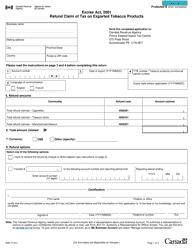

This version of the form is not currently in use and is provided for reference only. Download this version of

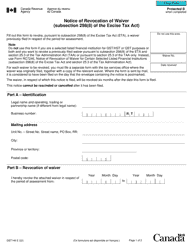

Form XE8

for the current year.

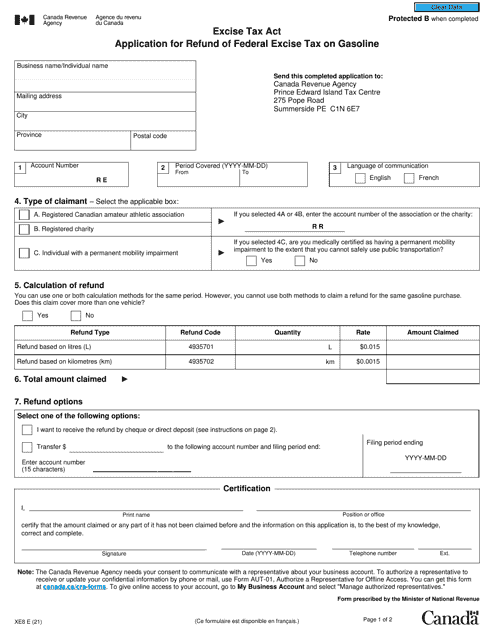

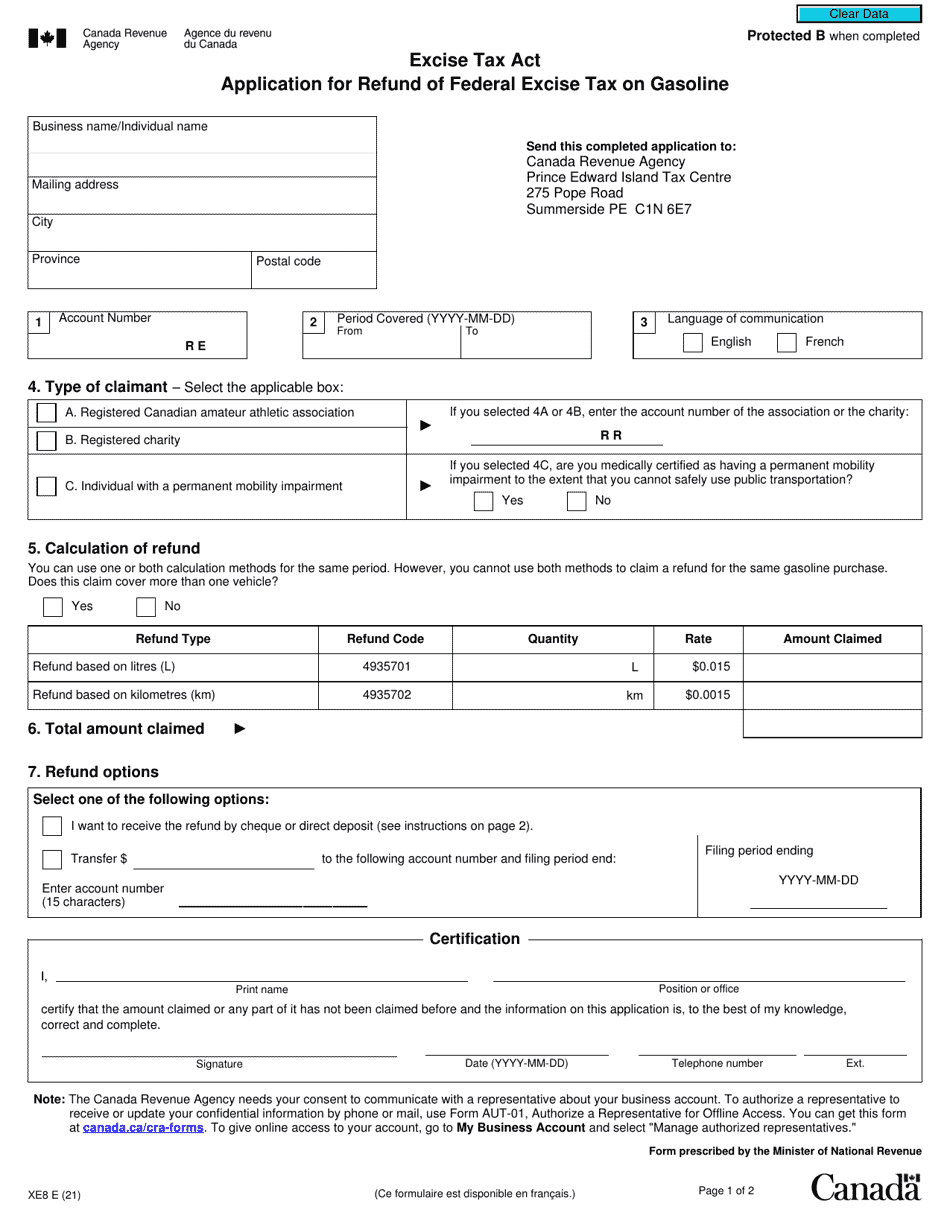

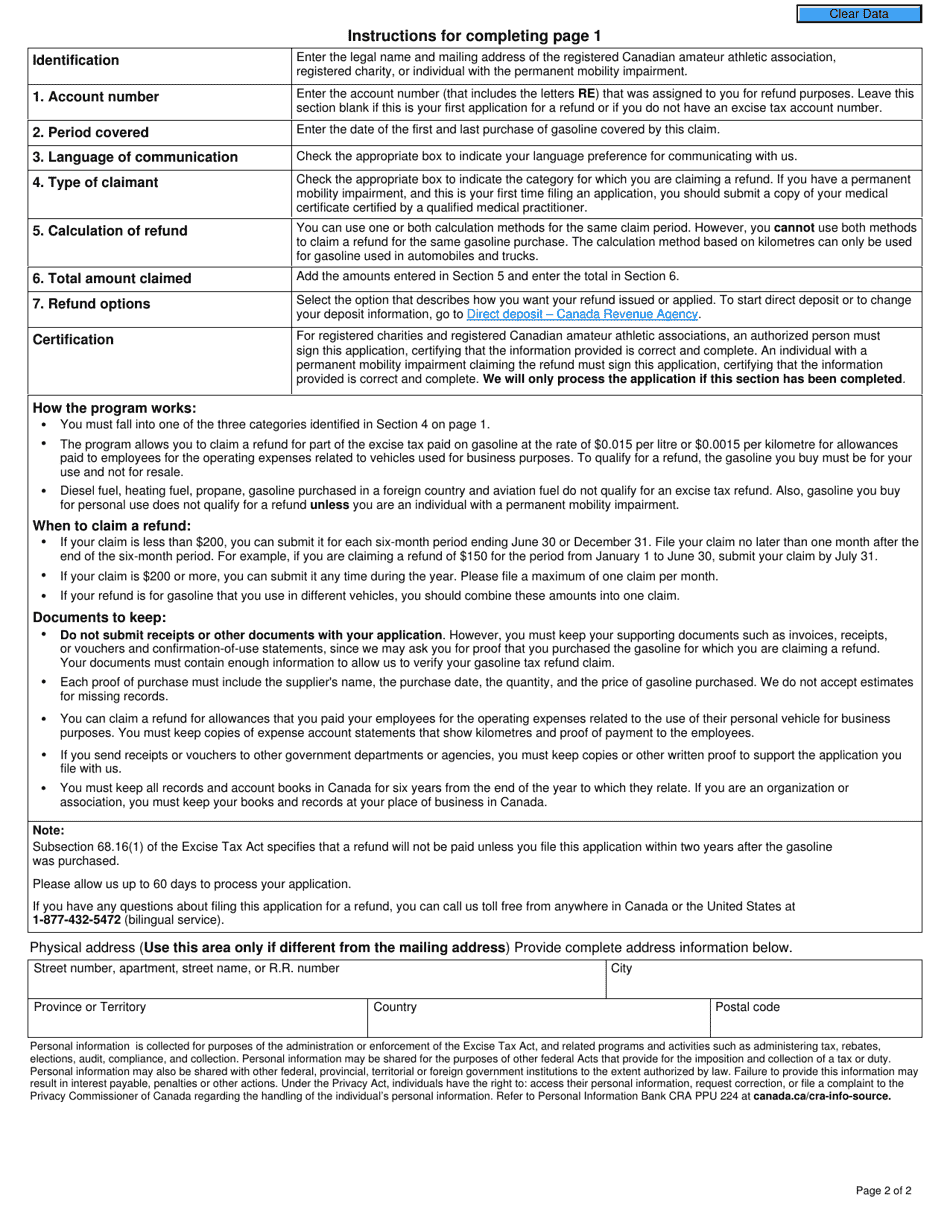

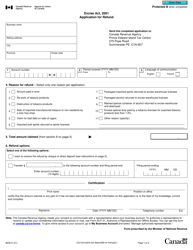

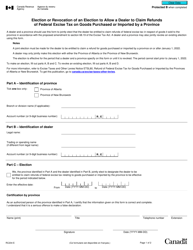

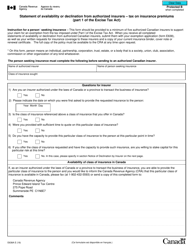

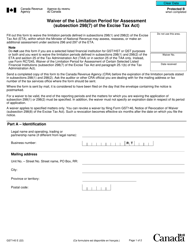

Form XE8 Excise Tax Act - Application for Refund of Federal Excise Tax on Gasoline - Canada

Form XE8 Excise Tax Act - Application for Refund of Federal Excise Tax on Gasoline in Canada is used to apply for a refund of the federal excise tax paid on gasoline.

The Form XE8 Excise Tax Act - Application for Refund of Federal Excise Tax on Gasoline in Canada is filed by the individuals or businesses who are eligible for a refund of the federal excise tax on gasoline. This form is not filed by a specific entity or organization.

