This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC66

for the current year.

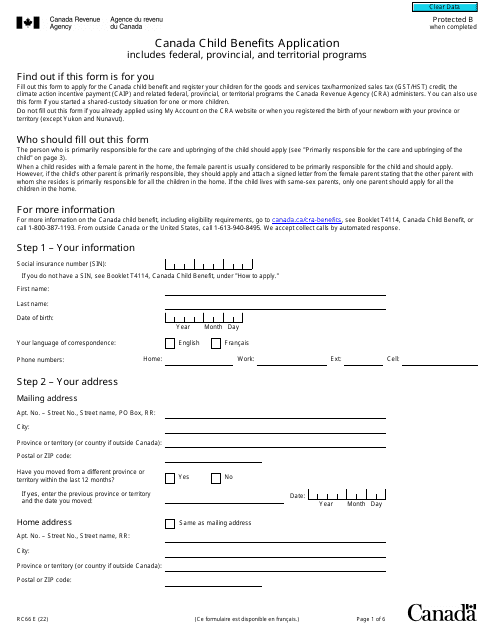

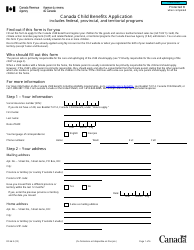

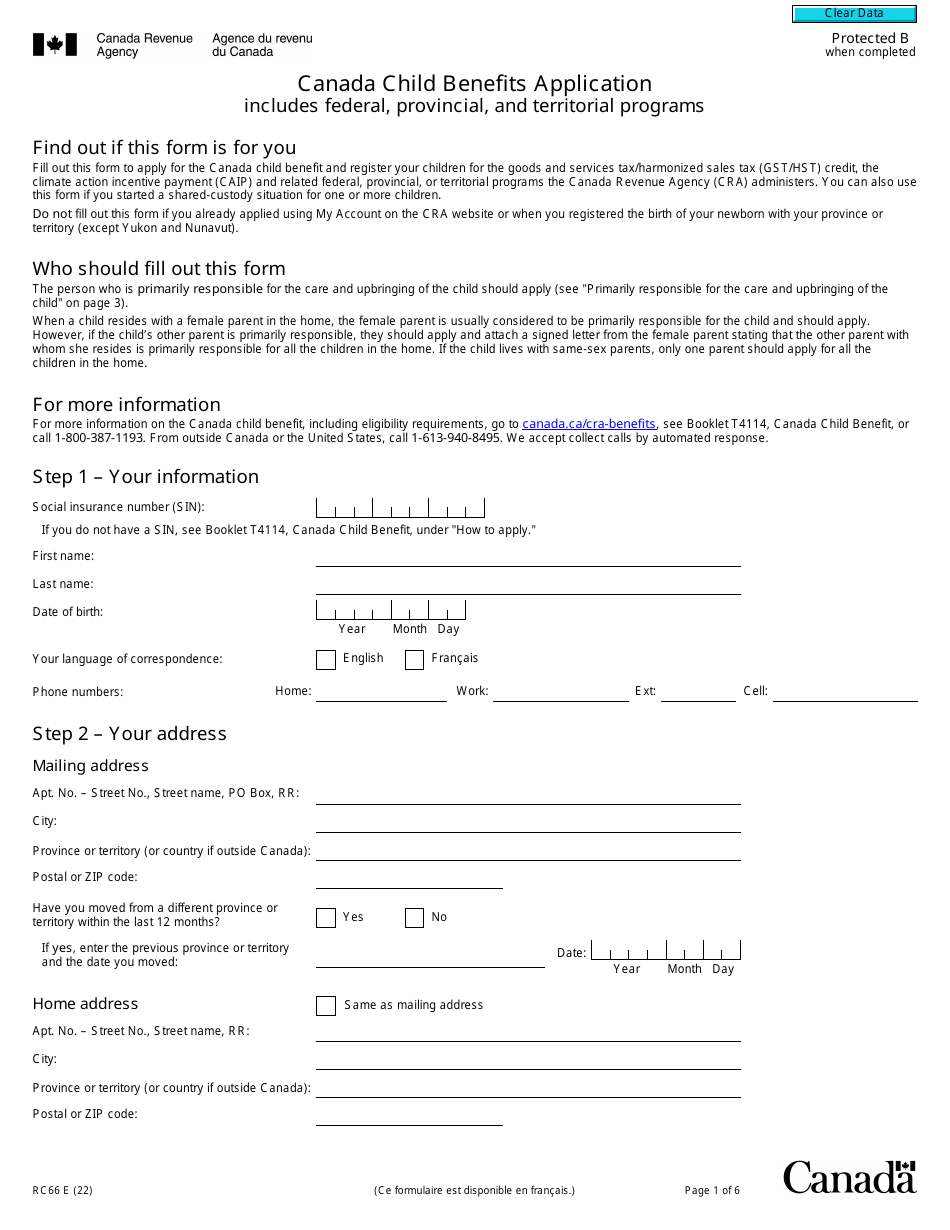

Form RC66 Canada Child Benefits Application Includes Federal, Provincial, and Territorial Programs - Canada

