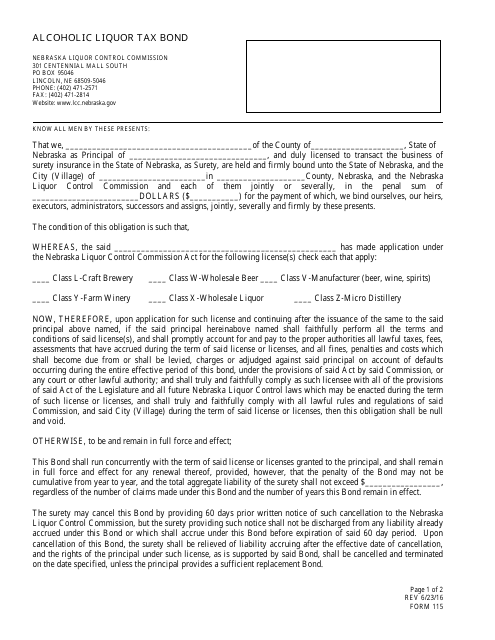

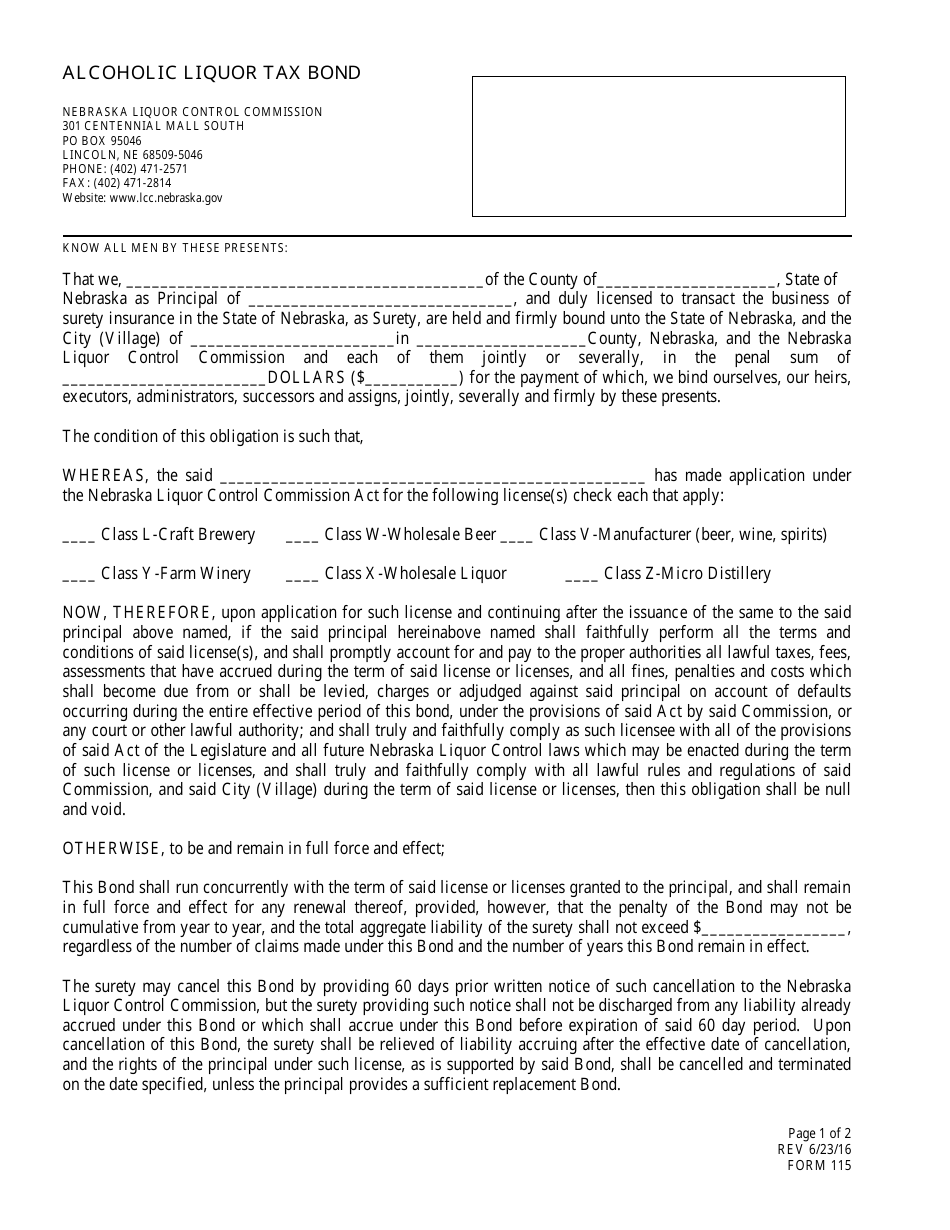

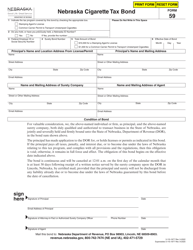

Form 115 Alcoholic Liquor Tax Bond - Nebraska

What Is Form 115?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 115?

A: Form 115 is the Alcoholic LiquorTax Bond used in the state of Nebraska.

Q: What is the purpose of Form 115?

