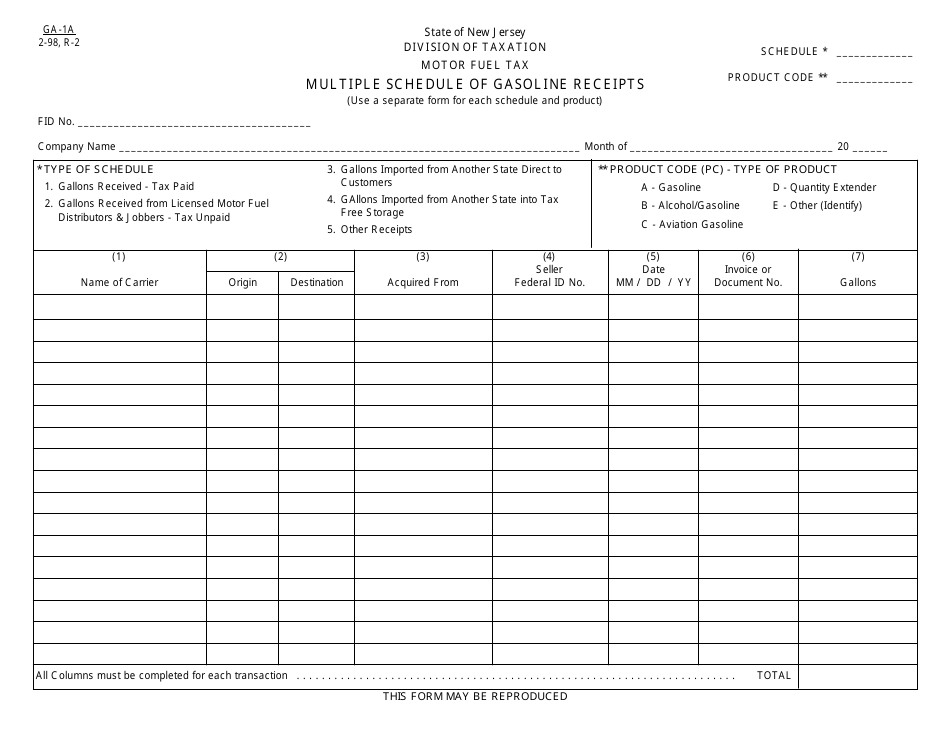

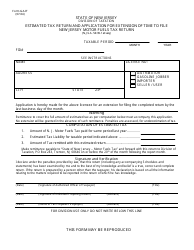

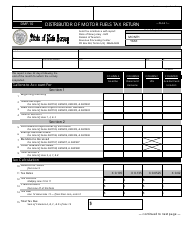

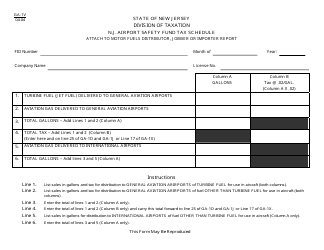

Form GA-1A Motor Fuel Tax Multiple Schedule of Gasoline Receipts - New Jersey

What Is Form GA-1A?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GA-1A?

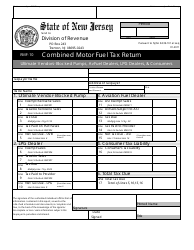

A: Form GA-1A is the Multiple Schedule of Gasoline Receipts for Motor Fuel Tax in New Jersey.

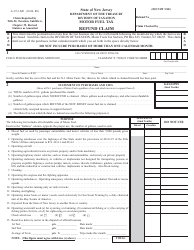

Q: Who needs to file Form GA-1A?

A: Anyone who sells gasoline in New Jersey needs to file Form GA-1A.

Q: What is the purpose of Form GA-1A?

A: The purpose of Form GA-1A is to report and track gasoline receipts for motor fueltax purposes.

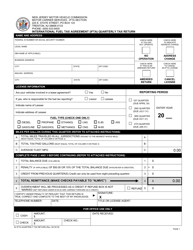

Q: What information is required on Form GA-1A?

A: Form GA-1A requires information such as the total number of gallons received, the supplier's name and address, and the date of receipt.

Q: When is Form GA-1A due?

A: Form GA-1A is due on a monthly basis, by the 20th day of the following month.

Q: Do I need to pay any fees for filing Form GA-1A?

A: No, there are no fees associated with filing Form GA-1A.

Form Details:

- Released on February 1, 1998;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GA-1A by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.