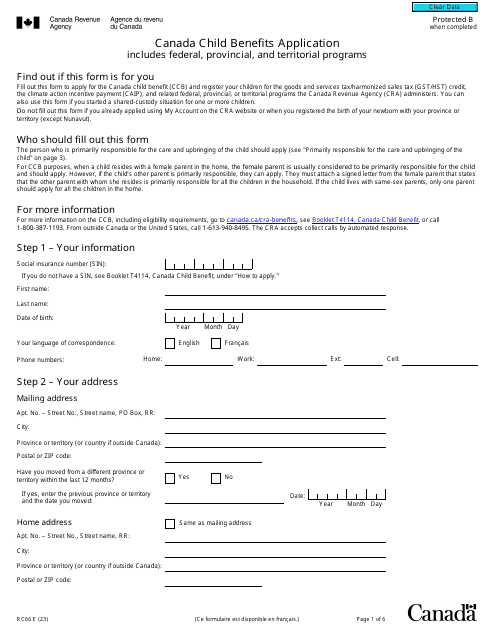

Form RC66 Canada Child Benefits Application Includes Federal, Provincial, and Territorial Programs - Canada

What Is Form RC66?

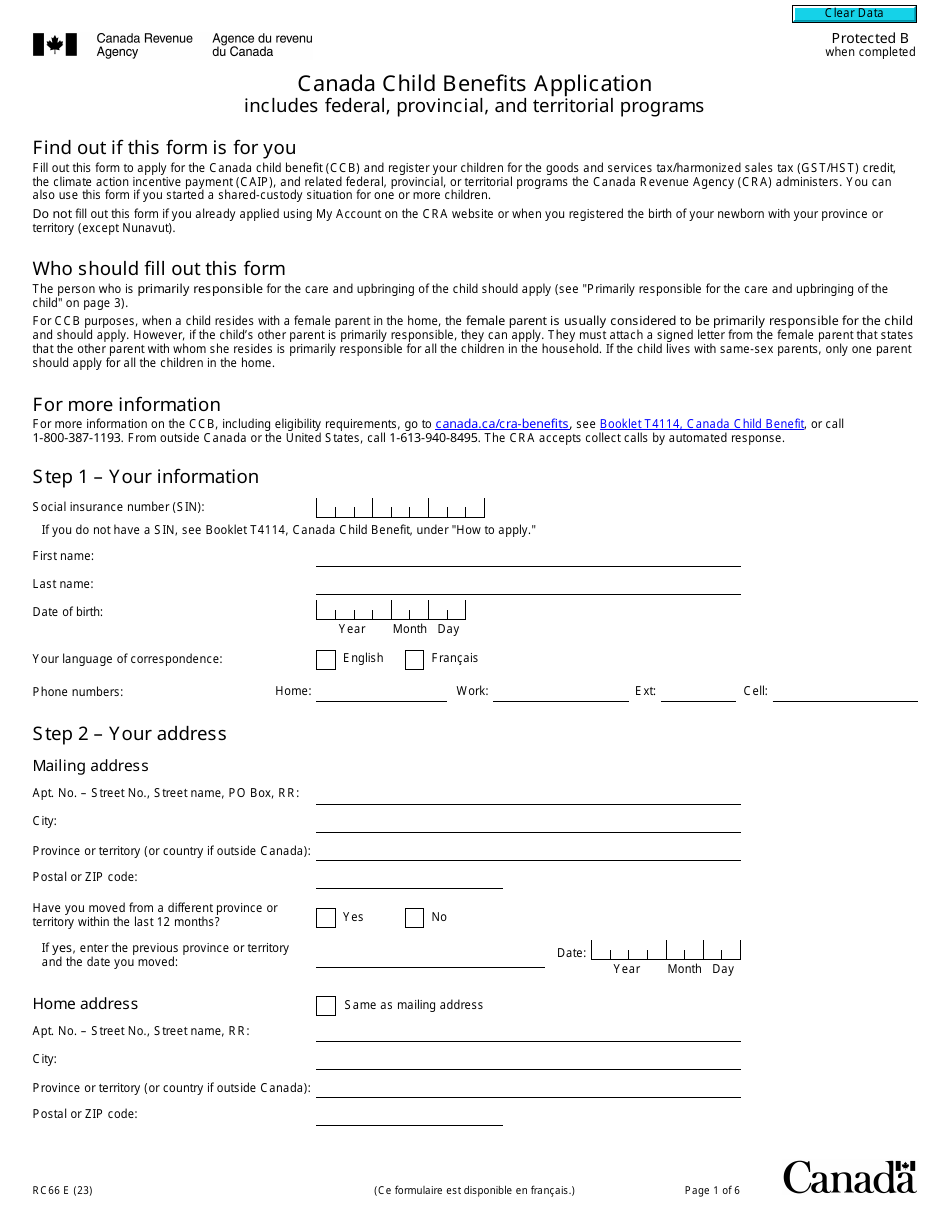

Form RC66, Canada Child Benefits Application , is used when the primary caregiver for a child is applying to take advantage of the benefits and credits Canada makes available as part of their benefits programs for children. This form is used by single parents or guardians of a child or a couple that is separated or divorced and has either a shared custody agreement or one parent agrees to be the primary caregiver.

Alternate Names:

- Child Tax Benefit Application Form;

- Child Tax Benefit Form.

This form is issued by the Canadian Revenue Agency (CRA) and was last updated on January 1, 2023 . A fillable Child Tax Benefit Application Form is available for download below. A large-print version of this document can be found through this link.

How to Fill Out a Child Tax Benefits Application Form?

To fill out Form RC66, Child Tax Benefits Application Form, you will need to include the following information:

- The primary caregiver's social insurance number, name, gender, birthdate, preferred language, and phone numbers.

- The full mailing and home address. This can include addresses in countries outside of Canada. You will also be asked if you have moved from a different province or territory recently and the date the move occurred.