A: The purpose of Form 115 is to provide a guarantee that the taxpayer will pay all required alcoholic liquor taxes in Nebraska.

Q: Who needs to file Form 115?

A: Any person engaged in the business of manufacturing, rectifying, blending, bottling or wholesaling alcoholic liquor in Nebraska needs to file Form 115.

Q: What information is required on Form 115?

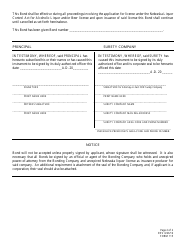

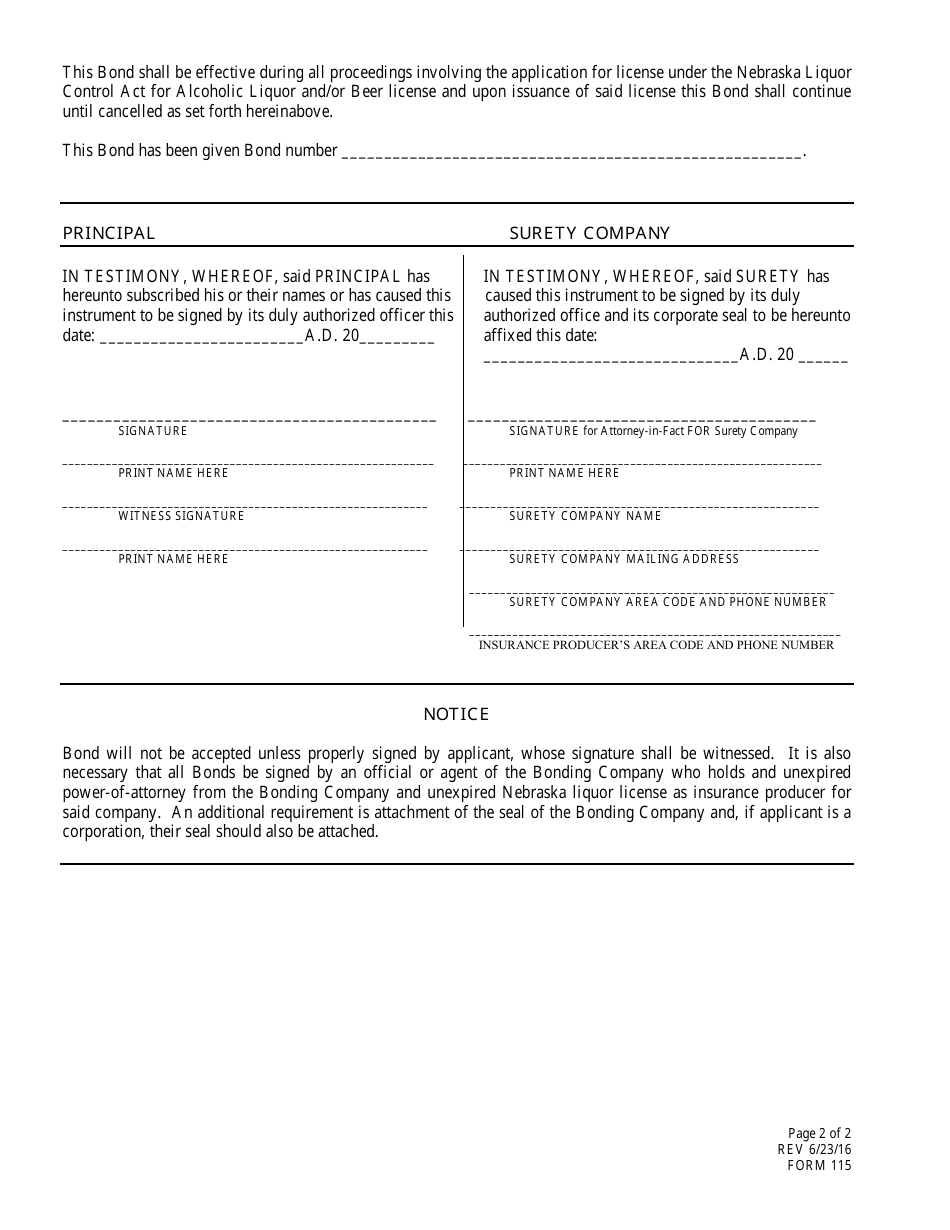

A: Form 115 requires information about the business, taxpayer identification numbers, bond information, and the signatures of the principal and surety.

Q: Can Form 115 be filed electronically?

A: No, Form 115 cannot be filed electronically. It must be filed in paper format and mailed to the Nebraska Department of Revenue.

Q: Is there a deadline for filing Form 115?

A: Yes, Form 115 must be filed at least 10 days prior to engaging in the business of manufacturing, rectifying, blending, bottling, or wholesaling alcoholic liquor.

Q: Do I need to renew Form 115?

A: No, Form 115 does not need to be renewed as long as the bond remains in effect.

Q: What happens if I fail to file Form 115?

A: Failure to file Form 115 may result in penalties, fines, or the revocation of your alcoholic liquor license.

Q: Are there any exemptions to filing Form 115?

A: Yes, certain entities such as non-profit organizations, governmental entities, and certain manufacturers are exempt from filing Form 115. Please consult the Nebraska Department of Revenue for more information.

Form Details:

- Released on June 23, 2016;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 115 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.