Buy-Sell Agreement Template

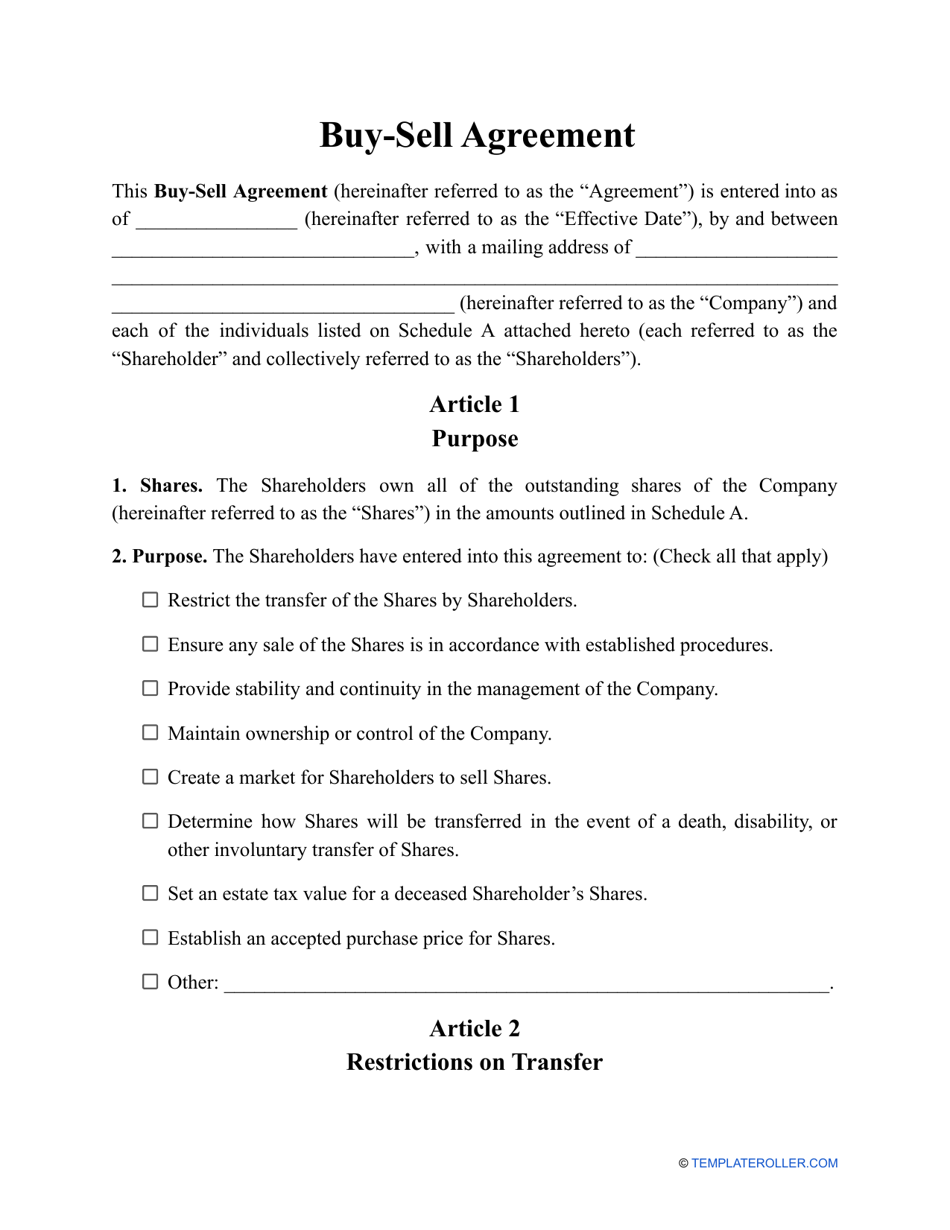

What Is a Buy-Sell Agreement?

