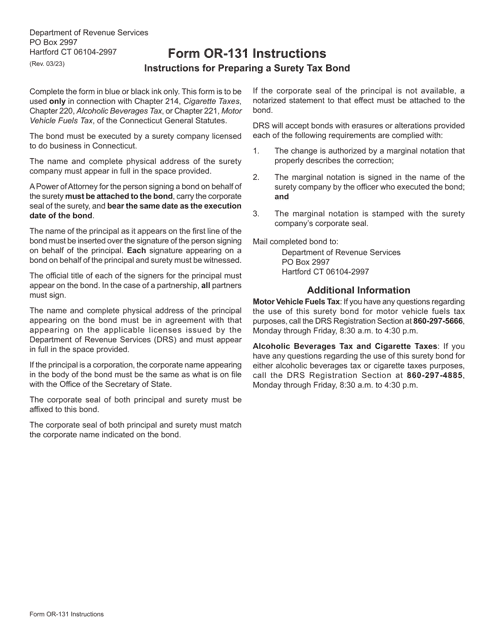

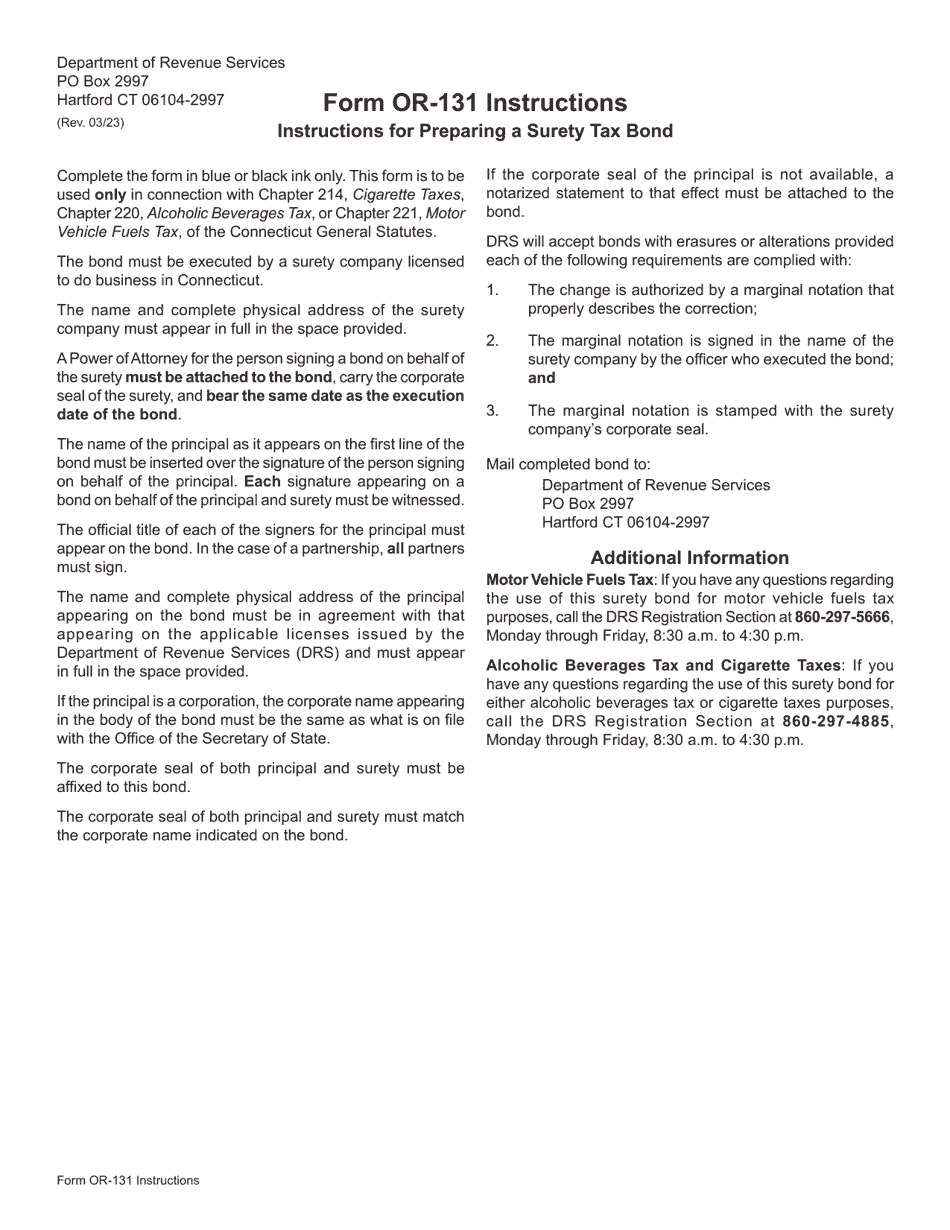

Instructions for Form OR-131 Surety Tax Bond - Connecticut

This document contains official instructions for Form OR-131 , Surety Tax Bond - a form released and collected by the Connecticut Department of Revenue Services.

FAQ

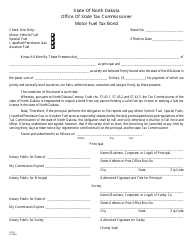

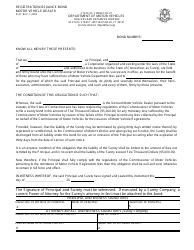

Q: What is Form OR-131 Surety Tax Bond?

A: Form OR-131 Surety Tax Bond is a document used to provide a surety bond to the Connecticut Department of Revenue Services as a guarantee that the taxpayer will fulfill their tax obligations.

Q: Who needs to use Form OR-131 Surety Tax Bond?

A: Taxpayers in Connecticut who are required to provide a surety bond to the Department of Revenue Services are required to use Form OR-131.

Q: What is the purpose of a surety bond?

A: A surety bond is used as a financial guarantee that the taxpayer will pay their tax obligations in full and on time.

Q: Is there a fee for filing Form OR-131 Surety Tax Bond?

A: There may be a fee associated with filing Form OR-131 Surety Tax Bond. The specific fee amount can be found in the instructions for the form.

Q: What should I do with the completed Form OR-131 Surety Tax Bond?

A: The completed Form OR-131 Surety Tax Bond should be submitted to the Connecticut Department of Revenue Services along with any required supporting documentation.

Q: What happens if I fail to provide a surety bond?

A: If you fail to provide a surety bond when required, it may result in penalties and interest being assessed on your tax liabilities.

Q: Can I cancel or withdraw a surety bond?

A: Yes, a surety bond can be canceled or withdrawn. You should consult the Connecticut Department of Revenue Services for the specific procedures and requirements.

Q: Are there any alternatives to providing a surety bond?

A: Yes, there may be alternative options available, such as a cash deposit or an irrevocable letter of credit. You should consult the Connecticut Department of Revenue Services for more information.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Connecticut Department of Revenue Services.