FAQ

Q: What is Form XE8?

A: Form XE8 is the Application for Refund of Federal Excise Tax on Gasoline in Canada.

Q: What is the Excise Tax Act?

A: The Excise Tax Act is Canadian legislation that governs the taxation of certain goods, including gasoline.

Q: What does the Form XE8 allow me to do?

A: Form XE8 allows you to apply for a refund of the federal excise tax paid on gasoline in Canada.

Q: Who can apply for a refund using Form XE8?

A: Anyone who has paid federal excise tax on gasoline in Canada can apply for a refund using Form XE8.

Q: How do I apply for a refund using Form XE8?

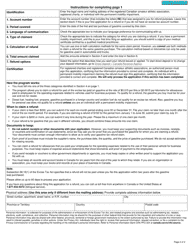

A: To apply for a refund using Form XE8, you need to fill out the form with your information and provide supporting documentation, then submit it to the Canada Revenue Agency.

Q: What supporting documentation do I need to provide with Form XE8?

A: You may need to provide receipts, invoices, or other documents that show you paid the federal excise tax on gasoline.

Q: Is there a deadline for submitting Form XE8?

A: Yes, there is a deadline for submitting Form XE8. You must submit the form within two years from the end of the calendar year in which you paid the federal excise tax on gasoline.

Q: How long does it take to receive a refund after submitting Form XE8?

A: The processing time for refunds can vary, but the Canada Revenue Agency aims to issue refunds within eight weeks of receiving a complete application.

Q: Can I apply for a refund of provincial or territorial gasoline taxes using Form XE8?

A: No, Form XE8 is specifically for the refund of federal excise tax on gasoline. To claim a refund for provincial or territorial gasoline taxes, you will need to contact the appropriate provincial or territorial authority.