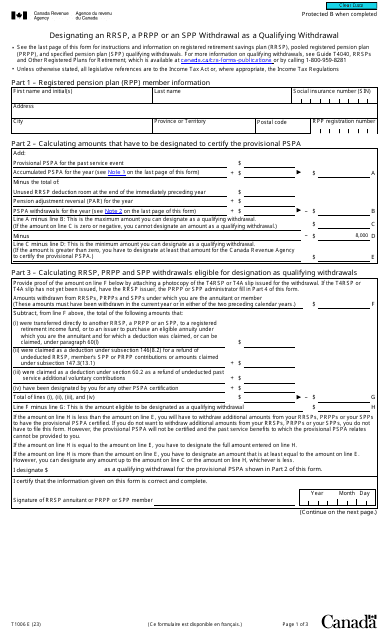

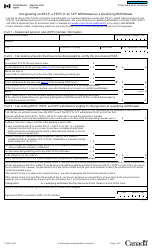

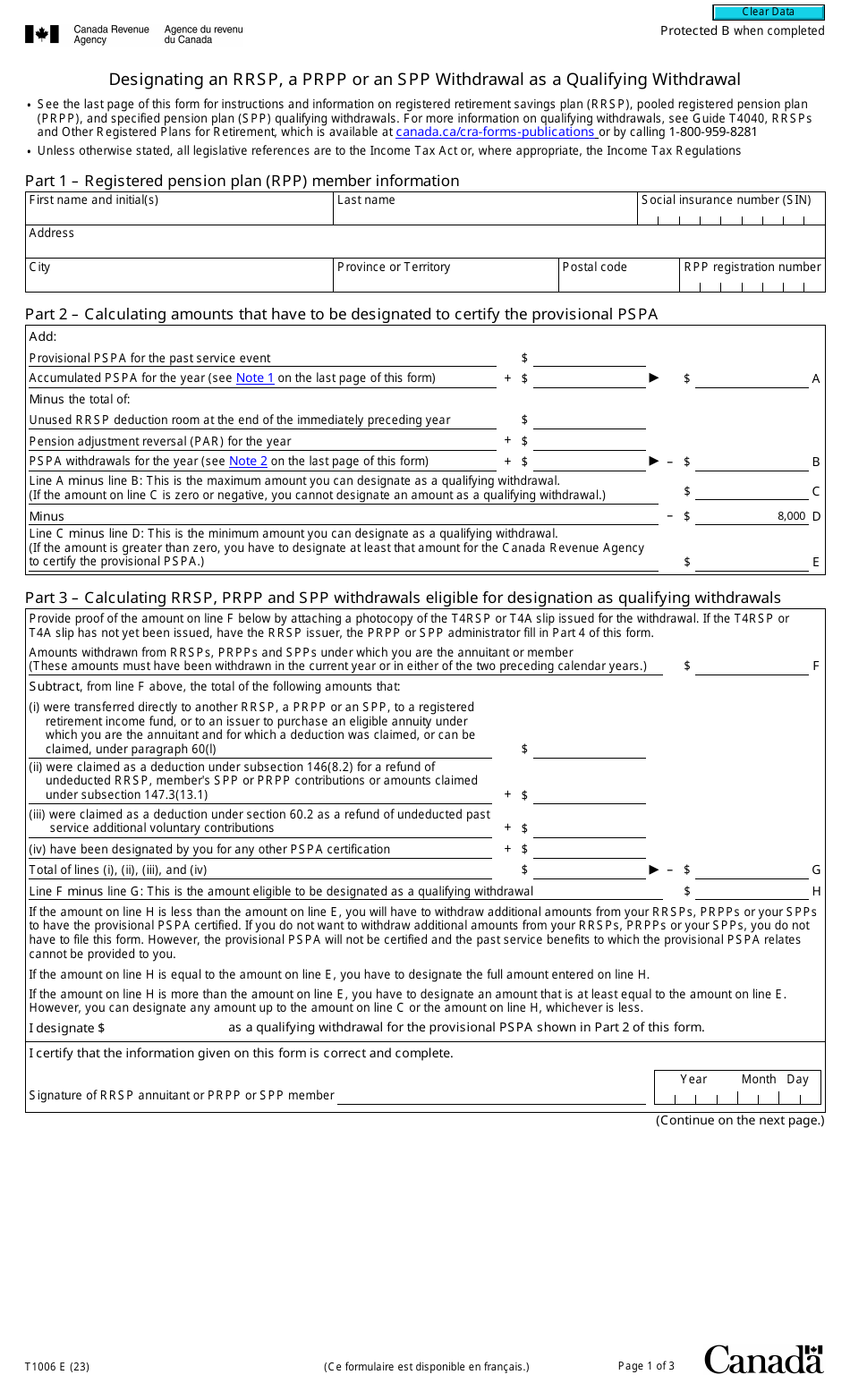