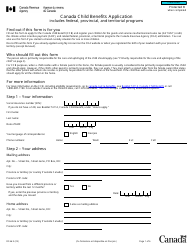

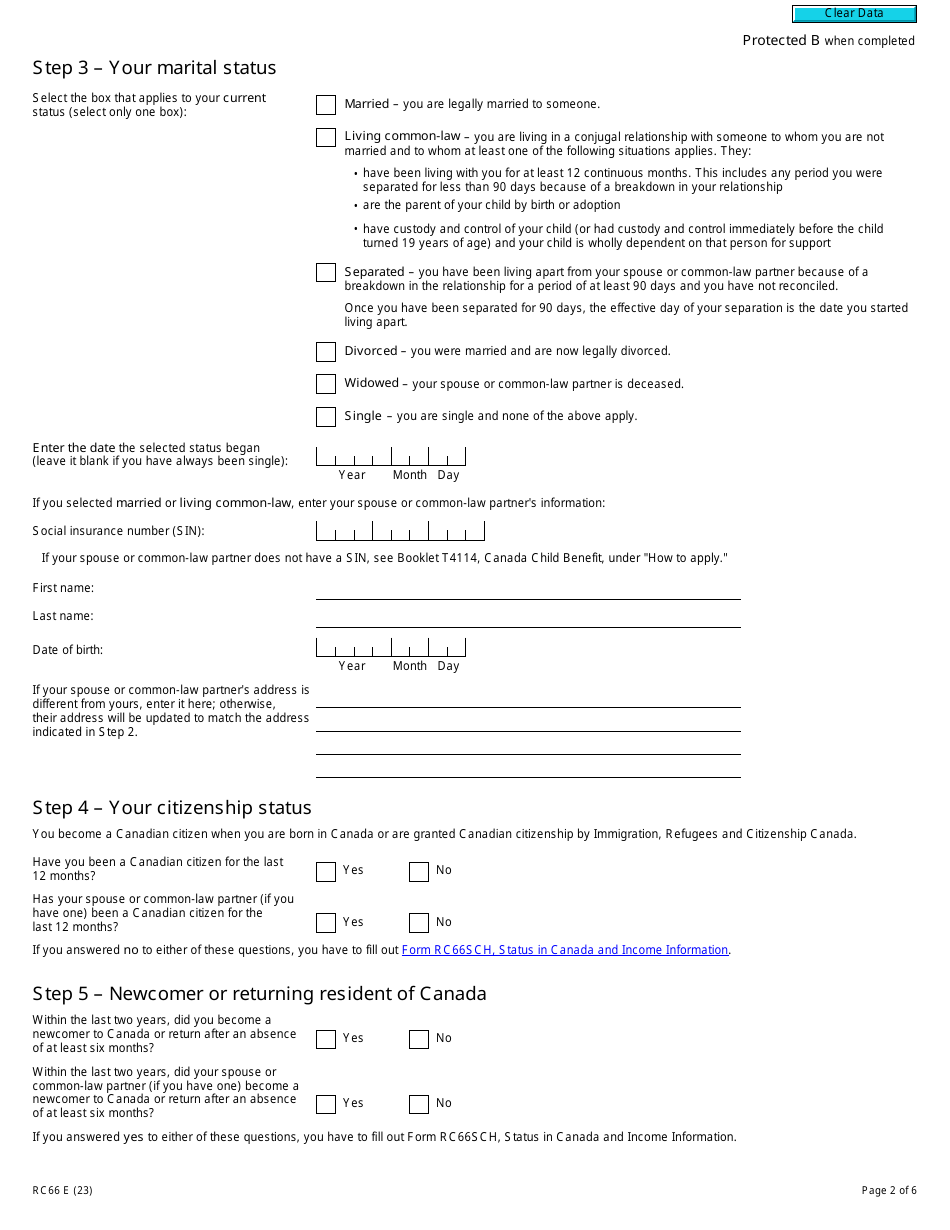

- Select the applicable marriage status (married, common-law relationship, separated, or widowed) and the date your current relationship status began.

- Specify your Canadian citizenship status, if you have been a citizen for at least twelve months, and if your partner or spouse has also been a citizen for at least twelve months.

- If you are new to Canada or returning to the country, you will be asked to complete an additional form depending on the length of time you and your spouse or partner have been in Canada.

