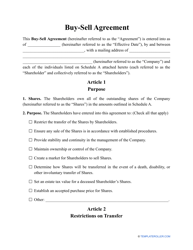

Buy-Sell Agreement Planning Checklist Template - Sun Life Financial - Canada

The Buy-Sell Agreement Planning Checklist Template from Sun Life Financial in Canada is a tool designed to help individuals or businesses plan for the future sale or transfer of a company or business interest. It provides a checklist of important considerations and steps that should be taken into account when creating a buy-sell agreement.

FAQ

Q: What is a buy-sell agreement?

A: A buy-sell agreement is a legally binding contract between co-owners of a business that outlines what will happen if one of the owners wants to sell their share or passes away.

Q: Why is a buy-sell agreement important?

A: A buy-sell agreement helps ensure a smooth transition of ownership in the event of a partner's departure or death, and protects the business and remaining owners from potential disputes or financial issues.

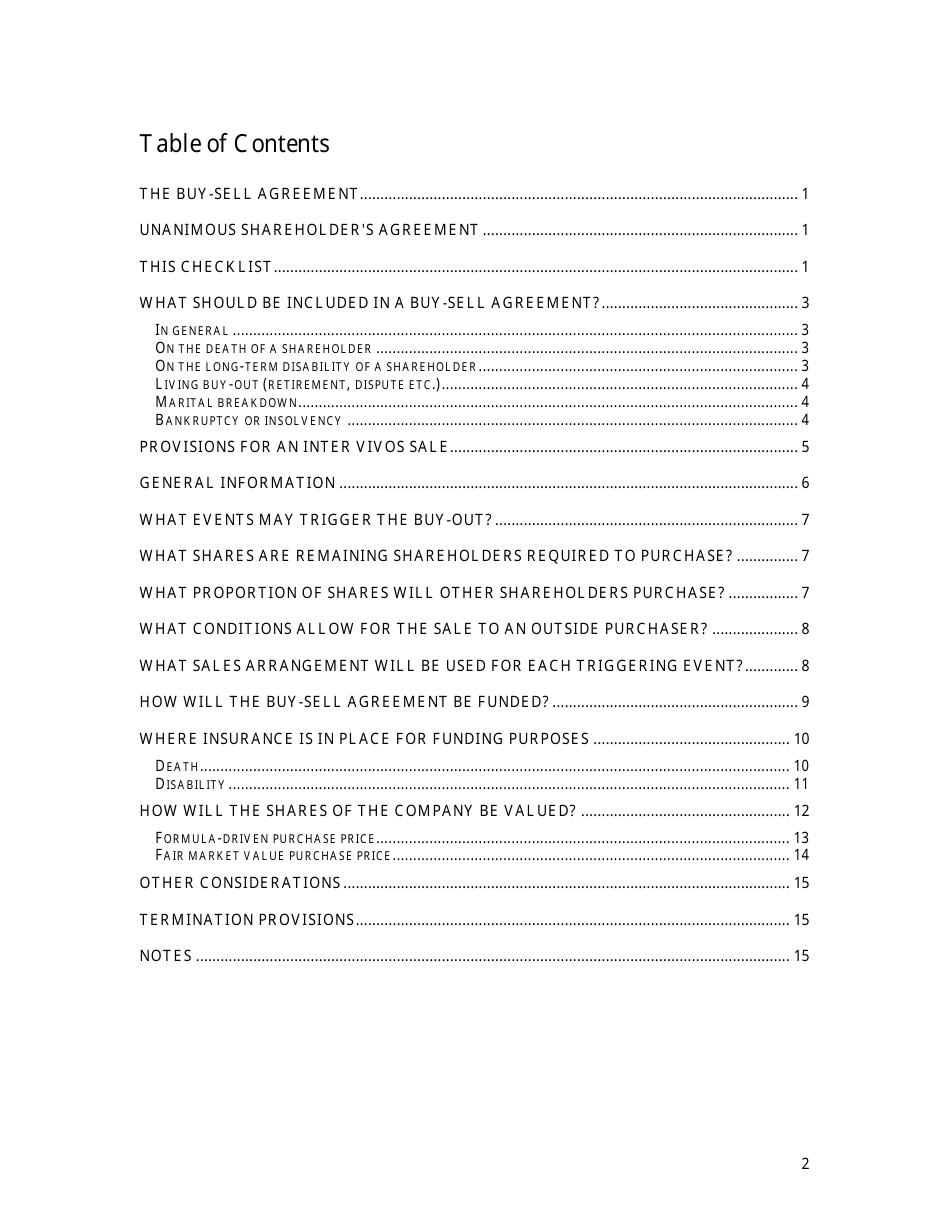

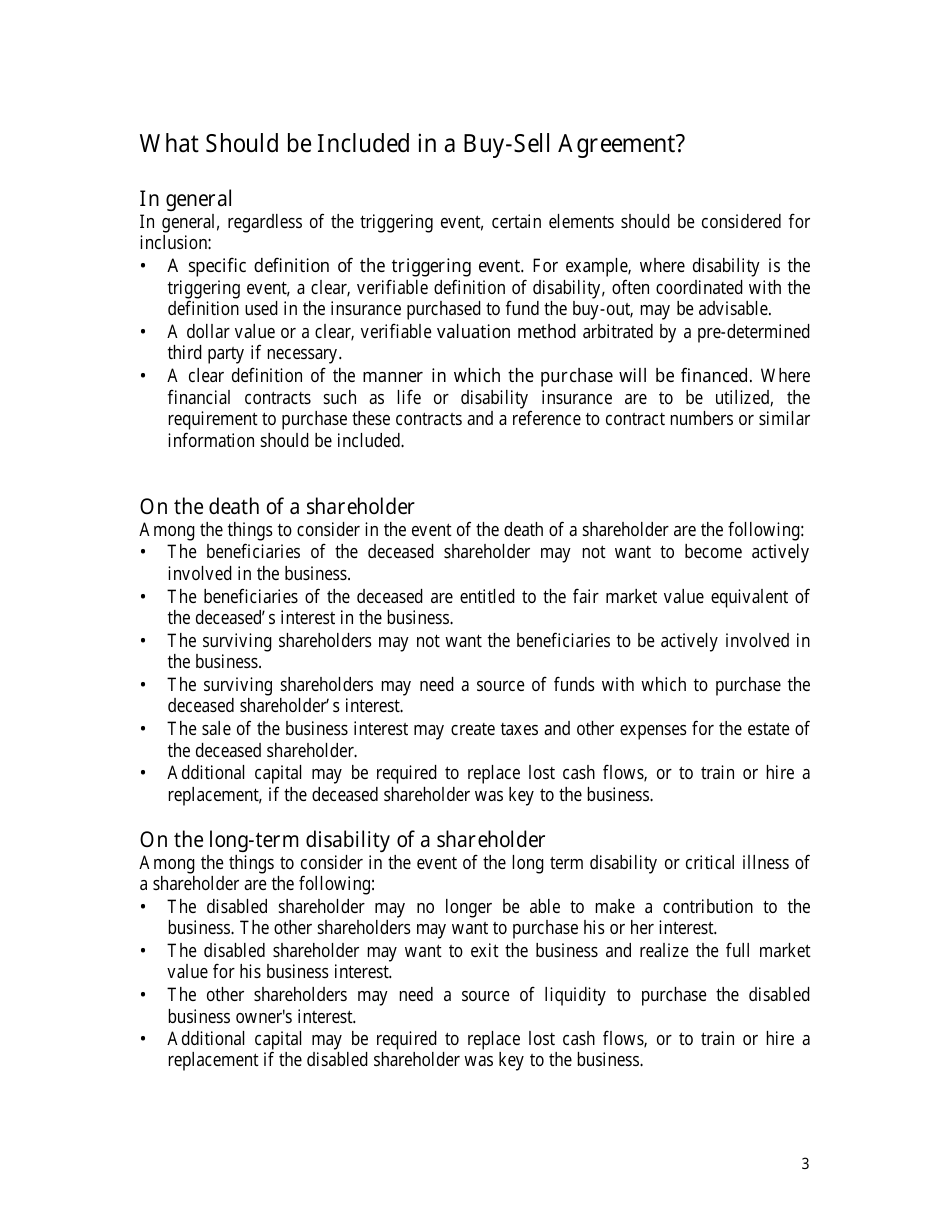

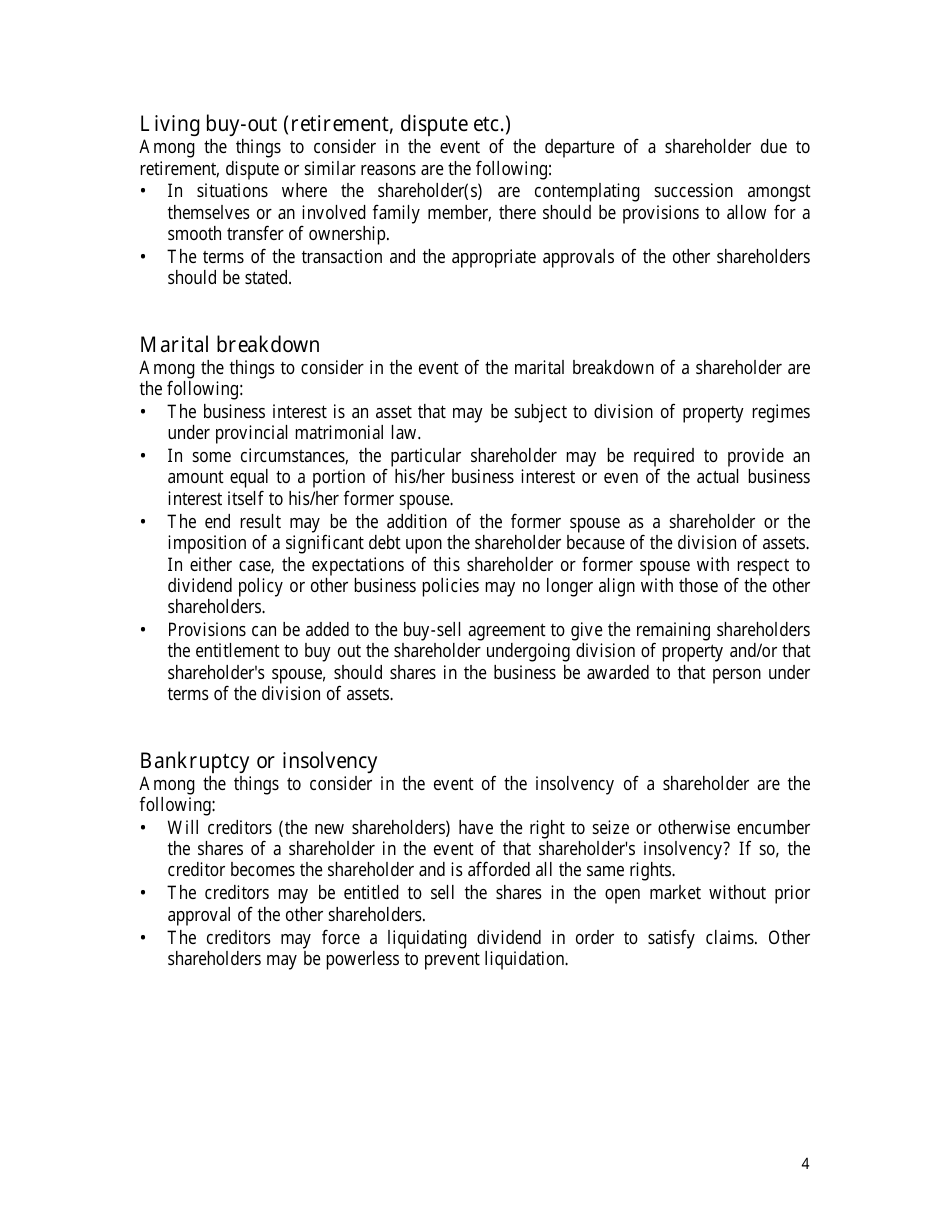

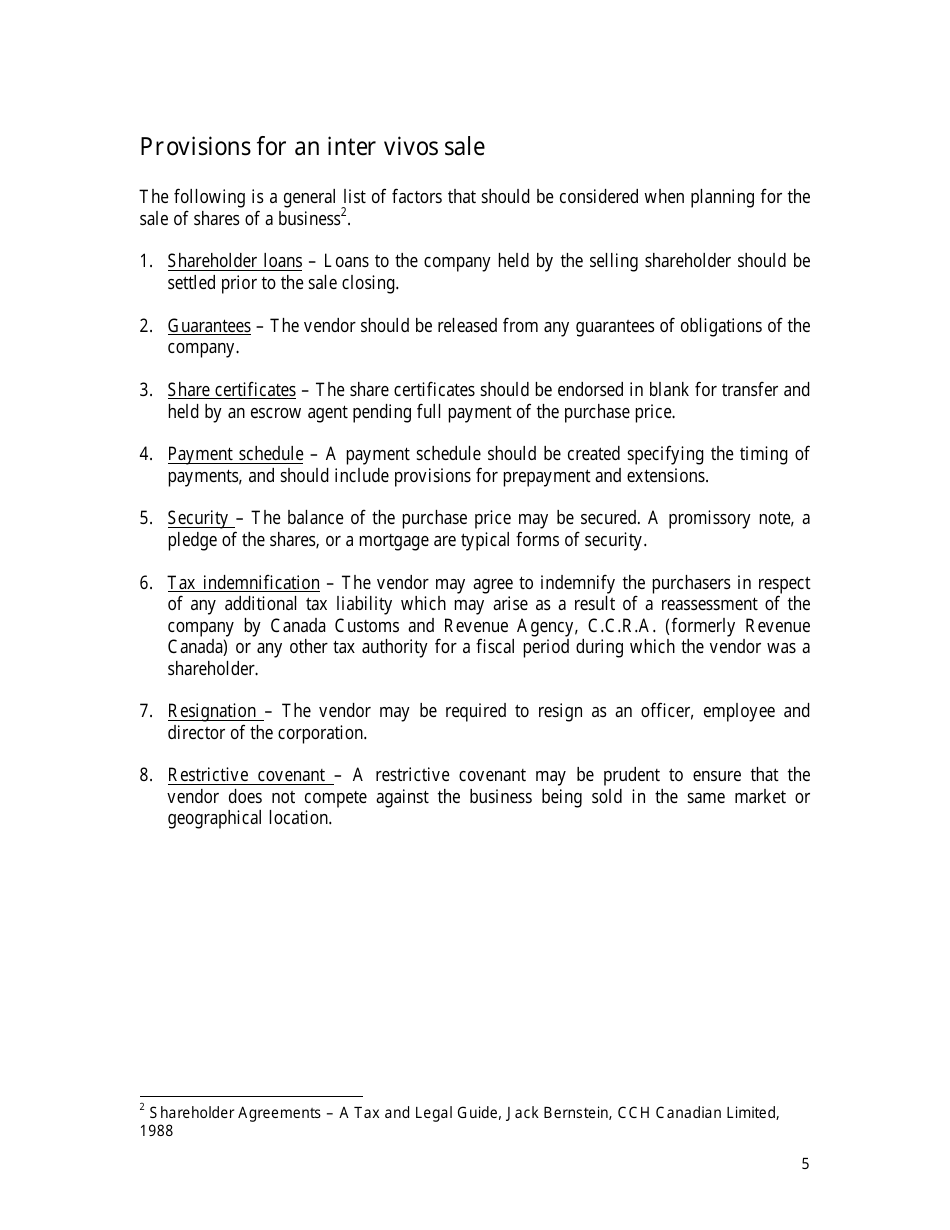

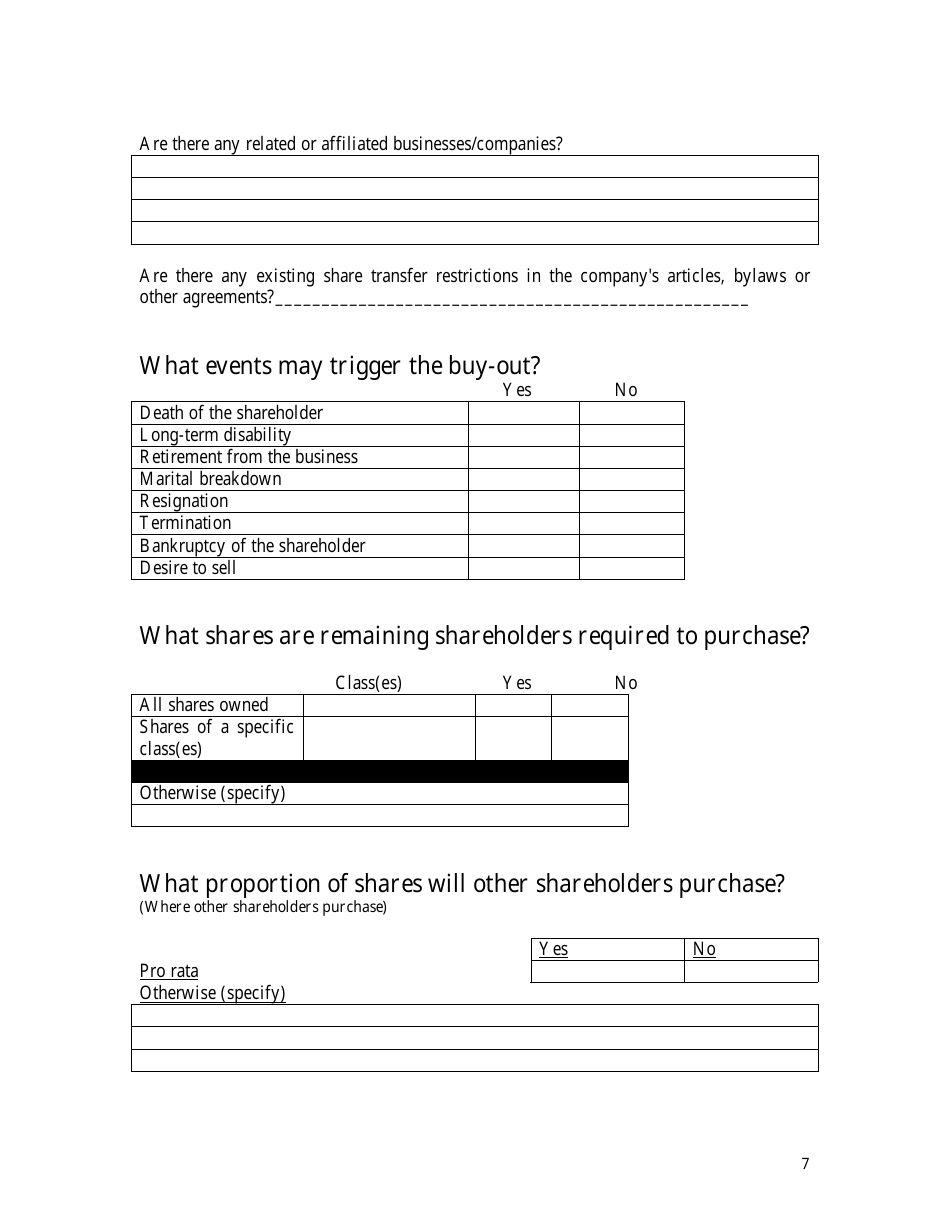

