This version of the form is not currently in use and is provided for reference only. Download this version of

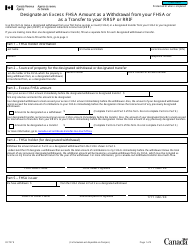

Form T1006

for the current year.

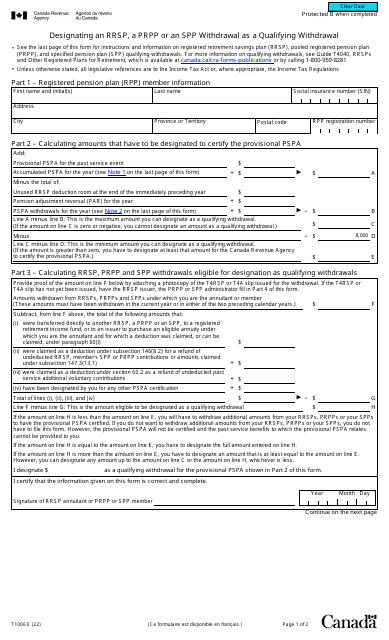

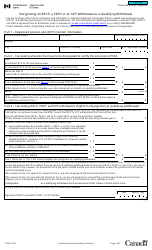

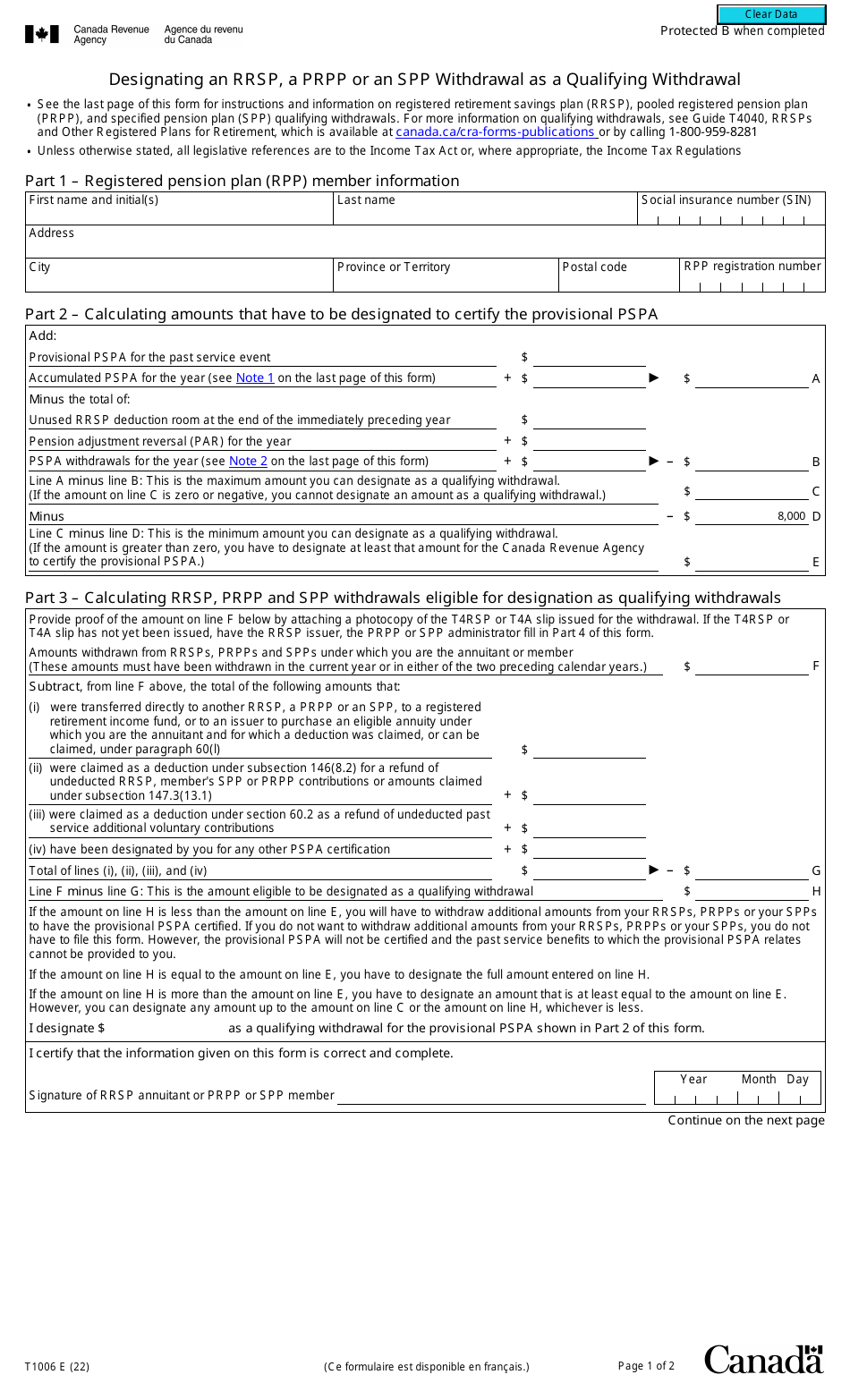

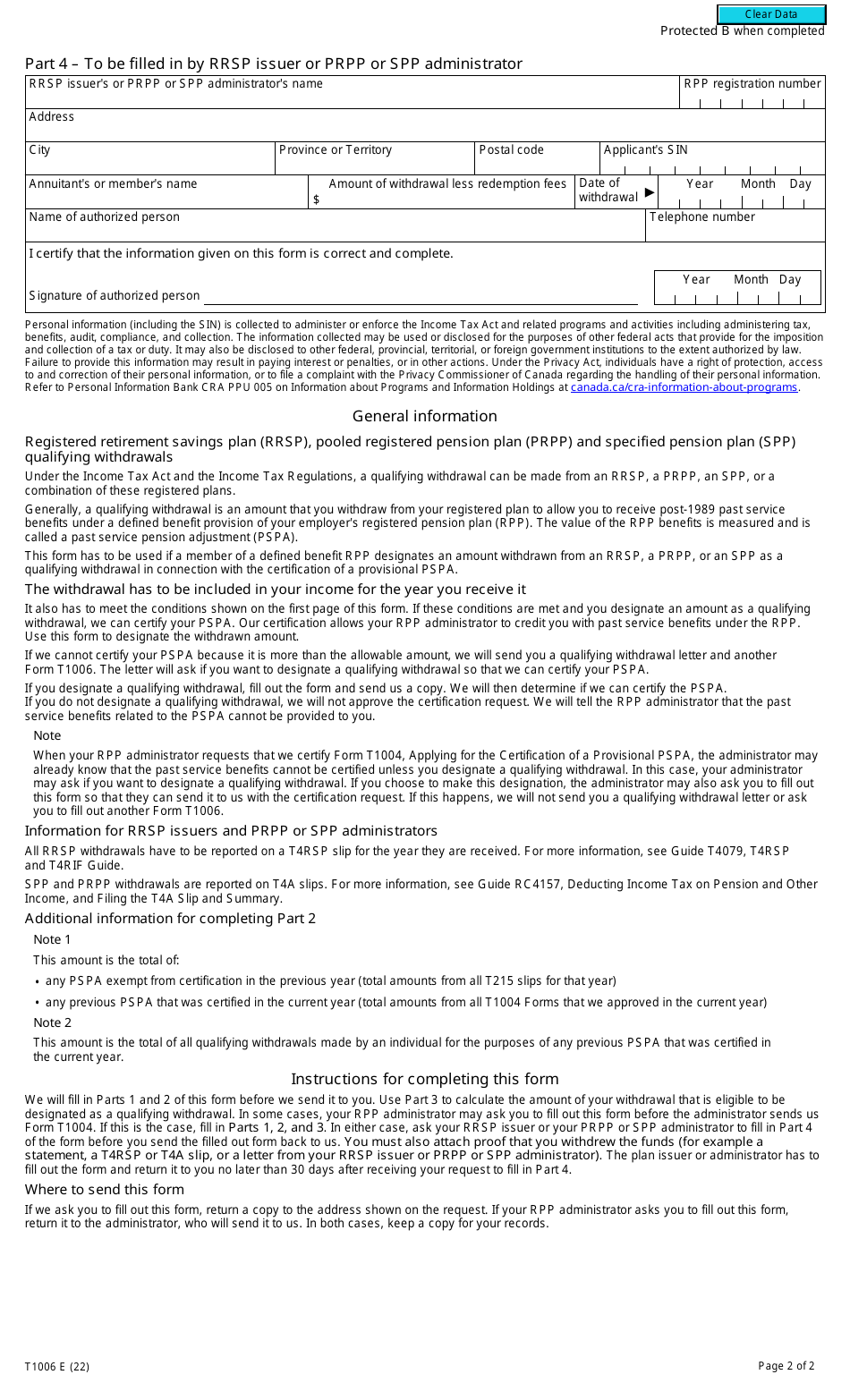

Form T1006 Designating an Rrsp, a Prpp or an Spp Withdrawal as a Qualifying Withdrawal - Canada

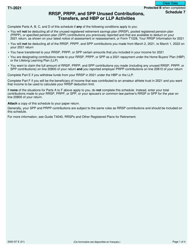

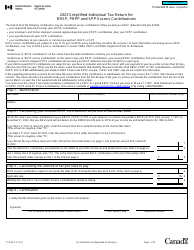

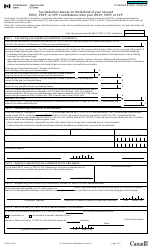

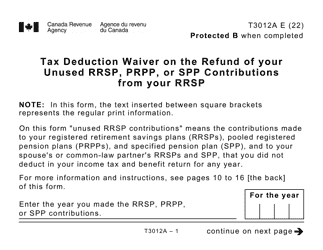

Form T1006 Designating an RRSP, PRPP, or SPP Withdrawal as a Qualifying Withdrawal is used in Canada to designate a withdrawal from a Registered Retirement Savings Plan (RRSP), Pooled Registered Pension Plan (PRPP), or Specified Pension Plan (SPP) as a qualifying withdrawal. A