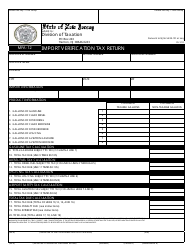

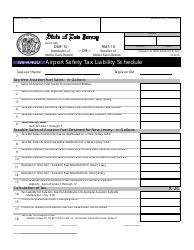

Instructions for Form MFA-12 Import Verification Tax Return - New Jersey

This document contains official instructions for Form MFA-12 , Import Verification Tax Return - a form released and collected by the New Jersey Department of the Treasury. An up-to-date fillable Form MFA-12 is available for download through this link.

FAQ

Q: What is Form MFA-12?

A: Form MFA-12 is the Import Verification Tax Return - New Jersey.

Q: Who needs to file Form MFA-12?

A: Anyone who is engaged in importing goods into New Jersey needs to file Form MFA-12.

Q: What is the purpose of Form MFA-12?

A: The purpose of Form MFA-12 is to report and pay the Import Verification Tax.

Q: What information is required on Form MFA-12?

A: Form MFA-12 requires information such as import shipment details, value of goods imported, and applicable tax rates.

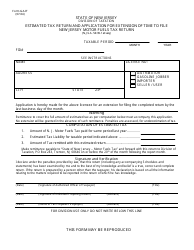

Q: When is Form MFA-12 due?

A: Form MFA-12 is due on a quarterly basis, with the due dates falling on the last day of the months of April, July, October, and January.

Q: Are there any penalties for late filing of Form MFA-12?

A: Yes, there are penalties for late filing of Form MFA-12, including interest on the tax liability.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New Jersey Department of the Treasury.