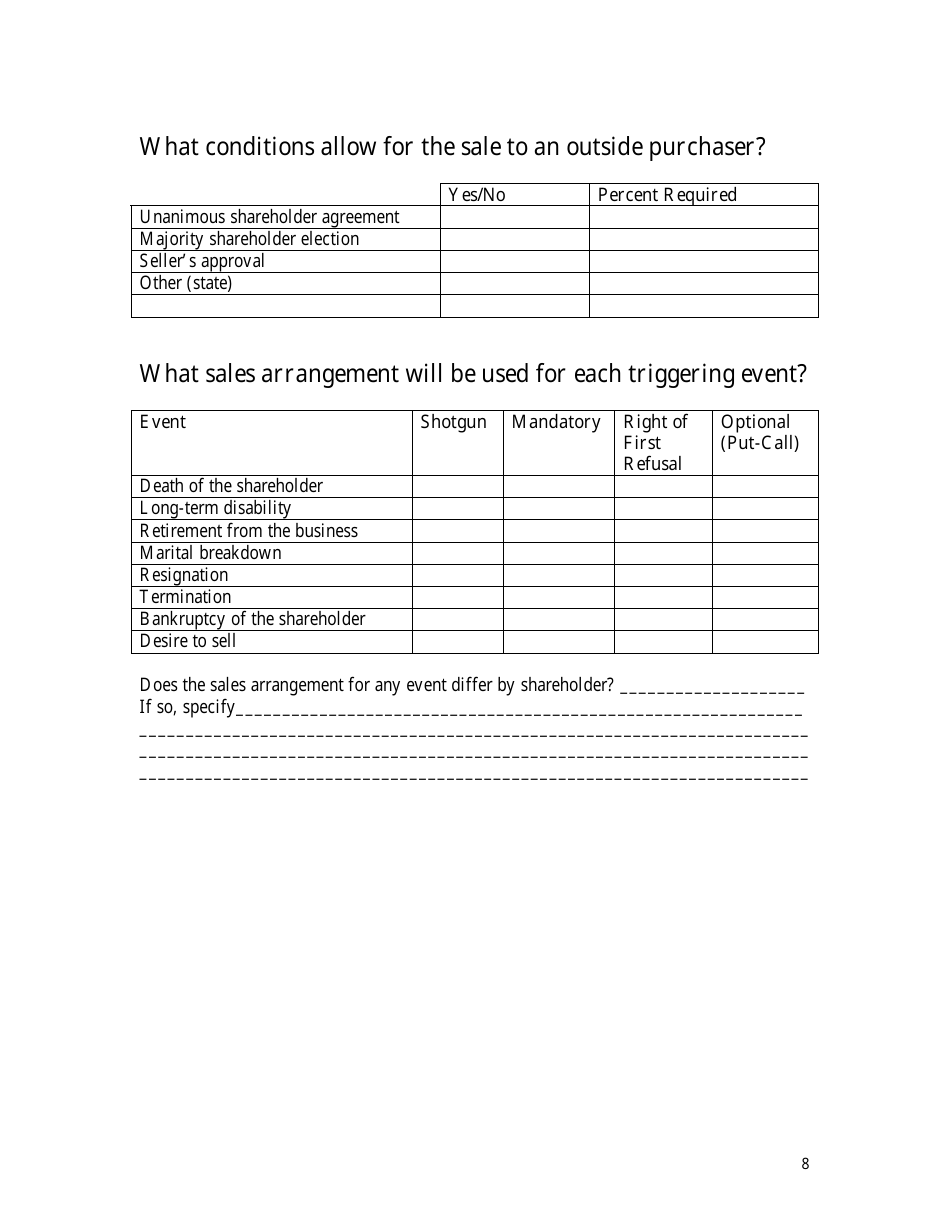

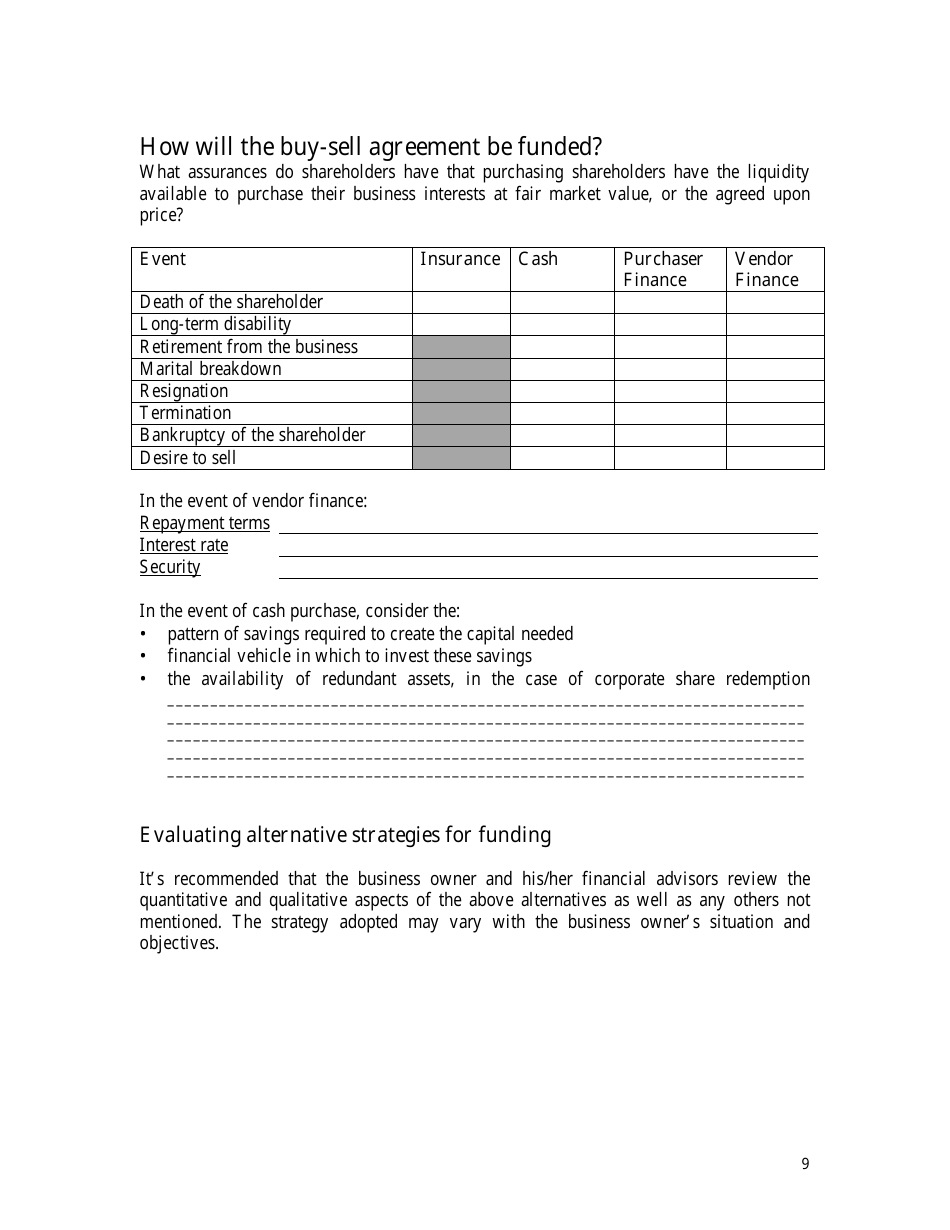

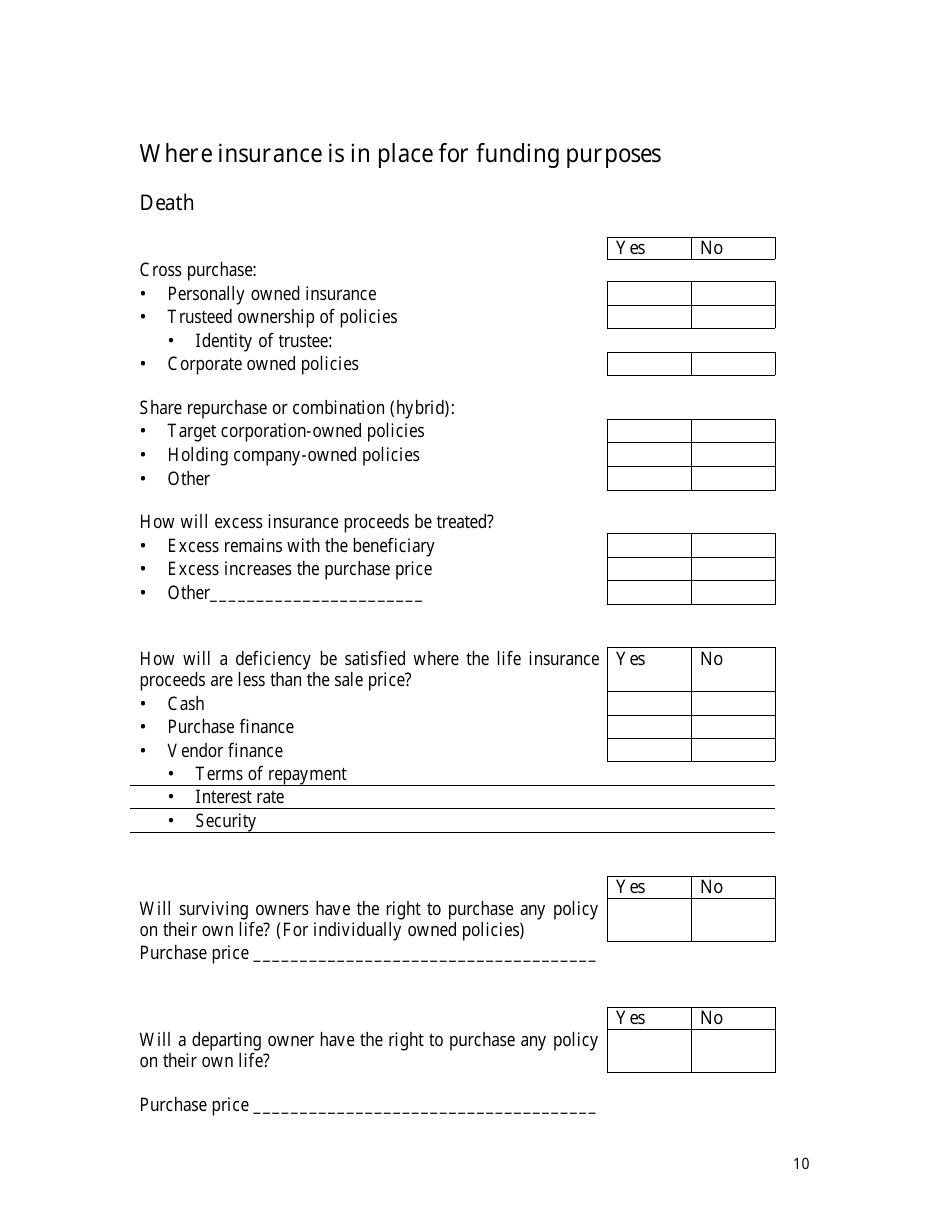

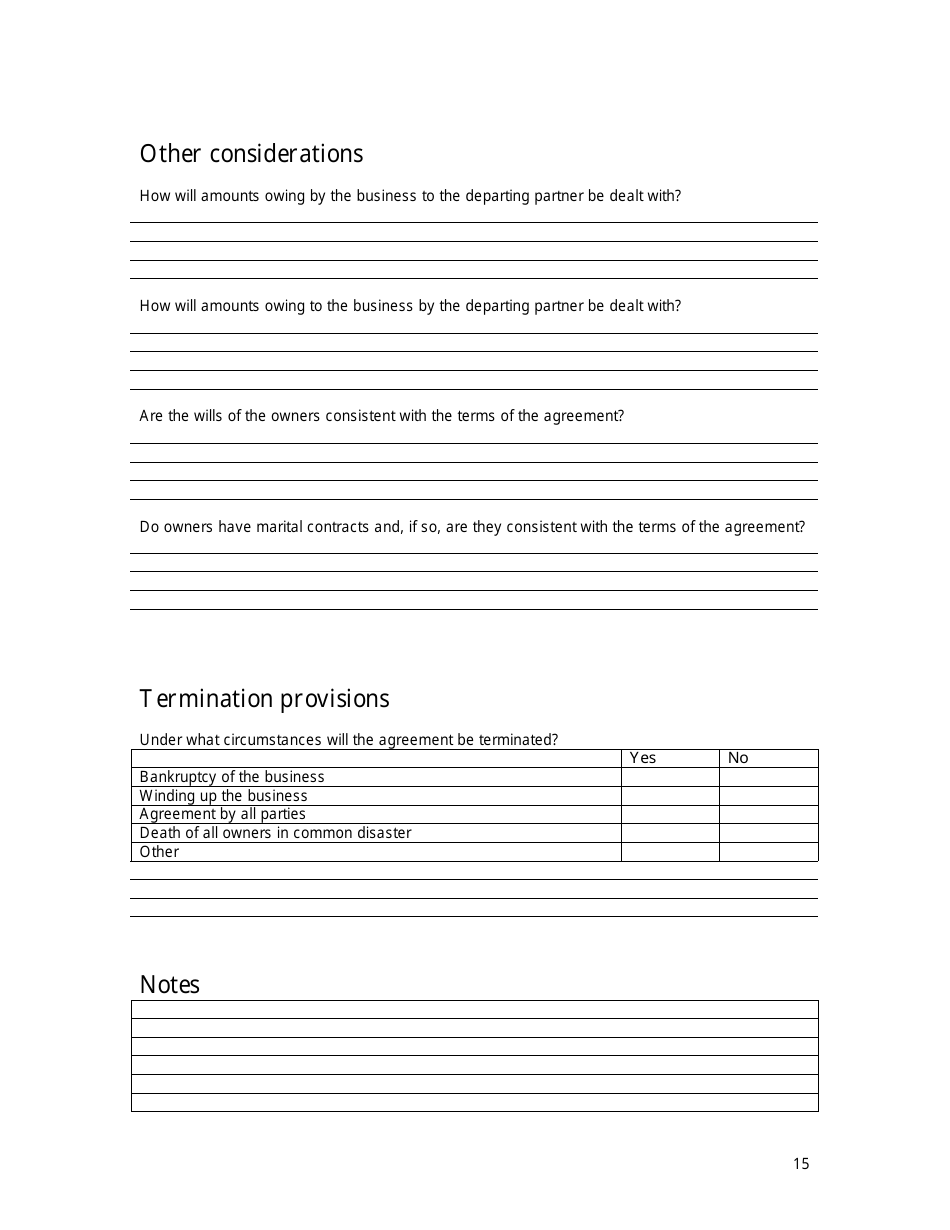

Q: What should be included in a buy-sell agreement?

