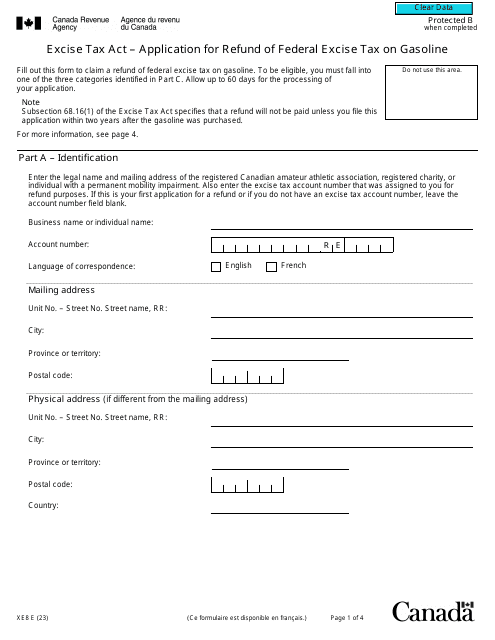

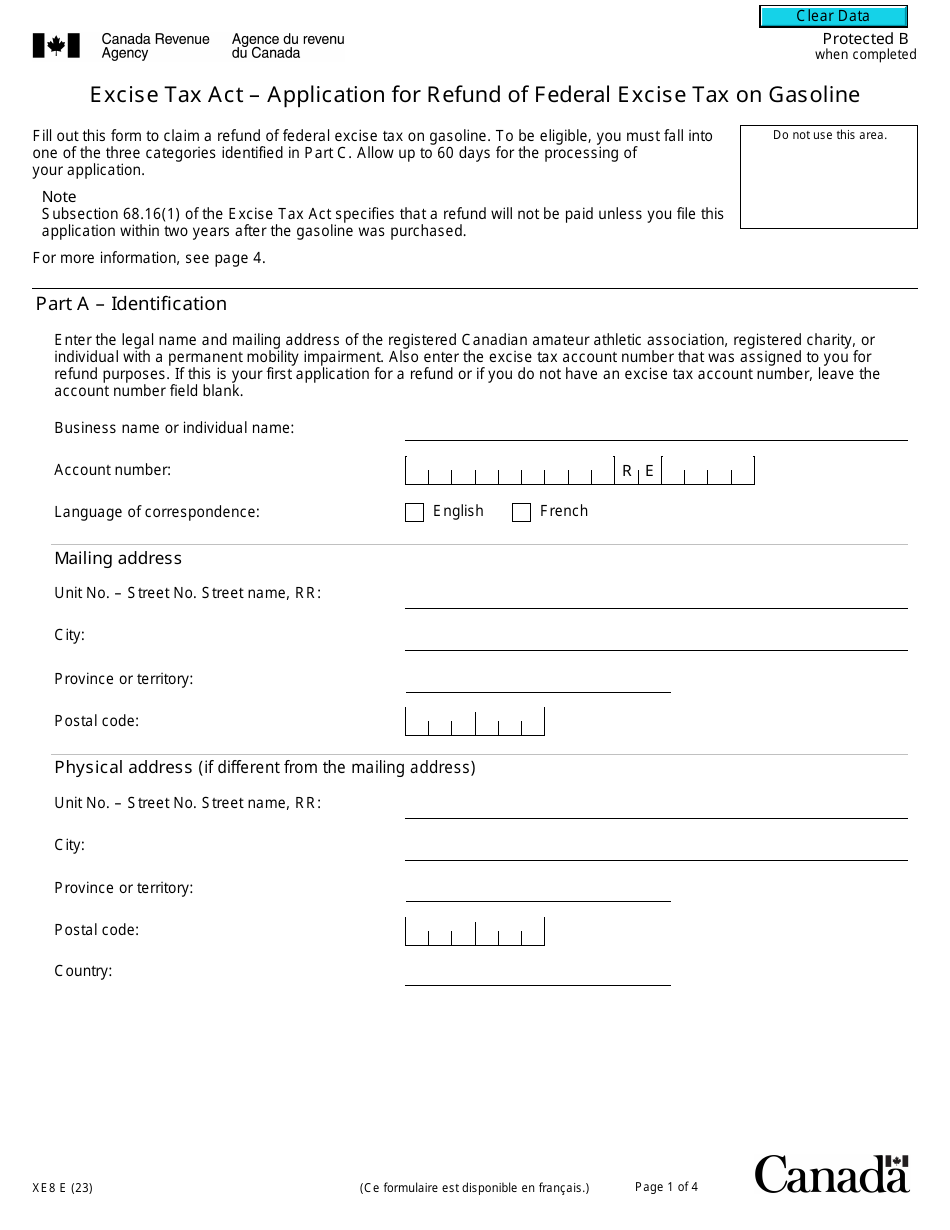

Form XE8 Excise Tax Act - Application for Refund of Federal Excise Tax on Gasoline - Canada

Form XE8 Excise Tax Act - Application for Refund of Federal Excise Tax on Gasoline in Canada is used to apply for a refund of the federal excise tax paid on gasoline.

