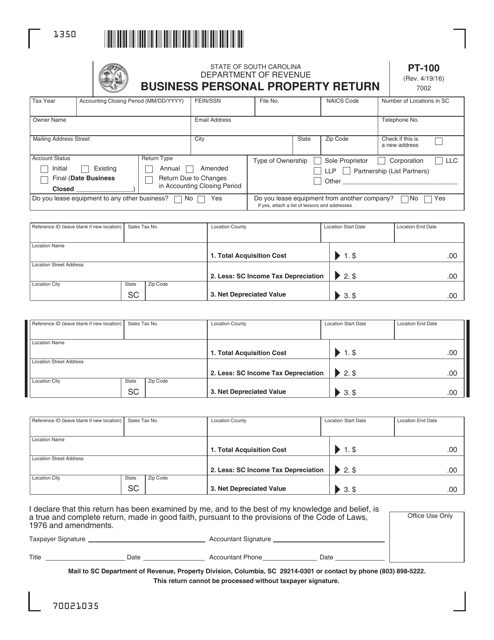

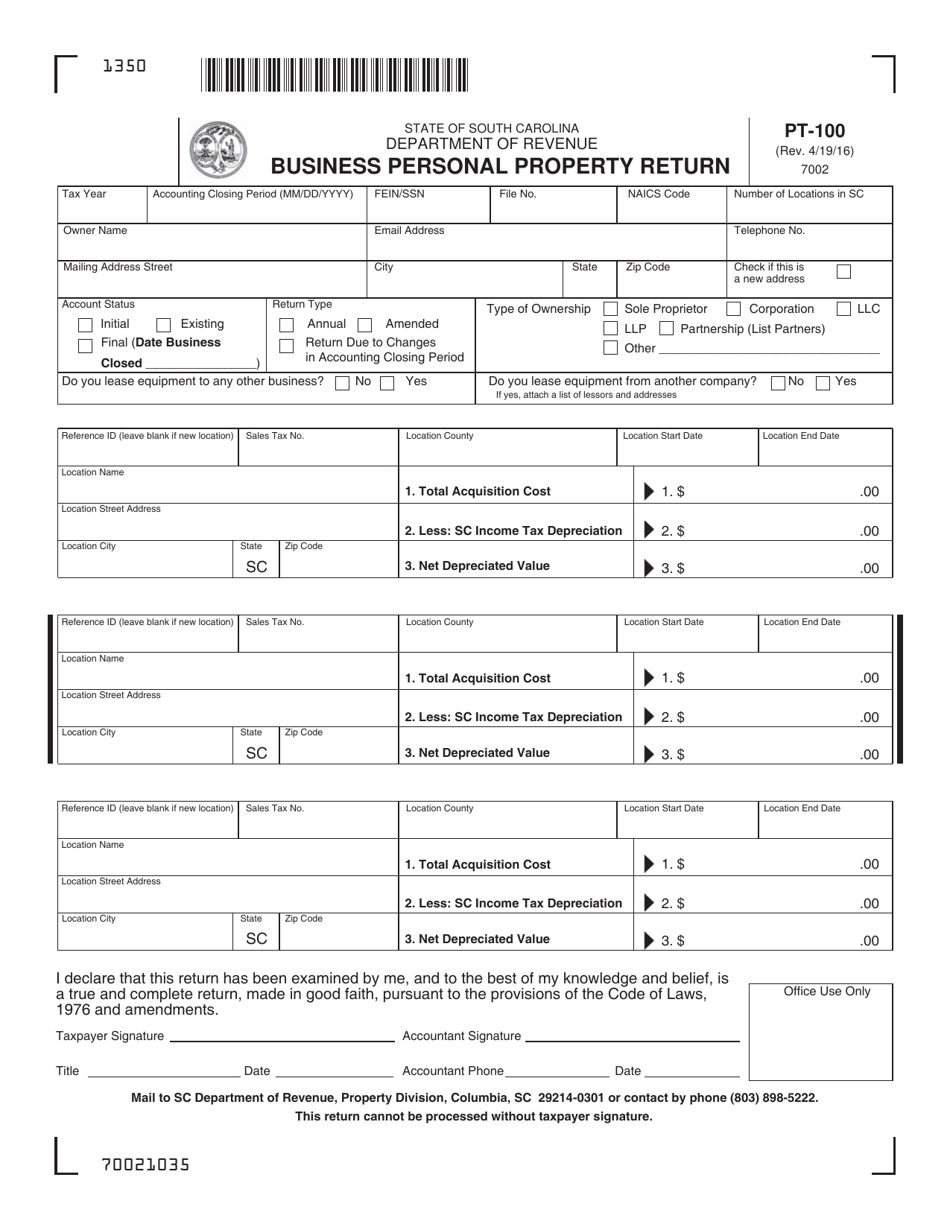

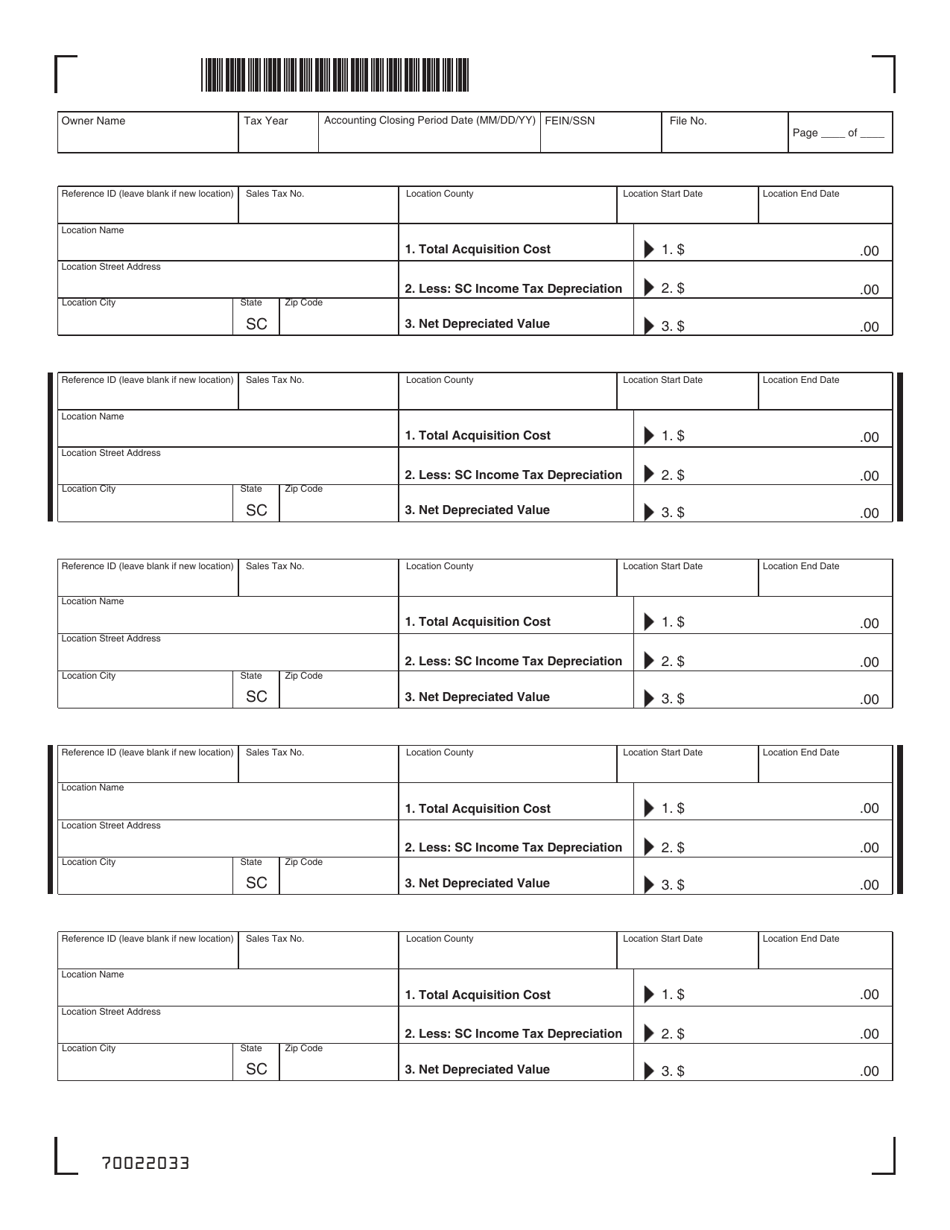

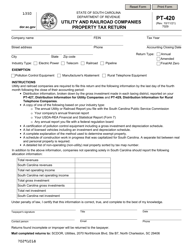

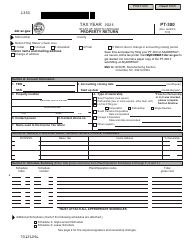

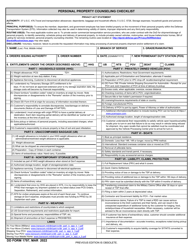

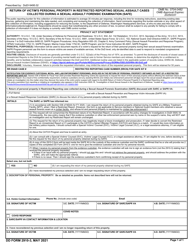

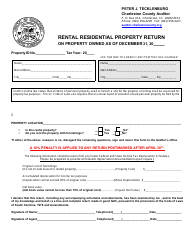

Form PT-100 Business Personal Property Return - South Carolina

What Is Form PT-100?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is a Form PT-100?

A: Form PT-100 is a Business Personal Property Return.

Q: What is the purpose of Form PT-100?

A: The purpose of Form PT-100 is to report personal property used in a business.

Q: Who needs to file Form PT-100?

A: Anyone who owns or operates a business in South Carolina and has personal property used in that business needs to file Form PT-100.

Q: How often do I need to file Form PT-100?

A: Form PT-100 needs to be filed annually.

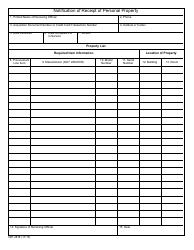

Q: What is considered personal property for the purpose of this form?

A: Personal property can include furniture, equipment, machinery, and other tangible assets used in the business.

Q: Are there any exemptions for personal property?

A: Yes, there are exemptions available for certain types of personal property, such as inventory held for resale.

Q: What is the deadline for filing Form PT-100?

A: Form PT-100 is due by April 30th of each year.

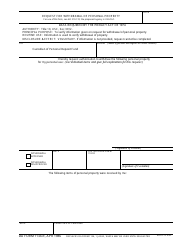

Q: What happens if I don't file Form PT-100?

A: Failure to file Form PT-100 may result in penalties and interest.

Q: Can I appeal the assessed value of my personal property?

A: Yes, you can appeal the assessed value of your personal property by contacting the County Assessor's Office.

Form Details:

- Released on April 19, 2016;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-100 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.