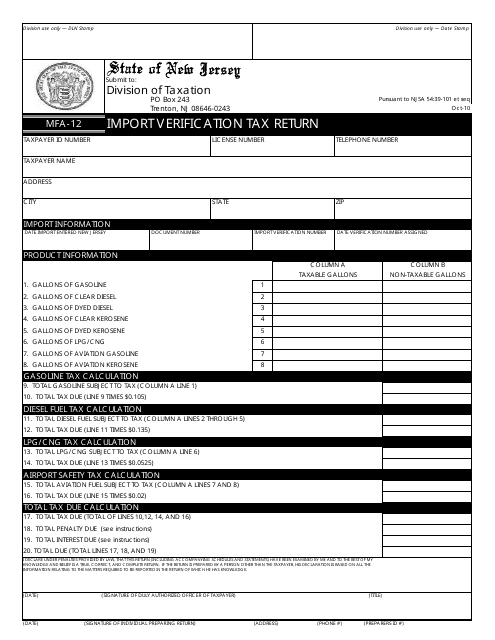

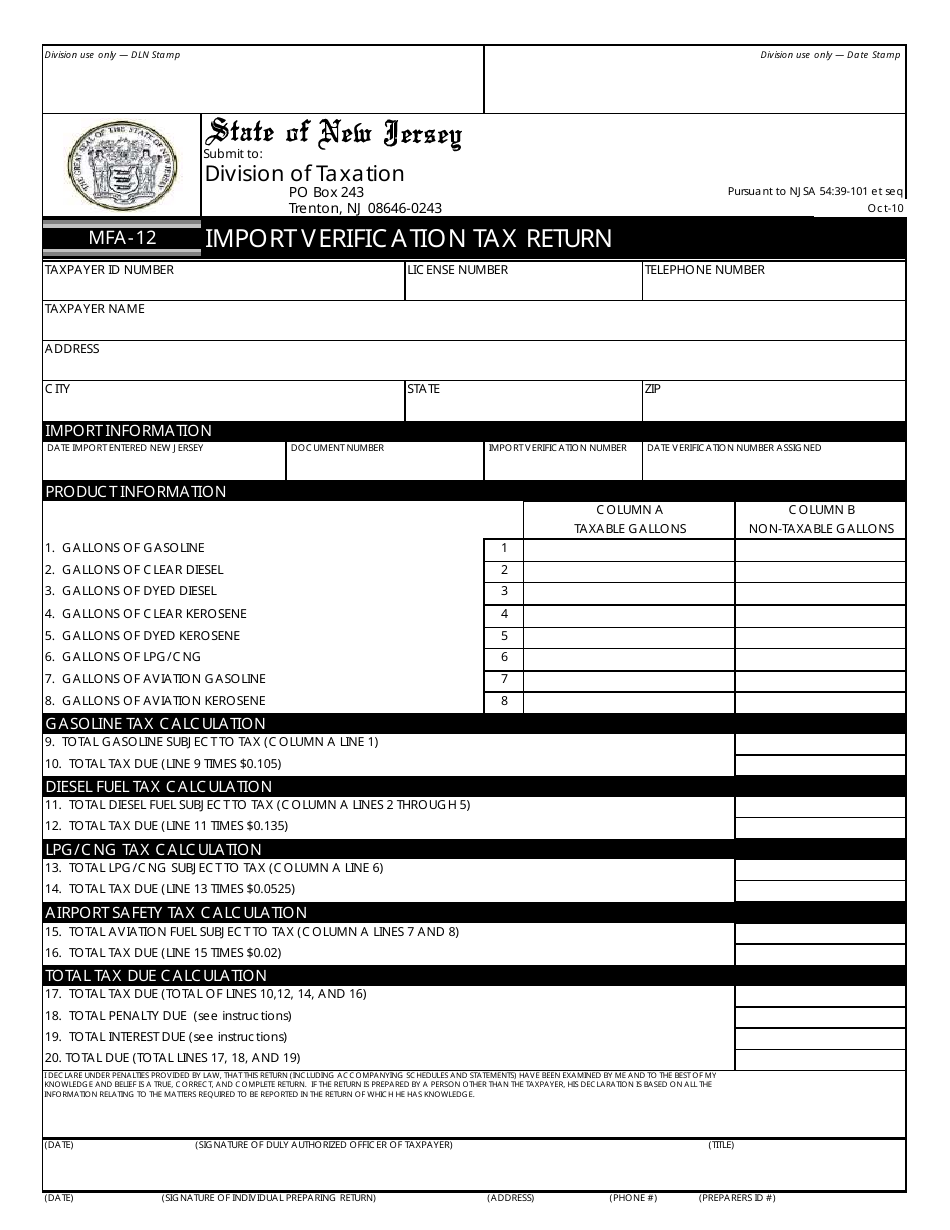

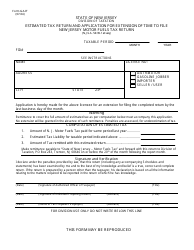

Form MFA-12 Import Verification Tax Return - New Jersey

What Is Form MFA-12?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form MFA-12?

A: Form MFA-12 is the Import Verification Tax Return for businesses in New Jersey.

Q: Who needs to file Form MFA-12?

A: Businesses engaged in importation and subject to the Importation License Fee in New Jersey need to file Form MFA-12.

Q: What is the purpose of Form MFA-12?

A: Form MFA-12 is used by businesses to report and pay the Importation License Fee to the state of New Jersey.

Q: When is Form MFA-12 due?

A: Form MFA-12 is due on the last day of the month following the close of each calendar quarter.

Q: Is there a penalty for not filing Form MFA-12?

A: Yes, there may be penalties for failure to file Form MFA-12 or for filing late.

Q: Are there any exemptions to filing Form MFA-12?

A: Yes, certain businesses may be exempt from filing Form MFA-12. It is recommended to consult the instructions or a tax professional for specific exemption criteria.

Form Details:

- Released on October 1, 2010;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MFA-12 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.