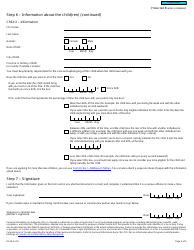

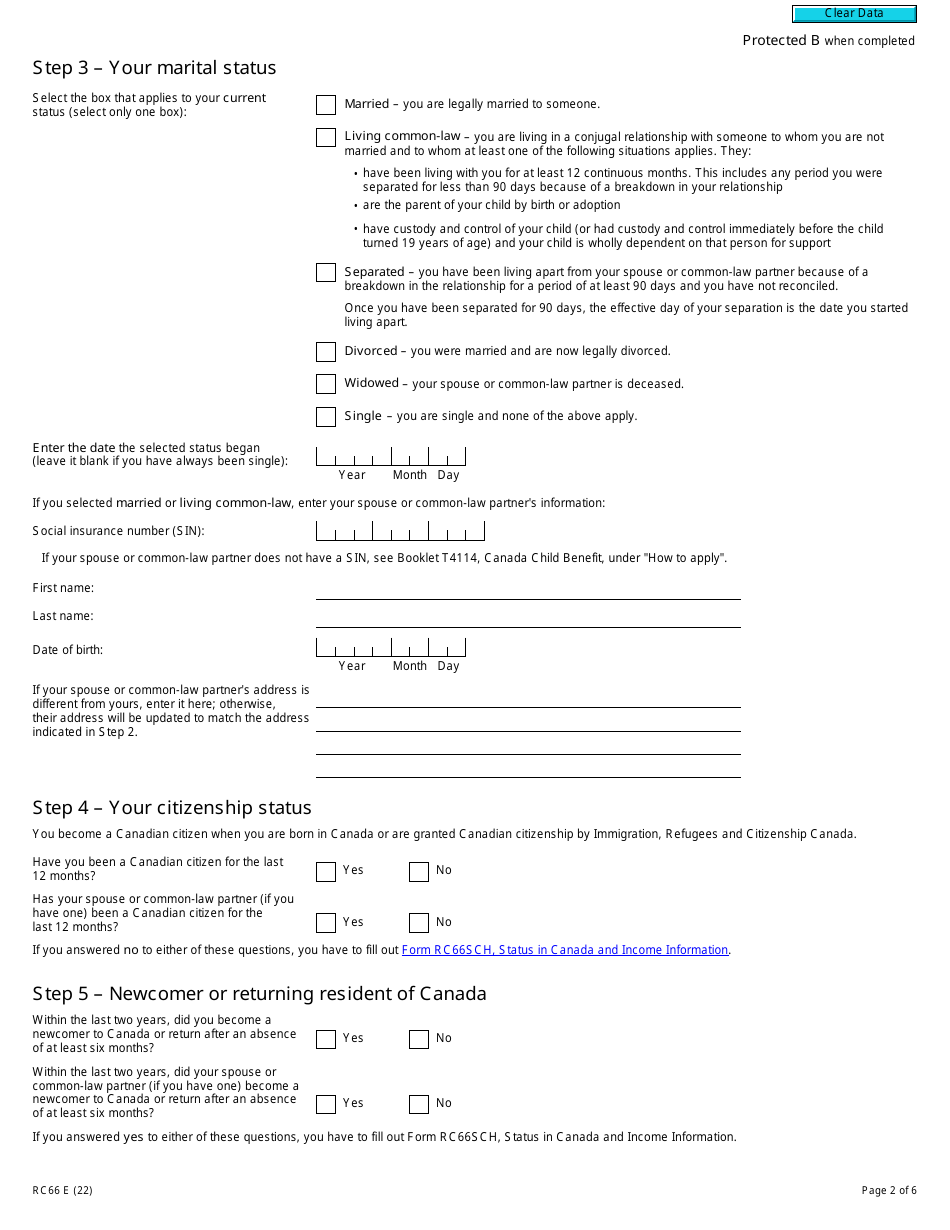

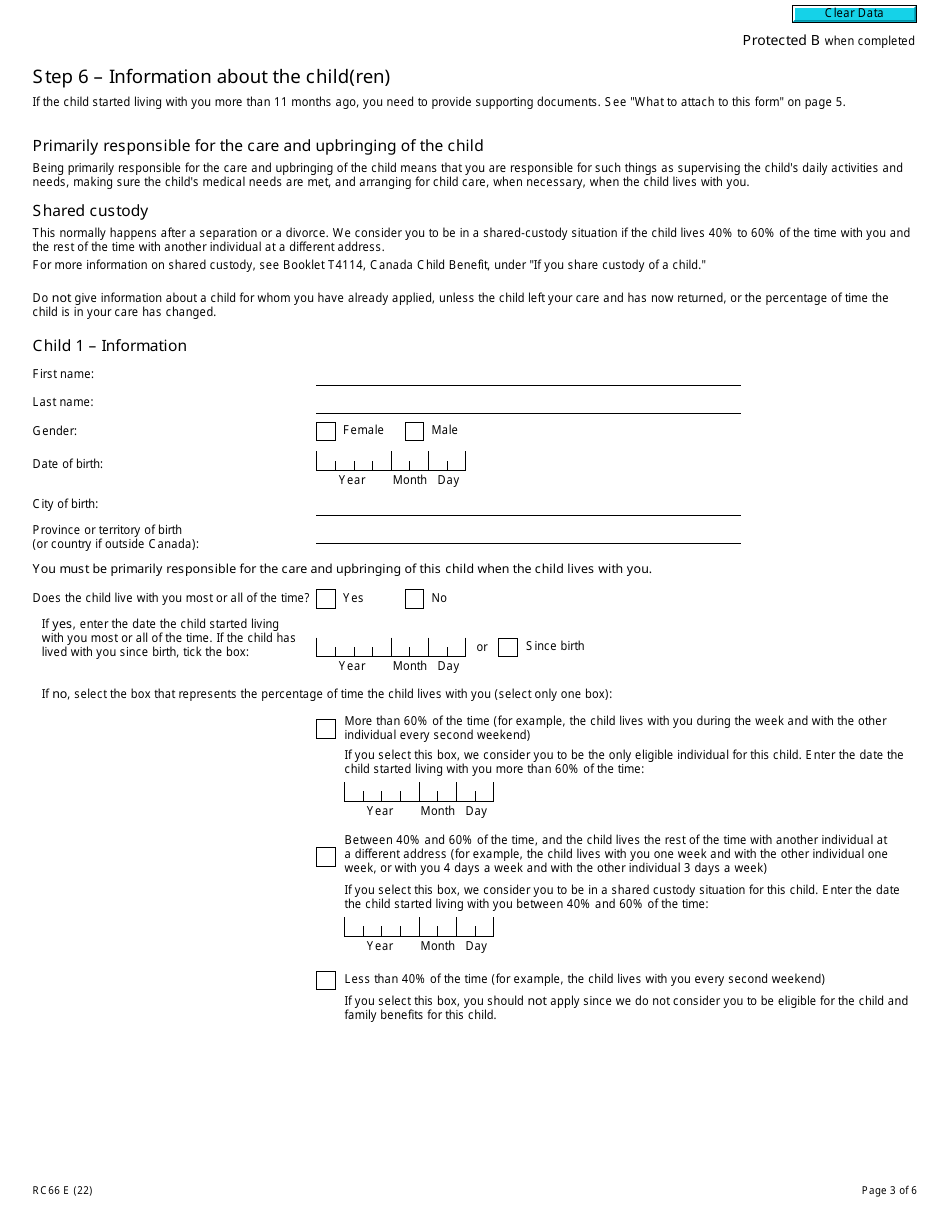

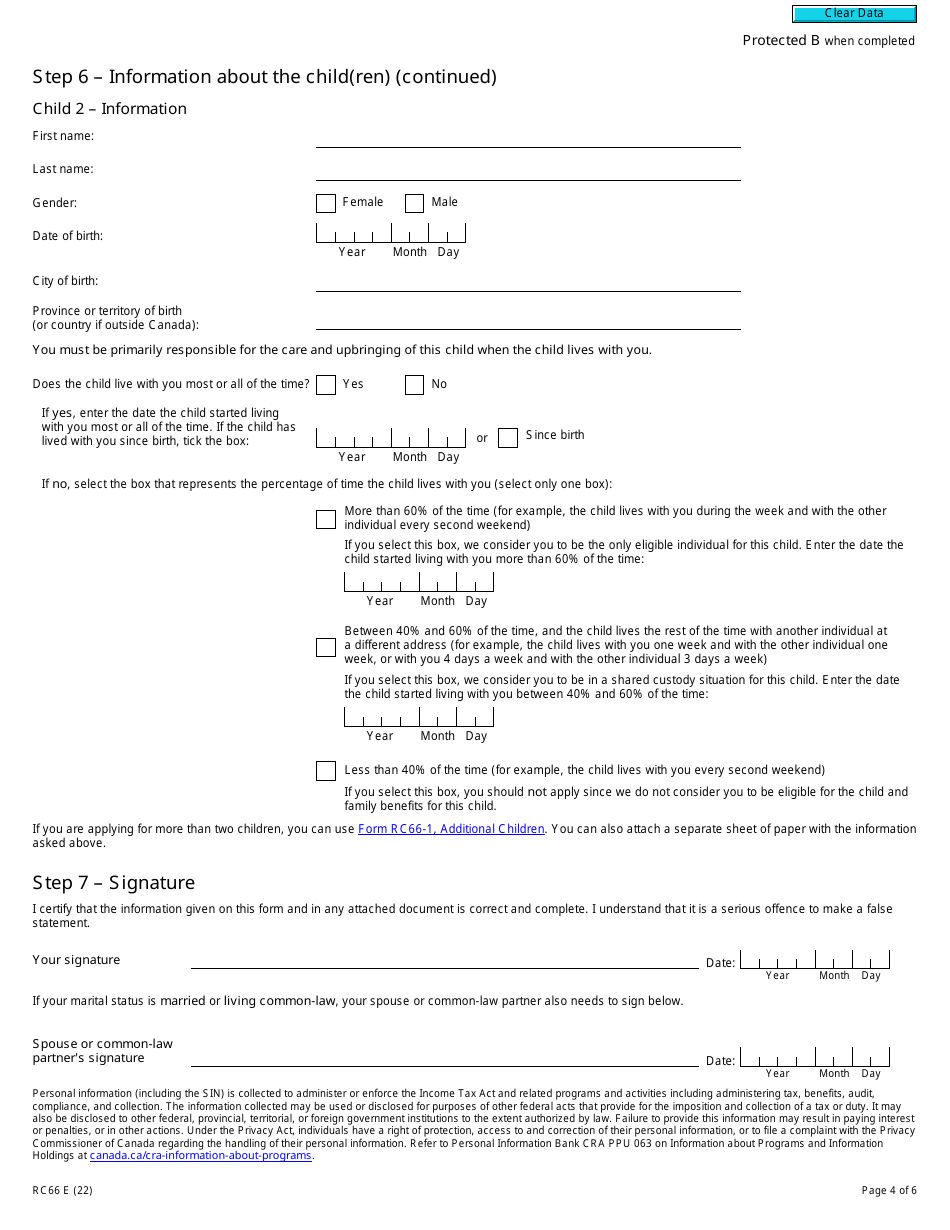

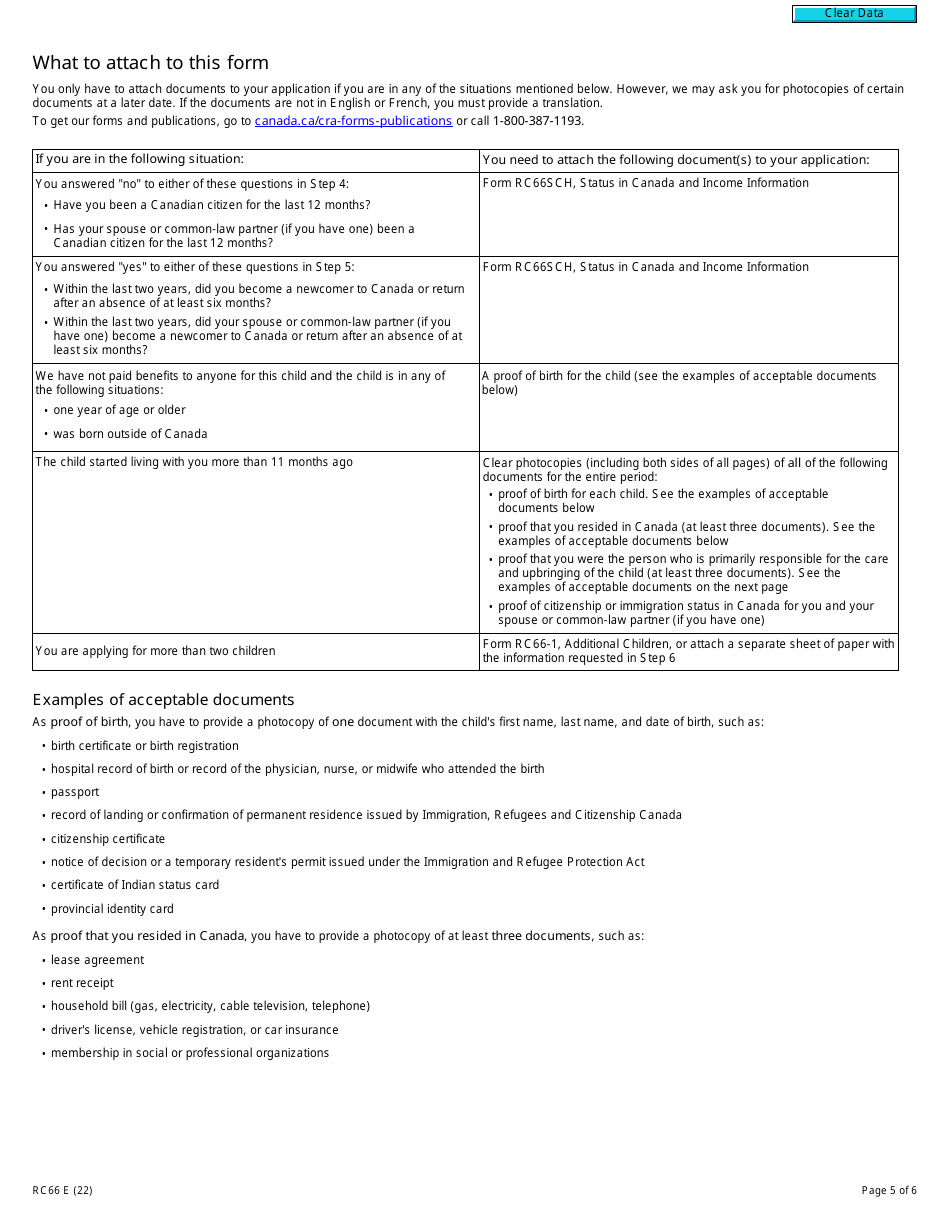

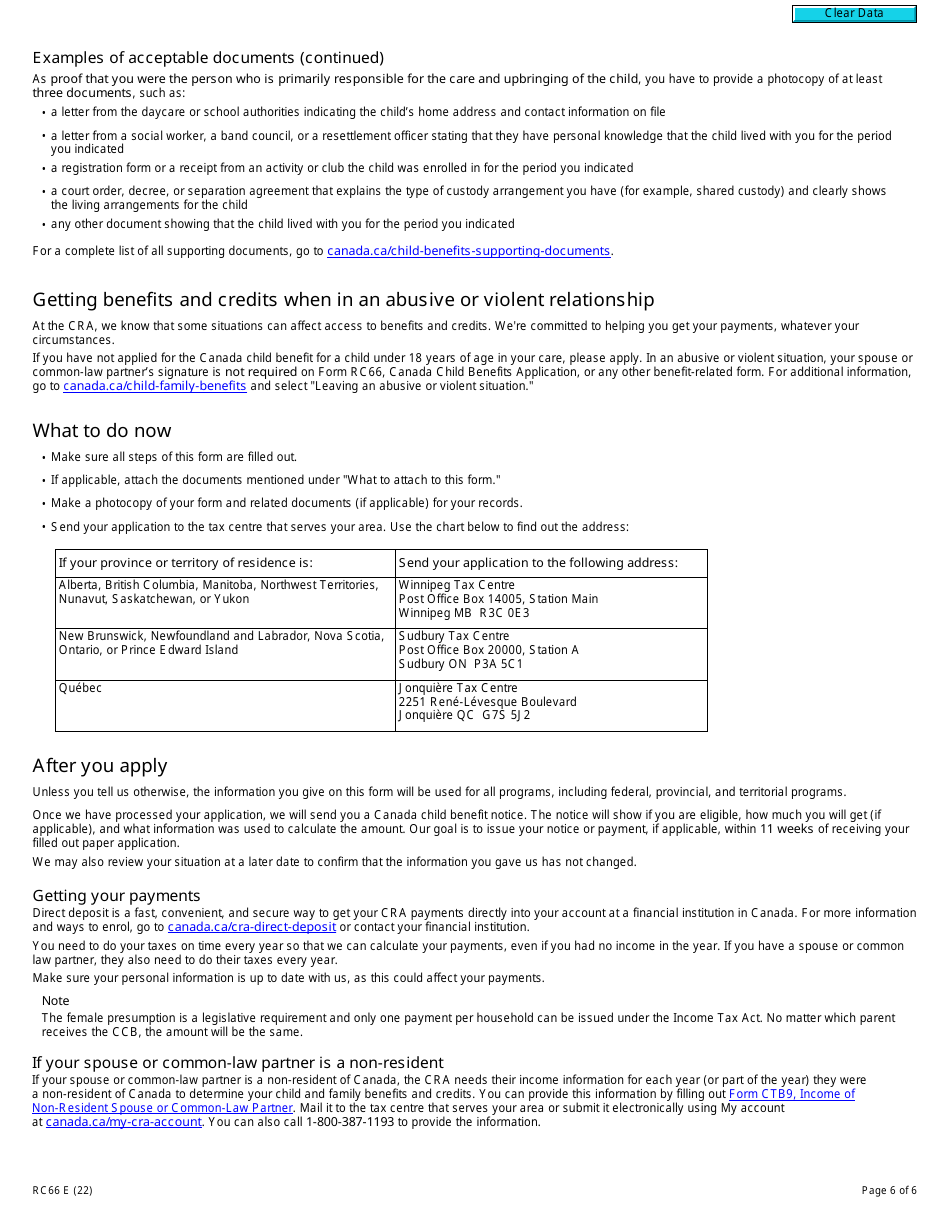

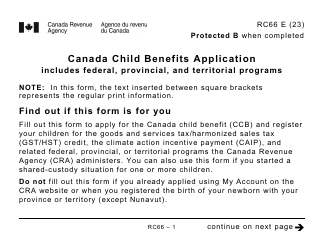

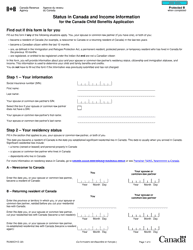

Form RC66, also known as the Canada Child Benefits Application, is a form used in Canada to apply for child benefits. This includes the Canada