Free Payroll Forms and Templates

What Is Payroll?

Payroll refers to the total amount of wages the employer must pay to their employees during a certain period of time. Working with the correct payroll forms and systems will quickly improve your daily business operations and reduce the risk of disputes and disagreements if the employee will think you did not pay them money they have earned.

You do not need to employ any payroll services or purchase expensive payroll software with additional fees to calculate payroll taxes and handle deductions – you can deal with payroll yourself by gathering all tax information from your employees and filing the required documentation with the Internal Revenue Service.

How to Do Payroll?

Here is how you create your own payroll and streamline all the employee payments:

- Collect information to process payroll forms - your employer identification number, state and local tax identification numbers, and employees' details from various tax forms;

- Determine a payroll schedule - you can pay your employees once a week, once a month, or twice a month;

- Calculate payroll and do not forget overtime pay and deductions from gross pay;

- Submit tax information to the Internal Revenue Service;

- Draft payroll records to stay on top of any possible mistakes or omissions.

The following templates will help you to manage payroll of your entity:

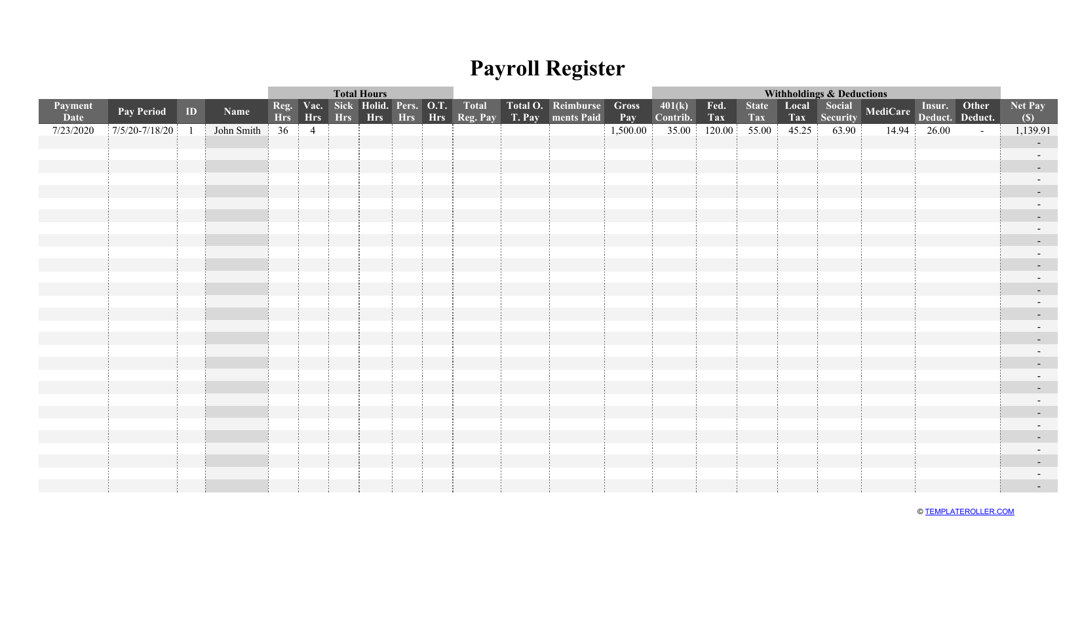

- Payroll Register. It is recommended to compose a spreadsheet that will identify employees who receive a salary and contain combined totals of the gross pay, net pay, and necessary deductions. You will be able to see how much money is paid to a certain employee and all individuals employed by your business.

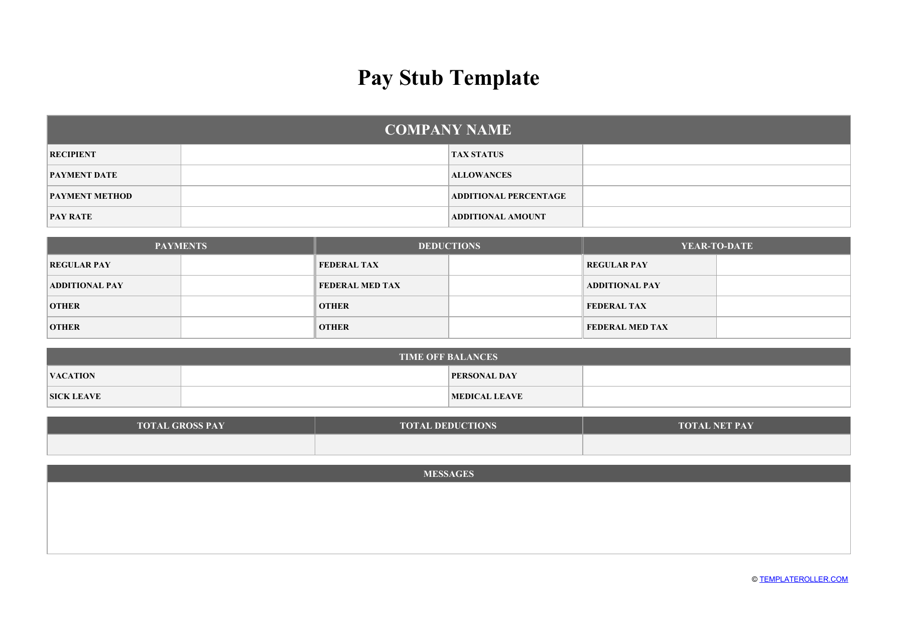

- Pay Stub. This simple form is given to the employee along with a paycheck every two weeks or month. It outlines the amount of money earned by them and shows how much money you have removed for taxes and insurance fees.

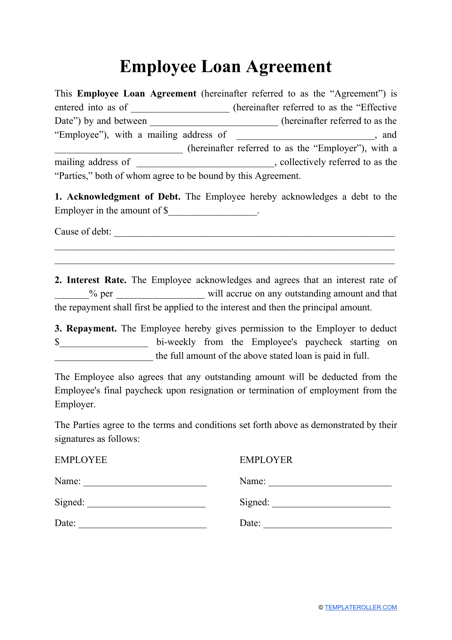

- Employee Loan Agreement. You can enter into this contract with your employee if they ask you for advance payment and extra money before their official payday comes. If the employee fails to repay the loan, it is allowed to make deductions from their future paychecks.

How to Calculate Payroll Taxes?

Whether you are an owner of a small business or you have to manage a big company, the best way to deal with payroll tax is to use a Paycheck Calculator, also known as a "Payroll Tax Calculator". In four steps, you will be able to find out the amount of tax to pay:

- Calculate the gross pay - the amount of money your employees have earned before any taxes are withheld;

- Compute the tax withholdings using W-4 Forms completed by employees;

- Apply deductions to the employees' paychecks;

- Add reimbursements for expenses employees paid for themselves.

Check out these related topics:

Related Articles

Documents:

4

This contract contains the consent of an employer to provide a loan to an employee, which will be further deducted from the employee's payroll.

This is a document that contains an official record that an employee got paid from their employer.

This is an accounting tool that allows financial departments of any organization to determine the correct wages of all of their employees.

This report is usually represented as an electronic spreadsheet or online application and indicates a worker's payroll information for a certain period of time.