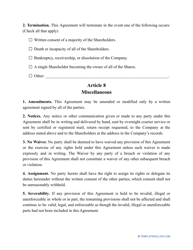

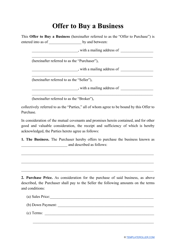

A Buy-Sell Agreement is a legally binding document that ensures that a business or a fraction of the business gets redistributed in the event that the business owner becomes unfit to run the business for specific reasons, mainly associated with death. Planning such an agreement ensures that the business has a clear strategy and plan of what to do if such an event occurs. In the absence of such an agreement, a business can face multiple issues regarding finances and legal questions.

Alternate Names:

- Buy and Sell Agreement;

- Buyout Agreement.

The main purpose of such an agreement prevents new business partners from being added to a company that may not know, understand, or care about the business - which could have obvious catastrophic effects on a business. Imagine a situation where a business partner passes away and their share of the business is inherited by one of their relatives. The agreement ensures that standard business operating tasks will still be carried out as planned.

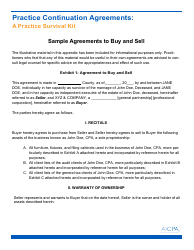

A Buy-Sell Agreement template can be downloaded by clicking the link below.

How Does a Buy-Sell Agreement Work?

A Buy-Sell Agreement sets out clear and concise steps regarding the passage of business ownership from the old business owner to the new owner. This usually occurs during the death of the business owner or if they decide to sell and retire from the company. In general, the outstanding share of the business will be sold to various individuals within the business.

Having such an agreement in place ensures that there is a clear strategy with previously agreed conditions regarding the sale of a business. It also outlines a fair price of shares. These factors will help prevent any potential conflicts if an owner wants to sell their share, as all of these details will be previously discussed and agreed upon in the agreement.

How Much Does a Buy-Sell Agreement Cost?

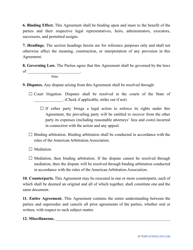

It would be difficult to put a definite price on the Buy-Sell Agreement as the overall price is dependent upon several factors mainly relating to the size of the business, the business structure and the level of intricacy required when forming the agreement. The costs are paid directly from the business to a lawyer that will often charge for:

- Consultations;

- Drafting of the agreement (costs for this vary between $700-$800 depending on the State);

- Reviewing the agreement (costs for this average between $1200-$1300 depending on the State);

- Potentially resolving any problems that arise as a result of the agreement.

If hired on an hourly basis, it could cost anything between $350-$450 per hour depending on the State. Although it may seem rather pricey to finalize all the details of the agreement, it will actually save you more cash in the long run if you can prove that you have a specific plan in place, should it need to be implemented.