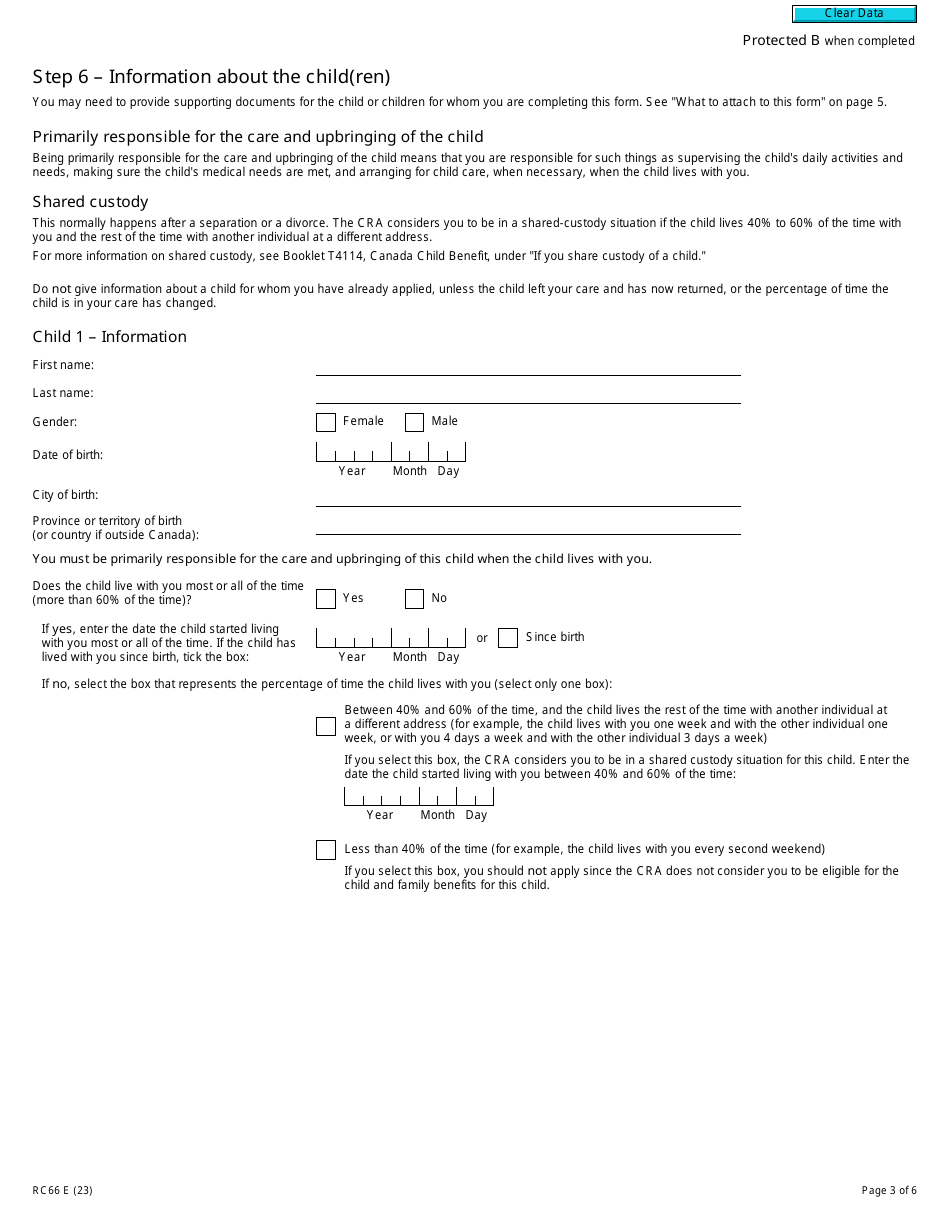

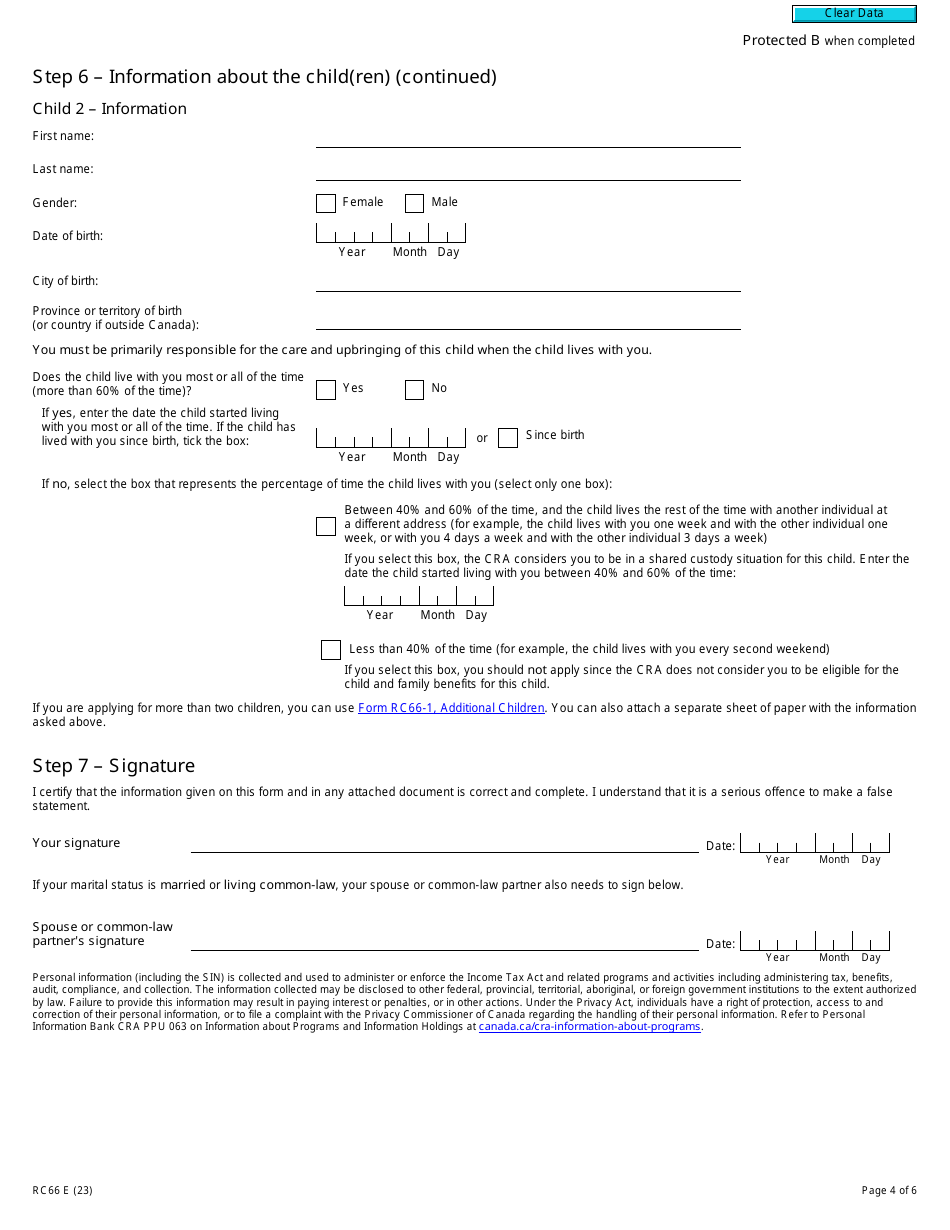

- Provide general information about each child, including their name, gender, birthdate, where they were born. You will also need to declare if the child lives in your household full-time or part-time.