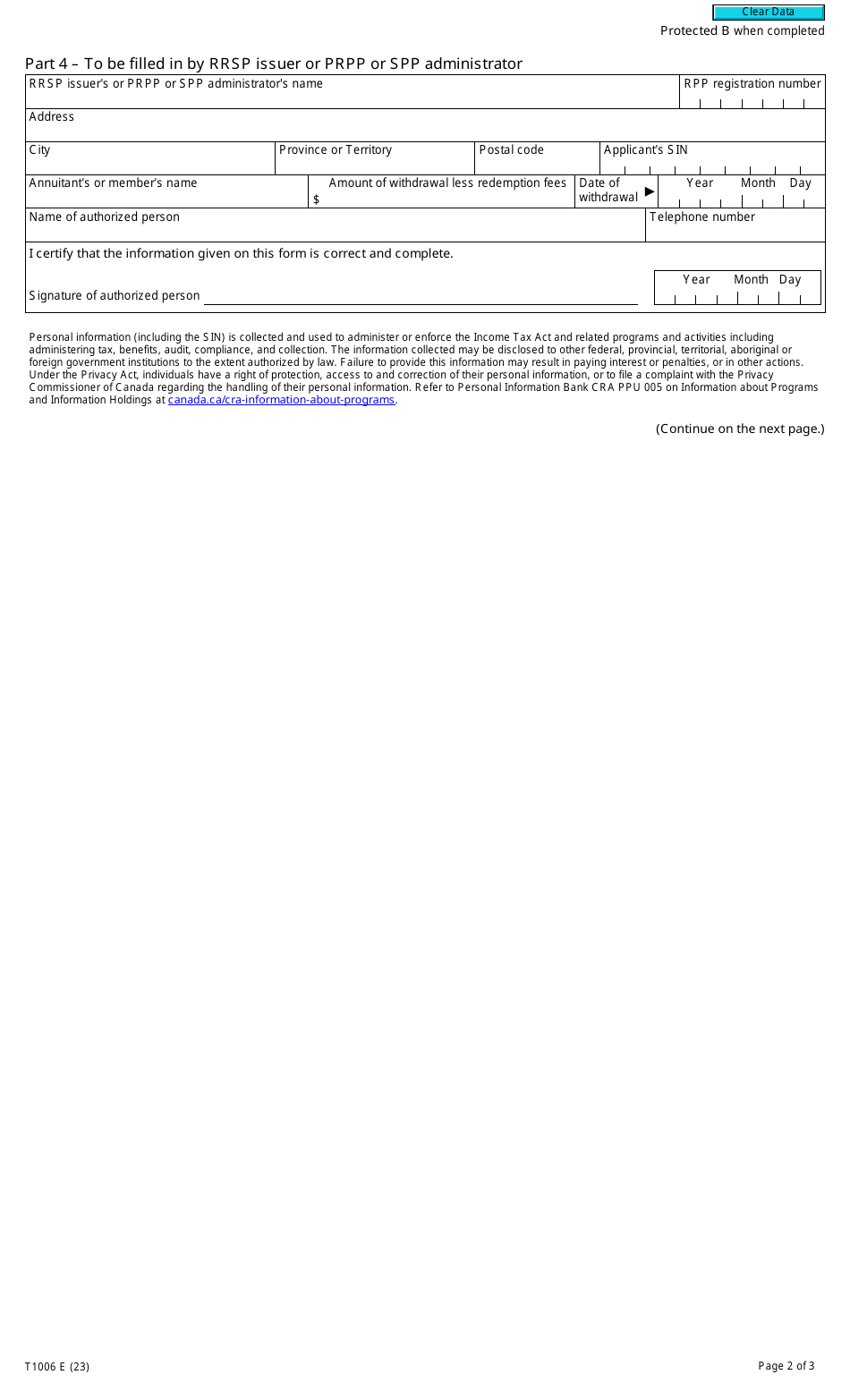

Form T1006 Designating an Rrsp, a Prpp or an Spp Withdrawal as a Qualifying Withdrawal - Canada