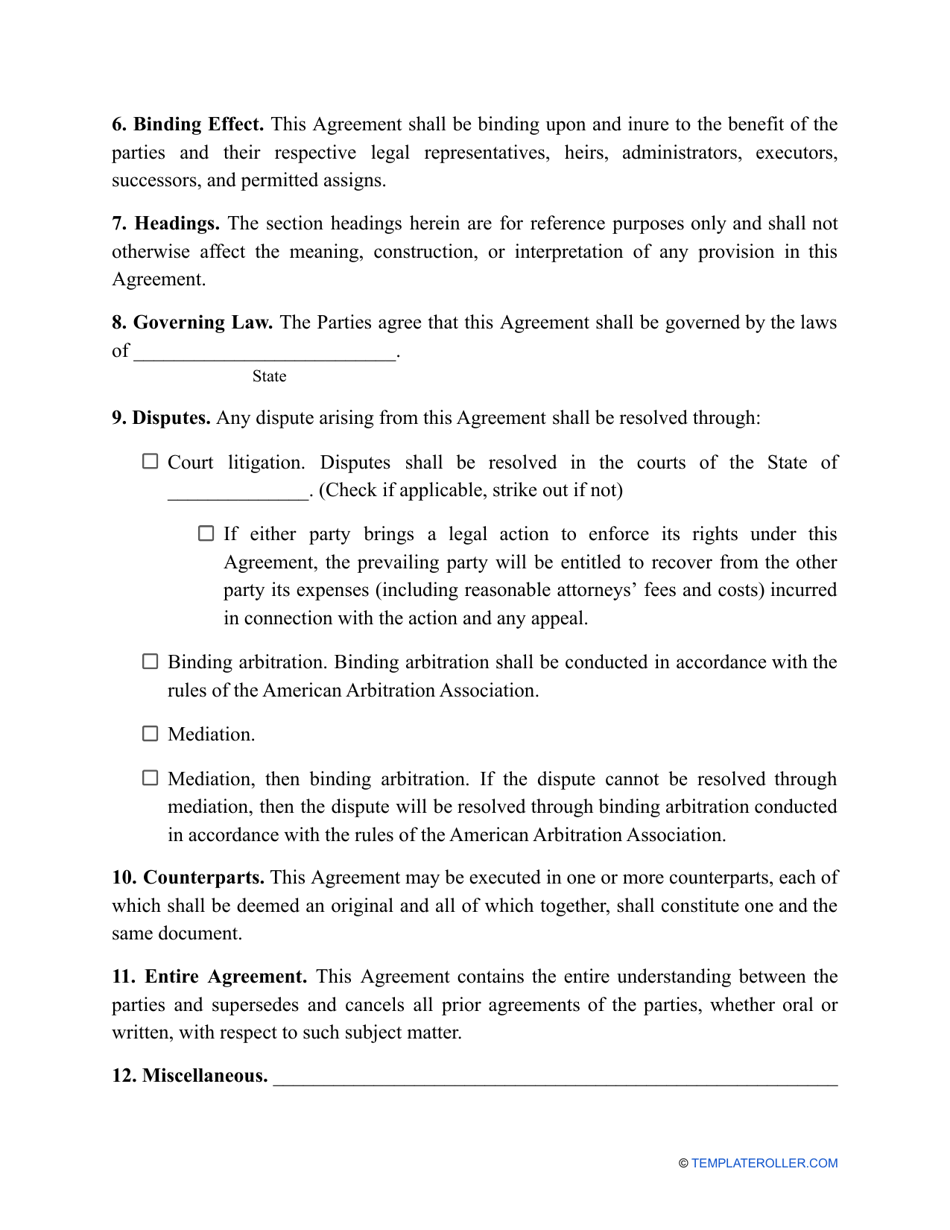

How to Write a Buy-Sell Agreement?

Although this would depend on the specific type of agreement, a simple Buy-Sell Agreement will always contain information regarding the valuation, the conditions of the agreement, and information regarding tax complications that could occur. If you want to draft a Buy-Sell Agreement individually, ensure that you take the following tips into account:

- The earlier the better . The earlier this agreement is agreed upon, drafted up, and signed - the better. This will prevent any potential emotional outbursts if done beforehand.

- Draft up the conditions . These conditions should cover two main things. The first of these is a clear strategy for the direction of the business should a successor come along. That way, they will know exactly what can and should be done. The second condition should outline a list of events that could cause the agreement to be triggered.

- Ensure all business partners have life insurance coverage for one another which will allow a business partner to successfully buy out their partner by ensuring that they have the necessary finances for this.

- Include the valuation of the business . This is crucial as it values the shares a partner holds should they decide to sell.

- Consider any tax complications that could arise, particularly those associated with estate taxes otherwise you could potentially be left with a lot less money than you would have initially hoped.

What Is a Cross-Purchase Buy-Sell Agreement?

A Cross-Purchase Buy-Sell Agreement is used when the shares of a partner are bought out by other business partners in events that are agreed upon in the agreement. Usually, this covers retirement, the sale of shares, or death. Usually, the shares can be of high value and the various partners may not have sufficient funds to buy out the shares immediately. This is why it is critical to take out life insurance coverage as these costs will help cover the costs associated with purchasing the shares of a former partner.

Still looking for a particular template? Take a look at the related templates below: