This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form I-027 Schedule 2WD

for the current year.

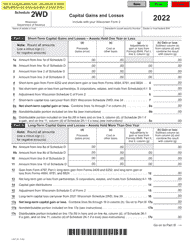

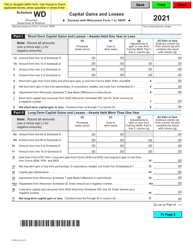

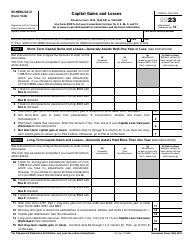

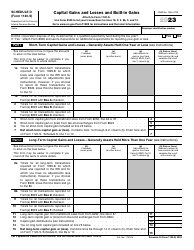

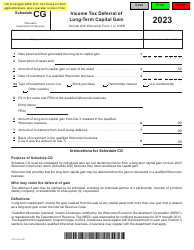

Instructions for Form I-027 Schedule 2WD Capital Gains and Losses - Wisconsin

This document contains official instructions for Form I-027 Schedule 2WD, Capital Gains and Losses - a form released and collected by the Wisconsin Department of Revenue. An up-to-date fillable Form I-027 Schedule 2WD is available for download through this link.

FAQ

Q: What is Form I-027?

A: Form I-027 is the Schedule 2WD used to report capital gains and losses for Wisconsin.

Q: What is a capital gain?

A: A capital gain is a profit made from the sale of a capital asset like stocks, real estate, or bonds.

Q: What is a capital loss?

A: A capital loss is the opposite of a capital gain and occurs when a capital asset is sold for less than its original purchase price.

Q: Who needs to fill out Form I-027?

A: Resident individuals, part-year residents, and nonresidents who have capital gains or losses from Wisconsin sources are required to fill out this form.

Q: Do I need to include all my capital gains and losses on Form I-027?

A: Yes, you need to include all capital gains and losses from Wisconsin sources on this form, even if you have federal capital gains or losses that aren't taxable in Wisconsin.

Q: When is the deadline for filing Form I-027?

A: The deadline for filing Form I-027 is the same as the deadline for filing your Wisconsin income tax return, which is usually April 15th.

Q: Can I file Form I-027 electronically?

A: Yes, you can file Form I-027 electronically using the Wisconsin e-file system.

Q: What should I do if I have questions or need assistance with Form I-027?

A: If you have questions or need assistance with Form I-027, you can contact the Wisconsin Department of Revenue or seek help from a tax professional.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.