This version of the form is not currently in use and is provided for reference only. Download this version of

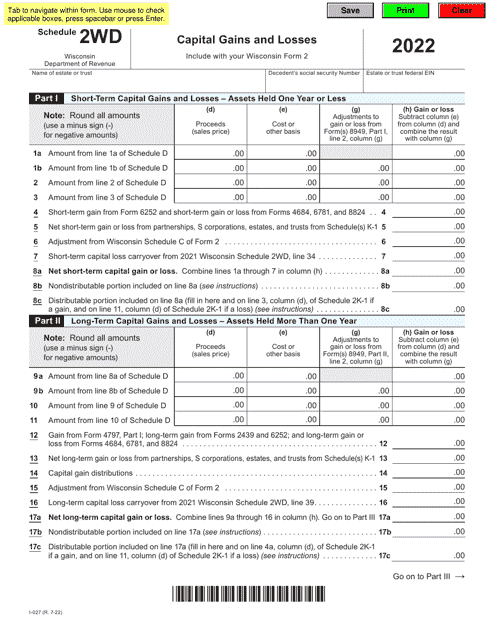

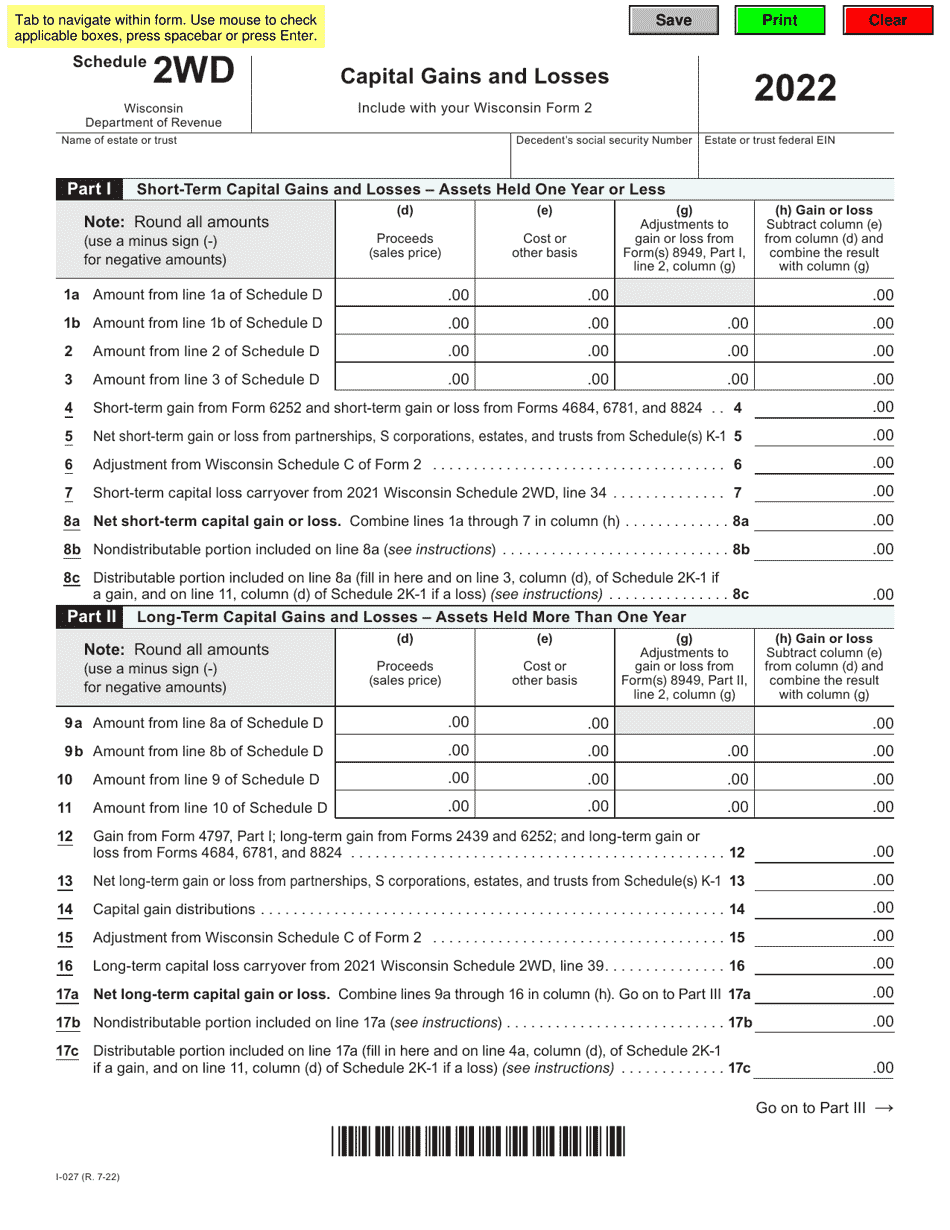

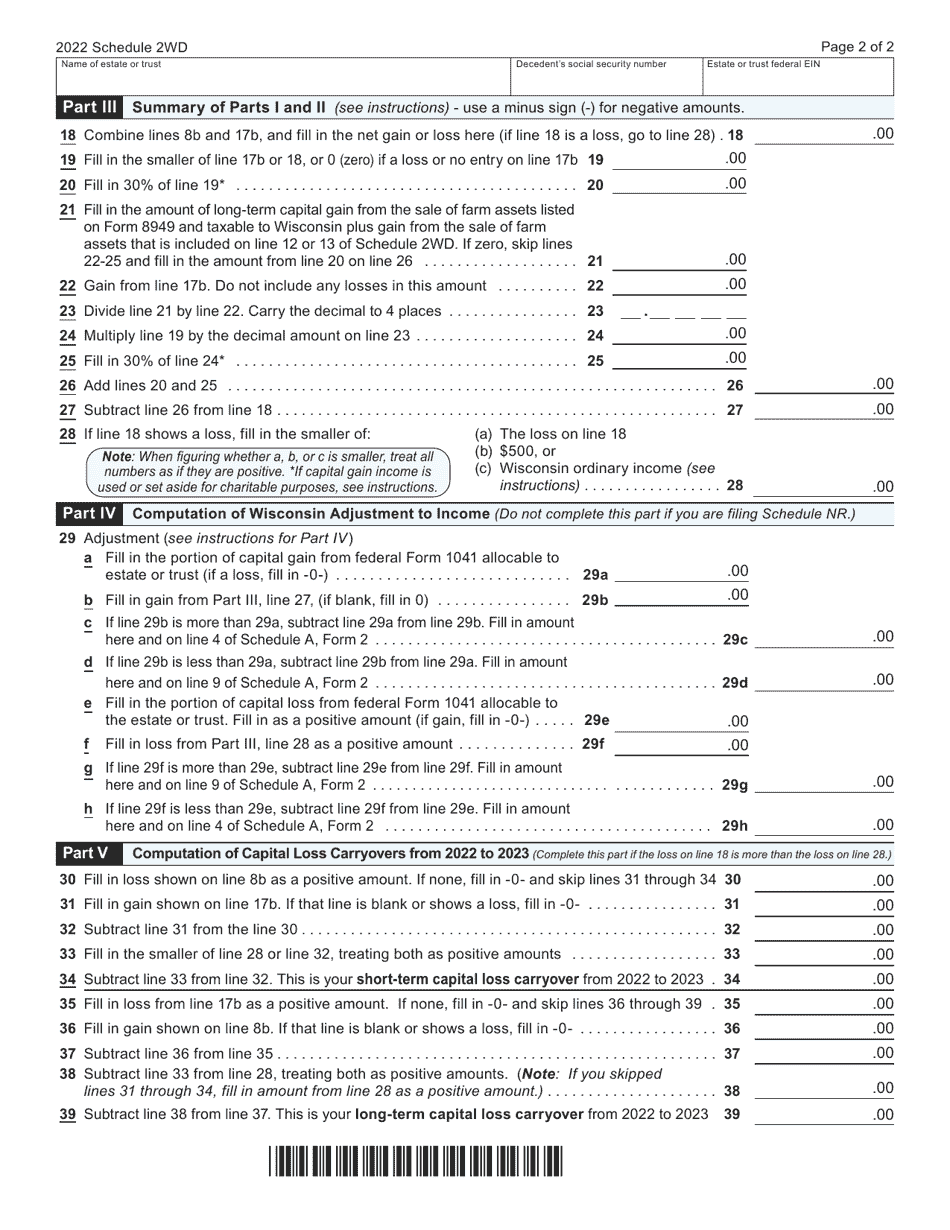

Form I-027 Schedule 2WD

for the current year.

Form I-027 Schedule 2WD Capital Gains and Losses - Wisconsin

What Is Form I-027 Schedule 2WD?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form I-027?

A: Form I-027 is a tax form used to report capital gains and losses in Wisconsin.

Q: Who needs to file Form I-027?

A: Anyone who has capital gains or losses in Wisconsin needs to file Form I-027.

Q: What are capital gains and losses?

A: Capital gains are the profits from selling a capital asset, such as stocks or real estate. Capital losses are the losses from selling a capital asset.

Q: What is Schedule 2WD?

A: Schedule 2WD is a specific part of Form I-027 that is used to report capital gains and losses in Wisconsin.

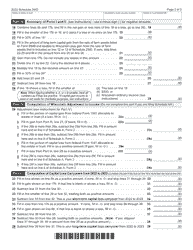

Q: How do I fill out Schedule 2WD?

A: You will need to provide information about each capital gain or loss, including the date of sale, the purchase price, and the sale price.

Q: When is Form I-027 due?

A: Form I-027 is typically due on the same date as your federal tax return, which is typically April 15th.

Q: Can I file Form I-027 electronically?

A: Yes, you can file Form I-027 electronically if you are using tax software that supports Wisconsin state tax returns.

Q: What happens if I don't file Form I-027?

A: If you have capital gains or losses in Wisconsin and fail to file Form I-027, you may face penalties and interest on any taxes owed.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form I-027 Schedule 2WD by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.