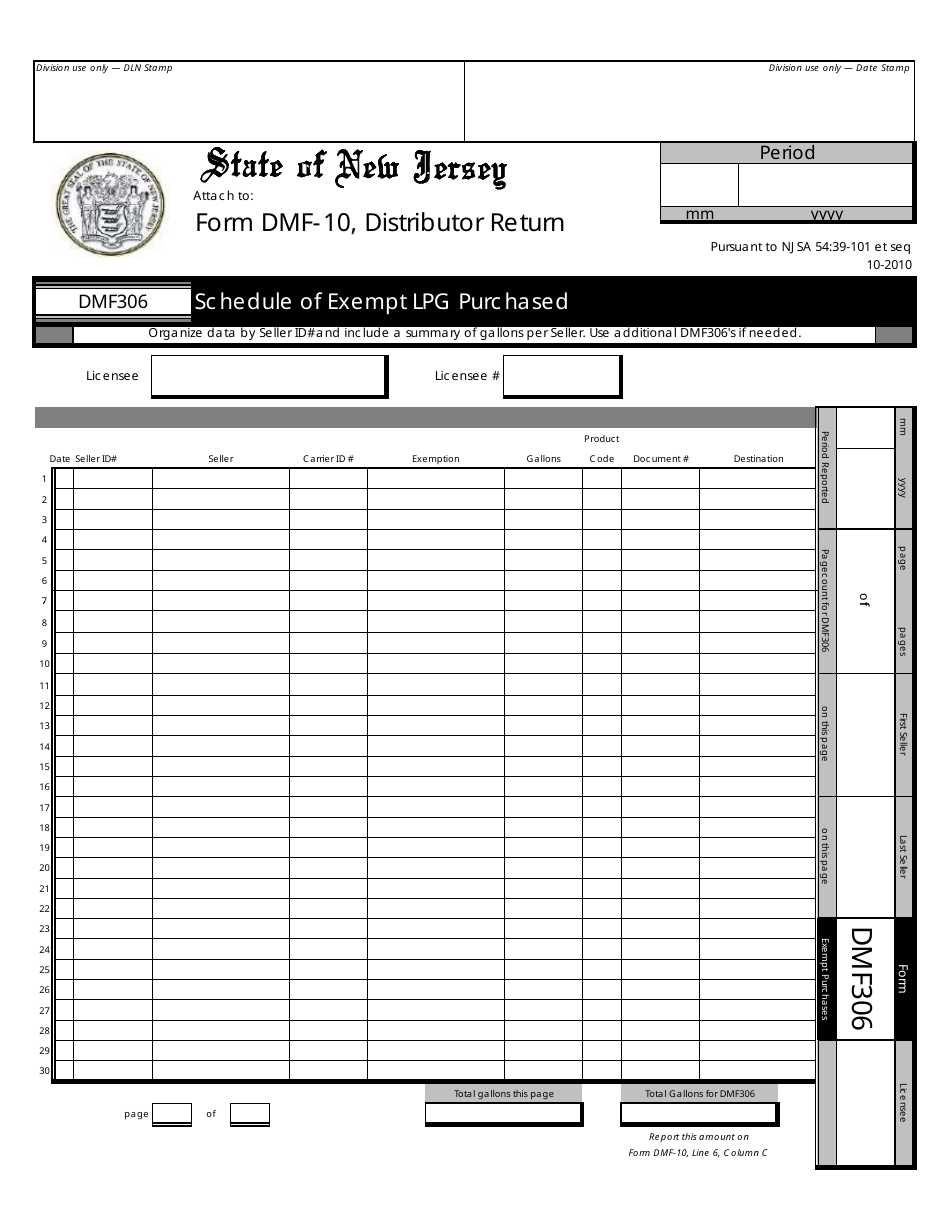

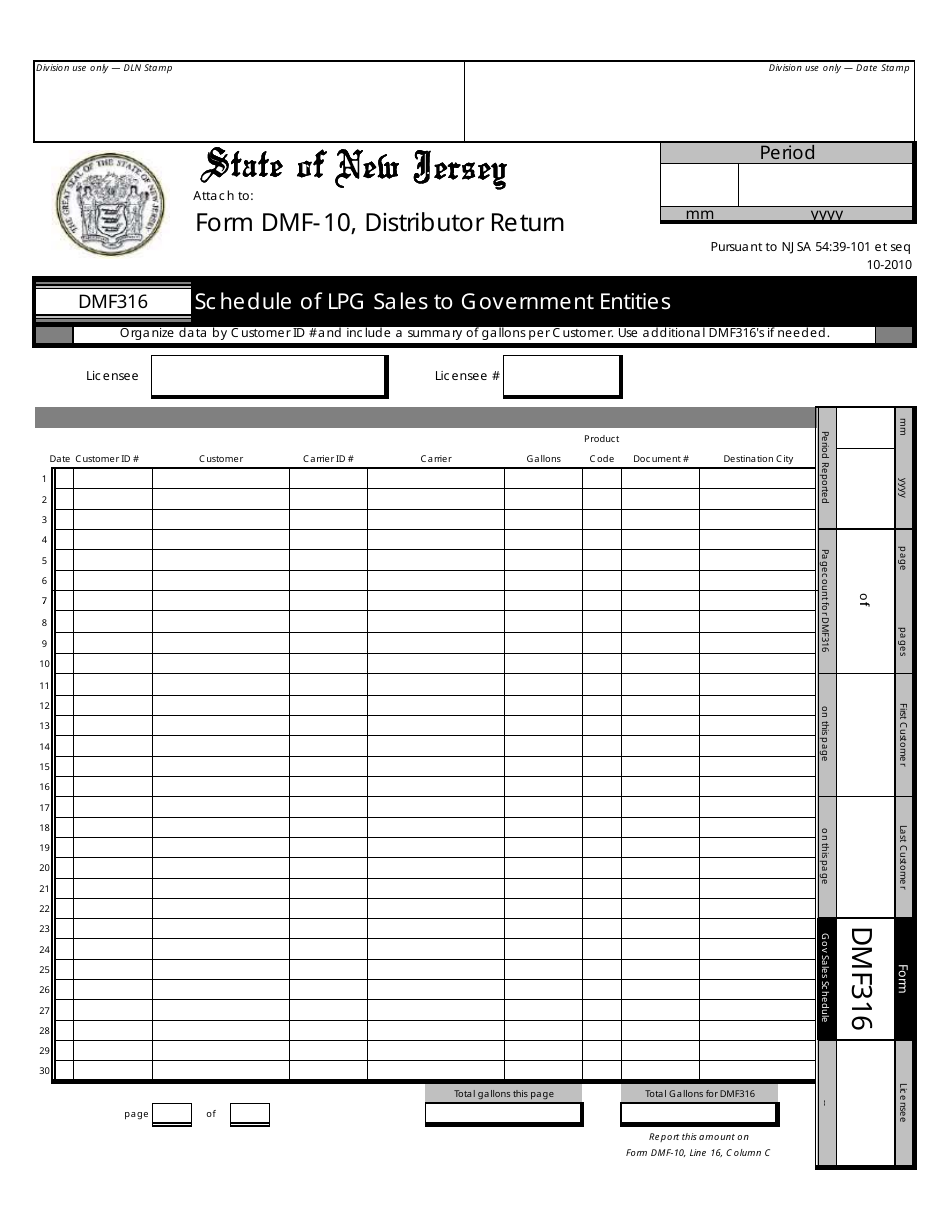

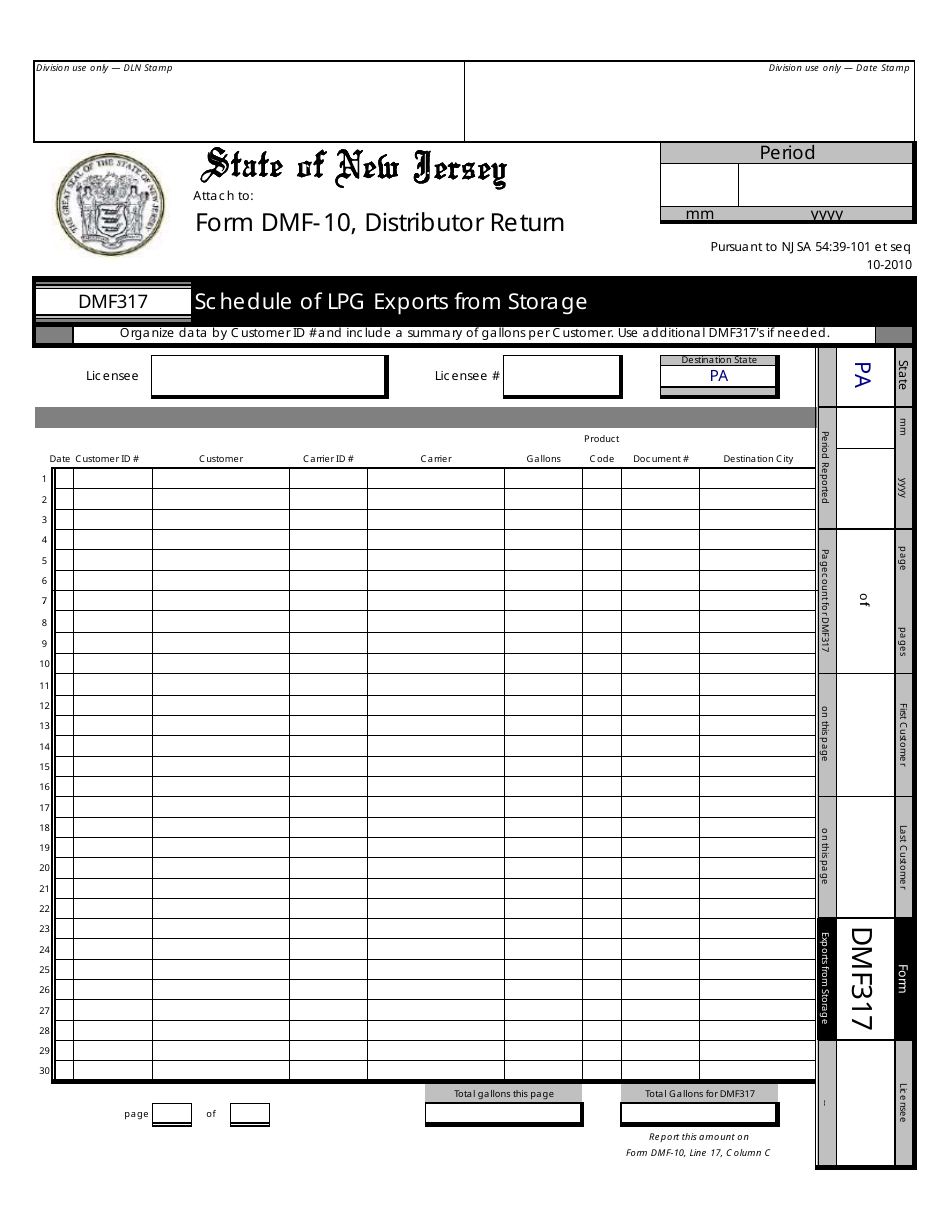

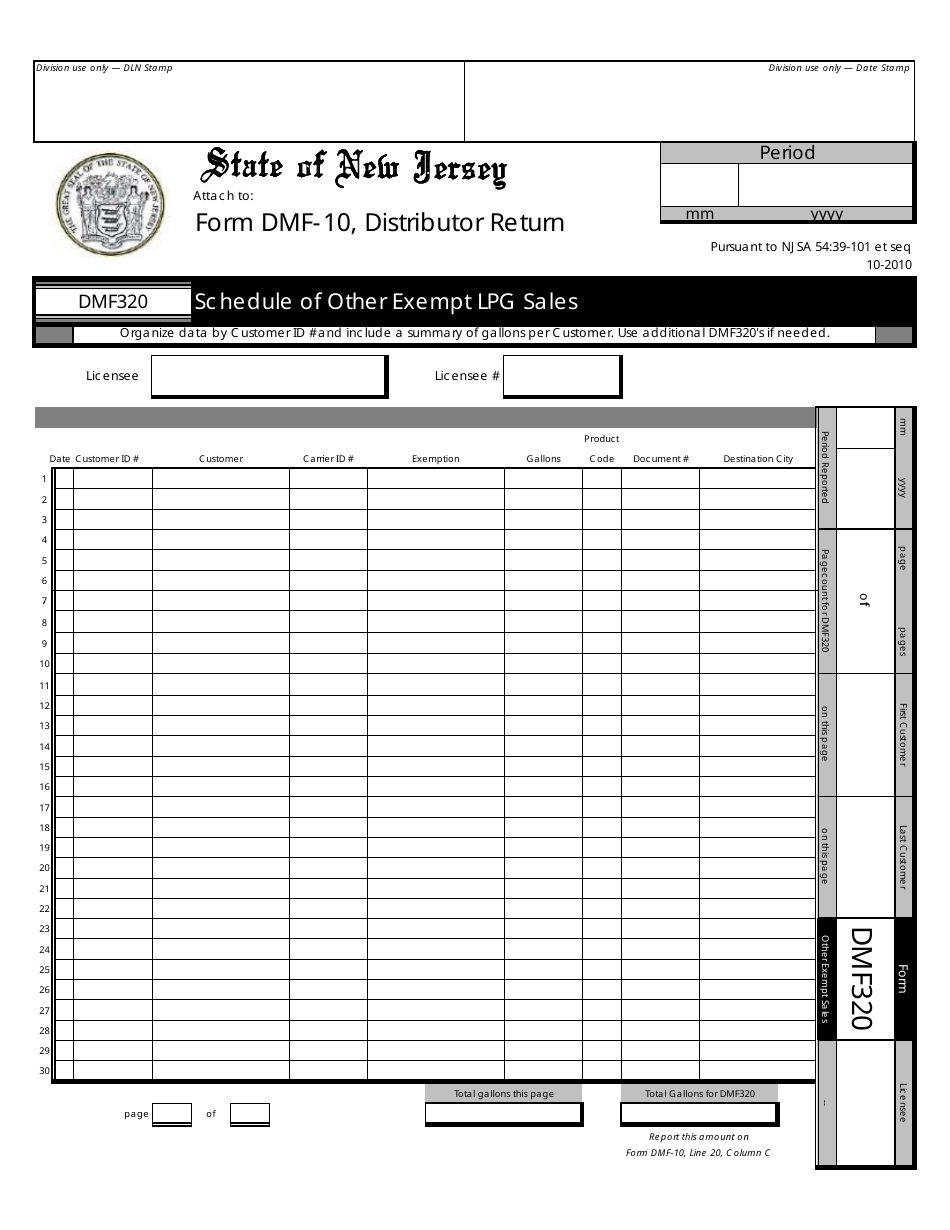

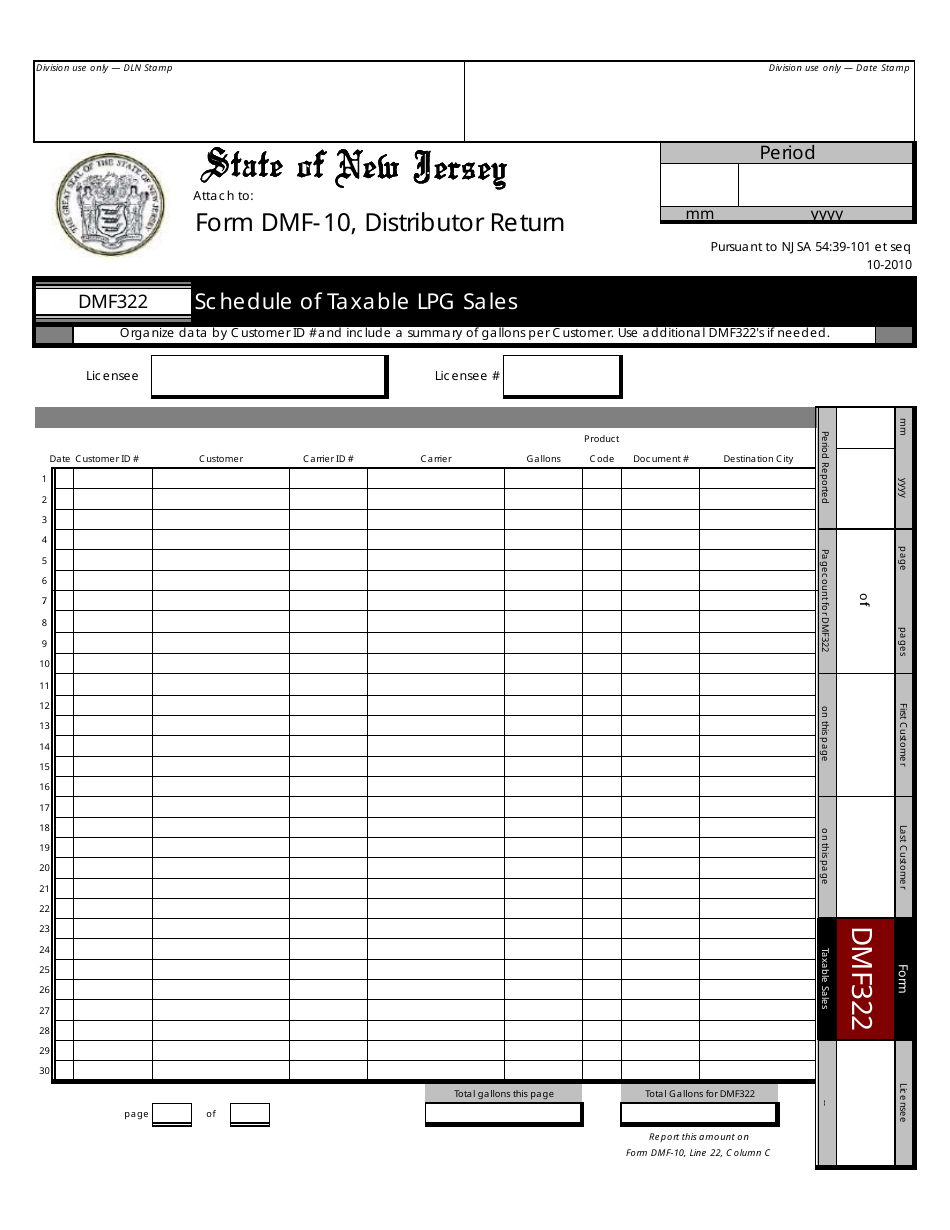

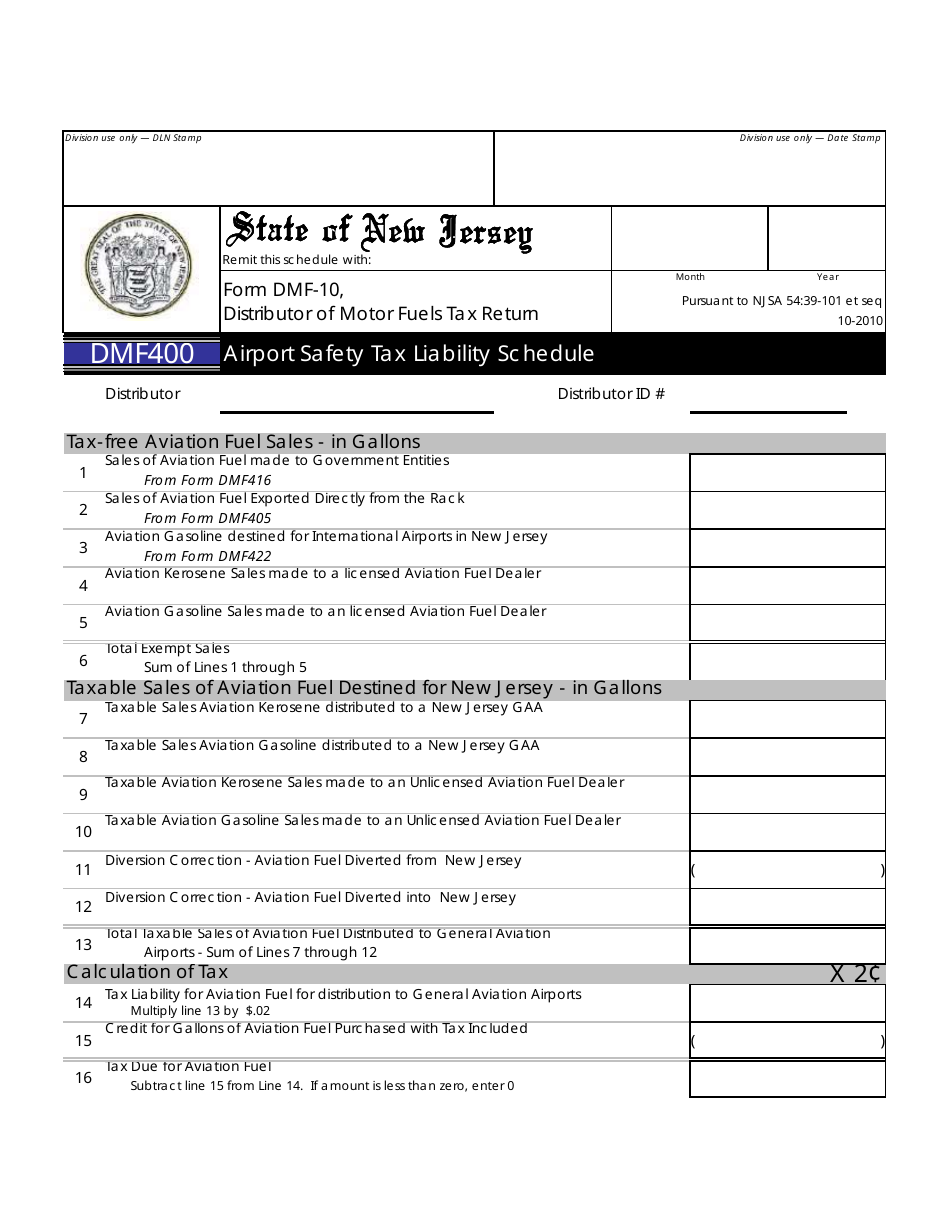

