Instructions for Form GAC113, GAC114 - Minnesota

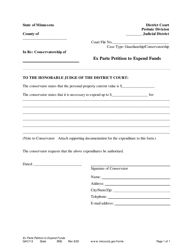

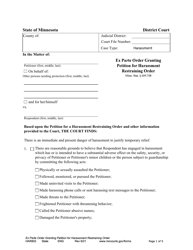

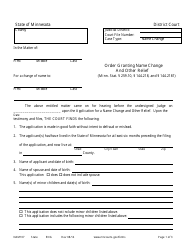

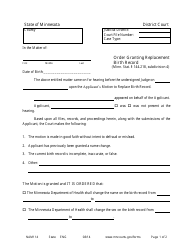

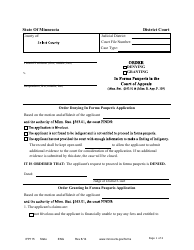

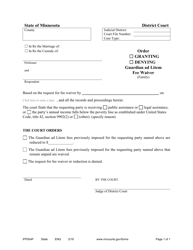

This document contains official instructions for Form GAC113 , and Form GAC114 . Both forms are released and collected by the Minnesota District Courts. An up-to-date fillable Form GAC113 is available for download through this link. The latest available Form GAC114 can be downloaded through this link.

FAQ

Q: What is Form GAC113?

A: Form GAC113 is a form used in Minnesota for submitting individual income tax returns.

Q: What is Form GAC114?

A: Form GAC114 is a form used in Minnesota for submitting corporate income tax returns.

Q: Who needs to file Form GAC113?

A: Any individual who is a resident of Minnesota and has income to report needs to file Form GAC113.

Q: Who needs to file Form GAC114?

A: Any corporation that operates or does business in Minnesota needs to file Form GAC114.

Q: What information do I need to complete Form GAC113?

A: You will need information on your income, deductions, and credits.

Q: What information do I need to complete Form GAC114?

A: You will need information on your corporation's income and expenses.

Q: When is the deadline for filing Form GAC113?

A: The deadline for filing Form GAC113 is April 15th.

Q: When is the deadline for filing Form GAC114?

A: The deadline for filing Form GAC114 is the 15th day of the 4th month following the close of the corporation's taxable year.

Q: Can I file Form GAC113 and GAC114 electronically?

A: Yes, you can file Form GAC113 and GAC114 electronically using the Minnesota Department of Revenue's e-Services system.

Q: What happens if I file Form GAC113 or GAC114 after the deadline?

A: If you file Form GAC113 or GAC114 after the deadline, you may be subject to penalties and interest on any amount due.

Q: Can I get an extension to file Form GAC113 or GAC114?

A: Yes, you can request an extension to file Form GAC113 or GAC114, but you will still need to pay any tax due by the original deadline.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Minnesota District Courts.