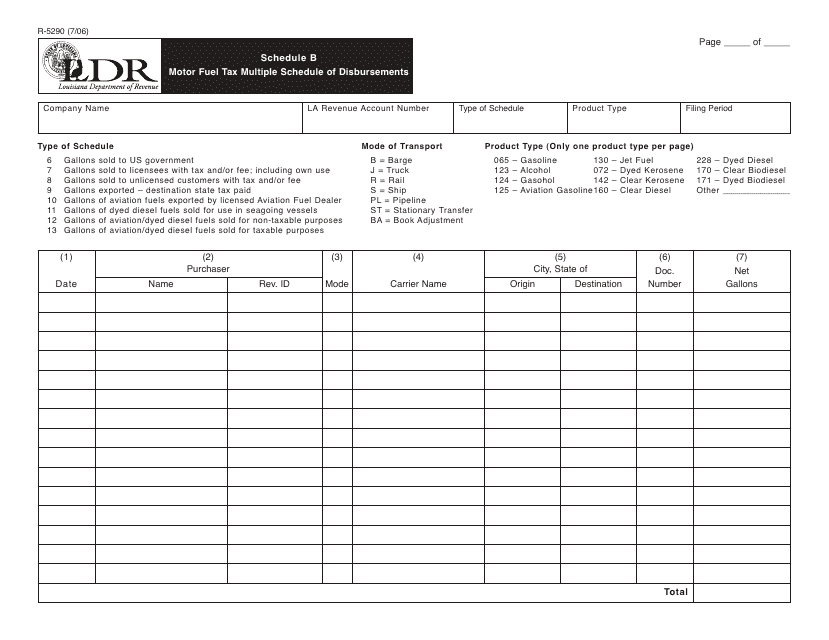

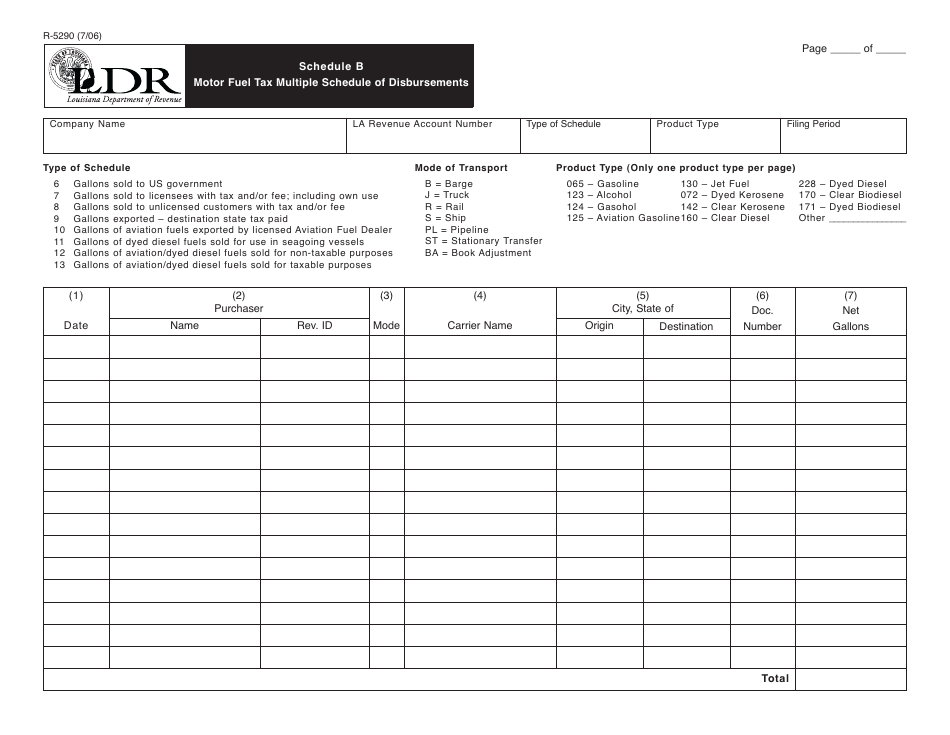

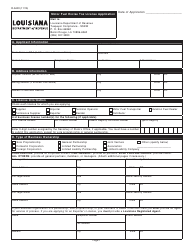

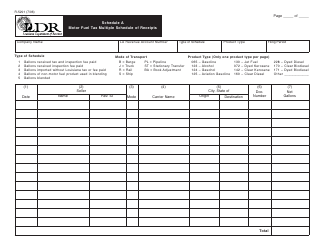

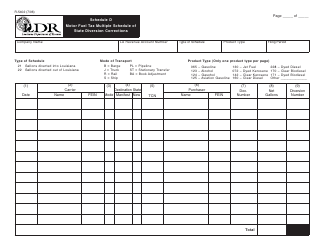

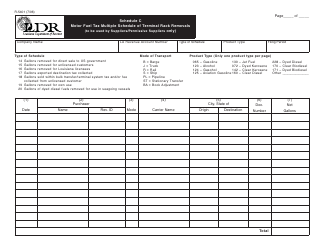

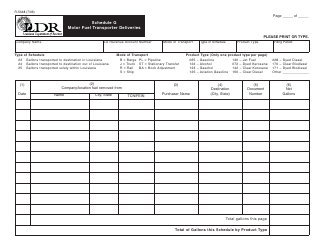

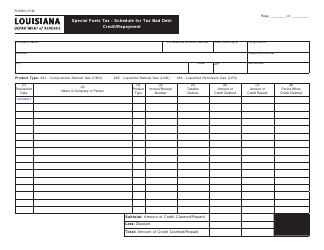

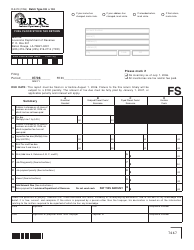

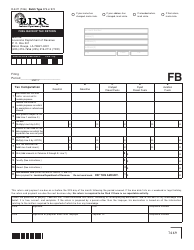

Form R-5290 Schedule B Motor Fuel Tax Multiple Schedule of Disbursements - Louisiana

What Is Form R-5290 Schedule B?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-5290 Schedule B?

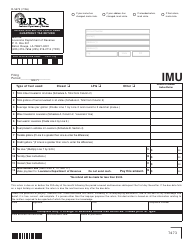

A: Form R-5290 Schedule B is a document used for reporting the disbursements of motor fuel tax in the state of Louisiana.

Q: What is the purpose of Schedule B?

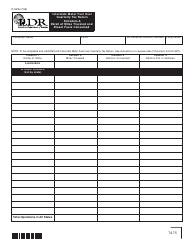

A: The purpose of Schedule B is to provide a detailed breakdown of the disbursements made by the taxpayer for motor fuel taxes in Louisiana.

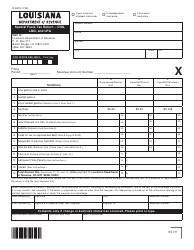

Q: What information is required on Schedule B?

A: Schedule B requires the taxpayer to provide information such as the date of disbursement, the recipient of the disbursement, the amount disbursed, and the reason for the disbursement.

Q: Who needs to fill out Schedule B?

A: Anyone who is required to report and pay motor fuel tax in Louisiana needs to fill out Schedule B if they have made any disbursements related to motor fuel taxes.

Q: Is there a deadline for filing Schedule B?

A: Yes, Schedule B must be filed by the due date specified by the Louisiana Department of Revenue, which is usually on a quarterly basis.

Form Details:

- Released on July 1, 2006;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-5290 Schedule B by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.