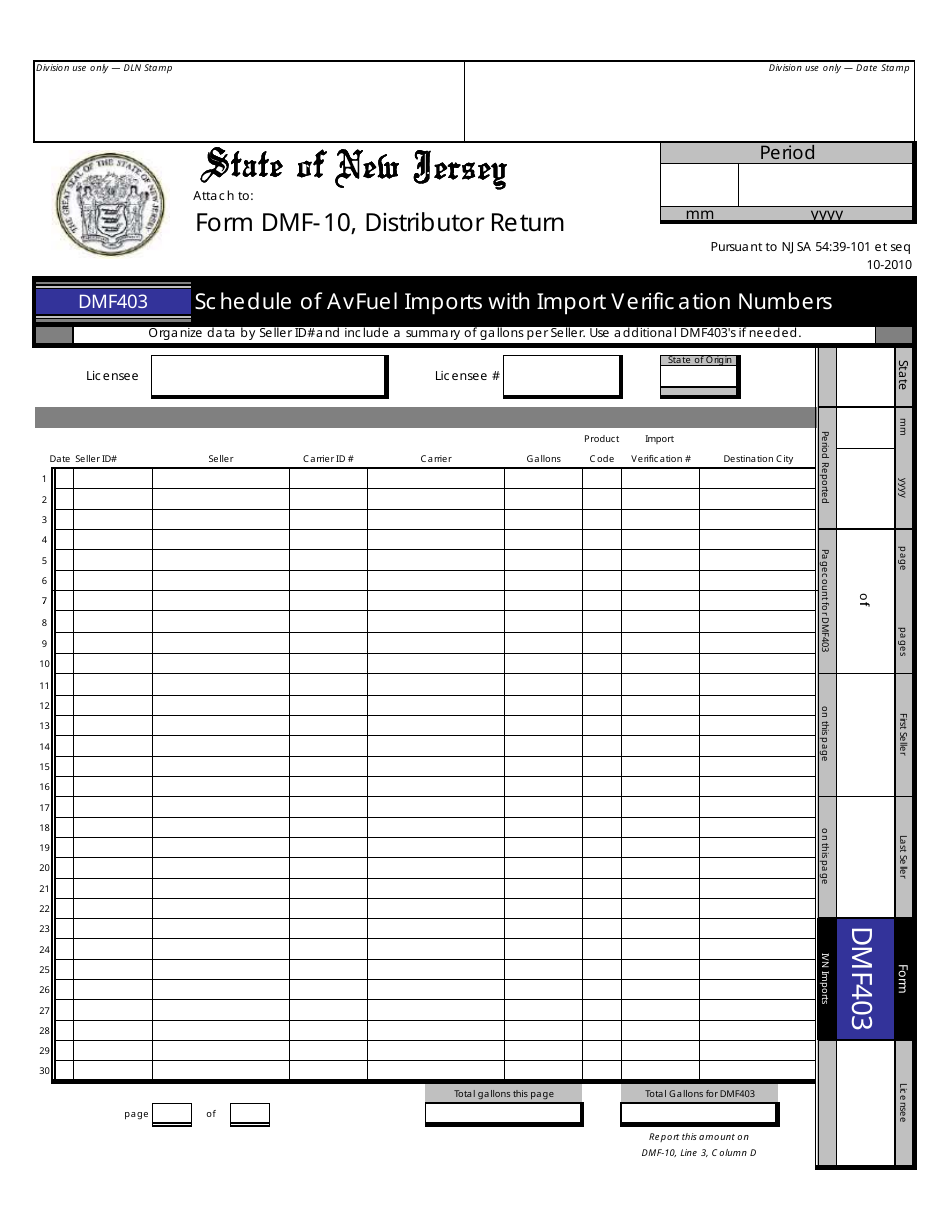

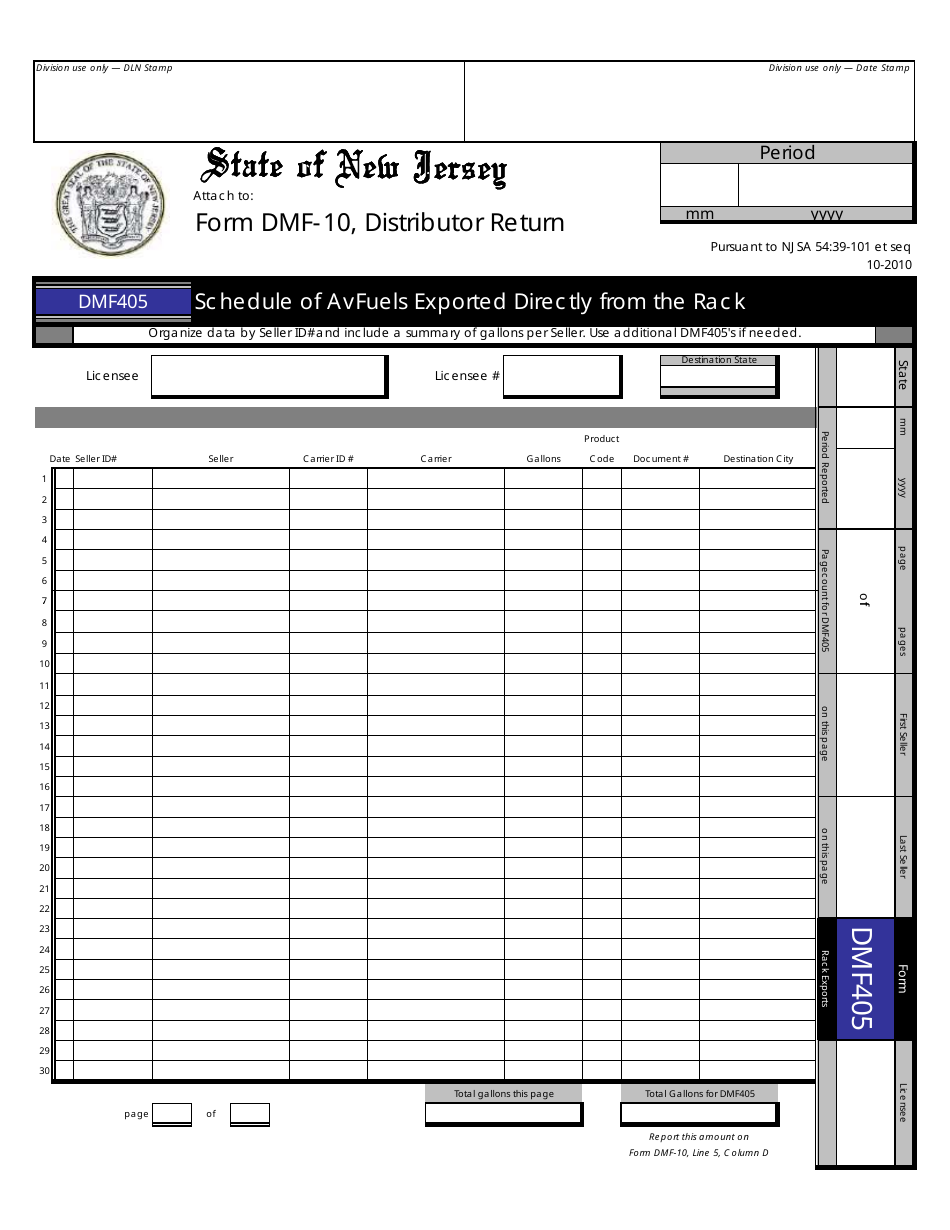

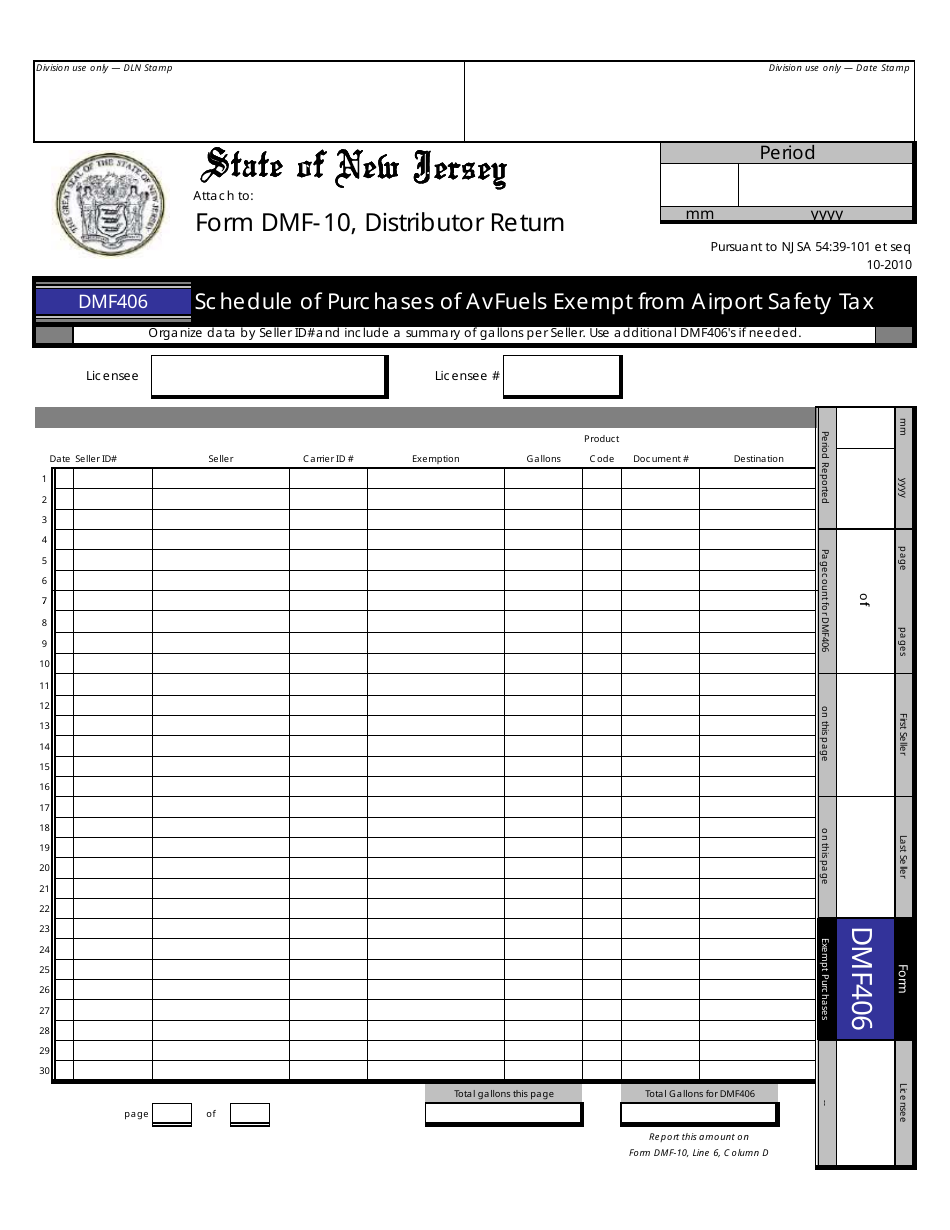

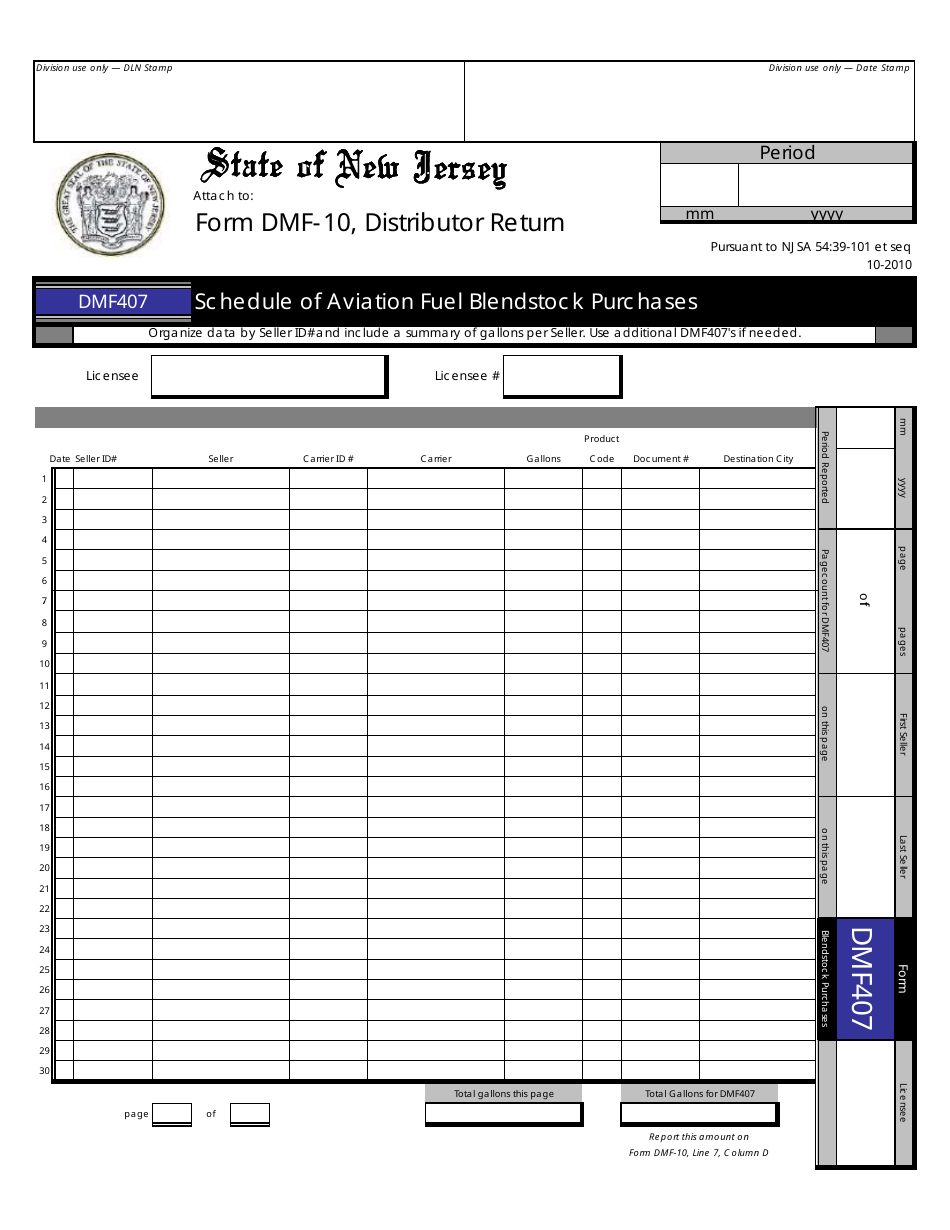

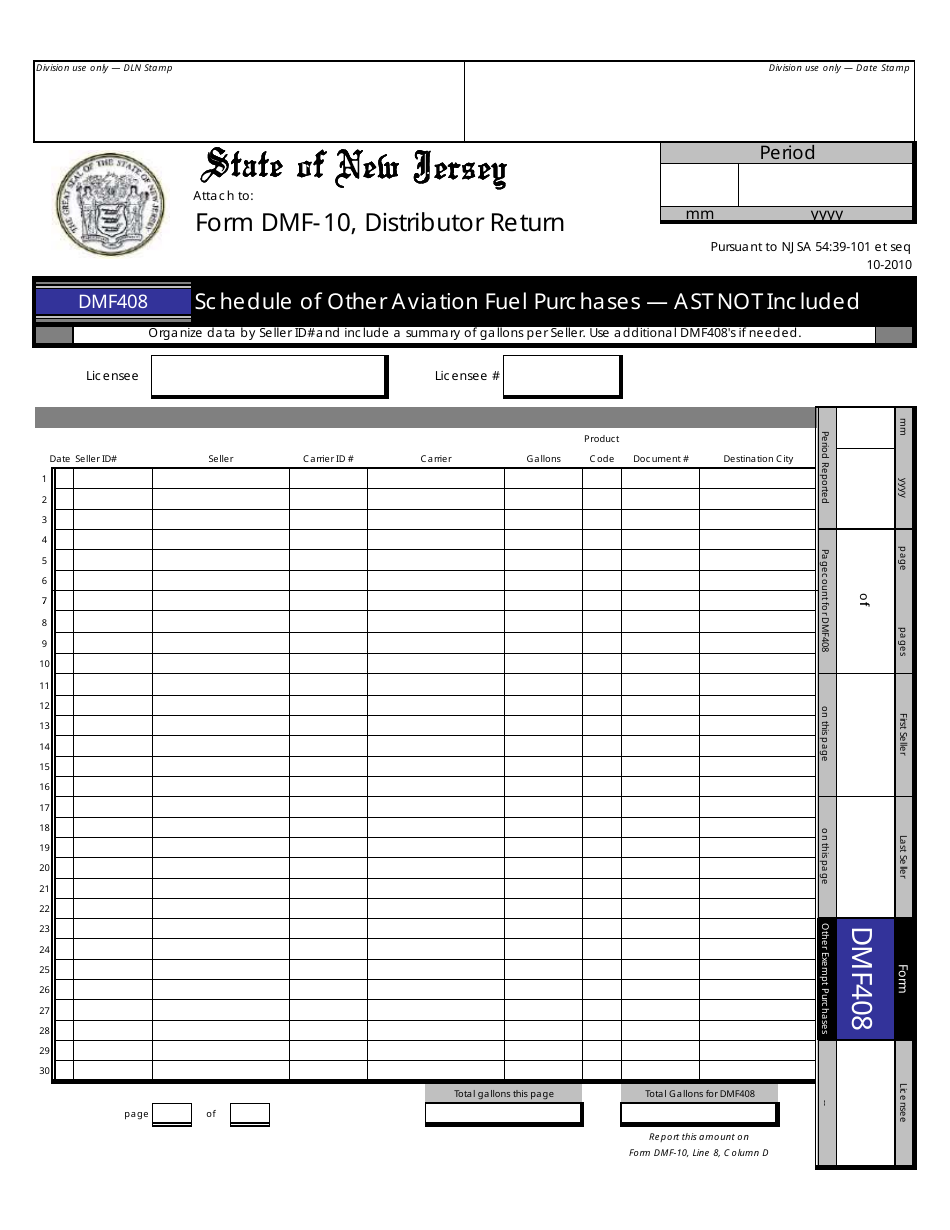

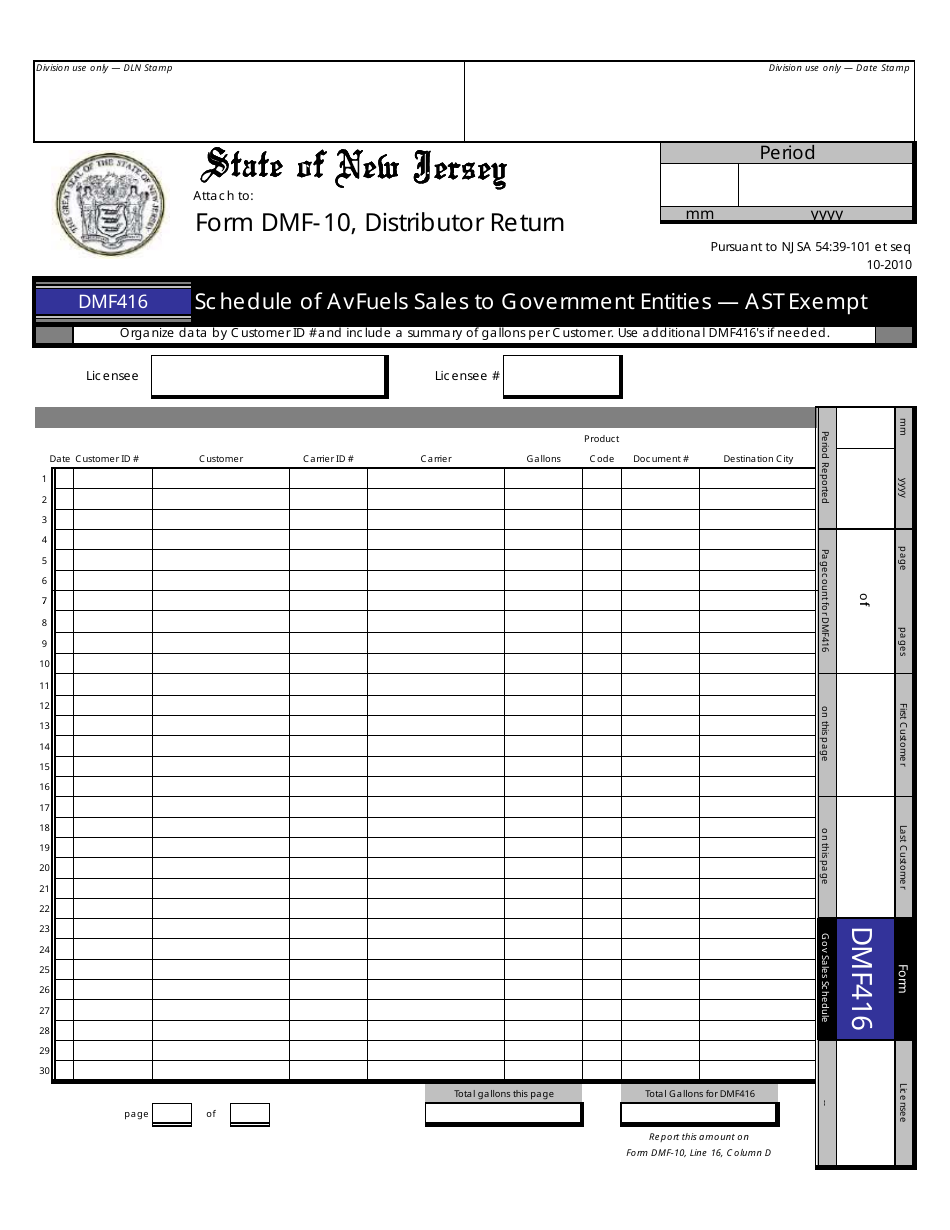

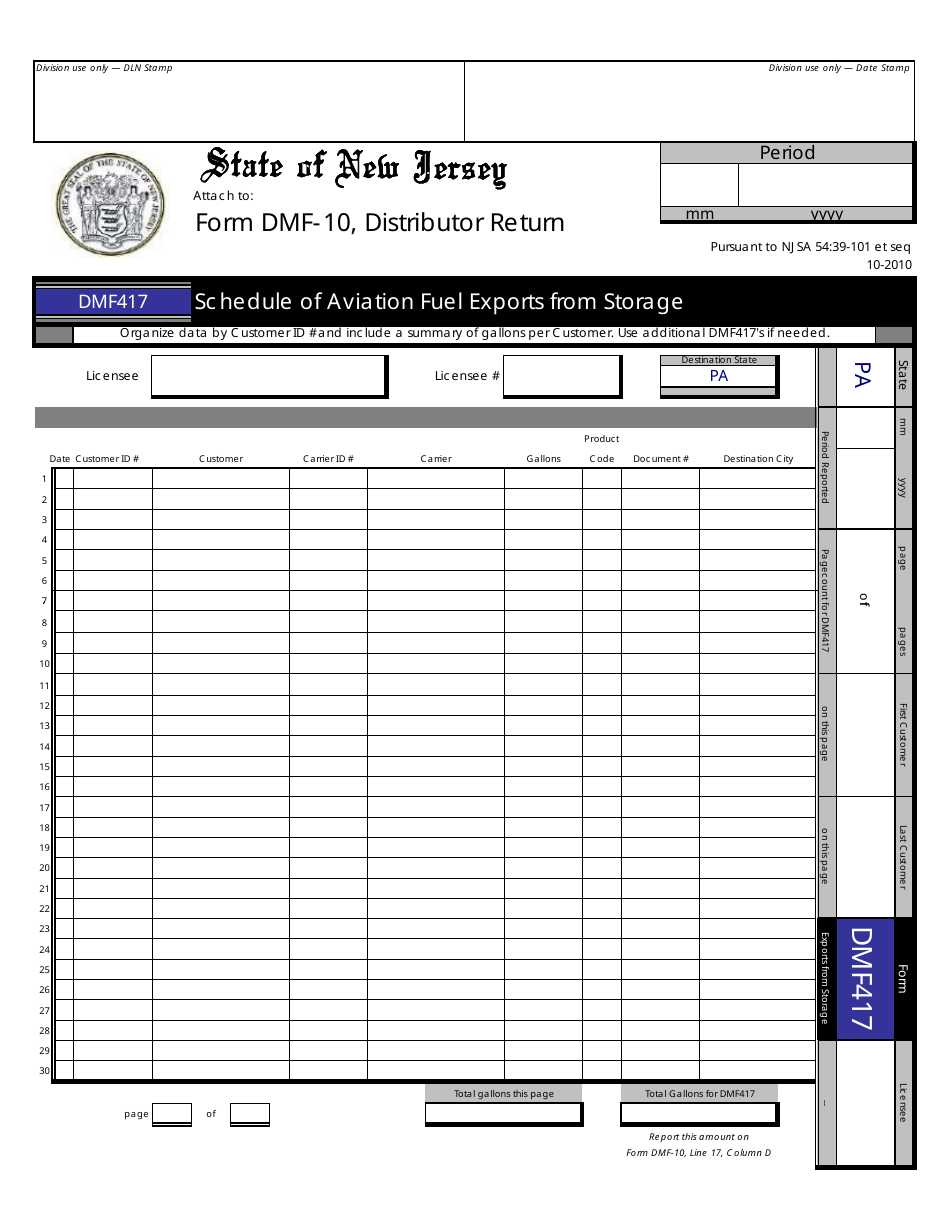

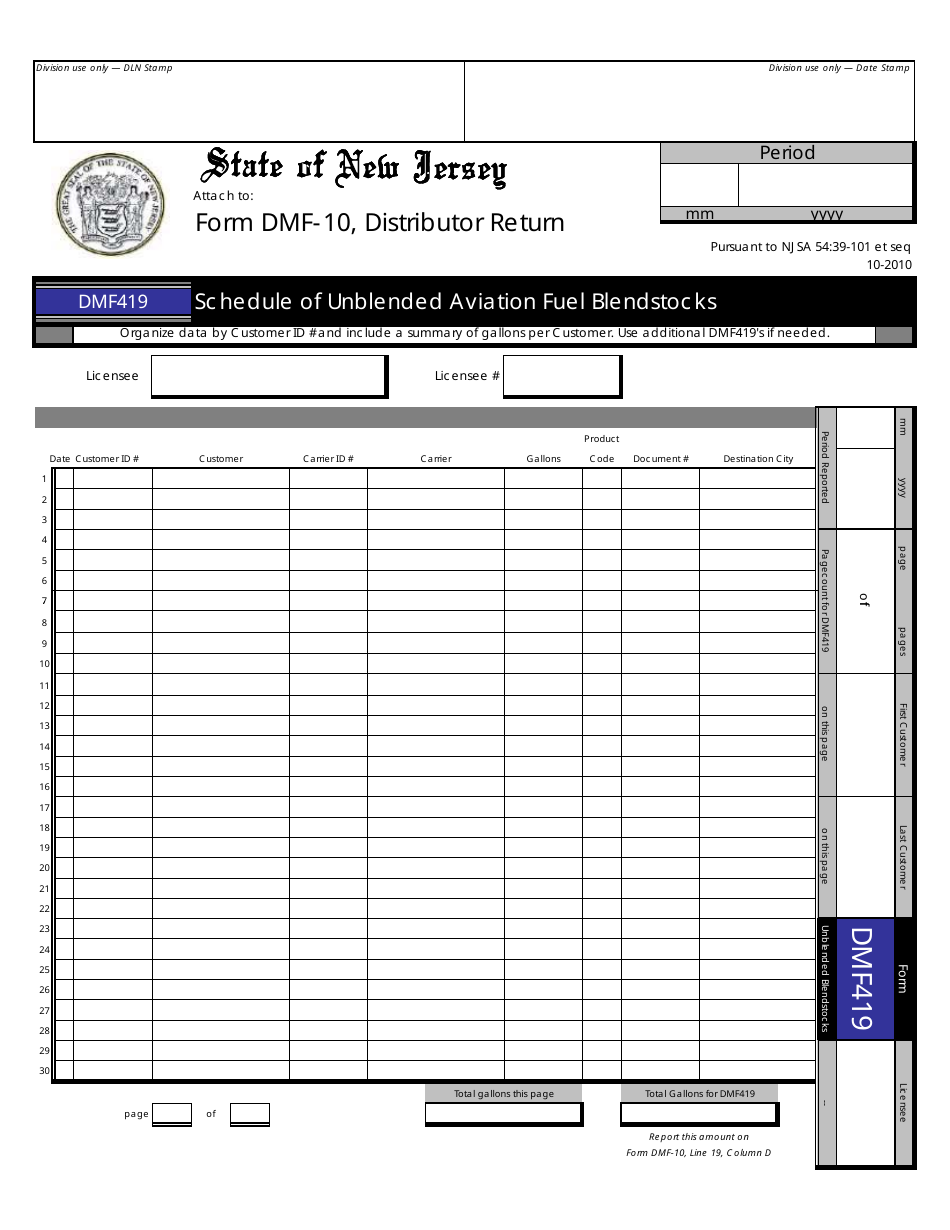

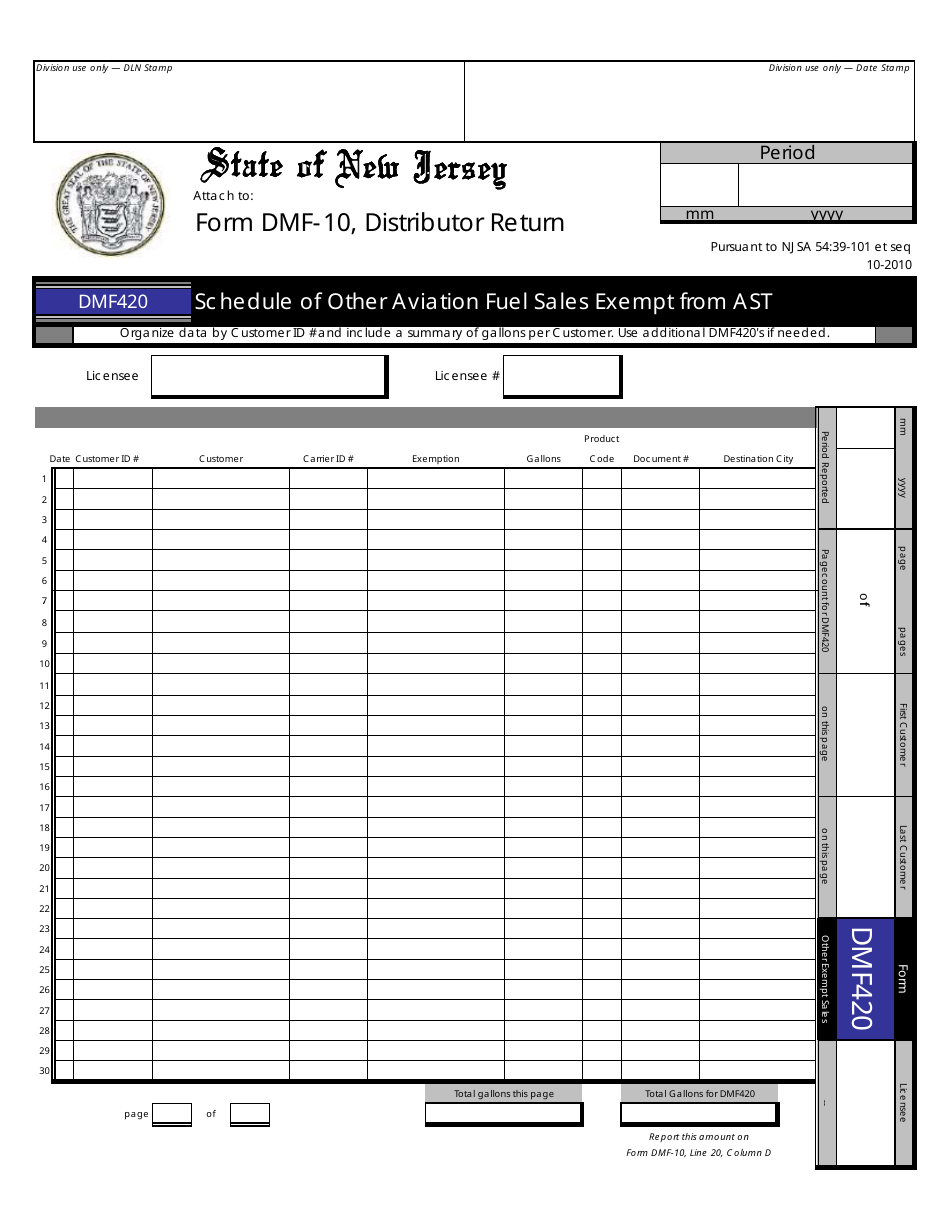

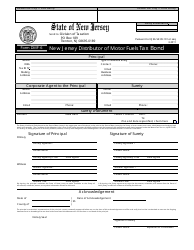

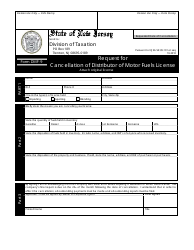

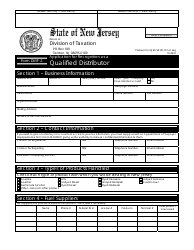

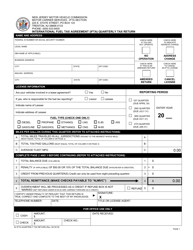