The Form XE8 Excise Tax Act - Application for Refund of Federal Excise Tax on Gasoline in Canada is filed by the individuals or businesses who are eligible for a refund of the federal excise tax on gasoline. This form is not filed by a specific entity or organization.

Form XE8 Excise Tax Act - Application for Refund of Federal Excise Tax on Gasoline - Canada - Frequently Asked Questions (FAQ)

Q: What is Form XE8? A: Form XE8 is the Application for Refund of Federal Excise Tax on Gasoline in Canada.

Q: What is the Excise Tax Act? A: The Excise Tax Act is Canadian legislation that governs the taxation of certain goods, including gasoline.

Q: What does the Form XE8 allow me to do? A: Form XE8 allows you to apply for a refund of the federal excise tax paid on gasoline in Canada.

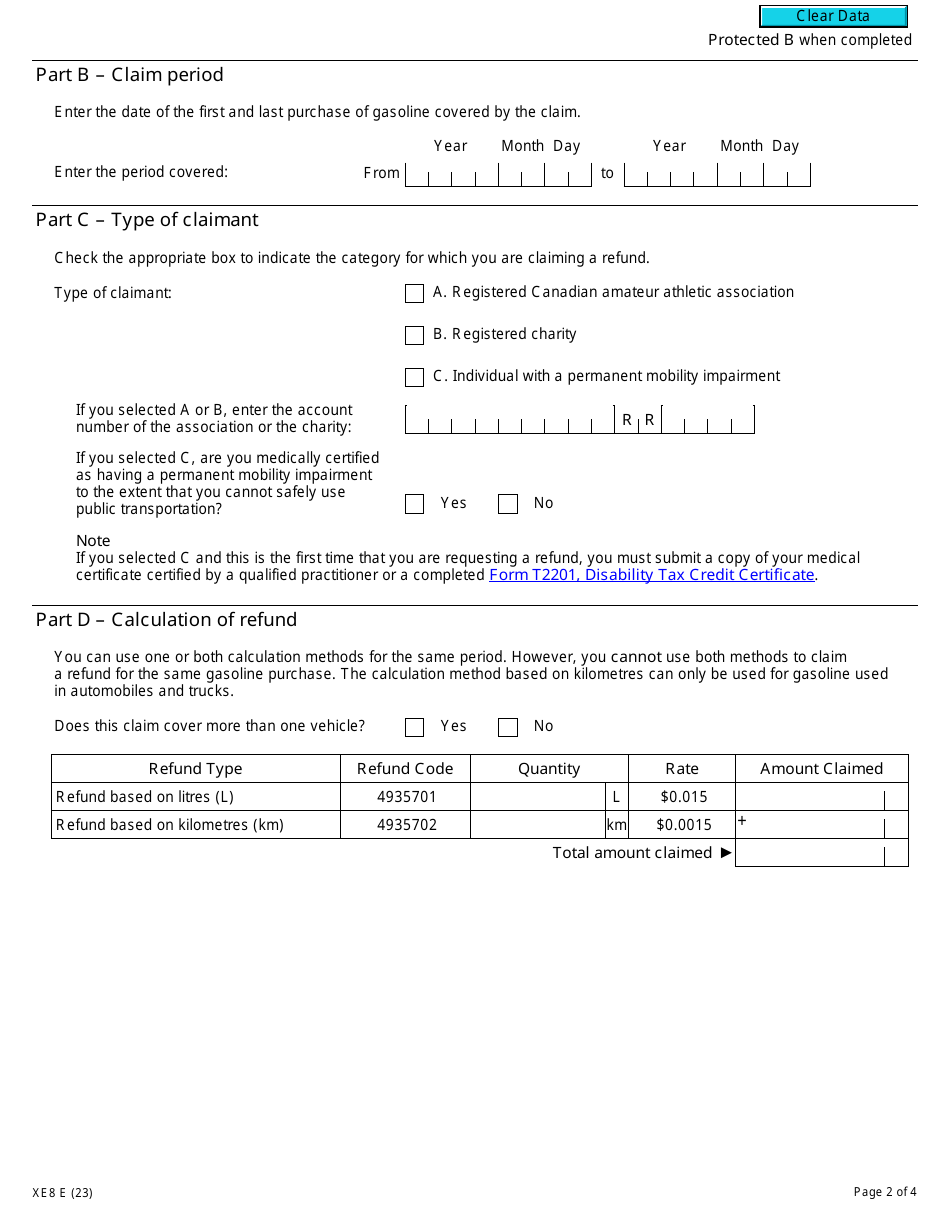

Q: Who can apply for a refund using Form XE8? A: Anyone who has paid federal excise tax on gasoline in Canada can apply for a refund using Form XE8.

