Instructions for Valuation Notice - Minnesota

This document was released by Minnesota Department of Revenue and contains the most recent official instructions for Valuation Notice .

FAQ

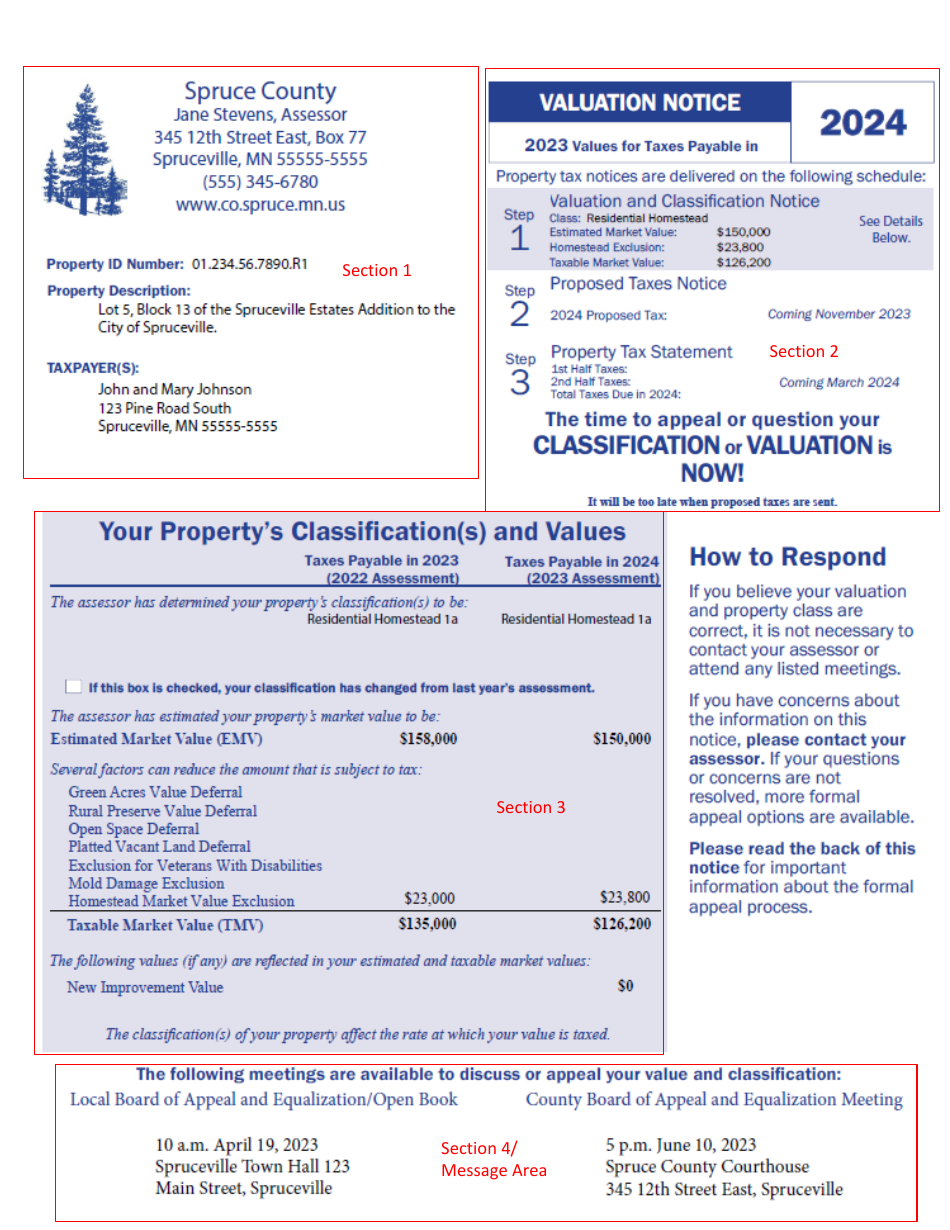

Q: What is a Valuation Notice?

A: A Valuation Notice is a document that provides you with the assessed value of your property for tax purposes.

Q: Why am I receiving a Valuation Notice?

A: You are receiving a Valuation Notice because it is the annual assessment of your property's value for property tax purposes.

Q: How is the assessed value determined?

A: The assessed value is determined based on the market value of your property as of January 2nd of the assessment year.

Q: Can I appeal the assessed value?

A: Yes, you have the right to appeal the assessed value if you believe it is incorrect. The Valuation Notice will provide instructions on how to do so.

Q: Are there any exemptions or credits available?

A: Yes, there may be exemptions or credits available that could reduce your property taxes. Contact your local assessor's office for more information.

Q: What should I do if I disagree with the Valuation Notice?

A: If you disagree with the Valuation Notice, you should contact your local assessor's office to discuss your concerns and explore your options.

Q: When is the deadline to appeal the assessed value?

A: The deadline to appeal the assessed value is usually 30 days from the date of the Valuation Notice, but it may vary depending on your jurisdiction.

Q: What happens if I don't appeal the assessed value?

A: If you don't appeal the assessed value, it will be used to calculate your property taxes for the upcoming tax year.

Q: Can the assessed value change from year to year?

A: Yes, the assessed value can change from year to year based on changes in the market value of your property.

Q: Is the assessed value the same as the market value?

A: No, the assessed value is not necessarily the same as the market value of your property. The assessed value is used for property tax purposes only.

Instruction Details:

- This 8-page document is available for download in PDF;

- Might not be applicable for the current year. Choose an older version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Minnesota Department of Revenue.