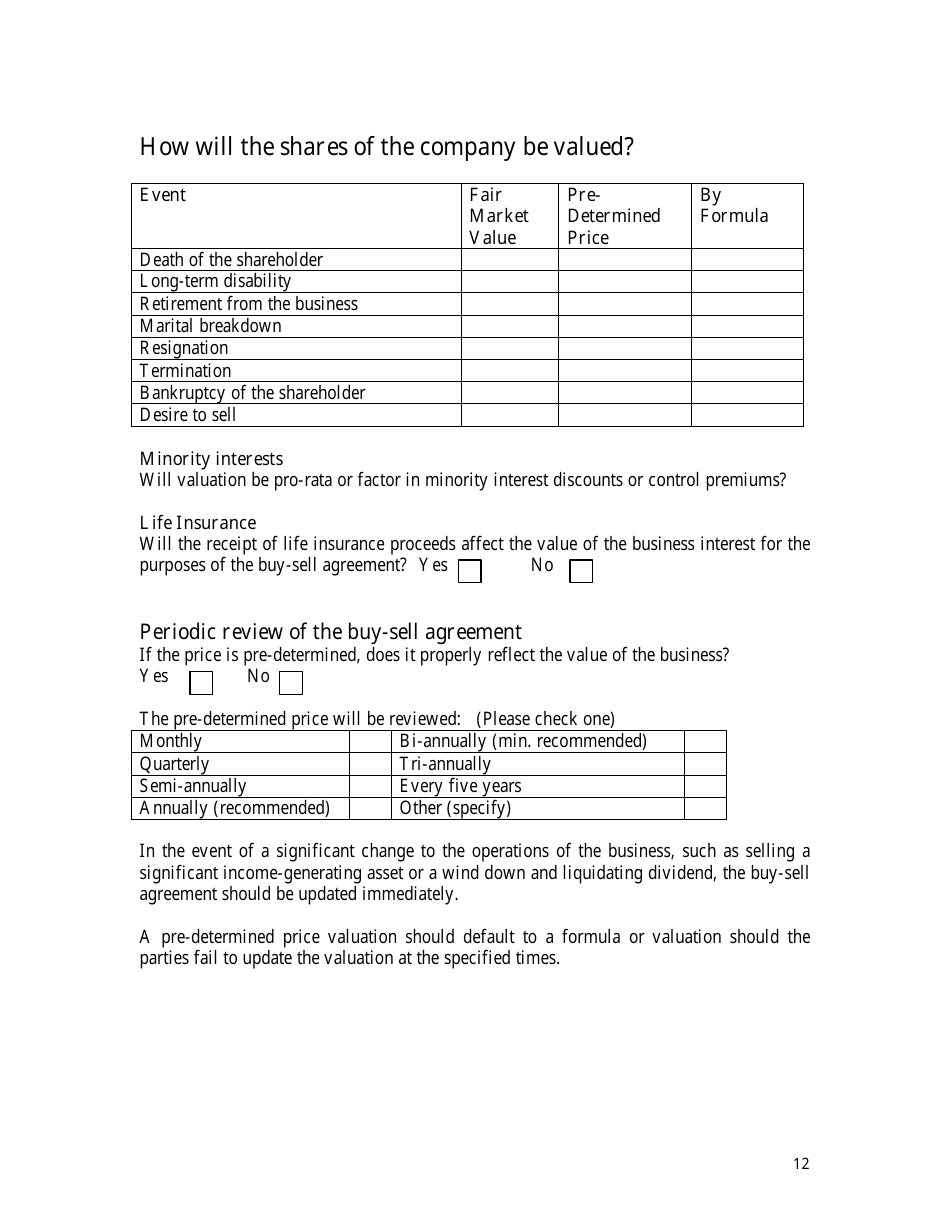

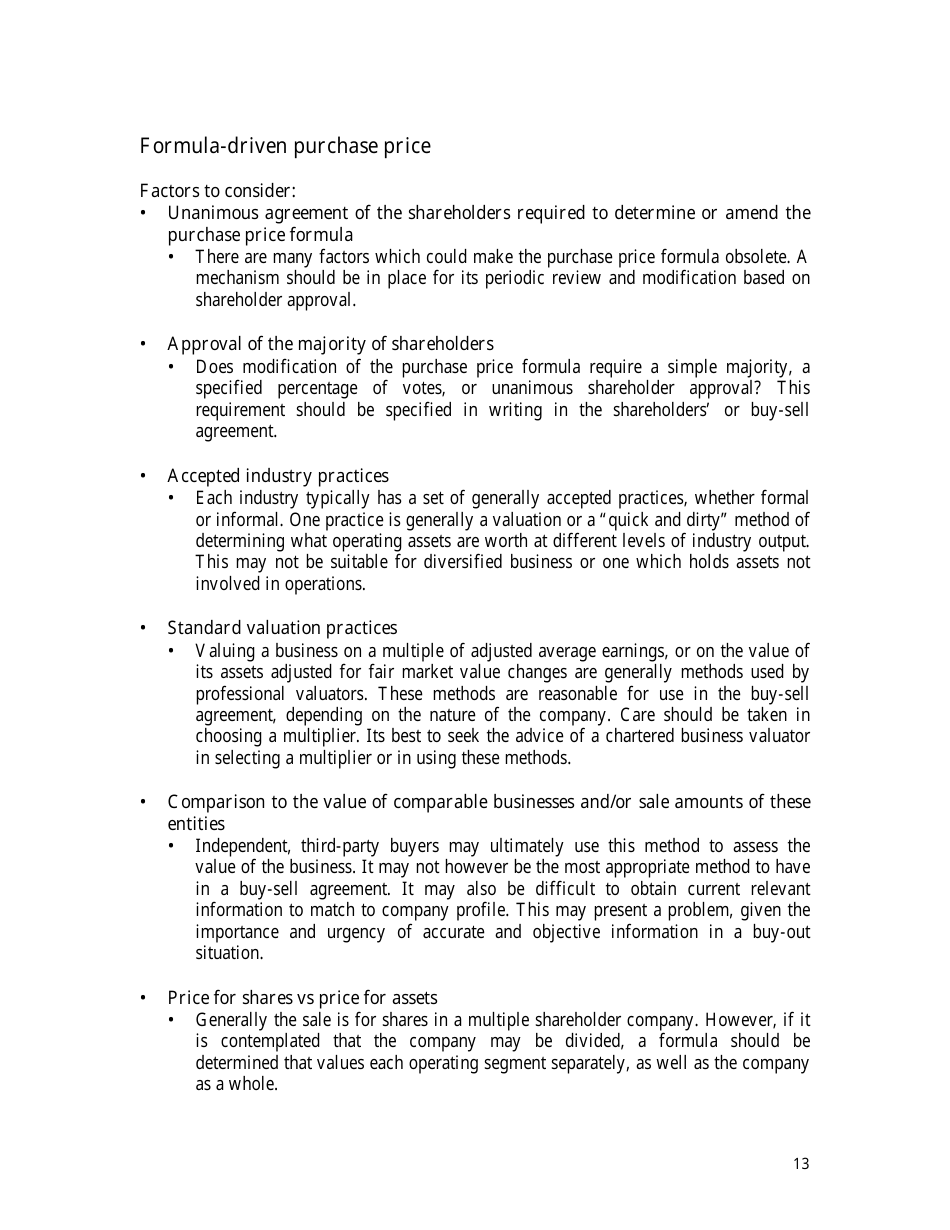

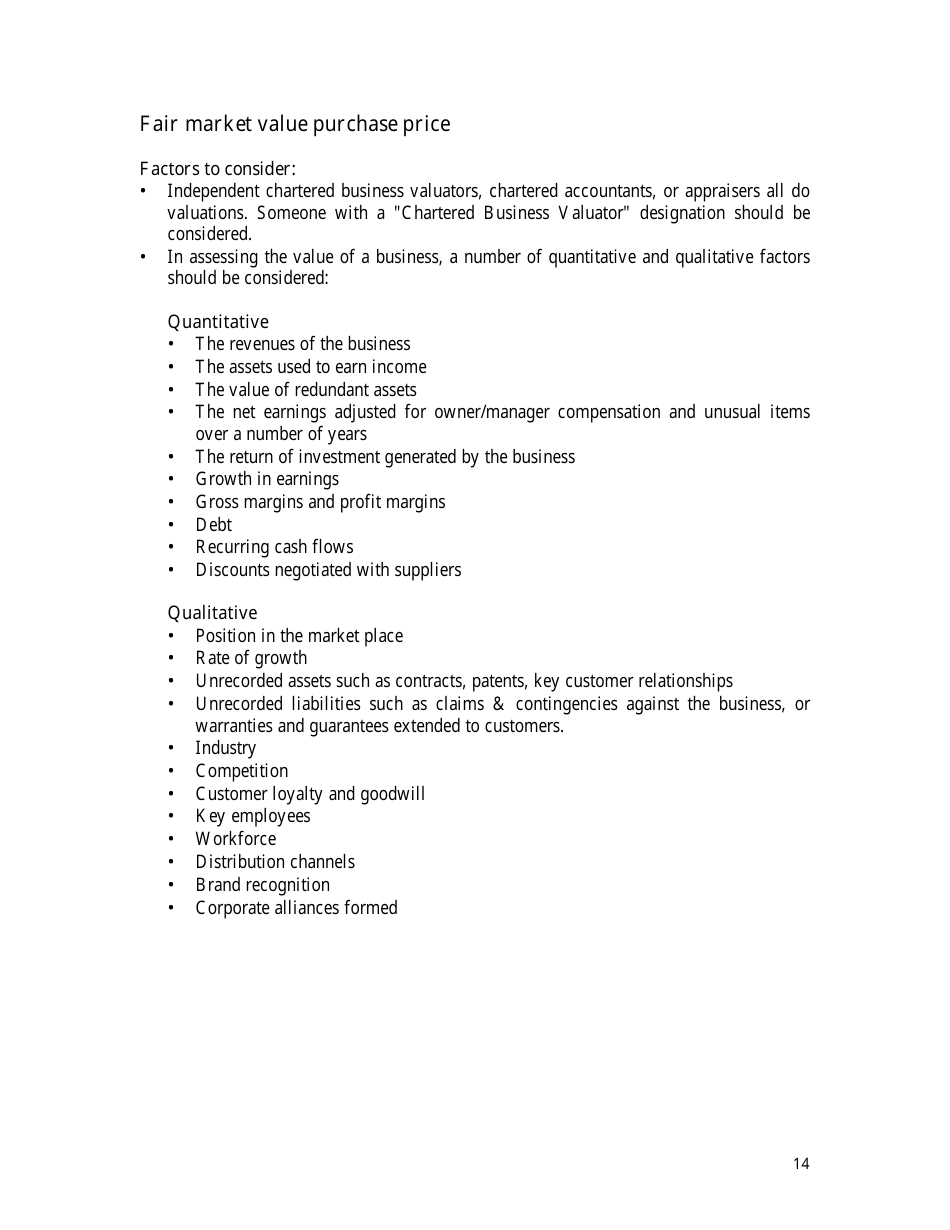

A: A buy-sell agreement should include details about the sale or transfer of shares, valuation methods for the business, funding sources for the buyout, and any restrictions or conditions on selling shares.

Q: What are the different types of buy-sell agreements?

A: The different types of buy-sell agreements include cross-purchase agreements, entity purchase agreements, and hybrid agreements.

Q: Who should have a buy-sell agreement?

A: Any business with multiple owners should have a buy-sell agreement in place to protect the interests of the owners and the business itself.

Q: Is a buy-sell agreement legally binding?

A: Yes, a buy-sell agreement is a legally binding contract that must be agreed upon and signed by all parties involved.

Q: Can a buy-sell agreement be changed or modified?

A: Yes, a buy-sell agreement can be changed or modified by mutual agreement of all parties involved in the agreement.

Q: What happens if there is no buy-sell agreement in place?

A: If there is no buy-sell agreement in place, the departure or death of a business owner can lead to disputes, financial complications, and potentially even the dissolution of the business.