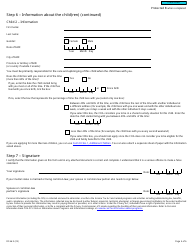

- The final sections require your and your partner's signatures and dates of signing the form.

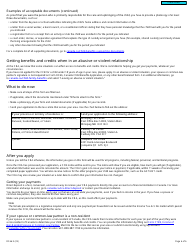

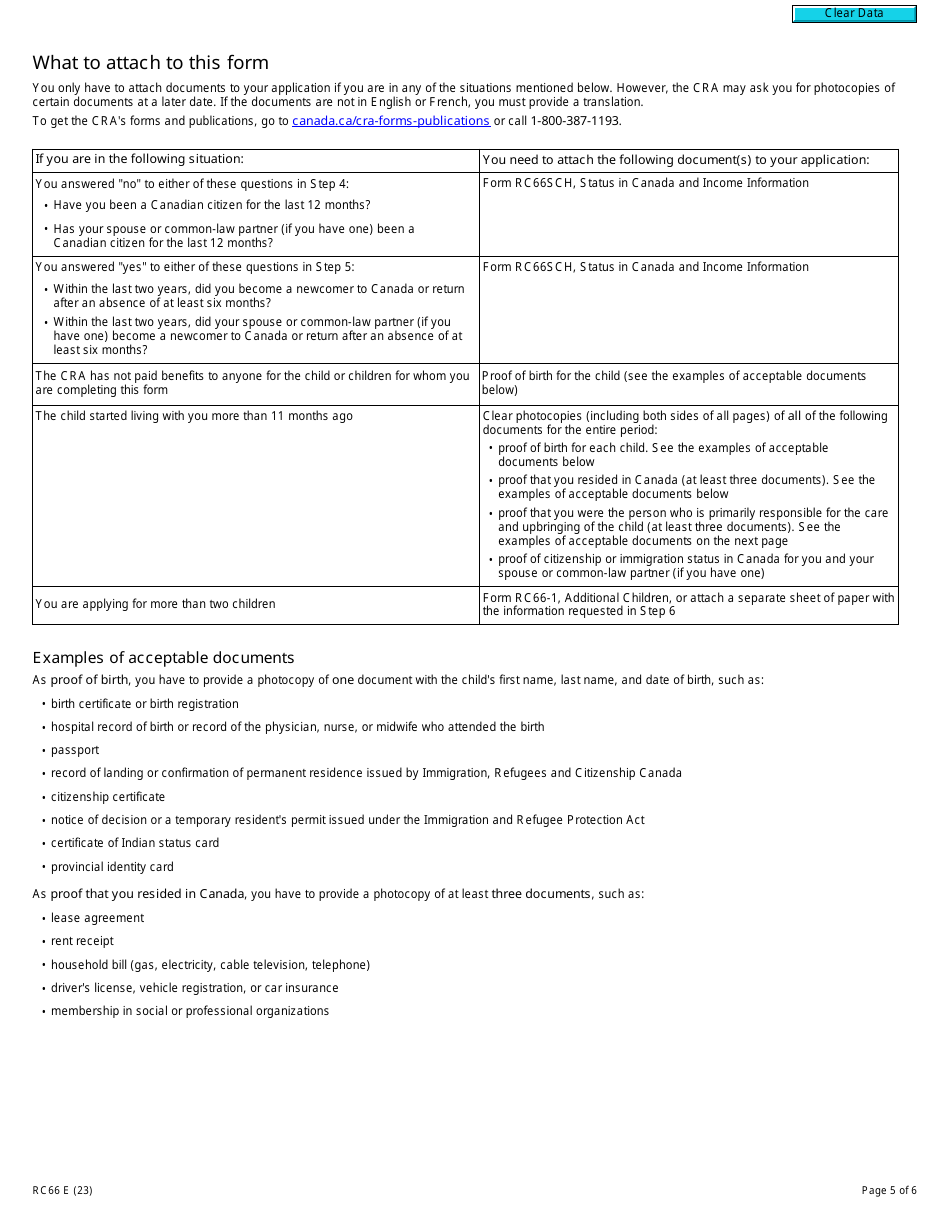

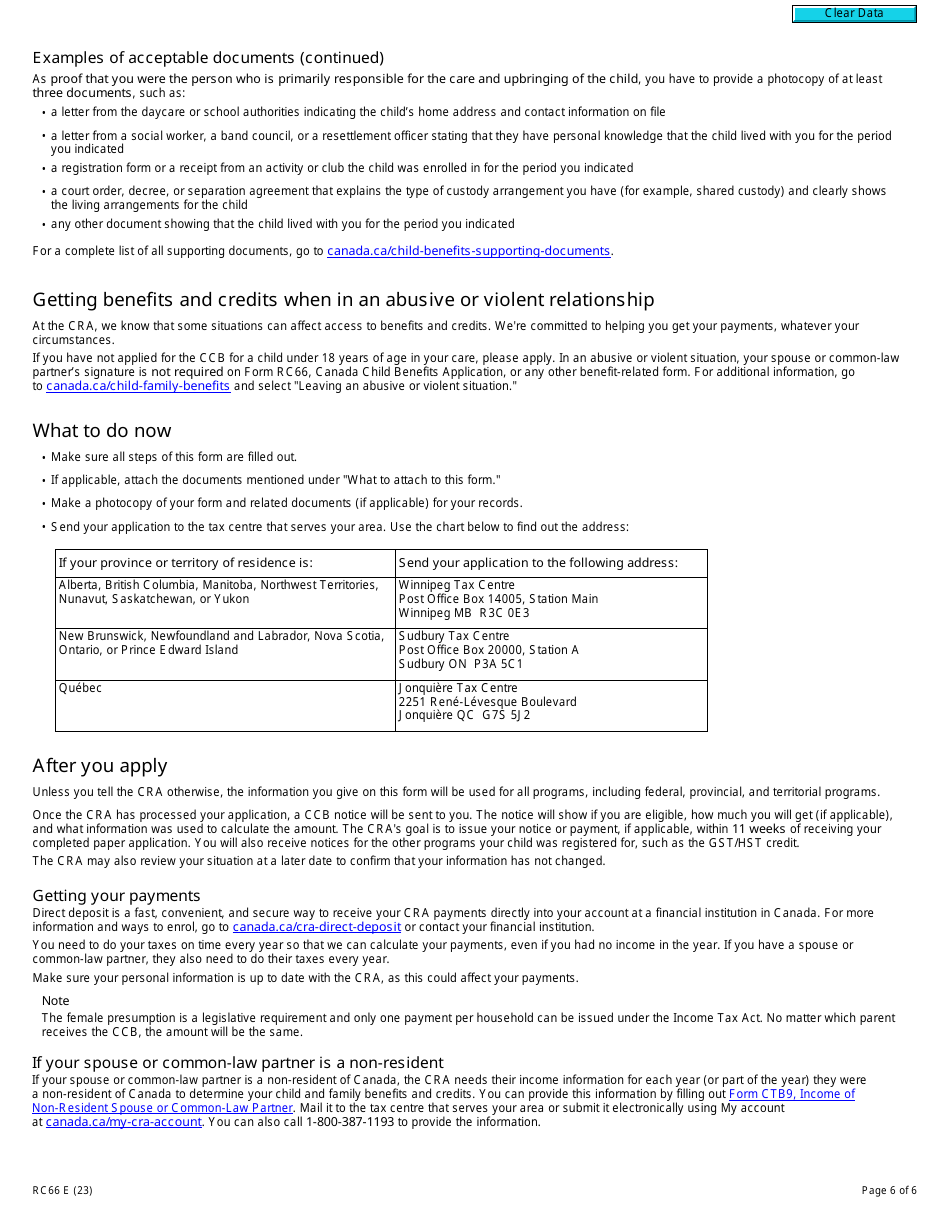

The last two pages contain helpful tips and a list of required documentation. Read through the provided instructions to determine if any additional forms will be needed in order to qualify as a benefits recipient. Once you have completed each section, you can find your correct mailing address for the application at the end of the document.