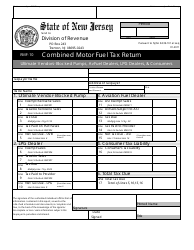

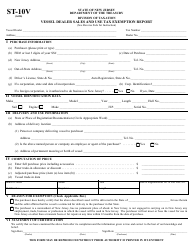

Form DMF-10 Distributor of Motor Fuels Tax Return - New Jersey

What Is Form DMF-10?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form DMF-10?

A: Form DMF-10 is the Distributor of Motor Fuels Tax Return in New Jersey.

Q: Who needs to file form DMF-10?

A: Distributors of motor fuels in New Jersey need to file form DMF-10.

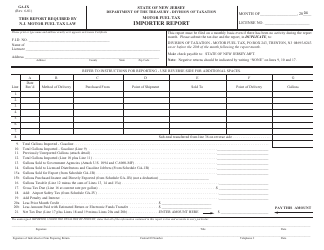

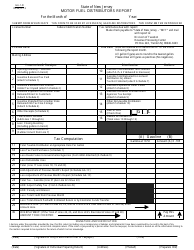

Q: What is the purpose of form DMF-10?

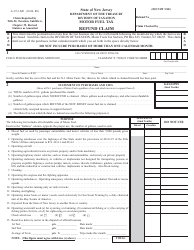

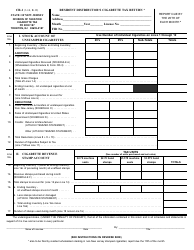

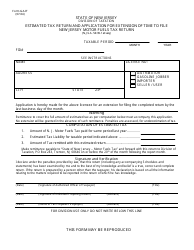

A: Form DMF-10 is used to report and pay the motor fuels tax in New Jersey.

Q: When is form DMF-10 due?

A: Form DMF-10 is due on a monthly basis by the 20th day of the following month.

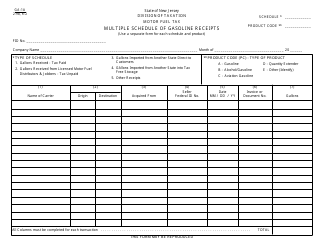

Q: What information is required on form DMF-10?

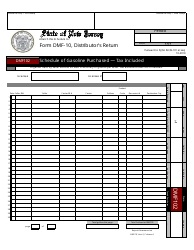

A: Form DMF-10 requires information about the quantity and type of motor fuels sold or stored in New Jersey, as well as the amount of tax due.

Form Details:

- Released on October 1, 2010;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DMF-10 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.