qualifying withdrawal is generally made under certain circumstances, such as for the purchase or construction of a qualifying home or for educational purposes.

The taxpayer or the individual who made the withdrawal files the Form T1006 for designating an RRSP, PRPP, or SPP withdrawal as a qualifying withdrawal in Canada.

FAQ

Q: What is Form T1006?

A: Form T1006 is a form used in Canada to designate an RRSP, a PRPP, or an SPP withdrawal as a qualifying withdrawal.

Q: What is an RRSP?

A: RRSP stands for Registered Retirement Savings Plan. It is a tax-advantaged savings account in Canada.

Q: What is a PRPP?

A: PRPP stands for Pooled Registered Pension Plan. It is a retirement savings option available in Canada.

Q: What is an SPP?

A: SPP stands for Specified Pension Plan. It is a type of pension plan in Canada.

Q: What is a qualifying withdrawal?

A: A qualifying withdrawal refers to a withdrawal from an RRSP, PRPP, or SPP that meets certain criteria to be eligible for tax benefits.

Q: How do I designate a withdrawal as a qualifying withdrawal?

A: You can designate a withdrawal as a qualifying withdrawal by using Form T1006 and following the instructions provided.

Q: What are the tax benefits of qualifying withdrawals?

A: Qualifying withdrawals from RRSPs, PRPPs, or SPPs may be eligible for certain tax exemptions or credits.

Q: Are there any deadlines for filing Form T1006?

A: The deadlines for filing Form T1006 may vary, so it is important to check with the CRA or consult with a tax professional for the specific deadlines.

Q: Can I designate multiple withdrawals as qualifying withdrawals on a single Form T1006?

A: Yes, you can designate multiple withdrawals as qualifying withdrawals on a single Form T1006, as long as they meet the criteria and are reported correctly.