Child Benefit (CCB) provided by the federal government, as well as any provincial or territorial benefits that may apply. The purpose of these benefits is to provide financial assistance to families in Canada with children under 18 to help cover the costs of raising them. This form needs to be completed by parents or guardians to provide necessary information to the appropriate government entities so they can determine eligibility and calculate the benefit amount.

The Form RC66, which is the Canada Child Benefits Application including federal, provincial, and territorial programs, is typically filed by parents or legal guardians who primarily care for the child. They need to be residents of Canada for tax purposes and the child must be under 18 years of age. This form is used to apply for all child benefit programs including the Canada Child Benefit, the Child Disability Benefit, and any related provincial or territorial programs.

FAQ

Q: What is the Form RC66 in Canada?

A: Form RC66 in Canada is a Child Benefits Application form that is used to apply for all child benefit programs. This includes federal, provincial, and territorial programs.

Q: Who is eligible for the Canada child benefits?

A: Residents of Canada who have primary care and custody of a child under 18 are eligible for Canada child benefits. You must also be a Canadian citizen, a permanent resident, a protected person, or temporary resident who has lived in Canada for the past 18 months.

Q: How can I apply for Child Benefits in Canada?

A: You can apply for Child Benefits in Canada by filling out the Form RC66. This form can be submitted digitally or mailed to the Canada Revenue Agency.

Q: What types of programs are included in the Canada child benefits?

A: The Canada child benefits include the Canada Child Benefit, the Additional Child Amount, and any related provincial or territorial benefits.