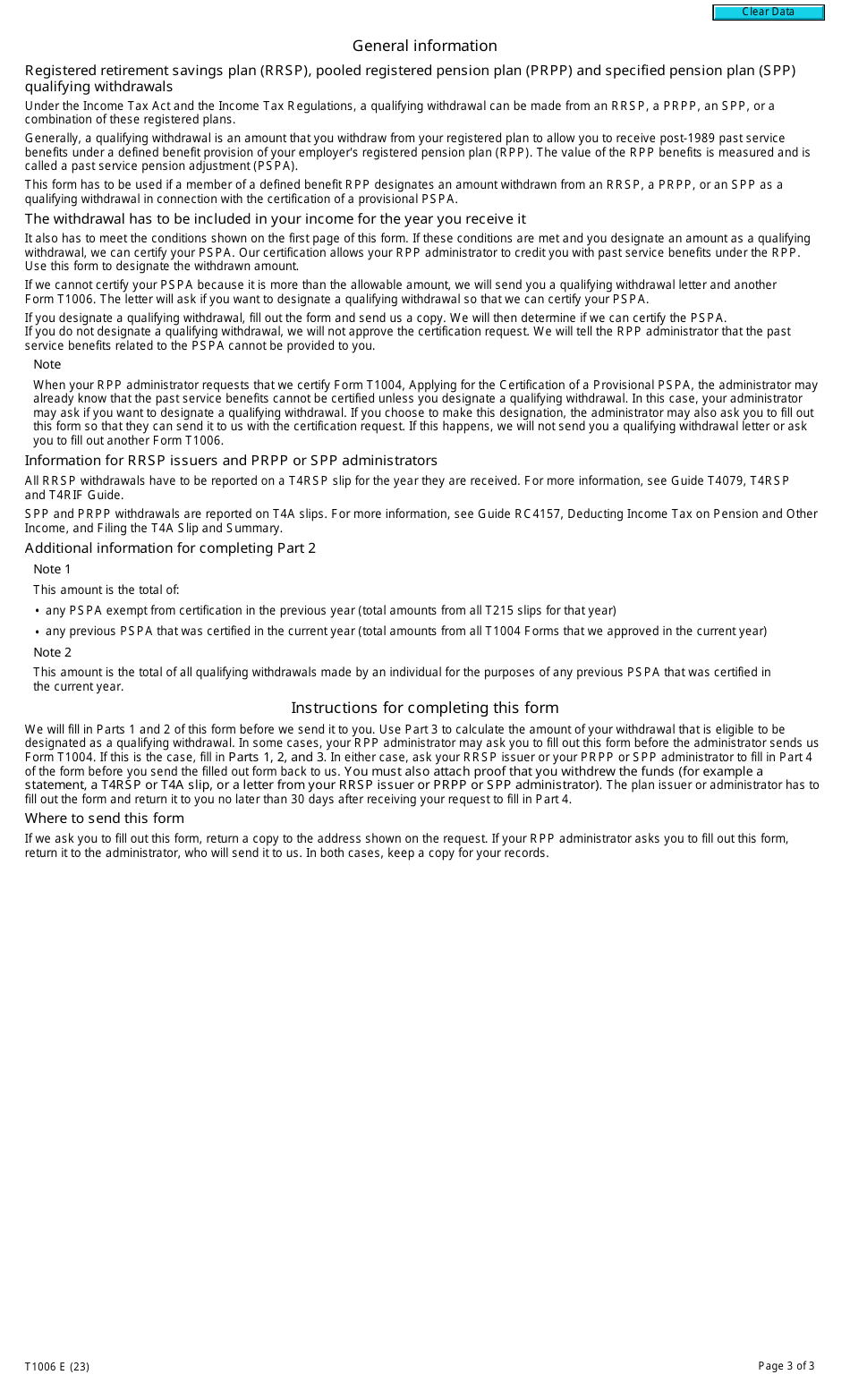

Form T1006 Designating an RRSP, PRPP, or SPP Withdrawal as a Qualifying Withdrawal is used in Canada to designate a withdrawal from a Registered Retirement Savings Plan (RRSP), Pooled Registered Pension Plan (PRPP), or Specified Pension Plan (SPP) as a qualifying withdrawal. A qualifying withdrawal is generally made under certain circumstances, such as for the purchase or construction of a qualifying home or for educational purposes.

The taxpayer or the individual who made the withdrawal files the Form T1006 for designating an RRSP, PRPP, or SPP withdrawal as a qualifying withdrawal in Canada.

Form T1006 Designating an Rrsp, a Prpp or an Spp Withdrawal as a Qualifying Withdrawal - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1006?

A: Form T1006 is a form used in Canada to designate an RRSP, a PRPP, or an SPP withdrawal as a qualifying withdrawal.

Q: What is an RRSP?

A: RRSP stands for Registered Retirement Savings Plan. It is a tax-advantaged savings account in Canada.

Q: What is a PRPP?

A: PRPP stands for Pooled Registered Pension Plan. It is a retirement savings option available in Canada.

Q: What is an SPP?

A: SPP stands for Specified Pension Plan. It is a type of pension plan in Canada.

Q: What is a qualifying withdrawal?

A: A qualifying withdrawal refers to a withdrawal from an RRSP, PRPP, or SPP that meets certain criteria to be eligible for tax benefits.

Q: How do I designate a withdrawal as a qualifying withdrawal?

A: You can designate a withdrawal as a qualifying withdrawal by using Form T1006 and following the instructions provided.

Q: What are the tax benefits of qualifying withdrawals?

A: Qualifying withdrawals from RRSPs, PRPPs, or SPPs may be eligible for certain tax exemptions or credits.

Q: Are there any deadlines for filing Form T1006?

A: The deadlines for filing Form T1006 may vary, so it is important to check with the CRA or consult with a tax professional for the specific deadlines.

Q: Can I designate multiple withdrawals as qualifying withdrawals on a single Form T1006?

A: Yes, you can designate multiple withdrawals as qualifying withdrawals on a single Form T1006, as long as they meet the criteria and are reported correctly.