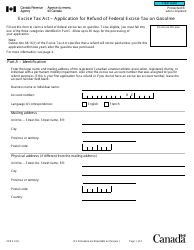

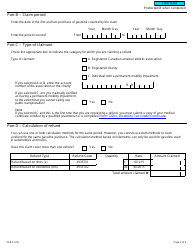

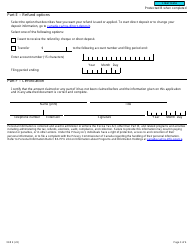

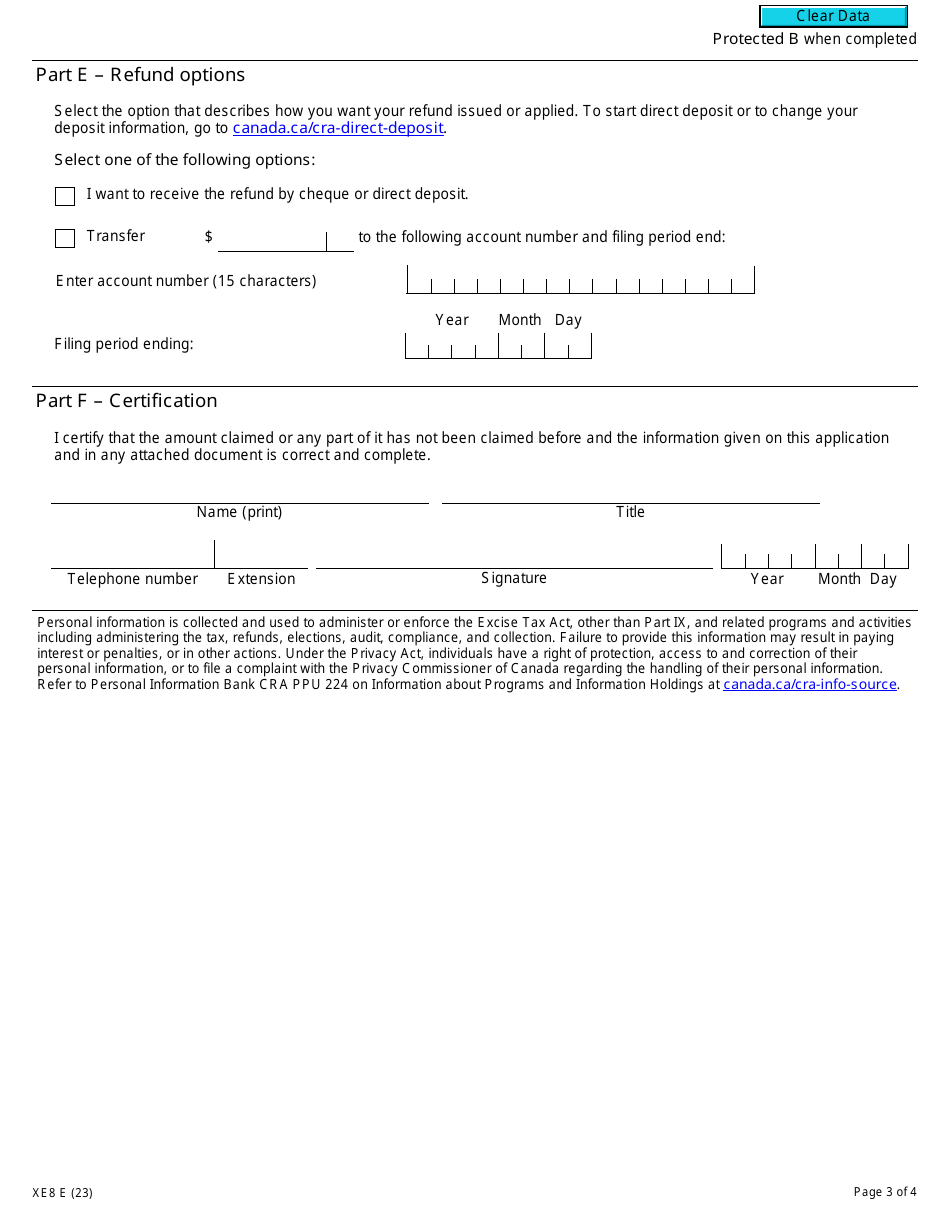

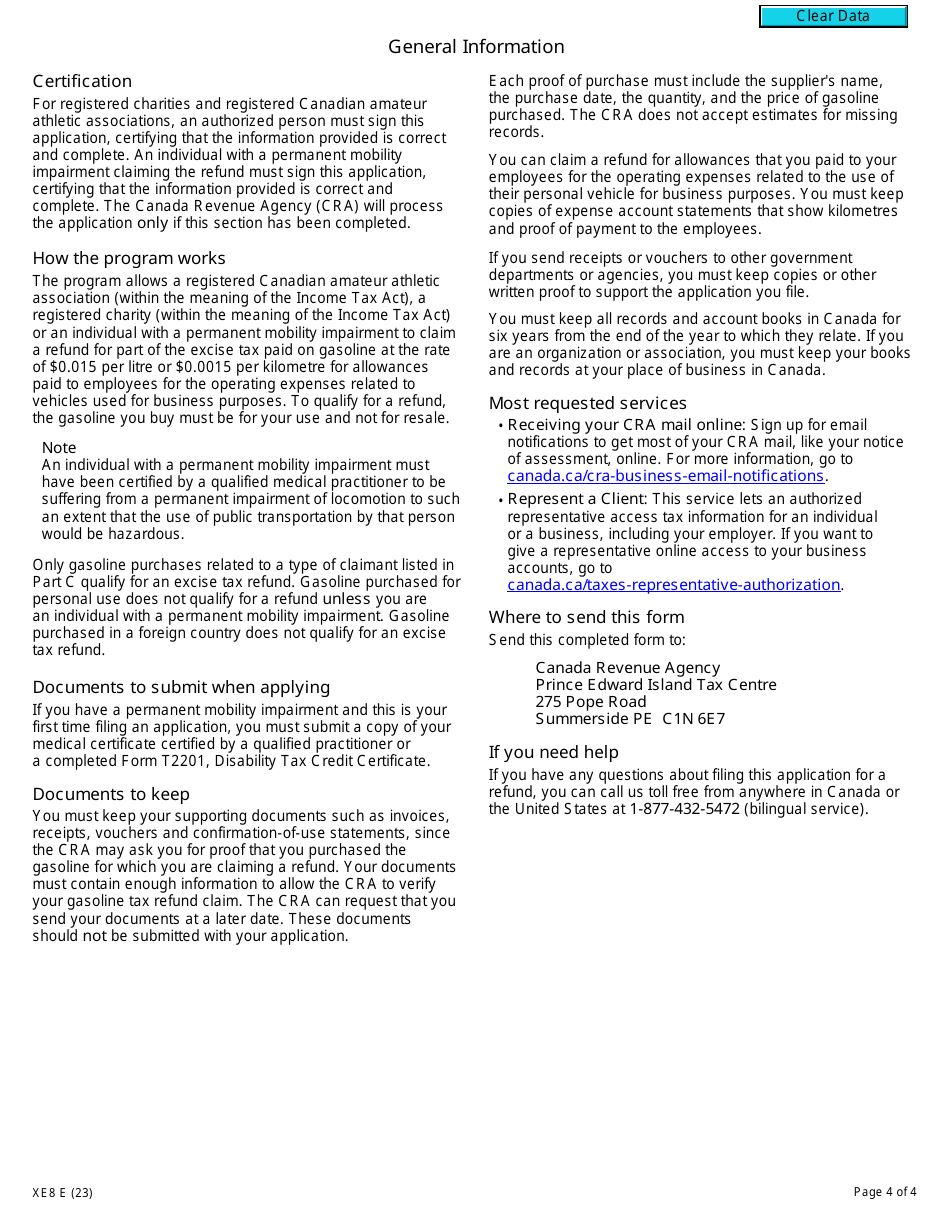

Q: How do I apply for a refund using Form XE8? A: To apply for a refund using Form XE8, you need to fill out the form with your information and provide supporting documentation, then submit it to the Canada Revenue Agency.

Q: What supporting documentation do I need to provide with Form XE8? A: You may need to provide receipts, invoices, or other documents that show you paid the federal excise tax on gasoline.

Q: Is there a deadline for submitting Form XE8? A: Yes, there is a deadline for submitting Form XE8. You must submit the form within two years from the end of the calendar year in which you paid the federal excise tax on gasoline.

Q: How long does it take to receive a refund after submitting Form XE8? A: The processing time for refunds can vary, but the Canada Revenue Agency aims to issue refunds within eight weeks of receiving a complete application.

Q: Can I apply for a refund of provincial or territorial gasoline taxes using Form XE8? A: No, Form XE8 is specifically for the refund of federal excise tax on gasoline. To claim a refund for provincial or territorial gasoline taxes, you will need to contact the appropriate provincial or territorial authority.